|

市場調查報告書

商品編碼

1645123

非洲低溫運輸物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Africa Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

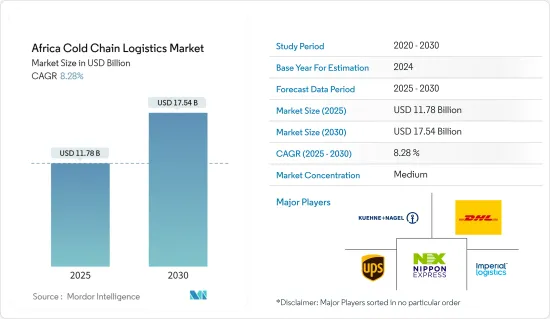

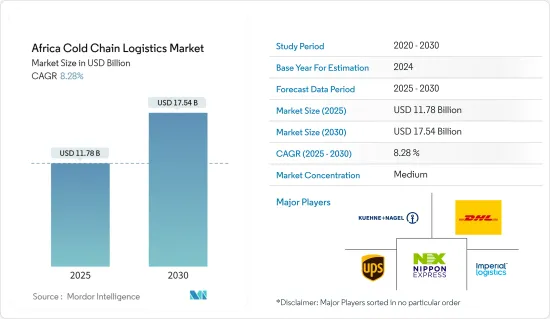

2025 年非洲低溫運輸物流市場規模預估為 117.8 億美元,預計到 2030 年將達到 175.4 億美元,預測期內(2025-2030 年)的複合年成長率為 8.28%。

非洲對高效低溫運輸包裝解決方案的需求顯著增加。這種日益成長的興趣是由非洲大陸的經濟成長以及對溫度敏感產品品質和安全日益成長的需求所推動的。預計,隨著非洲大陸對溫控商品的需求不斷增加、許多新參與者的進入以及政府的舉措和計劃,低溫運輸產業將得到推動。為了滿足國家長期的交通需求,該國正在製定一項名為「2050國家交通總體規劃」的計劃,該計劃將監督多式聯運系統的建設。

隨著出口商、進口商和物流業者數量的不斷成長,南非正呈現新興經濟體的形象。維持高效的低溫運輸對於推動這些產業的成長和維持其長久性至關重要。

AP Moller Capital宣布將於2023年3月初收購Vector 物流。 AP Moller Capital 表示,此次收購為 Vector 物流提供了絕佳的機會,以加速其在供應鏈專業知識和物流服務方面實現獨立的使命。此外,為了滿足非洲日益成長的需求,我們將擴大目標區域,拓展活動範圍,在更廣泛的地區提供服務。

非洲低溫運輸物流市場趨勢

包裝和冷凍食品的需求不斷增加

非洲對包裝冷藏保存食品的需求正在上升。都市化、生活方式的改變和高所得族群的崛起都是促成這項發展的因素。這些產品的需求不斷成長,是由多種因素推動的,包括經濟發展、現代零售店的普及以及煤炭鏈基礎設施的改善。

2024 年 2 月,在柏林舉行的 2024 年蔬果展覽會結束時,政府宣布將興建一條連接義大利Liguria地區拉斯佩齊亞港和北非的增強型物流走廊。此次合作涉及港口系統管理局和塔洛斯集團,重點是加強義大利馬裡納迪卡拉拉港和拉斯佩齊亞港與非洲沿海幾個目的地之間的農產品運輸。該舉措旨在加強物流聯繫,特別是在農產品食品領域。

非洲聯盟將該地區的糧食安全列為優先事項,並正在推動農業價值鏈中的政策、資金和多方相關利益者干預。為了提高糧食安全和農業效率,干預措施著重於對農場採取直接行動和支持系統,以促進糧食從一個地方運輸到另一個地方。

埃及水產品出口成長

埃及的海鮮產業正在成長,與低溫運輸物流有很大關係。該行業正在不斷擴大,低溫運輸技術和物流的進步促進了其發展。高效的低溫運輸系統確保水產品從捕撈到出售都保持新鮮。這些物流增強對於延長產品保存期限、減少廢棄物和滿足國際品質標準發揮關鍵作用。煤炭鏈物流與埃及水務產業的整合是推動其上升趨勢的關鍵因素。

埃及農業和墾務部報告稱,埃及的魚類產量預計在 2023 年 7 月達到 200 萬噸,自給率達 85%。報告稱,埃及的魚類產量居非洲第一、世界第六位,吳郭魚產量居第三位,隨著國家計劃達到運作,出口率預計將上升。

