|

市場調查報告書

商品編碼

1642147

整合通訊與協作:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Unified Communications And Collaboration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

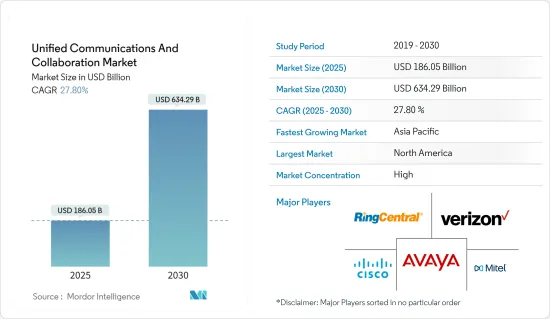

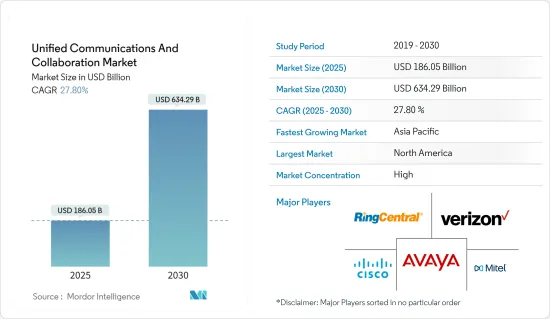

整合通訊和協作市場規模預計在 2025 年為 1,860.5 億美元,預計到 2030 年將達到 6,342.9 億美元,預測期內(2025-2030 年)的複合年成長率為 27.8%。

傳統上,整合通訊和協作的需求一直由單一產品主導。公司正在選擇適合其特定需求的產品。例如,公司購買電子郵件伺服器用於通訊、購買團隊室用於團隊合作、購買入口網站用於組織資訊共用、購買 PBX 和語音郵件用於電話服務。客戶擴大做出策略性技術決策,根據整個協作堆疊的功能、豐富性和整合性來部署整合通訊和協作環境。

關鍵亮點

- 選擇協作和通訊產品的公司通常會根據平台的未來方向來選擇。選擇正確的平台可以幫助企業降低IT成本、管理開銷和整合挑戰。此外,整體平台方法在最終用戶培訓、採用和商業價值方面提供了顯著的優勢。

- 經濟高效的雲端基礎的解決方案的出現,正推動 IT 預算最少的醫療保健提供者採用該解決方案。基於訂閱的統一通訊服務使醫療保健客服中心能夠建立 PBX(專用交換機)系統,以無縫地滿足來自不同位置的多個客戶請求。

- 各種用於個人和 B2B 的資料密集型應用程式正在湧現,包括 AR、VR 和視訊應用程式。 IT、電訊、BFSI、醫療保健、零售、媒體娛樂和許多其他行業都需要各種類型的高頻寬、低功耗、超低延遲和高速度的視訊會議。

- 遠端工作要求推動了基於軟體的通訊成為服務供應商業務永續營運的關鍵推動因素,並催生了新的 UCaaS(統一通訊即服務)解決方案,用於容量調整和服務交付(無論位置如何)。創造了前所未有的機會來展示雲端服務的靈活性,並預計這一趨勢將支持市場成長。

- 實施UCC系統成本高是中小企業面臨的最大問題之一。將多個通訊管道整合到單一平台上需要在基礎設施、軟體和硬體方面進行大量投資。

- 新冠疫情加速了遠端工作的轉變,迫使公司和組織採用虛擬協作工具來確保業務永續營運。隨著越來越多的在家工作,對視訊會議、即時通訊和其他通訊和協作技術的需求正在激增。

整合通訊和協作市場趨勢

零售推動成長

- 零售商正在轉向雲端技術來增加銷售額、分析客戶訊息,並透過降低成本和提高網路效能來改善用戶體驗。例子包括用於語音和其他協作工具的整合通訊即服務(UCaaS)、用於在零售店之間集中資訊服務的支援 WiFI 的網路即服務 (SDNA) 以及軟體廣域網路 (SWAN) 等正在增加零售商的利益。

