|

市場調查報告書

商品編碼

1644990

中國光電監控系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China PV Monitoring Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

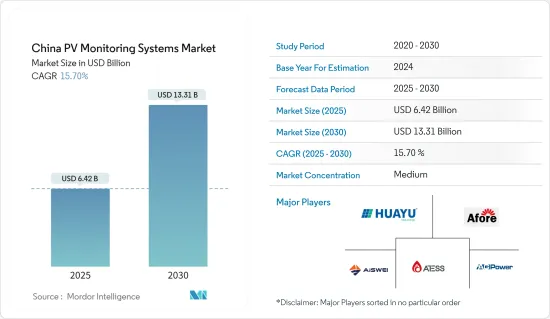

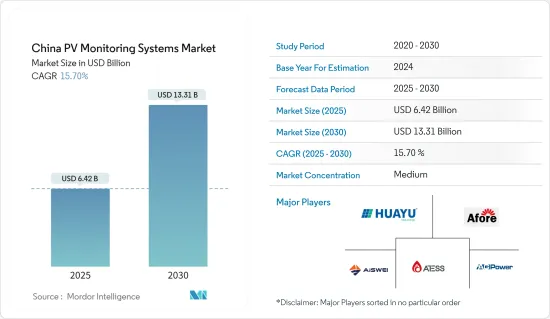

中國光電監控系統市場規模預計在2025年達到64.2億美元,2030年達到133.1億美元,預測期間(2025-2030年)的複合年成長率為15.7%。

主要亮點

- 從中期來看,預計政府優惠政策和太陽能發電普及等因素將在預測期內推動光電監測系統的需求。

- 另一方面,對其他清潔能源替代品的關注度不斷提高預計會阻礙光伏監控系統市場的發展。

- 然而,太陽能發電系統的技術進步和升級為光伏監控系統市場參與者提供了充足的機會。

中國光電監控系統市場趨勢

住宅市場預計將大幅成長

- 在我國,住宅用電需求逐年增加。根據《世界能源統計評論2023》,中國初級能源消費量達到159.39艾焦耳。這將導致住宅領域太陽能發電系統的安裝增加。

- 截至 2022 年,中國是最大的太陽能光電裝置容量市場,裝置容量約 29 吉瓦。根據國際可再生能源機構的預測,住宅安裝太陽能光電發電的成本將從2012年的2,856美元/千瓦下降到2022年的640美元/度。

- 2022年3月,菜鳥網路在10萬平方公尺的倉庫屋頂安裝了太陽能發電系統。該倉庫位於中國東部浙江省的杭州和寧波。

- 根據亞歐清潔能源諮詢組織預測,截至2022年10月,中國太陽能電池和組件產能將從2021年的361吉瓦增加到2022年終的600吉瓦。

- 考慮到以上所有因素,預計住宅領域在預測期內將顯著成長。

對太陽能發電的日益重視正在推動市場

- 由於太陽能電池組件成本的下降以及這些組件可用於熱水加熱和發電等多種用途的靈活性,預計光伏 (PV) 在預測期內將顯著成長。

- 此外,中國也積極投資可再生能源,以實現2030年排放達到高峰、2060年實現碳中和的雙重碳目標。據稱,該國是世界上最大的可再生能源投資國。

- 根據國際可再生能源機構(IRENA)預測,2022年中國太陽能發電裝置容量約為3.924億千瓦,與前一年同期比較成長28.07%。政府正在大力推動安裝太陽能發電設施。

- 中國政府致力於鼓勵住宅和商業用戶安裝太陽能光電發電,進而增加太陽能的使用率。到2023年,政府規定現有的住宅和商業建築必須安裝屋頂太陽能發電系統。

- 截至 2022 年 3 月,太陽能屋頂安裝量分別從 2017 年和 2021 年的 19.4 吉瓦增加到 27.3 吉瓦,這得益於政府為促進太陽能光伏發電的採用而推出的獎勵和友好政策,例如上網電價和降低太陽能光伏安裝成本。

- 考慮到上述因素,預測期內政府政策預計將推動光電監控系統市場的發展。

中國光電監控系統產業概況

中國的光電監控系統市場處於半分散狀態。該市場的主要企業(不分先後順序)包括華域新能源科技、愛士惟科技(上海)、艾伏新能源、武漢銀能電源和深圳艾特斯電源科技。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 政府優惠政策

- 限制因素

- 更重視替代清潔能源來源

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 按產品

- 硬體

- 軟體

- 按應用

- 住宅

- 商業的

- 產業

第6章 競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Afore New Energy

- Wuhan AG Power Co., Ltd.

