|

市場調查報告書

商品編碼

1640572

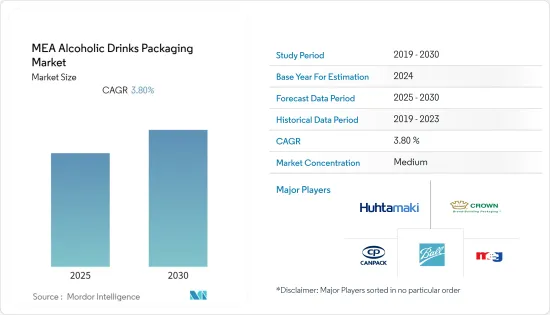

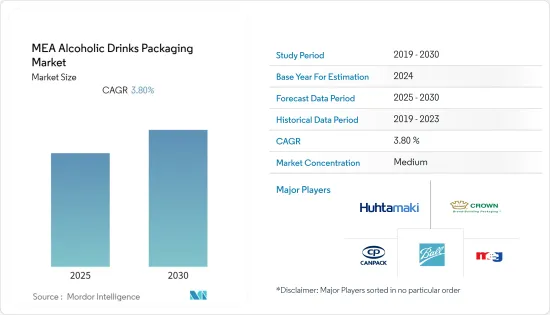

中東和非洲酒精飲料包裝市場佔有率分析、行業趨勢和成長預測(2025-2030 年)MEA Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內中東和非洲酒精飲料包裝市場預計複合年成長率為 3.8%

關鍵亮點

- 根據美國農業部對外農業局的數據,預計 2020 年南非釀酒葡萄產量將小幅增加 1%,達到 125 萬噸。灌溉計劃受益於良好的天氣,提高了產量並幫助一些地區從 2016-2018 年的乾旱中恢復過來。預計2020年葡萄酒產量將達9.47億公升。南非的葡萄酒產業正在顯示出復甦的跡象,但也面臨低價值葡萄酒進口商和庫存增加的威脅。

- 新冠疫情對該地區酒精飲料市場的影響好壞參半。例如,在南非,封鎖期間全面禁止在國內運輸和銷售酒精飲料。然而,在阿拉伯聯合大公國,持續的產品供應和供應鏈的彈性使得市場看到Off-Trade商店的家庭消費購買增加。在沙烏地阿拉伯,唯一的酒精飲料類別——無酒精啤酒的銷量在 2020 年全年都在下降。

- 啤酒、葡萄酒和烈酒的無酒精替代品為禁酒的中東市場的消費者提供了優質的替代品。此類創新也可能適合酒精消費受限的市場。沙烏地阿拉伯是世界上最大的無酒精啤酒消費量市場之一。 2015年至2019年間,該國無酒精啤酒消費量增加了近一倍。預計未來還將持續成長。

- 在阿拉伯聯合大公國,酒精消費量的成長主要受到旅遊業和大量居住者的推動。旅遊業和大量外籍人口是阿拉伯聯合大公國酒精飲料成長的主要原因。根據世界衛生組織 (WHO) 的數據,阿拉伯聯合大公國最受歡迎的酒精飲料是烈酒,佔總量的 82%,其次是啤酒 (10%) 和葡萄酒 (8%)。

- 此外,阿拉伯聯合大公國還頒布了新法律,取消了對 21 歲以上人士消費、銷售和持有酒精的處罰。放寬酒精限制是該國伊斯蘭個人法改革的一部分。放寬個人限制旨在「加強阿拉伯聯合大公國的寬容原則」。此舉體現了該國作為國際旅遊和商業中心的聲譽正在改變。這些變化預計將促進該地區的酒精飲料消費。

中東和非洲酒精飲料包裝市場的趨勢

金屬罐包裝可望大幅成長

- 在土耳其,啤酒業對金屬飲料罐的需求正在增加。金屬罐在國產拉格啤酒中的佔有率成長迅速,已占到總銷量的一半左右。玻璃瓶裝啤酒和金屬飲料罐之間的價差正在推動罐裝啤酒的銷售。

- 罐裝葡萄酒是南非葡萄酒包裝市場出現的新趨勢,釀酒商紛紛推出其熱門產品的罐裝版本。例如,當地的Perdeberg Wines推出了250毫升罐裝的Soft Smooth Red系列葡萄酒。

- 在阿拉伯聯合大公國,許多品牌現在都使用金屬飲料罐裝來銷售其產品。所有進口品牌均採用此種包裝,24瓶330毫升啤酒的價格比同等玻璃瓶包裝的價格更低。每個品牌都提供較小的包裝尺寸來測試新的烈酒。

- 在無酒精啤酒領域,我們預期人們對金屬罐的偏好會日益成長。無酒精啤酒品牌 Barbican 引領潮流,其石榴、蘋果和草莓口味的啤酒包裝從玻璃包裝轉向設計新穎的金屬罐包裝。

