|

市場調查報告書

商品編碼

1641822

越南數位電子看板市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vietnam Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

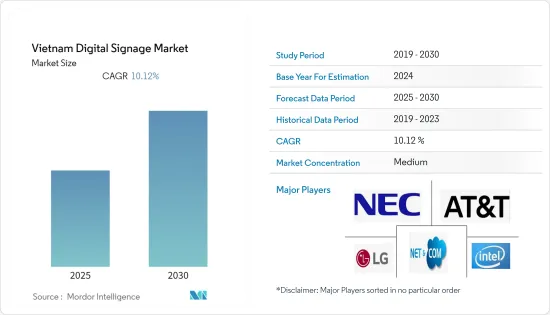

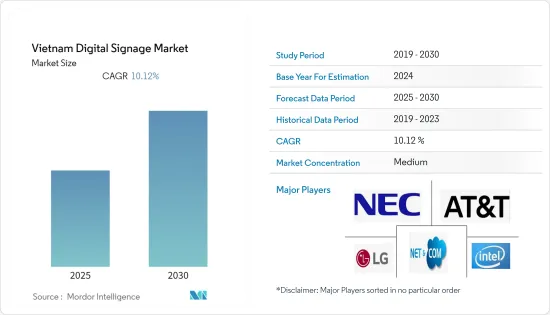

預計預測期內越南數位電子看板市場複合年成長率將達到 10.12%。

主要亮點

- 數位電子看板已成為影響購買決策的關鍵因素。政府、醫療保健、公共交通和零售店等機構現在嚴重依賴數位電子看板來更好地吸引目標受眾並傳達訊息。

- 預計未來幾年,數位電子看板位看板將在各種新興經濟體中迅速發展,因為內容和訊息可以顯示在電子螢幕或數位看板上,並且可以在不對實體標牌進行任何修改的情況下進行更改。被使用。隨著技術的進步和價格的下降,數位電子看板的採用變得越來越普遍和主流。

- 數位電子看板解決方案供應商不斷投資於產品創新。例如,三星宣佈在全球推出其模組化 MicroLED 螢幕的最新版本「The Wall Luxury」。預計此類技術創新和不斷成長的廣告支出將推動該國的需求。

- 新冠疫情爆發對所調查的市場產生了影響,因為在初期,製造工廠被關閉,在家工作的趨勢也導致需求下降。然而,這種情況擴大了許多行業的數位數位電子看板行銷範圍,尤其是醫院和公共場所已經利用這項技術來顯示重要資訊。此外,俄羅斯和烏克蘭之間的戰爭正在影響整個包裝生態系統。

越南數位電子看板看板市場趨勢

OLED 成長顯著

- OLED 技術有望大幅提升影像品質,並有可能實現革命性的新型消費顯示器。 OLED 經常被吹捧為數位顯示器和螢幕的未來。

- OLED是唯一能夠克服傳統顯示器限制的技術,並且與動態形式相結合,增強了真實感。 OLED 基於自發光光源,這意味著它們能夠提供卓越的光線和色彩還原。它的靈活性和透明度是透過創新有機發光二極體材料的開發而實現的。

- 一種被稱為透明OLED(T-OLED)的自發射OLED技術甚至可以創造出透明度提高四倍的螢幕。它保留了 OLED 技術的無限對比度和理想色彩,可實現壯觀的影像疊加。 LCD只能產生透明度為10%的顯示螢幕,而T-OLED的透明度卻達到了38%。螢幕正面具有抗紫外線功能,從正面觀看時,螢幕後面的內容可以與內容融為一體,使其成為商店櫥窗中吸引旁觀者注意力的理想展示品。

- 在越南,我們正在推銷OLED數位電子看板的應用。例如,2021年8月,越南在胡志明市西貢展覽和會議中心舉辦了國際LED/OLED數位電子看板展會。

- 此外,LG Display 已在越南投資 14 億美元,擴大用於電視、智慧型手機和汽車螢幕的有機發光二極體(OLED) 顯示器的生產。根據海防市公告,此項投資將使LG Display的月度OLED模組產能從960萬台擴大至1,010萬台、1,300萬台和1,400萬台。

數位電子看板廣泛應用於商業應用

- 全球數位電子看板數位電子看板市場正在蓬勃發展,因為需要在商業空間(例如酒店中心、零售店和其他公共場所)安裝數位看板來顯示廣告以及產品資訊、說明、方向和娛樂內容。數量的不斷增加。

