|

市場調查報告書

商品編碼

1641998

穿戴式運算設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Wearable Computing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

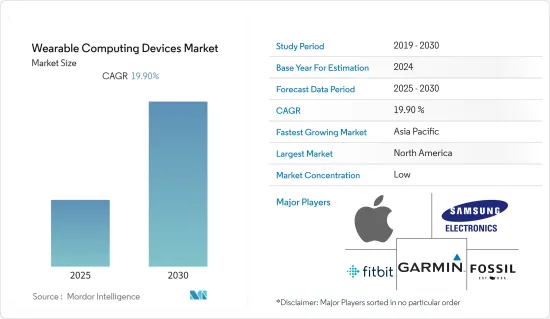

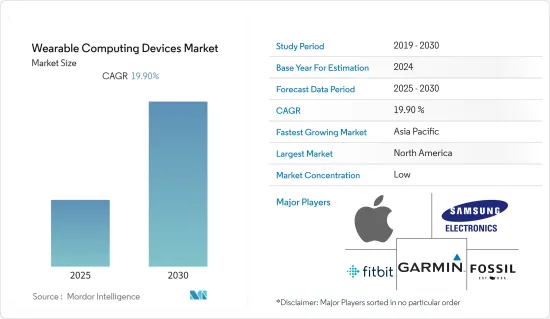

預計預測期內穿戴式計算設備市場複合年成長率將達到 19.9%。

主要亮點

- 穿戴式裝置市場日益進步的技術正在推動市場發展隨著各領先供應商不斷增加的技術創新,穿戴式科技正迅速發展成為一個重要的技術領域。

- 消費者健康意識的增強正在推動市場的發展。在全球消費者健康意識不斷增強的趨勢推動下,心率變異性監測、心電圖和脈搏追蹤等醫療功能擴大被整合到智慧穿戴裝置中。越來越多的參與者以具有競爭力的價格推出健身設備,加速了穿戴式裝置市場的發展趨勢。

- 然而,由於新冠疫情的爆發,全球電子設備需求大幅下降,但逐漸恢復正常。根據國際產業組織IPC發布的報告,與歐洲同業相比,在北美、亞太地區和全球開展業務的公司的訂單訂單下降速度更快。半導體技術推動的連結能力不斷增強,為智慧型手錶、健身帶等數位健康設備的發展提供了助力。

- 邁瑞推出了mWear系統,這是一種病患監測解決方案,可支援對心電圖、血氧飽和度、非侵入性血壓、呼吸頻率、脈搏頻率和體溫等生命徵象進行全面、準確的測量。透過突顯關鍵症狀變化並自動觸發緊急模式和警報升級,臨床醫生可以有效識別病情惡化的早期跡象並及時介入。

穿戴式運算設備市場趨勢

智慧服飾:具有巨大成長潛力的市場

- 智慧服裝的潛在用途包括傳導能量、與其他設備通訊、轉換成不同的材質以及保護穿著者免受環境危害的能力。由於對技術布料的需求,預計未來幾年該市場將大幅擴張。半導體與這些智慧服飾結合,可以方便監測工業工人的安全和健康相關問題。

- 台灣智慧服飾製造商 AiQ 推出了汽車玻璃應用的不銹鋼纖維織物。

- Carhartt 與 clim8 合作推出智慧加熱背心。這件背心可以對變化的環境、活動量和體溫做出即時反應。穿上這件衣服可以幫助員工避免過熱並在寒冷的天氣裡穿多層衣服。

- 新加坡南洋理工大學的科學家開發出一種柔韌防水的織物,可以將身體運動轉化為電能,為穿戴式裝置供電。當擠壓時,這種織物會將最輕微的運動產生的振動轉化為電荷。

預計北美將佔據較大的市場佔有率

- 北美是智慧穿戴裝置最大的市場之一,其中美國領先,其次是加拿大。可支配收入的增加、新技術產品的採用和需求的加速是市場的一些基本促進因素。

- 根據Value Penguin在美國進行的一項調查,92%的美國會戴上智慧型手錶或Fitbit來監測自己的健康狀況。調查還發現,88% 的受訪者同意佩戴手錶有助於他們走更多步並定期鍛煉,從而達到健身目標。如果健身追蹤器能為使用者提供健康保險折扣,70% 的網路使用者會願意配戴健身追蹤器。

- Northside Hospital System 的一項市場研究發現,為全膝關節置換術患者提供線上物理治療可將旅行時間縮短約 2 小時 20 分鐘,從而節省 169.93 美元。

- 該地區對外骨骼的需求預計將促進該地區研究市場的成長。 2022 年 8 月,北美工人國際工會 (LiUNA) 舉辦了一場外骨骼培訓課程,邀請了從穿戴式裝置的開發和應用中受益最多的真實用戶參加。

- 美國已經採用了這種外骨骼技術。 2022年10月,展出了ROHM Robotics製作的實例。外骨骼由腿部矯正器具和背包提供動力,將協助航空搬運工團隊從飛機上裝卸大型裝備、補給和食物。總的來說,它是有利的,因為它可以減少疲勞,增加耐力並平衡飛行員的體重。