南非市場可望大幅成長

- 過去十年來,南非啤酒愛好者已經喜歡上了愛爾淡啤酒和拉格啤酒,但以高粱為原料的精釀啤酒僅限於農村地區。此外,自製和商業高粱啤酒通常以不衛生、不安全且不防篡改的包裝出售。但最近,南非的一些新建小型釀酒廠已開始採用現代配方釀造現代高粱啤酒。他們還為這款啤酒推出了一種名為「錐形紙盒」的紙質包裝。因此,這種包裝可確保零售商和消費者對密封紙箱內啤酒的品質充滿信心。

- 永續性趨勢在消費者和酒精飲料市場的主要參與者中日益受到青睞。近日,南非啤酒公司為其Castle Light系列推出了全新的Cold Rock二次包裝。

- 根據 BizTrends 2020 的數據,高檔蘭姆酒的流行趨勢在南非正在興起。隨著南非黑人中產階級人口的成長,香檳和干邑白蘭地可能仍會繼續受歡迎。隨著消費者轉向高檔葡萄酒和進口葡萄酒,氣泡酒的銷售量持續上漲。鑑於消費者面臨的嚴峻經濟壓力,他們擴大轉向即飲(RTD)和國際飲料,以利用國際品牌資質和實惠的價格分佈在競爭中脫穎而出。

- 在新冠肺炎疫情期間,消費者購買力下降和可支配收入減少,促使更大價值包裝的出現。例如,1 公升容量的 Carling Black Label 啤酒雖然基數較低,但仍實現了強勁成長。

中東和非洲酒精飲料包裝產業概況

多家提供酒精飲料包裝解決方案的公司的存在加劇了市場競爭。因此,中東和非洲酒精飲料包裝市場適度細分,許多公司開始實施擴大策略。我將介紹一些最新進展。

- 2021 年 6 月 - Can-Pack 與 SSHS Group Hungary 合作,透過柔和的色彩和霧面飾面,賦予其 Regenera 品牌罐頭柔和、現代和高檔的感覺。 Regenera 是一種由草本萃取物製成的水果口味機能飲料,旨在抵抗宿醉的副作用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 消費者購買力成長

- 提高酒精飲料製造商透過包裝來區分其產品的意識

- 市場問題

- 政府對酒精飲料消費的限制

- 評估新冠肺炎對市場的影響

第5章 市場區隔

- 按主要材質

- 玻璃

- 金屬

- 塑膠

- 紙

- 按酒精產品

- 葡萄酒

- 烈酒

- 啤酒

- 其他

- 依產品類型

- 玻璃瓶

- 金屬罐

- 塑膠瓶

- 其他

- 按國家

- 阿拉伯聯合大公國

- 南非

- 埃及

- 土耳其

- 其他中東和非洲地區

第6章 競爭格局

- 公司簡介

- Ball Corporation

- Crown Holdings Inc.

- Huhtamaki Oyj

- Saudi Arabian Glass Co. Ltd

- Saverglass SAS

- Consol Glass Ltd

- Middle East Glass Manufacturing Company SAE

- Bonpak(Pty)Ltd

- The National Company For Glass Industries(Zouja)

- Majan Glass Company SAOG

- Nampak Ltd

- Can-Pack SA

第7章投資分析

第 8 章:市場的未來

簡介目錄

Product Code: 55052

The MEA Alcoholic Drinks Packaging Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- According to USDA Foreign Agricultural Service, South Africa's wine grape production was projected to increase marginally by 1% to 1.25 million metric tons in 2020. The irrigation facilities are improving with favorable weather conditions and improved yields, and some regions also recovered from the 2016-2018 drought conditions. Wine production was projected to reach 947 million liters in 2020. While the South African wine industry is showing signs of rebounding, it also faces threats from imports of low-value wine suppliers and rising stocks.

- There has been a mixed impact of the COVID-19 pandemic on the alcoholic drinks market in the region. For instance, in South Africa, during the lockdown, transportation and sale of alcoholic drinks were banned entirely within the country, meaning that on-trade sales could not simply move into the off-trade during the period of on-trade closures. However, in the United Arab Emirates, due to the continued availability of the products and supply chain resilience, the market has seen increased purchases in off-trade outlets for home consumption. Sales of non-alcoholic beer, the only category present in alcoholic drinks in Saudi Arabia, declined throughout 2020 as the COVID-19 pandemic led to the government-mandated closure of all on-trade establishments.

- Alcohol-free alternatives of beer, wine, and spirits offer a premium trade-up alternative for consumers in the Middle Eastern markets where alcohol is banned. Such innovations may also suit the market where alcohol consumption is restricted. Saudi Arabia was one of the largest markets for alcohol-free beer consumption globally. Volume consumption of non-alcohol beer almost doubled in the country between 2015 and 2019. It is expected to grow further in the future.

- In the United Arab Emirates (UAE), alcohol growth is majorly contributed by tourism and its vast expatriate population. Emiratis make up 10% of the people, while expatriates account for 90%. According to the World Health Organization, spirits were the most popular alcohol in the United Arab Emirates, with a share of 82%, followed by beer (10%) and wine (8%).