- 透過提高消費者的品牌知名度、吸引路人的注意力、提高業務效率、增強客戶體驗以及在市場上推廣新產品,商業數位電子看板可幫助企業高效營運,並使公司能夠有效地接觸客戶並與他們互動,從而吸引新的商業機會。

- 例如,社群媒體是影響和吸引零售業客戶的強大工具。但事情並不總是那麼簡單。創建成功的社交媒體內容、傳播它並讓人們「喜歡」它可能很困難。數位電子看板可讓您重新利用您的社交媒體訊息並將其呈現在您的受眾面前,而不會受到其他干擾。

- 零售店中的數位電子看板可以引導顧客購買特定產品、提供提升銷售,甚至提供洗手間或急救站的方向以及緊急資訊。這節省了員工人事費用並讓客戶能夠控制自己的體驗。

越南數位電子看板產業概況

越南的數位電子看板市場部分分散,由幾個主要企業組成。從市場佔有率來看,目前只有少數主要參與者佔據市場主導地位。然而,許多公司正在透過創新解決方案擴大其市場佔有率,贏得新契約並拓展新市場。主要參與者包括 Net &Com Integrated Telecom、Votatel Integrated Solutions Vietnam Co. Limited、NEC Corporation(越南)、ATT Systems Group(越南)、Inavate AV 和 Ingram Micro(英特爾公司)。

- 2022 年 12 月—據越南政府稱,韓國電子巨頭三星和 LG 計劃在越南再投資數十億美元。由於全球需求疲軟,三星今年兩度削減越南智慧型手機產量,之後發表了上述聲明。越南最大的外國投資者三星電子計劃將其總投資額從180億美元增加至200億美元。

- 2022 年 2 月 -Panasonic Corporation宣布,總部位於越南社會主義共和國平陽省的Panasonic生活解決方案越南公司將在其現有工廠所在地建造一座新辦公大樓,以滿足越南對電氣建築材料日益成長的需求。消息已公佈。新工廠總建造成本為13億日圓(988萬美元),將成為該公司第二家生產配線裝置和斷路器的工廠。新工廠預計於 2023 年 4 月開始生產。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 顯示器技術不斷進步

- 非接觸式互動日益流行

- 市場限制

- 數位電子看板面臨的安全挑戰

第6章 市場細分

- 按顯示方式

- 液晶/等離子

- LED

- 投影螢幕

- 有機發光二極體

- 其他顯示模式

- 按解決方案類型

- 硬體

- 軟體

- 按應用

- 基礎設施

- 產業

- 商業的

- 其他用途

第7章 競爭格局

- 公司簡介

- Net & Com Integrated Telecom

- Vodatel Integrated Solutions Vietnam Co. Limited

- NEC Corporation

- ATT Systems Group

- Inavate AV

- Intel Corporation

- LG Corporation

- Panasonic Corporation

- Sony Group Corporation

第8章投資分析

第9章:市場的未來

The Vietnam Digital Signage Market is expected to register a CAGR of 10.12% during the forecast period.

Key Highlights

- Digital signage has played an important factor in influencing the purchase decision. Institutions like the government, healthcare, public transit, and retail stores are now heavily relying on digital signage to better engage their targeted audiences to communicate their message.

- As digital signage enables content and messages to be displayed on an electronic screen or digital sign and can be changed without modification to the physical sign, aggressive growth across various emerging economies over the next few years is anticipated. The adoption of digital signage is becoming more popular and mainstream with the technological advancements and decrease in price.

- The vendors offering digital signage solutions are continuously investing in product innovations. For instance, Samsung announced the global launch of The Wall Luxury, the latest version of its modular MicroLED screen, which can be tailored to any size and aspect ratio. Such innovations and the increase in ad spending are expected to drive the demand in the country.

- The COVID-19 outbreak has affected the studied market, as the manufacturing facilities were closed in the initial phase, and work-from-home trends also reflected the decrease in demand. However, the scenario expanded the scope of marketing through digital signage across many industries, especially in hospitals and public places, which utilized the technology for displaying important information. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Vietnam Digital Signage Market Trends

OLED to Show Significant Growth

- OLED technology promises significantly enhanced picture quality, with the potential for innovative new consumer display presentations. It is often hailed as the future of digital displays and screens.

- It is the only technology that overcomes the limitations of conventional displays, as it offers enhanced reality combined with a dynamic form. OLED provides superior light and color expression, as it is based on self-emitting light sources. Its flexibility and transparent nature result from the development of innovative OLED materials.