穿戴式運算設備產業概況

穿戴式運算設備市場分散且競爭激烈。新冠疫情爆發後,人們對健康和健身變得更加謹慎,加速了醫療保健領域對健身穿戴裝置的需求。工業 4.0 正在徹底改變各領域的服務,包括製造業、醫療保健和銀行業。這些技術進步也為穿戴式裝置創造了強勁的終端用戶市場。消費者可支配收入的增加為新興市場創造了巨大的市場機會。此外,許多新參與者進入市場,使得競爭愈加激烈。主要參與者包括 Fitbit Inc.、Apple Inc. 和 Adidas AG。

2022 年 1 月,Matterport 宣布與法國虛擬實境開發商 Retail VR 建立合作夥伴關係。透過採用這種身臨其境型技術,Retail VR 可以促進全球品牌的零售和電子商務宣傳活動。數位雙胞胎解決方案使該公司能夠為消費者提供實體店的高品質數位掃描。

2022年12月,Meta收購荷蘭3D智慧眼鏡製造商Luxexcel。 Luxexcel 擅長將全像膜、投影機和 AR(擴增實境)體驗所需的其他元素設計成處方鏡片。 Meta 正在研發新一代VR頭戴裝置將提供高清混合實境,將虛擬物件融入用戶的實體環境中。 Luxexcel 的 3D 列印處方鏡片可用於此目的。

2023 年 2 月,Wellstar Healthcare 與 VR 通訊技術開發商 Moth+Flame 建立合作。 Moth+Flame 提供的訓練將困難談話中的焦慮程度降低了 57%。

2023 年 2 月,印度穿戴式品牌 Gizmore 與 Optiemus Electronics Limited 合作,每年生產約 100 萬支智慧型手錶。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 對市場的影響

- 市場促進因素

- 穿戴式裝置市場技術進步日新月異

- 消費者健康意識增強

- 市場限制

- 穿戴式裝置正變得越來越複雜,安全風險限制了其功能的使用

第5章 市場區隔

- 依產品類型

- 智慧型手錶

- 頭戴式顯示器

- 智慧穿戴

- 耳罩式

- 健身追蹤器

- 隨身攝影機

- 外骨骼

- 其他穿戴式裝置(醫療/臨床穿戴裝置、智慧眼鏡)

- 按最終用戶

- 健身與健康

- 醫療保健

- 資訊娛樂

- 工業和國防

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Apple Inc.

- Samsung Electronics Co. Ltd

- Garmin Ltd

- Fitbit Inc.

- Fossil Group Inc.

- Huawei Technologies Co. Ltd

- Sony Corporation

- Microsoft Corporation

- Nuheara Limited

- Omron Healthcare Inc.

- Huami Corporation

- Withings

- Medtronic PLC

- AIQ Smart Clothing Inc.

- Sensoria Inc.

- GoPro Inc.

- Transcend Information Inc.

- Ekso Bionics Holdings Inc.

- Cyberdyne Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Wearable Computing Devices Market is expected to register a CAGR of 19.9% during the forecast period.

Key Highlights

- Increasing technological advancements in the wearables market are driving the market. Wearable technology is quickly evolving into a significant technology segment, owing to the growing number of technological innovations by various major vendors.

- The increase in health awareness among consumers is driving the market. Owing to the growing trend of health consciousness amongst the global populous, medical features, such as heart rate fluctuation monitoring, ECG, and pulse rate tracking, are increasingly being embedded into smart wearables. More players launching fitness devices at competitive pricing are accelerating the wearable market trends.

- However, with the outbreak of COVID-19, the global demand for electronics slumped significantly but is gradually returning back to normal flow. According to a report released by IPC (international industry association), backlogs are declining at a higher rate among firms operating in North America, APAC, and globally when compared to firms in Europe. The development of improved connectivity enabled by semiconductors will drive digital health gadgets like smartwatches or fitness bands.

- Mindray launched the mWear system, a patient monitoring solution that supports comprehensive and precise measurements of vital signs, including ECG, oxygen saturation, noninvasive blood pressure, respiration rate, pulse rate, and temperature. With the highlights of critical sign changes, auto-triggered emergency mode, and alarm escalations, clinicians can effectively identify early signs of deterioration and offer timely interventions.

Wearable Computing Devices Market Trends

Smart Clothing Expected to Witness Significant Growth

- Potential uses for smart clothing include its capacity to conduct energy, communicate with other devices, change into different materials, and shield its wearer from environmental dangers. The market is anticipated to expand significantly in the upcoming years due to the demand for technical fabrics. Combining semiconductors with these intelligent clothing items will make it easier to monitor industrial worker security and health-related issues.

- AiQ, a Taiwanese smart clothing company, introduced stainless steel fiber-based woven fabric for automotive glass applications.

- Carhartt launched Smart Heated Vest in partnership with clim8. The vest is made to react instantly to shifting environments, exercise levels, and body temperatures. By donning this, employees can avoid overheating in cold-weather gear and clinging to layers of clothing.