為了支持漁業部門,該部還成立了湖泊保護和魚類資源發展局來管理和促進漁業發展。政府還為漁船配備追蹤設備,每艘船需支付 3 萬英鎊(970 美元)的費用。因此,鑑於可能實現大批量生產,該地區的低溫運輸物流具有發展機會。

非洲低溫運輸物流行業概況

在非洲建立煤炭鏈物流業務需要專門的基礎設施,包括溫控倉儲設施和運輸。現有企業已經與主要供應商和客戶建立了關係,因此可以設定市場進入障礙。然而,該行業不斷發展的性質和潛在的政府舉措可能會吸引新的進入者。非洲的低溫運輸物流市場已經成熟並且與國內外現有的參與者競爭激烈。每家公司的服務品質、可靠性、地理覆蓋範圍和技術力都是關鍵的競爭因素。該行業正在不斷發展,各公司也不斷創新以保持競爭優勢。東南亞郵政服務市場的領導者是日本通運、UPS 和 DHL。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 低溫運輸設施的技術趨勢與自動化

- 政府法規和舉措

- 聚焦氣候控制儲存

- 運輸和倉儲成本

- 排放標準和法規對低溫運輸產業的影響

- 地緣政治與疫情將如何影響市場

第5章 市場動態

- 市場促進因素

- 生鮮產品需求不斷增加

- 增強健康意識

- 市場限制

- 高成本

- 缺乏適當的基礎設施

- 市場機會

- 政府措施和投資

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/購買者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈/供應鏈分析

第6章 市場細分

- 按服務

- 貯存

- 運輸

- 附加價值服務(冷凍、標籤、庫存管理等)

- 按溫度

- 常溫

- 冷藏

- 冷凍

- 按應用

- 園藝(新鮮水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉類、魚類、家禽

- 加工食品

- 製藥、生命科學、化學

- 其他用途

- 按國家

- 埃及

- 摩洛哥

- 奈及利亞

- 南非

- 非洲其他地區

第7章 競爭格局

- 公司簡介

- Imperial Logistics LTD

- Cold Solutions East Africa

- ARCH Emerging Markets Partners Limited

- Nippon Express Co. Ltd

- Zenith Carex International Limited

- Ayoba Cold Storage

- Kennie-o Cold Chain Logistics(KCCL)

- Trans-nationwide Express PLC(TRANEX)

- Kuehne+Nagel

- Cool World Rentals

- DP World

- Lineage Logistics

- CCS Logistics

- AfriAg

- 其他公司

第 8 章:市場的未來

第 9 章 附錄

- 資本流動洞察

- 對外貿易統計-出口及進口,依產品、依國家

- 交通運輸及倉儲業對經濟的貢獻

The Africa Cold Chain Logistics Market size is estimated at USD 11.78 billion in 2025, and is expected to reach USD 17.54 billion by 2030, at a CAGR of 8.28% during the forecast period (2025-2030).

The demand for efficient cold chain packaging solutions in Africa has increased significantly. This increase in interest is due to the continent's growing economy, as well as increasing demand for quality and security of temperature-sensitive products. The cold chain industry is expected to be boosted by the increasing demand for temperature-controlled goods in the continent, the entry of many new businesses, and the government's efforts and programs. To meet the country's long-term transport needs, South Africa has an ongoing plan, namely the National Transport Master Plan 2050, to oversee the construction of multimodal transport systems.

With growing exporters, importers, and logistics operators, South Africa is experiencing an emerging economy. Maintaining an efficient cold chain is essential to facilitate these sectors' growth and maintain their longevity.

A.P. Moller Capital announced that it would acquire Vector Logistics at the beginning of March 2023. According to A.P. Moller Capital, the acquisition provides Vector Logistics a great opportunity to accelerate its mission of going independent in supply chain expertise and logistics services. In this context, it will also expand its coverage to meet growing demand in Africa and broaden its activities to serve the wider geographic area.

Africa Cold Chain Logistics Market Trends

Demand for Packaged and Frozen Food is Rising

In Africa, the demand for packaged, cold-stored foods is increasing. Urbanization, changes in lifestyles, and the growth of a higher class are some of the factors that contribute to this development. The growth in demand for these products is being driven by several factors, including economic development, the proliferation of modern retail outlets, and improvements to cold chain infrastructure.