- 在零售領域,RFID技術仍處於崛起階段。 RFID作為一種近距離技術,具有固有的協同效應。它已作為收銀機定價和庫存管理領域的客戶服務工具得到了廣泛的測試。 RFID 還可作為下一代行動和手持設備的裝置識別和身份驗證機制 - 例如,在顧客進入商店時識別他們並根據他們的偏好自訂體驗。只有資訊才能發揮如此規模的客戶體驗影響。整合通訊技術是零售業的主要技術,將客戶、銷售和庫存業務整合到單一電話、電腦和 POS 系統中。

- 顧客購買模式的快速變化正在推動零售業從單一顧客接觸點轉向透過網路和社群媒體的全通路零售的動態轉變。日益成長的消費者需求推動所有通路購物和客戶服務體驗的改善,而這與實現零售業務流程自動化的創新通訊工具的需求相符。

- 該服飾零售商的網路商店可能會將部分活動從傳統的雲端模式轉換,以利用不同的雲端模型來確保業務的順利運作。您可以利用公共雲端資源來處理訂單並管理資源可擴充性。另一方面,涉及客戶付款資訊等敏感資料、需要嚴格控制的監管工作可以採用私有雲端模式來完成。

- 此外,根據Kantar 2023的數據,亞馬遜被評為全球最有價值的零售品牌,品牌價值約1,750億美元。該公司提供網路零售、電腦、家用電子電器、數位內容領域的產品以及購物折扣等其他本地相關服務。此類零售商的興起也可能刺激研究市場的需求。

北美:有望實現成長

- 快速擴張的整合通訊(UC&C) 市場為企業提供了廣泛的通訊和協作工具。過去幾年,市場大幅成長,這主要歸因於對遠程辦公解決方案的需求不斷增加以及雲端技術的採用。北美佔據 UC&C 市場收益的大部分佔有率,並且是該市場的關鍵參與企業。

- 北美的高技術採用率和對創新的重視使得 UC&C 市場擁有成熟的解決方案。 UC&C 市場的先驅者-微軟、思科和 IBM 的總部都位於北美。

- 這些公司在研發方面投入了大量資金,以創造出滿足企業不斷變化的需求的創新 UC&C 解決方案。

- 北美經濟規模龐大且多元化,各領域的公司集中度較高,為 UC&C 市場提供了有利的解決方案。這些企業需要能夠提高生產力、降低成本並同時增加消費者參與度的溝通和協作解決方案。 UC&C 解決方案已成為北美公司最受歡迎的選擇之一,因為它們為企業提供了實現這些目標的全面工具。

整合通訊與協作 (UC&C) 產業概覽

整合通訊和協作市場正在整合,並見證著快速的技術創新、產業整合以及向團隊和工作流程協作的轉變。近年來,對完整 UC&C 平台的需求導致許多供應商合併,因為這是獲得基本客群的最快方式。市場領導者正專注於新產品開發技術,以加強產品系列增加客戶獲取。

- 2023年11月,Momentum宣布已完成G12 Communications的收購。透過與 G12 聯手,該公司將提供最佳的語音協作解決方案,幫助組織和現代勞動力在日益數位化和協作的世界中蓬勃發展。

- 2023 年 10 月,思科宣布了其 AI 策略,並透過在其 Webex 平台中加入強大的基於 AI 的功能和特性將其付諸實踐。該公司重點介紹了幾種新的設備選項,宣傳了與蘋果的合作夥伴關係,並討論了與 Microsoft Teams 等第三方協作供應商的團隊合作和互通性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 消費者議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估產業中的 COVID-19

第5章 市場動態

- 市場促進因素

- 計量收費模式的出現推動了對傳統 UC 解決方案的需求

- 勞動力動態的變化導致新的企業合作的出現

- 由於中小企業需求不斷成長而推動採用

- 市場問題

- 傳統 UC 的管理和整合挑戰依然存在

第6章 技術概述

- UC&C 的演變

- 各種 UC&C 服務的成本比較

- 新案例研究- 情境協作、企業社交網路和其他內部溝通工具

第7章 市場區隔

- 依實施類型

- 本地/託管

- 雲(UCaaS)

- 按類型

- 商業 VOIP/UC 解決方案

- 企業協作

- 客服中心服務

- 客戶互動應用程式

- 其他

- 按最終用戶產業

- 零售

- BFSI

- 醫療

- 公共部門

- 其他終端用戶產業(物流、IT/通訊等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區(拉丁美洲及中東及非洲)

第8章 競爭格局

- 公司簡介

- Avaya Inc.

