|

市場調查報告書

商品編碼

1640509

拉丁美洲酒精飲料包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)LA Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

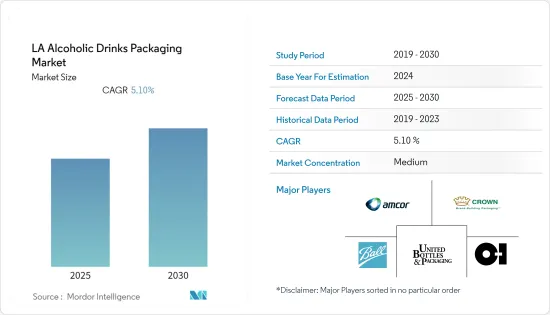

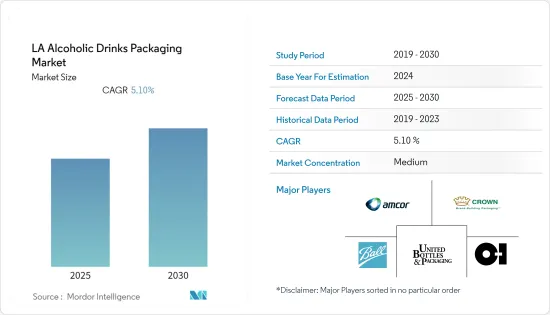

預計預測期內拉丁美洲酒精飲料包裝市場的複合年成長率將達到 5.1%。

主要亮點

- 近年來,一些阿根廷本土烈酒引起了國際關注,例如墨西哥龍舌蘭酒、巴西凱Caipirinha和阿根廷馬爾貝克葡萄酒。這些是該地區最暢銷的類別。此外,遊客數量的增加往往會花費更多的收入來品嚐該地區受歡迎的酒精飲料。因此,這些暢銷國家將對市場成長產生正面影響。

- 泛美衛生組織 2020 年在拉丁美洲和加勒比地區進行的一項研究發現,在新冠疫情爆發的頭幾個月(2020 年 3 月至 6 月),酒精飲料的消費量高於2019 年。著女性為15.2%,男性為13.1%。這可能部分是由於政府為遏制新冠病毒傳播而實施的隔離措施。在那段時期裡,酒吧、夜總會等各種人們通常飲酒的場所都被關閉,派對和聚會被禁止,有些地方甚至禁止銷售酒精飲料。

- 根據泛美衛生組織的數據,葡萄酒在疫情期間變得更受歡迎,在分析期內(2020 年 3 月至 6 月),葡萄酒的消費者佔有率與 2019 年相比增加了 7.5%。同時,啤酒和烈酒消費佔有率分別下降了3.6%和3.5%。然而,疫情過後,銷售額預計將恢復到疫情之前的水準。

- 根據國際葡萄與葡萄酒組織的數據,2020 年,阿根廷和智利繼續在拉丁美洲的葡萄酒生產和出口中處於領先地位。兩國出口的葡萄酒大部分都是散裝運輸。因此,這些國家的葡萄酒包裝成長受到限制,因為大多數出口的葡萄酒都是在其他國家包裝的。

拉丁美洲酒精飲料包裝市場的趨勢

啤酒可望主導市場

- 拉丁美洲的啤酒消費量位居世界第三。在全球範圍內,最受歡迎的啤酒是皮爾森啤酒,但消費者的習慣正在發生變化,精釀啤酒和高級啤酒的消費量正在迅速成長。同樣,啤酒製造商也正在從傳統的玻璃瓶包裝轉向金屬罐和寶特瓶。

- 考慮到拉丁美洲戶外活動和盛會的日益流行,金屬罐包裝讓啤酒消費者可以在多樣化、活躍的環境中享用自己喜歡的啤酒,同時又不影響產品的口味或品質。飲料罐可無限回收,只需 60 天就能變成新罐。

- 消費者可支配收入的增加和快速的都市化(巴西87%的人口居住在城市)是推動啤酒在受調查市場流行的一些關鍵因素。此外,無酒精啤酒的推出預計將刺激該地區對此類啤酒的需求。

- 巴西是拉丁美洲最大的啤酒消費國。巴西的啤酒市場主要由國內品牌推動。所銷售的啤酒大部分都是入門價位,許多消費者都能負擔得起。然而,許多巴西消費者正接受少喝酒但享受健康的趨勢。啤酒市場的消費者變得越來越“喜歡嘗試”,因此越來越多的人開始尋求新風格的啤酒。這一趨勢為優質啤酒和精釀啤酒創造了各種機會。此外,現代消費者(主要是千禧世代和 Z 世代)似乎對品牌的忠誠度較低,這為向市場推出新型啤酒創造了機會。

巴西可望佔據較大市場佔有率

- 巴西傳統上可能與葡萄酒沒有聯繫,但其亞熱帶氣候意味著它可以生產各種獨特的葡萄酒。巴西是第三大葡萄酒生產國,2020 年葡萄酒產量為 190 萬百公升。巴拉圭、中國和美國是三大出口市場,佔巴西葡萄酒出口總額的70%以上。製造商不再進行散裝出口,而是主要出口瓶裝氣泡酒,從而推動了當地的葡萄酒包裝產業的發展。