- Scientists at Nanyang Technological University in Singapore developed a flexible waterproof fabric capable of converting body movement into electrical energy for powering wearable devices. A distinguished type of polymer is used to design this fabric, which converts vibrations produced by the slightest motions into an electric charge when squeezed.

North America Expected to Hold Significant Market Share

- North America is one of the largest markets for smart wearables, with the United States leading the market, followed by Canada. The increase in disposable income and the accelerated adoption and demand for new technological gadgets are some of the fundamental drivers of the market.

- According to a survey conducted by Value Penguin in the USA, 92% of Americans wear smartwatches or fitbits to monitor their health. The survey also revealed that 88% of these respondents agree that wearing the watch has helped them achieve a fitness goal by increasing steps and exercising regularly. 70% of netizens are willing to wear a fitness tracker if provided with health insurance discounts.

- The market study by Northside Hospital System showed that online physiotherapy sessions given to patients of total knee arthroplasties saved approximately 2 hours and 20 minutes in travel time and a saving of USD 169.93.

- The demand for exoskeletons in the region is anticipated to aid the growth of the market studied in the region. In August 2022, the Laborers' International Union of North America (LiUNA) sponsored an exoskeleton training session where real-world users who benefited most from the development and introduction of wearables were highlighted.

- US Air Force is adopting this exoskeleton technology. In October 2022, displayed a Roam Robotics-made example of one of these. This exoskeleton aids aerial porter teams in loading and unloading bulky pallets of gear, supplies, and food from transport planes when it is activated by leg braces and a rucksack. Overall, it is advantageous since it lessens tiredness, boosts endurance, and balances airmen's weight.

Wearable Computing Devices Industry Overview

The wearable computing devices market is fragmented and highly competitive. Post-COVID-19 pandemic, people became more cautious about health and fitness, which accelerated the demand for fitness wearables in the healthcare sectors. Industry 4.0 is revolutionizing the services of every sector, be it manufacturing, healthcare, banking, and others. These technical advancements are creating a robust end-user market for wearables as well. The rising disposable income of consumers is creating huge market opportunities in developing regions. Also, as many new players are entering this market, the competition is increasing in the market. The key players include Fitbit Inc., Apple Inc., and Adidas AG.

In January 2022, Matterport announced its partnership with Retail VR (a French virtual reality developer). By adopting this immersive technology, Retail VR can boost retail and eCommerce campaigns for global brands. With digital twin solutions, the company can give its shoppers high-quality digital scans of physical stores.

In December 2022, Meta acquired Netherlands-based 3D smart glass maker Luxexcel. The latter is proficient in designing elements required for an augmented reality (AR) experience within a prescription lens, such as holographic film and projectors. Meta is working on the next level of VR headset that would deliver high-resolution mixed reality to blend virtual objects into the physical environment around the users. Luxexcel's 3D-printed prescription lenses can be used for this.

In February 2023, Wellstar Healthcare collaborated with Moth+Flame, a VR communication technology developer. The training provided by Moth+Flame reduced the anxiety levels around difficult conversations by 57%.

In February 2023, the Indian wearable brand Gizmore partnered with Optiemus Electronics Limited to manufacture nearly 1 million smartwatches annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 COVID-19 Influence on the Market

- 4.5 Market Drivers

- 4.5.1 Increasing Technological Advancements in the Wearables Market

- 4.5.2 Increase in Health Awareness Among Consumers

- 4.6 Market Restraints

- 4.6.1 Growing Complexity of Wearable Devices and Limited Use of Features, Augmented by Security Risks

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Smartwatches

- 5.1.2 Head Mounted Displays

- 5.1.3 Smart Clothing

- 5.1.4 Ear Worn

- 5.1.5 Fitness Trackers

- 5.1.6 Body Worn Camera

- 5.1.7 Exoskeleton

- 5.1.8 Other Wearables (Medical/Clinical-grade Wearables and Smart Glasses)

- 5.2 End User

- 5.2.1 Fitness and Wellness

- 5.2.2 Medical and Healthcare

- 5.2.3 Infotainment

- 5.2.4 Industrial and Defense

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Apple Inc.

- 6.1.2 Samsung Electronics Co. Ltd

- 6.1.3 Garmin Ltd

- 6.1.4 Fitbit Inc.

- 6.1.5 Fossil Group Inc.

- 6.1.6 Huawei Technologies Co. Ltd

- 6.1.7 Sony Corporation

- 6.1.8 Microsoft Corporation

- 6.1.9 Nuheara Limited

- 6.1.10 Omron Healthcare Inc.

- 6.1.11 Huami Corporation

- 6.1.12 Withings

- 6.1.13 Medtronic PLC

- 6.1.14 AIQ Smart Clothing Inc.

- 6.1.15 Sensoria Inc.

- 6.1.16 GoPro Inc.

- 6.1.17 Transcend Information Inc.

- 6.1.18 Ekso Bionics Holdings Inc.

- 6.1.19 Cyberdyne Inc.