- Cisco Systems Inc.

- RingCentral Inc.

- Verizon Communications Inc.

- Mitel Network Communications

- Polycom Inc.(Plantronics)

- NEC Corporation

- AT&T Inc.

- GoToConnect

- 8x8 Inc

- Zoom Video Communications Inc.

- 3CX Ltd.

第9章投資分析

第10章:投資分析市場的未來

The Unified Communications And Collaboration Market size is estimated at USD 186.05 billion in 2025, and is expected to reach USD 634.29 billion by 2030, at a CAGR of 27.8% during the forecast period (2025-2030).

Traditionally, demand for unified communication and collaboration has been dominated by single products. Businesses used to select their own products for particular needs. For example, organizations bought email servers for messaging, team rooms for teamwork, portals for organizational information sharing, and PBX and voicemail for telephony services. Customers are making strategic technology decisions to deploy unified communications and collaboration environments based on the entire collaboration stack's capability, richness, and integration.

Key Highlights

- Companies that choose collaboration and communication products often do so based on the platform's future direction. Selecting the right platform helps companies reduce IT costs, management overhead, and integration challenges. Moreover, a holistic platform approach substantially benefits end-user training, adoption, and business value.

- The advent of cost-effective cloud-based solutions has increased healthcare providers' adoption, often categorized as having minimum IT budgets. With the subscription-based united communication services, the healthcare contact centers establish their PBX (Private Branch Exchange) systems and seamlessly address multiple customer requests from various sites.

- Various individual and B2B data-intensive applications, such as AR, VR, and video applications, are emerging. The industries such as IT, telecom, BFSI, healthcare, retail, media and entertainment, and many others have different types of video conferencing essentials, including high bandwidth, low power, ultra power latency, and high speed.

- Remote work mandates create an unprecedented opportunity for service providers to promote software-based communications as a critical enabler of business continuity and demonstrate the flexibility of unified communications as a service (UCaaS) and cloud services regarding capacity adjustments and service delivery (irrespective of location). This trend is expected to support market growth.

- The high installation costs of UCC systems are one of the greatest problems SMEs confront. Integration of multiple communication channels onto a single platform necessitates substantial investments in infrastructure, software, and hardware.

- The COVID-19 pandemic hastened the transition to remote work, compelling businesses and organizations to adopt virtual collaboration tools to ensure business continuity. Demand for video conferencing, instant messaging, and other communication and collaboration technologies has skyrocketed as more employees work from home

Unified Communications and Collaboration Market Trends

Retail Sector to Witness the Growth

- In order to increase sales, analyse customer information and improve the user experience by lowering costs and improving network performance, retailers are taking advantage of cloud technology. For example, the benefits to retailers are enhanced by Unified Communications as a Service UCaaS for Voice and Other Collaboration Tools, WiFI Networks Enabled Network As A Service SDNA for Centralized Data Services Across All Retails,and Software Wide Area Networks.

- In the retail sector, RFID technology is still increasing. As a proximity technology, RFID has an innate synergistic effect. In the field of pricing and inventory management in the checkout line, it has been extensively tested as a customer service tool. RFID is also intended to be a device recognition and authentication mechanism for the next generation of mobile or handheld devices, like recognising customers who are coming into stores in order to deliver tailored experiences based on their tastes. Only information can be used to leverage the impact of a customer experience at this scale. Unified communications technologies that integrate customer, sales and inventory operations in a single telephone, computer or point of sale system are the locus for retailing.

- Rapid changes in customer purchasing patterns have led to a dynamic shift in the retail sector from an individual point of interaction to omnichannel via the Internet or social media. Increased consumer demand has led to the need for an enhanced shopping and customer service experience across all channels, which is in line with the requirement of innovative communication tools that will enable automated retail business processes.

- In order to guarantee a smooth functioning of its business, clothing retailers' online stores may switch from the traditional cloud model for several activities in order to take advantage of different cloud models. In order to process orders and manage the scalability of resources, public cloud resources could be used. On the other hand, working on legal regulations, including essential data, such as customer payment details, which require strict management, could be done using a private cloud model.