- Furthermore, the United Arab Emirates made new laws and removed punishments for the consumption, sales, and possession of alcohol for those 21 years and over. The easing of alcohol restrictions is part of an overhaul of the country's Islamic personal laws. Relaxing personal regulations aim to "consolidate the UAE's principles of tolerance." This move reflects the country's changing reputation as a hub for international tourism and business. These changes will boost the consumption of alcoholic beverages in the region.

MEA Alcoholic Drinks Packaging Market Trends

Metal Can Packaging is Expected to Grow Significantly

- In Turkey, the demand for metal beverage cans has increased in the beer segment. The share of metal cans in domestic lager is growing rapidly, accounting for just under half of the total volume share. The price difference between beer in glass bottles and metal beverage cans drives the sales of cans.

- Wine in a can is a new trend penetrating the South African wine packaging market, with winemakers introducing canned versions of their popular offerings. For example, local player Perdeberg Wines has launched a 250ml can format of its Soft Smooth Red range, with the pack featuring a striking zebra-print design.

- In the United Arab Emirates, many brands are increasingly offering their products in metal beverage cans. All imported brands use this type of packaging, with a beer in the 330 ml format in a 24-pack being cheaper than the equivalent packaging for glass bottles. Brands offer smaller size packages for testing new spirits.

- A growing preference for metal cans is expected to be seen in the non-alcoholic beer segment. A non-alcoholic beer brand, Barbican, is driving this trend by shifting from glass packaging to metal cans with refreshing designs for its pomegranate, apple, and strawberry flavors.

The South African Market is Expected to Grow Significantly

- In the last decade, while the country's beer fans embraced Pale Ales and Lagers, the reach of local sorghum-based beer remained limited to rural areas. Also, homebrewed and commercial sorghum beer is often sold in unhygienic and unsafe packaging that is not tamper-proof. However, a few of South Africa's new microbreweries recently started to turn sorghum-based beer into their modern recipes. They also introduced paper-based packaging 'conical cartons' for this beer, which are sealed pack cartons. Therefore, this type of packaging ensures retailers' and consumers' trust regarding the quality of the beer inside a sealed carton.

- The sustainability trend is gaining traction among consumers and major players in the alcoholic drinks market. Recently, South African Breweries launched its new Cold Lock secondary packaging for its Castle Lite range that claims to keep the beer colder for longer without using ice after refrigeration.

- According to #BizTrends2020, the premium rum trend gained momentum in the country. Champagne and Cognac will continue to be popular as the population of black middle-class increases in South Africa. The rise of sparkling wine continues as consumers develop a taste for premium and imported wines. With the severe economic pressure faced by consumers, ready-to-drink (RTD) and international beers may continue to drive category growth as consumers use the international brand credentials and accessible price points to differentiate themselves from their peers.

- During COVID-19, the declining consumer purchasing power and reduced disposable incomes drove the emergence of larger value-for-money packaging. For instance, the 1 liter Carling black label size recorded strong growth, albeit from a low base.

MEA Alcoholic Drinks Packaging Industry Overview

The availability of several players providing packaging solutions for alcoholic beverages has intensified the competition in the market. Therefore, the Middle-East and African alcoholic drinks packaging market is moderately fragmented, with many companies developing expansion strategies. Some of the recent developments are:

- June 2021 - Can-Pack collaborated with SSHS Group Hungary to give its Regenera brand a gentle, modern, premium look and feel for its can using subtle color with a matte finish. Regenera is a fruit-flavored, functional drink made from herbal extracts that aim to combat the side effects of hangovers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growth in Purchasing Power of Consumers

- 4.4.2 Growing Awareness Among Alcoholic Beverage Manufacturers to Differentiate Their Products Over Packaging

- 4.5 Market Challenges

- 4.5.1 Government Restrictions on Alcoholic Drinks Consumption

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Primary Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Paper

- 5.2 By Alcoholic Products

- 5.2.1 Wine

- 5.2.2 Spirits

- 5.2.3 Beer

- 5.2.4 Other Types of Alcoholic Beverages

- 5.3 By Product Type

- 5.3.1 Glass Bottles

- 5.3.2 Metal Cans

- 5.3.3 Plastic Bottles

- 5.3.4 Other Product Types

- 5.4 By Country

- 5.4.1 United Arab Emirates

- 5.4.2 South Africa

- 5.4.3 Egypt

- 5.4.4 Turkey

- 5.4.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ball Corporation

- 6.1.2 Crown Holdings Inc.

- 6.1.3 Huhtamaki Oyj

- 6.1.4 Saudi Arabian Glass Co. Ltd

- 6.1.5 Saverglass SAS

- 6.1.6 Consol Glass Ltd

- 6.1.7 Middle East Glass Manufacturing Company SAE

- 6.1.8 Bonpak (Pty) Ltd

- 6.1.9 The National Company For Glass Industries (Zouja)

- 6.1.10 Majan Glass Company SAOG

- 6.1.11 Nampak Ltd

- 6.1.12 Can-Pack SA

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219