- 巴西啤酒巨頭安貝夫公司(Ambev SA)設定了2025年消除其包裝中塑膠污染的目標。該公司估計,該項目將創造價值 2.3909 億美元的業務。該公司正在與供應商、製造商、回收合作社、新興企業和大學等相關人員合作,以確保其所有飲料均採用可回收包裝或由 100% 可回收材料製成。

- 2020 年,巴西精釀啤酒品牌 Beerland 決定將 100% 的產品系列採用金屬罐而不是玻璃罐包裝。為了此次包裝轉型,該公司與 Crown Holdings 的子公司 Crown Embalagemes Metallicas da Amazonia 進行了合作。精釀啤酒商的目標是擴大地理覆蓋範圍、吸引當地消費者、提高品牌知名度和可用性、並滿足不斷變化的市場需求。 Bierland 之所以選擇飲料罐,是因為它有許多固有的優勢。

- Amcor plc 為位於聖保羅萊米的飲料製造商 New Age Bebidas 設計了一款自訂的600 毫升瓶子,將玻璃般的香檳式底座與輕質、抗碎 PET 的便利性相結合。 Amcor 採用一步吹塑成型工藝為啤酒廠生產瓶。瓶子有一個皇冠形的金屬蓋,複製了標準的玻璃瓶。 寶特瓶將取代玻璃瓶,並經過相同的冷灌、封蓋和巴氏殺菌製程。

拉丁美洲酒精飲料包裝產業概況

由於有多家公司提供酒精飲料包裝解決方案,市場競爭非常激烈。因此,市場適度分散,許多公司正在實施擴大策略。以下是一些最新進展:

- 2020 年 7 月-IntraPac International LLC 推出取得專利的燒瓶形寶特瓶。這是一個100毫升的燒瓶,尺寸非常適合隨身攜帶。此外,我們還改進了肩部幾何形狀,減輕了重量,並透過前標籤面板提供了增加 10% 的品牌空間。此瓶可100%以PCR處理。

- 2020 年 2 月 - Garcon Wines 與 Amcor plc 合作,使用消費後回收 (PCR) PET 塑膠製造扁平葡萄酒瓶。 Amcor 的寶特瓶具有時尚、現代的設計,完美滿足當今追求便利且永續性的生活方式。 寶特瓶不易破損,是海灘和泳池的理想選擇,而且它們還具有環境效益,因為它們重量輕、可無限回收,而且碳排放比玻璃瓶或鋁罐小。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 消費者購買力強

- 提高酒精飲料製造商透過包裝實現差異化的意識

- 市場挑戰

- 對環境和永續性的日益關注

- 評估新冠肺炎對市場的影響

第5章 市場區隔

- 按主要材料

- 玻璃

- 金屬

- 塑膠

- 紙

- 按酒精產品

- 葡萄酒

- 烈酒

- 啤酒

- RTD

- 其他酒精飲料

- 依產品類型

- 玻璃瓶

- 金屬罐

- 塑膠瓶

- 其他產品類型

- 按國家

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲國家

第6章 競爭格局

- 公司簡介

- Amcor Plc

- United Bottles & Packaging

- Ball Corporation

- Crown Holdings Inc.

- OI Glass Inc.

- Encore Glass

- IntraPac International LLC

- Graham Packaging Co.

- Berry Global Inc.

- Ardagh Group SA

第7章投資分析

第 8 章:市場的未來

簡介目錄

Product Code: 53934

The LA Alcoholic Drinks Packaging Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- In recent years, Argentina's certain local drinks came into the international limelight, such as Mexico's tequila, Brazil's Caipirinha, and Argentina's Malbec wine. These are the top-selling categories across the region. Moreover, rising tourists tend to spend more of their income to taste popular alcoholic drinks of the region. Therefore, these top-selling countries result in a positive impact on the market growth.

- According to a survey carried out by Pan American Health Organization in Latin America and the Caribbean in 2020, the consumption of alcoholic beverages decreased between the first months of the COVID-19 pandemic (March to June 2020) for both women and men by 15.2% and 13.1% respectively, when compared to 2019. It could be partly explained by the distancing measures implemented by governments to limit the spread of COVID-19. During that period, various establishments where people usually drink, such as bars and night clubs were closed, parties and gatherings were not allowed, and in some places, even sales of alcoholic beverages were prohibited.

- According to Pan American Health Organization, wine gained popularity during the pandemic, with the share of consumers increasing by 7.5% during the period (March to June 2020) analyzed in 2020, compared to 2019. At the same time, the beer and spirits share of consumers went down by 3.6% and 3.5%, respectively. But after the pandemic, it is expected that sales will rebound back to the pre-COVID-19 level.

- According to the International Organisation of Vine and Wine, Argentina and Chile remained the top producer and exporters of wine across Latin America in 2020. A big chunk of wine-both countries' export shipped in bulk. Therefore, the growth of wine packaging in these countries is restrained because a large share of their wine exported is packaged somewhere else.