- Furthermore, According to the Kantar 2023, Amazon was ranked as the world's most valuable retail brand, with a brand value of around 175 billion U.S. dollars Offerings products in the area of Internet retailing, computers, consumer electronics, digital content and other locally relevant services like shopping discounts. The demand in the market studied could also be stimulated by such an increase in retailers.

North America is Expected to Witness the Growth

- A variety of communication and collaboration tools are offered to enterprises by the rapidly expanding Unified Communications and Collaboration UC&C market. The market has grown significantly over the past few years, mainly as a result of increasing demand for teleworking solutions and adoption of cloud technologies. North America, with a significant share of the UC&C market's revenues, has become an important participant on this market.

- The high rate of technology adoption and emphasis on innovation in North America have made it mature UC&C market solution. Microsoft, Cisco, and IBM, pioneers in the UC&C market, are headquartered there.

- These businesses have made substantial investments in research and development to create innovative UC&C solutions that meet the evolving requirements of businesses.

- Due to its large and diverse economy and high concentration of businesses in a number of sectors, North America is a favourable solution for the UC&C market. Communication and collaboration solutions that increase productivity, reduce costs while increasing consumer involvement are sought by these businesses. UC&C solutions offer businesses a comprehensive set of tools to achieve these goals, making them one of the most popular options among North American companies.

Unified Communications and Collaboration Industry Overview

The unified communications and collaboration market is consolidated and witnessed rapid innovation, industry consolidation, and a shift toward team and workstream collaboration. In recent years, the need to have a complete UC&C platform caused many vendors to consolidate because acquiring the customer base was the fastest way to accomplish this. The significant players operating in the market focus on new product development techniques to strengthen their product portfolio and increase customer acquisition.

- In November 2023, Momentum,has announced that it has completed its acquisition of G12 Communications, By joining forces with G12, company would to deliver premier voice-enabled collaboration solutions that empower organizations and the modern workforce to thrive in an increasingly digital and collaborative world

- In October 2023, Cisco has announced an AI strategy that the company is making good on with a smattering of generative AI-based features and functionality into the Webex platform. The company highlighted several new device options, promoted its Apple partnership, and even discussed how teamwork and interoperability with third-party collaboration providers, such as Microsoft Teams,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Pay-as-you-go Model Driving the Demand over Legacy UC Solutions

- 5.1.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of Enterprise Collaboration

- 5.1.3 Growing Demand from SME's Expected to Drive Adoption

- 5.2 Market Challenges

- 5.2.1 Management and Integration Challenges Remain a Concern for Traditional UC

6 TECHNOLOGY OVERVIEW

- 6.1 Evolution of UC&C

- 6.2 Cost Comparison of Various UC&C Offerings

- 6.3 Emerging Case Studies - Contextual Collaborations, Enterprise Social Networking and Other Internal Communication Tools

7 MARKET SEGMENTATION

- 7.1 By Deployment Type

- 7.1.1 On-premise/Hosted

- 7.1.2 Cloud (UCaaS)

- 7.2 By Type

- 7.2.1 Business VOIP/UC Solutions

- 7.2.2 Enterprise Collaboration

- 7.2.3 Contact Center Services

- 7.2.4 Customer Interaction Applications

- 7.2.5 Other Types

- 7.3 By End-User Industry

- 7.3.1 Retail

- 7.3.2 BFSI

- 7.3.3 Healthcare

- 7.3.4 Public Sector

- 7.3.5 Others End User Industries (Logistics, IT & Telecom, Etc.)

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.4 Rest of the World (Latin America and Middle East & Africa)

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Avaya Inc.

- 8.1.2 Cisco Systems Inc.

- 8.1.3 RingCentral Inc.

- 8.1.4 Verizon Communications Inc.

- 8.1.5 Mitel Network Communications

- 8.1.6 Polycom Inc. (Plantronics)

- 8.1.7 NEC Corporation

- 8.1.8 AT&T Inc.

- 8.1.9 GoToConnect

- 8.1.10 8x8 Inc

- 8.1.11 Zoom Video Communications Inc.

- 8.1.12 3CX Ltd.