|

市場調查報告書

商品編碼

1644792

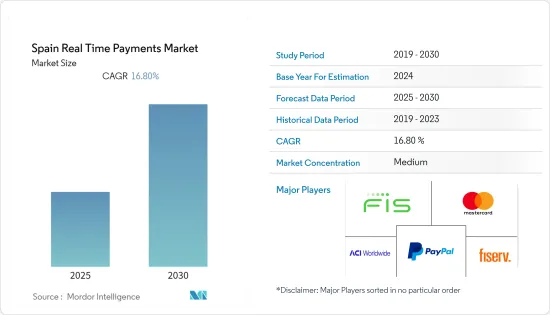

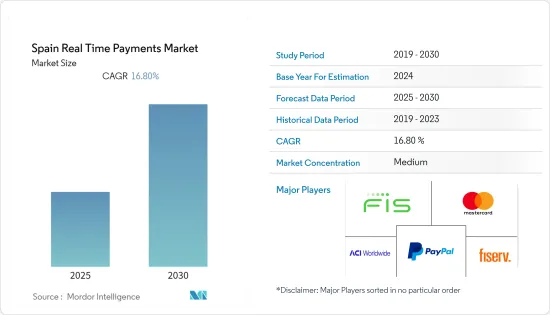

西班牙的即時付款:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Spain Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,西班牙即時付款市場預計將實現 16.8% 的複合年成長率

關鍵亮點

- 西班牙的付款系統仍以簽帳金融卡和信用卡為主。然而,後疫情時代的情況正在不斷變化,西班牙付款市場出現了行動錢包、數位付款、即時付款等替代付款。

- 由於 Bizum 應用程式的巨大成功,西班牙的即時付款市場正在蓬勃發展。 Bizum 於 2016 年推出,基於 SCT Inst,是西班牙銀行於 2016 年推出的一項付款服務,允許用戶透過智慧型手機進行個人對個人 (P2P)付款。 Bizum 行動錢包吸引了數百萬客戶,並定期添加除其原始 P2P 功能之外的功能。

- 促成即時付款快速普及的一個因素是 Bizum 的現代用戶介面,它模仿社交網路。其次,即時付款的使用案例穩定成長,越來越深入消費者的生活。其中包括支持對非政府組織的捐贈、2019 年推出的電子商務付款和退款,甚至即時付款國家彩券獎金。此外,2D碼技術的廣泛應用也增加了其易用性,目前已有超過 11,000 家零售商採用該技術。

- 此外,銀行和電子商務平台已開始提供即時付款服務,例如 Klarna 和 Afterpay 等提供的先買後付服務,以佔領這個快速成長的市場並吸引新用戶。許多 BNPL 平台允許沒有信用卡的人從公司購買並分期付款,因為他們不會對按時付款收取利息。 BNPL 讓企業能夠維持更好的結帳率和客戶維繫。這進一步推動了該地區即時付款市場的成長。

- COVID-19 疫情正在推動人們採用新的、更快、更安全的付款技術,例如即時付款。然而,雖然在封鎖和限制措施增加期間交易量有所下降,但即時付款和轉帳應用程式的使用也有所增加。在西班牙,Bizum 在 COVID-19 疫情期間得到了廣泛應用。

西班牙即時付款市場趨勢

P2P 領域預計將主導西班牙即時付款市場

- Bizum 和 PayPal 是該地區用於快速即時付款的熱門 P2P 應用程式。它們提供即時的P2P付款,讓用戶快速、輕鬆地轉賬,取代傳統的付款方式,改變國內和國際交易的遊戲規則。這種新的即時銀行轉帳方式使用戶的即時付款變得更快、更有效率、更便宜。

- 此外,P2P 交易中現金和卡片的普及度下降進一步推動了該地區即時 P2P 交易的興起。此外,西班牙 P2P付款的激增主要集中在一系列涉及金錢的社交互動和交易中,從餐廳分攤帳單到捐款。此外,即時和幾秒鐘內的付款通知是提升客戶對 P2P付款服務信任的關鍵因素。 Bizum 是 SCT Ins.Transfer,由於電話號碼是客戶帳戶的代理,因此提供了更友善的使用者體驗。

- 此外,P2P 的成長主要得益於 2016 年推出的 Bizum付款服務。 Bizum 讓客戶只需知道收款人的行動電話號碼即可進行安全、方便、快速的銀行帳戶到銀行帳戶付款。這種方法在西班牙年輕人中越來越受歡迎。