- Shenzhen Atess Power Technology Co., Ltd

- Yangzhou Bright Solar Solutions Co., Ltd.

- Xiamen E-star Energy Technology Co., Ltd.

- AISWEI Technology(Shanghai)Co., Ltd

- Aotai Electric Co., Ltd.

- GoodWe Technologies Co., Ltd.

- iPotisEdge Co.,Ltd

- Huayu New Energy Technologies Co., Ltd.

第7章 市場機會與未來趨勢

- 太陽能發電系統的技術進步與升級

簡介目錄

Product Code: 5000240

The China PV Monitoring Systems Market size is estimated at USD 6.42 billion in 2025, and is expected to reach USD 13.31 billion by 2030, at a CAGR of 15.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as favorable government policy and the promotion of solar installations are expected to drive the demand for PV monitoring systems during the forecast period.

- On the other hand, rising emphasis on other alternative clean energy sources is expected to hinder the PV monitoring systems market.

- Nevertheless, technological advancements and upgradation in solar PV systems create ample opportunities for the PV monitoring systems market players.

China PV Monitoring Systems Market Trends

Residential Segment Expected to Witness Significant Growth

- In China, the electricity demand in the residential sector increased annually. According to the Statistical Review of World Energy 2023, the primary energy consumption in China reached 159.39 exajoules. This, in turn, will increase the installation of solar PV systems in the residential sector.

- As of 2022, China was the largest market for solar energy installed capacity, with approximately 29GW. According to the International Renewable Energy Agency, the cost of solar PV installation in the residential sector declined from USD 2856/kW in 2012 to USD 640/kW in 2022.

- In March 2022, Cainiao Network installed the PV power generation systems on 100,000 square meters of a warehouse rooftop. These warehouses are located in Hangzhou and Ningbo in eastern China's Zhejiang Province.

- As of October 2022, according to Asia Europe clean energy advisory, China's solar cell and module production capacity will increase from 361 GW in 2021 to 600 GW at the end of 2022.

- Hence, owing to the above points, the residential segment is likely to see significant market growth during the forecast period.

Increasing Emphasis in Solar PV Installations to Drive the Market

- Solar photovoltaic (PV) is estimated to witness significant growth during the forecast period owing to the declining cost of solar modules and the flexibility of these modules for various applications like water heating, electricity generation, and others.

- Moreover, the country is heavily investing in renewable energy to reach the targeted limits of its two carbon goals; to reach peak emissions by 2030 and carbon neutrality by 2060. The country is said to be the biggest investor in renewable energy globally.

- According to International Renewable Energy Agency (IRENA), China has a total installed solar PV capacity of about 392.4 GW in 2022, witnessed an increase of 28.07% compared to last year. The government is significantly pushing to install solar PV installations.

- China's government focuses on increasing access to solar PV generation by encouraging residential and commercial users to install solar PV. By 2023, the government mandated the installation of a rooftop solar PV system in existing residential and commercial buildings.

- In March 2022, solar rooftop PV installation increased from 19.4 GW to 27.3 gigawatts in 2017 and 2021, respectively, due to the incentives and friendly policies introduced by the government to promote the adoption of solar PV, such as feed-in tariffs and declining installation costs of solar PV.

- Hence, owing to the above points, government policy is likely to drive the PV monitoring systems market during the forecast period.

China PV Monitoring Systems Industry Overview

China's PV monitoring systems market is semi fragmented. Some of the key players in this market (in no particular order) include Huayu New Energy Technologies Co. Ltd, AISWEI Technology (Shanghai) Co. Ltd, Afore New Energy, Wuhan AG Power Co. Ltd, and Shenzhen Atess Power Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Favorable Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Rising Emphasis on Other Alternative Clean Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Afore New Energy

- 6.3.2 Wuhan AG Power Co., Ltd.

- 6.3.3 Shenzhen Atess Power Technology Co., Ltd

- 6.3.4 Yangzhou Bright Solar Solutions Co., Ltd.

- 6.3.5 Xiamen E-star Energy Technology Co., Ltd.

- 6.3.6 AISWEI Technology (Shanghai) Co., Ltd

- 6.3.7 Aotai Electric Co., Ltd.

- 6.3.8 GoodWe Technologies Co., Ltd.

- 6.3.9 iPotisEdge Co.,Ltd

- 6.3.10 Huayu New Energy Technologies Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Upgradation in Solar PV Systems

02-2729-4219

+886-2-2729-4219