Latin America Alcoholic Drinks Packaging Market Trends

Beer Expected to Dominate the Market

- Latin America is the third biggest beer consumer by volume in the world. Pilsner is the most popular beer globally, but consumer habits are changing, and craft & premium beer consumption is increasing fast. Similarly, beer manufacturers are also transitioning from traditional glass bottle packaging to metal cans and PET bottles.

- Recognizing the growing popularity of outdoor activities and events throughout Latin America, the metal can format will help beer consumers easily enjoy their favorite brews in diverse, active environments without compromising product taste or quality. Beverage cans are infinitely recyclable and can be transformed into new cans in as little as 60 days, attributes that contribute to a circular economy.

- The increasing disposable incomes of consumers and rapid urbanization ( 87% urban population in Brazil) are a few significant factors driving the popularity of beer in the market studied. In addition, the introduction of non-alcoholic beer is expected to boost the demand for this category in the region.

- Brazil is the biggest consumer of beer in Latin America. Domestic brands primarily supply its beer market. Most sold beers are considered entry-price, which makes them accessible to a large audience. However, many Brazilian consumers have adopted the trend "drink less but drink better." Consumers in the beer market have become more 'experimental,' resulting in more people looking for new beer styles. This trend opens up a variety of opportunities for premium and craft beers. Also, modern consumers (primarily Millennials and Gen-Z) seem to be less brand loyal, creating opportunities for introducing new types of beers in the market.

Brazil is Expected to Hold Significant Market Share

- Brazil may not be inherently associated with wine, but it has a wide variety of distinctive wine production characteristics because of its subtropical climate. Brazil is the third-largest producer, with 1.9 million hectoliters of wine in 2020. Paraguay, China, and the United States are the three major export markets, as they constitute more than 70% of total Brazilian wine exports. Manufacturers mainly export sparkling wine bottles instead of exporting in bulk, promoting the local wine packaging industry.

- Brazil's one of the largest brewer Ambev SA has set a target to eliminate plastic pollution in its packaging by 2025. The company estimated that this move could generate USD 239.09 million (approx.) in business. It is partnering with stakeholders, including suppliers, manufacturers, recycling cooperatives, startups, and universities, to have all its beverages either in returnable packaging or made of 100% recycled material.

- In 2020, Brazil-based craft beer brand Bierland decided to pack 100% of its product portfolio into metal cans instead of glass. For this packaging transition, the company collaborated with Crown Embalagens Metalicas da Amazonia S.A., a Crown Holdings, Inc subsidiary unit. The craft brewer aims to expand its regional reach and appeal to local consumers, increase its brand presence, enhance its accessibility and respond to changing market demands. Bierland chose beverage cans due to their many inherent benefits.

- Amcor plc designed a custom 600 mL bottle for beverage maker New Age Bebidas of Leme, Sao Paulo, that features a glass-like, champagne-style base combined with the convenience of lightweight and shatter-resistant PET. Amcor used its one-step blow molding process to make the bottles for the brewery. The bottles feature a crown metal cap, replicating the standard glass bottle. The PET bottle will replace the glass and go through the same cold-filling, capping, and pasteurizing processes.

Latin America Alcoholic Drinks Packaging Industry Overview

The availability of several players providing packaging solutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies. Some of the recent developments are:

- July 2020 - IntraPac International LLC launched a patented Flask PET bottle. It is a 100 ml Flask which is the perfect size for on-the-go convenience. Moreover, it offers an enhanced shoulder profile, reduced gram weight, and increases the front label panel area by 10%, offering additional branding space. This bottle can be processed with 100% PCR.

- February 2020 - Garcon Wines collaborated with Amcor plc for the production of flat wine bottles made with post-consumer recycled (PCR) PET plastic. Amcor's PET Bottles are sleek, modern, and perfectly matching with today's lifestyle requirements for convenience and sustainability. PET bottles are unbreakable, beach- and pool-friendly, and also have environmental benefits since they are lightweight, infinitely recyclable, and have a lower carbon footprint than glass bottles or aluminum cans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 High Purchasing Power of Consumers

- 4.4.2 Growing Awareness Amongst the Alcoholic Beverage Manufacturers to Differentiate their Products Over Packaging

- 4.5 Market Challenges

- 4.5.1 Increasing Environmental and Sustainability Concerns

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Primary Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Paper

- 5.2 By Alcoholic Products

- 5.2.1 Wine

- 5.2.2 Spirits

- 5.2.3 Beer

- 5.2.4 Ready To Drink

- 5.2.5 Other Types of Alcoholic Beverages

- 5.3 By Product Type

- 5.3.1 Glass Bottles

- 5.3.2 Metal Cans

- 5.3.3 Plastic Bottles

- 5.3.4 Other Product Types

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Mexico

- 5.4.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Plc

- 6.1.2 United Bottles & Packaging

- 6.1.3 Ball Corporation

- 6.1.4 Crown Holdings Inc.

- 6.1.5 O I Glass Inc.

- 6.1.6 Encore Glass

- 6.1.7 IntraPac International LLC

- 6.1.8 Graham Packaging Co.

- 6.1.9 Berry Global Inc.

- 6.1.10 Ardagh Group SA

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219