- 例如,根據西班牙銀行報告的資料,2021年西班牙智慧型手機即時付款服務中P2P交易將佔交易量的98.95%,其次是C2eR和C2R。

- 預計所有上述因素將在預測期內推動 P2P 即時付款交易。

智慧型手機普及率上升可望推動即時付款市場

- 西班牙最受歡迎的即時付款方式是Bizum,它提供行動和2D碼付款。 Bizum 功能也整合到參與銀行的網站和行動應用程式中。該地區不斷成長的行動和網路普及率預計將推動西班牙的即時付款市場的發展。

- 例如,根據 GSMA Intelligence 報告,西班牙的行動行動電話連接數量從 2017 年 1 月的 52.3 成長到 2022 年 1 月的 55.5。

- 此外,Hootsuite 報告的資料顯示,該地區的網路用戶數量在過去幾年一直在持續成長。 2017年1月網路用戶數為3,780萬,預計2022年1月將增加至4,390萬。

- 此外,行動商務的興起進一步推動了該地區的即時付款市場成長。越來越多的西班牙人開始採用更快捷的付款方式來購物。這使得在該國開展業務的企業必須提供網路購物的即時付款。 Klarna 和 Afterpay 等許多大公司已經推出了本地 BNPL 服務。

- 由於上述因素,該地區的即時付款市場預計將在預測期內擴大。

西班牙即時付款產業概況

西班牙即時付款市場競爭激烈,市場呈現分割狀態。較大的公司提供創新的付款解決方案,並積極進行併購以擴大市場佔有率。西班牙即時付款市場的主要企業包括 ACI Worldwide Inc.、Fiserv Inc.、Mastercard Inc.、FIS Global 等。

- 2022 年 3 月-桑坦德銀行宣布推出即時付款解決方案,使客戶能夠以該地貨幣向巴西匯款。這項新服務由該銀行的付款金融科技公司 PagoNxt 提供,可為從歐洲到巴西的企業提供即時付款。該銀行在西班牙的中小企業和公司客戶將能夠透過網路銀行以巴西雷亞爾向巴西幣的收款人進行即時國際匯款。

- 2021 年 12 月-法國巴黎銀行繼續在整個歐洲推出 SEPA 即時付款計畫。法國巴黎銀行已在西班牙為其企業客戶推出了 SEPA 即時信用轉帳服務,其中包括可再生能源領域的全球領導者 EDPR。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 西班牙付款格局的演變

- 與西班牙無現金交易擴張相關的主要市場趨勢

- COVID-19 對西班牙付款市場的影響

第5章 市場動態

- 市場促進因素

- 智慧型手機普及率不斷提高預計將推動即時付款市場發展

- 對更快付款和減少對傳統銀行業務依賴的需求日益增加

- 即時便捷的即時付款

- 市場問題

- 付款詐騙和安全問題

- 市場機會

- 政府鼓勵數位付款發展的政策有望推動大眾即時付款的成長

- 數位付款產業的關鍵法規和標準

- 西班牙的整體監管狀況

- 可能成為監管障礙的經營模式

- 隨著商業環境的變化而有發展空間

- 關鍵用案例和使用案例分析

- 實際付款交易占全部交易的比例及主要國家交易量及交易金額的區域分析

- 主要國家地區實際付款交易與非現金交易比例及交易量分析

第6章 市場細分

- 依付款類型

- P2P

- P2B

第7章 競爭格局

- 公司簡介

- ACI Worldwide Inc.

- FIS Global

- Paypal Holdings Inc.

- Fiserv Inc.

- Mastercard Inc.

- VISA Inc.

- Iberpay

- Brite AB

- Payfare Inc.

- Apple Inc.

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 91096

The Spain Real Time Payments Market is expected to register a CAGR of 16.8% during the forecast period.

Key Highlights

- The payment system in Spain is still heavily dominated by debit and credit cards, which account for most of the transactions in the country. However, the scenario is continuously changing after the pandemic, and mobile wallets, digital payments, and alternative payments such as real-time payments are gaining ground in the Spain payments market.

- Spain's real-time payment market is growing rapidly, owing to the wildly successful Bizum app. Launched in 2016 and built on SCT Inst, Bizum is a payment service launched by Spanish banks in 2016 to allow users to conduct Person-to-Person (P2P) payments through a smartphone. The Bizum mobile wallet has attracted millions of customers and has regularly added features beyond its original P2P functions.

- A few factors that boosted the rapid adoption of real-time payments, such as the modern Bizum user interface replicating social networks. Another is a steady stream of use cases that take real-time payments deeper into consumers' lives. These include support for donations to NGOs, eCommerce payments launched in 2019 and refunds, and even real-time settlement of national lottery prizes. Its ease of use is also boosted by widely available QR-code initiation adopted at more than 11,000 retail stores.

- Moreover, banks and e-commerce platforms have started offering real-time payment services such as Buy Now Pay Later options like Klarna and Afterpay to capture the rapidly growing segment and appeal to new users. With no interest charged for on-time payments by many BNPL platforms, people without credit cards can make purchases from a business and pay in installments. BNPL lets companies maintain better checkout rates and customer retention. This is further boosting the region's real-time payments market growth.