In February 2024, the strengthened logistics corridor between the Ligurian port of La Spezia in Italy and North Africa was unveiled at the end of Fruit Logistica 2024 in Berlin. The collaboration involves the Harbour System Authority and the Tarros Group, with a focus on enhancing the transportation of agricultural goods between the ports of Marina di Carrara and La Spezia in Italy and several African coastal destinations. The initiative aims to bolster logistical ties, particularly in the agri-food sector.

The African Union prioritizes food security in the region and promotes policy, funding, and multistakeholder interventions in the agricultural value chain. To increase food security and agricultural efficiency, the intervention focuses on direct farm action and support systems facilitating the movement of food from one place to another.

Egyptian Export of Seafood is on the Rise

Egypt's fishing industry is experiencing growth, with a significant connection to cold chain logistics. The sector is expanding as advancements in cold chain technology and logistics contribute to its development. Efficient cold chain systems ensure the preservation of fresh seafood from catch to market. This enhancement in logistics plays a crucial role in extending the shelf life of products, reducing waste, and meeting international quality standards. The integration of cold chain logistics in Egypt's fishing industry is a key factor driving its upward trajectory.

The Ministry of Agriculture and Land Reclamation in Egypt reported that Egyptian fish production hit 2 million tons, marking a rate of 85% self-sufficiency, in July 2023. According to the report, Egypt has the highest fish production in Africa, sixth in the world, and third in tilapia production, and is expected to increase export rates with national projects operating at full capacity.

The Ministry also founded the Lake Protection and Fish Wealth Development Authority to regulate and facilitate the fishing industry to support the fishing sector. For EGP 30,000 (USD 970) per vessel, the government is also equipping fishing vessels with tracking devices. Therefore, with massive production, there is an opportunity for cold chain logistics in the area.

Africa Cold Chain Logistics Industry Overview

Specialized infrastructure, including temperature-controlled storage facilities and transport, is required for the establishment of an African cold chain logistics operation. Existing companies have established relationships with key suppliers and customers, which could create obstacles to entry into the market. However, new entrants can be attracted by the evolving nature of this sector and potential government initiatives. The presence of established companies, both local and international, in the African cold chain logistics market exerts a competitive influence. The quality of the service, reliability, geographic coverage, and technical capabilities of the companies are important factors for competition. The sector is evolving, and companies are constantly innovative to stay ahead of the competition. The leaders in the Southeast Asian postal services market are Nippon Express, UPS, and DHL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation in Cold Chain Facilities

- 4.3 Government Regulations and Initiatives

- 4.4 Spotlight on Ambient/Temperature-controlled Storage

- 4.5 Spotlight on Transportation Costs and Storage Costs

- 4.6 Impact of Emission Standards and Regulations on the Cold Chain Industry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Perishable Goods

- 5.1.2 Increasing Health Awareness

- 5.2 Market Restraints

- 5.2.1 High Cost Associated

- 5.2.2 Lack of adequate infrastructure

- 5.3 Market Opportunities

- 5.3.1 Government Initiatives and Investments

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

- 5.5 Industry Value Chain/Supply Chain Analysis

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Storage

- 6.1.2 Transportation

- 6.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 6.2 By Temperature

- 6.2.1 Ambient

- 6.2.2 Chilled

- 6.2.3 Frozen

- 6.3 By Application

- 6.3.1 Horticulture (Fresh Fruits and Vegetables)

- 6.3.2 Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3 Meat, Fish, Poultry

- 6.3.4 Processed Food Products

- 6.3.5 Pharma, Life Sciences, and Chemicals

- 6.3.6 Other Applications

- 6.4 By Country

- 6.4.1 Egypt

- 6.4.2 Morocco

- 6.4.3 Nigeria

- 6.4.4 South Africa

- 6.4.5 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Imperial Logistics LTD

- 7.2.2 Cold Solutions East Africa

- 7.2.3 ARCH Emerging Markets Partners Limited

- 7.2.4 Nippon Express Co. Ltd

- 7.2.5 Zenith Carex International Limited

- 7.2.6 Ayoba Cold Storage

- 7.2.7 Kennie-o Cold Chain Logistics (KCCL)

- 7.2.8 Trans-nationwide Express PLC (TRANEX)

- 7.2.9 Kuehne+Nagel

- 7.2.10 Cool World Rentals

- 7.2.11 DP World

- 7.2.12 Lineage Logistics

- 7.2.13 CCS Logistics

- 7.2.14 AfriAg*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Insights into Capital Flows

- 9.2 External Trade Statistics - Export and Import, by Product and by Country

- 9.3 Transport and Storage Sector Contribution to the Economy