- The self-lighting OLED technology known as transparent OLED (T-OLED) also produces four times more transparent screens. For a spectacular image overlay, it keeps the unending contrast and ideal colors of OLED technology. While LCD has only been used to produce displays with 10% clarity, T-OLED offers 38% transparency. Due to the front-facing UV protection, the display is perfect for store windows that draw attention from onlookers because things behind the screen blend with the content when viewed from the front.

- Vietnam is marketing the application of OLED digital signage boards in the country. For instance, in August 2021, the country hosted the International LED/OLED and Digital Signage Show at Saigon Exhibition and Convention Center in Ho Chi Minh.

- Moreover, LG Display also invested USD 1.4 billion in Vietnam to expand its organic light-emitting diode (OLED) display production, which is used in TVs, smartphones, and automotive screens. According to a statement made by Hai Phong city, the investment would expand LG Display's monthly production capacity of OLED modules from 9.6 million to 10.1, 13, and 14 million.

Digital Signage is Widely used in Commercial Applications

- The global digital signage market is booming due to the increasing number of digital signs being installed in commercial spaces, such as hospitality centers, retail stores, and other public spaces for advertising, as well as displaying product information, instructions, directions, and entertaining content.

- By increasing brand awareness among consumers, catching the attention of passersby, improving business operating efficiency, enhancing customer experiences, and promoting new products in the market, digital signage in commercial applications allows businesses to efficiently and effectively reach and interact with their customers, thereby attracting new business opportunities for them.

- For instance, social media is a powerful tool for influencing and enticing customers in the retail industry. However, it is not always simple. It may be tough to create successful social media material, distribute it, and persuade others to "like" it. It is simple to repurpose social media information and get it in front of an audience without any other distractions with digital signage.

- Customers can be directed to specific products, upsell things, find their way to restrooms or assistance stations, and even get emergency information with digital signage in retail. This saves money on employees and puts customers in command of their own experience.

Vietnam Digital Signage Industry Overview

The Vietnamese digital signage market is partially fragmented and consists of several major players. In terms of market share, few major players currently dominate the market. However, many companies are increasing their market presence with innovative solutions by securing new contracts and tapping new markets. The major players include Net & Com Integrated Telecom, Vodatel Integrated Solutions Vietnam Co. Limited, NEC Corporation (Vietnam), ATT Systems Group (Vietnam), Inavate AV, and Ingram Micro (Intel Corporation).

- December 2022 - According to the Vietnamese government, South Korean electronics behemoths Samsung and LG plan to invest billions of dollars more in Vietnam. Samsung made the statement after reducing smartphone manufacturing in Vietnam twice this year in response to weakening demand worldwide. The largest single foreign investor in Vietnam, Samsung Electronics, will increase its overall investment to USD 20 billion from USD 18 billion.

- February 2022 - To meet the rising demand for electrical construction materials in Vietnam, Panasonic Corporation announced that Panasonic Life Solutions Vietnam Co., Ltd., with its headquarters in Binh Duong province, Socialist Republic of Vietnam, would build a new building on the grounds of its current factory. With an estimated expenditure of 1.3 billion yen (9.88 million USD), this will be the company's second factory capable of producing wiring devices and circuit breakers. Production at the new facility is anticipated to begin in April 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancements in Displays

- 5.1.2 Contactless Interaction is Becoming Increasingly Popular

- 5.2 Market Restraints

- 5.2.1 Issues with Digital Signs that are Currently being Addressed in Terms of Security

6 MARKET SEGMENTATION

- 6.1 By Mode of Display

- 6.1.1 Liquid Crystal Display/Plasma

- 6.1.2 LEDs

- 6.1.3 Projection Screens

- 6.1.4 OLEDs

- 6.1.5 Other Modes of Display

- 6.2 By Solution Type

- 6.2.1 Hardware

- 6.2.2 Software

- 6.3 By Application

- 6.3.1 Infrastructure

- 6.3.2 Industrial

- 6.3.3 Commercial

- 6.3.4 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Net & Com Integrated Telecom

- 7.1.2 Vodatel Integrated Solutions Vietnam Co. Limited

- 7.1.3 NEC Corporation

- 7.1.4 ATT Systems Group

- 7.1.5 Inavate AV

- 7.1.6 Intel Corporation

- 7.1.7 LG Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Sony Group Corporation