- The COVID-19 pandemic has boosted the use of new fast and secure payment technologies, such as real-time payments. However, the volume of transactions has fallen during periods of lockdown or tighter restrictions, but the use of instant money payment or transfer apps has also increased. In Spain, the use of Bizum stands out during the COVID-19 outbreak.

Spain Real-Time Payments Market Trends

P2P Segment is Expected to Dominant the Spain Real Time Payments Market

- Bizum and PayPal are two popular P2P apps customers have used for fast and immediate payments in the region. These offer real-time P2P payments that allow users to transfer money between people so quickly and easily that they are replacing more traditional means of payment and changing the game's rules in terms of national and international transactions. This new way of making bank transfers immediately makes these real-time payments much faster, more efficient, and cheaper for users.

- Moreover, the declining popularity of cash and cards for P2P transactions is further increasing the real-time P2P transactions in the region. Additionally, the surge in P2P payments in Spain is governed by various social interactions and transactions involving money, from dividing up the bill at a restaurant to donating. Also, immediacy and payment notifications in seconds are the key factors that grow customer confidence in the P2P payment service. Bizum is an SCT Ins. Transfer with a more friendly user experience because the phone number is a proxy for the customer's account.

- Furthermore, the growth in P2P is primarily supported by the launch of the Bizum payment service in 2016. Bizum enables customers to make payments from bank account to bank account securely, conveniently, and quickly just by knowing the recipient's mobile phone number. The method is becoming increasingly popular in Spain among youth.

- For instance, as per data reported by the Bank of Spain, the P2P transactions on Spain's real-time payment service for the smartphone was 98.95% in the year 2021, followed by C2eR and C2R, respectively.

- All of the above mentioned factors are expected to boost the P2P real-time payment transactions over the forecast period.

Rising Smartphone Penetration is Expected to Foster the Real Time Payments Market

- The most popular real-time payment method in Spain is Bizum, which offers mobile and QR-code payment services. Also, Bizum functionalities are integrated within the website and mobile apps of the participating banks. The growing mobile and internet penetration in the region is expected to drive the real-time payments market in Spain.

- For instance, as reported by GSMA Intelligence, the number of mobile cellular connections in Spain grew from 52.3 in January 2017 to 55.5 in January 2022.

- Furthermore, as data reported by Hootsuite, the number of internet users has been continuously increasing in the region over the past few years. There were 37.8 million internet users in January 2017, which grew to 43.9 million in January 2022.

- Moreover, the rise of mobile commerce further fuels the growth in the region's real-time payments market. Increasingly, the people of Spain are relying on faster payment methods to make their purchases. This makes it incredibly important for organizations doing business in the country to offer real-time payments for online shopping. Many major players such as Klarna and Afterpay have already introduced their regional BNPL services.

- All of the factors above are expected to boost the real-time payments market in the region over the forecast period.

Spain Real-Time Payments Industry Overview

The competition in the Spain real-time payments market is high, and the market appears to be fragmented. Major players offer innovative payment solutions and indulge in mergers and acquisitions to gain market share. Major players in the Spain real-time payments market include ACI Worldwide Inc., Fiserv Inc., Mastercard Inc., and FIS Global, among others.

- March 2022 - Santander announced the launch of a real-time payments solution enabling customers to make transfers into Brazil in local currency. The new service, delivered through the bank's payments FinTech PagoNxt, will allow instant payments for companies from Europe to Brazil. The bank's SME and corporate clients in Spain will be able to make instant international payments in Brazilian real to recipients in Brazil through online banking.

- December 2021 - BNP Paribas continues to roll out the SEPA Instant Payments plan across Europe. BNP Paribas has activated SEPA Instant credit transfers in Spain for its corporate customers, including EDPR, a global leader in the renewable energy sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in Spain

- 4.4 Key market trends pertaining to the growth of cashless transaction in Spain

- 4.5 Impact of COVID-19 on the payments market in Spain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Smartphone Penetration is Expected to Boost the Real Time Payments Market

- 5.1.2 Growing Need for Faster Payments and Falling Reliance on Traditional Banking

- 5.1.3 Immediacy and Ease of Convenience of the Real Time Payments

- 5.2 Market Challenges

- 5.2.1 Payment Fraud and Security Issues

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across Spain

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide Inc.

- 7.1.2 FIS Global

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 Fiserv Inc.

- 7.1.5 Mastercard Inc.

- 7.1.6 VISA Inc.

- 7.1.7 Iberpay

- 7.1.8 Brite AB

- 7.1.9 Payfare Inc.

- 7.1.10 Apple Inc.

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219