|

市場調查報告書

商品編碼

1651035

社群媒體中的人工智慧:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)AI in Social Media - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

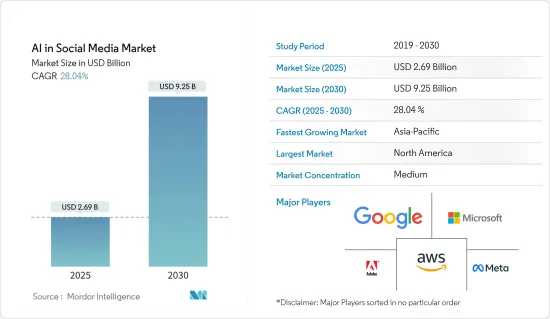

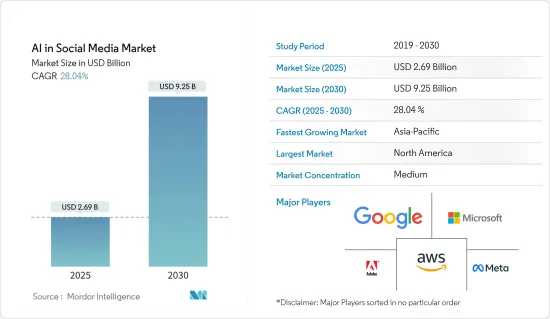

社群媒體中的人工智慧市場規模在 2025 年估計為 26.9 億美元,預計到 2030 年將達到 92.5 億美元,預測期內(2025-2030 年)的複合年成長率為 28.04%。

社群媒體已經成為客戶資訊資料的一級資訊來源之一。隨著社群媒體用戶數量的增加,預測期內對了解客戶偏好的人工智慧解決方案的需求預計會增加。

主要亮點

- 社群媒體和人工智慧技術的融合,以實現有效的廣告和競爭優勢,正在推動市場的發展。銀行、金融服務和保險業在銀行助理方面投入了大量資金,許多機構現在使用帶有人工智慧介面的聊天機器人與客戶交談。

- 電子商務公司正在使用人工智慧技術向社群媒體用戶的個人資料提供個人化的產品推薦。例如,亞馬遜的人工智慧驅動的產品推薦融入購買過程的每一步。

- 此外,人工智慧工具的日益廣泛使用預計將推動社交媒體對人工智慧的需求。例如,吉百利於 2022 年 1 月發起了一項計劃,允許小型企業主使用利用名人面孔和聲音的人工智慧工具免費做廣告。

- 透過從社群媒體平台收集資料,人工智慧可以預測COVID-19感染的傳播,建立預警系統,提供有關敏感位置的有用資訊,並預測疾病和死亡率。

然而,人工智慧是一項複雜的技術,企業需要具備特定技能的員工來管理、創建和整合人工智慧系統。例如,從事人工智慧系統工作的員工需要熟悉機器學習、深度學習、認知運算和影像識別等技術。預計人工智慧技術專家數量有限將阻礙市場成長。

社群媒體中的人工智慧市場趨勢

零售業正在經歷顯著成長

- 社交媒體在網路購物和其他電子商務活動中的日益廣泛使用預計將推動零售業的成長。隨著零售商利用社群媒體平台加強與客戶的關係,社群媒體平台變得越來越受歡迎。社群媒體中的人工智慧可以幫助零售品牌預測行銷趨勢、更有效地進行促銷、超越競爭對手並獲得其他好處。

- 人工智慧將使零售商能夠提供個人化的產品提案,提供資料驅動的店內體驗,並使用影像識別搜尋來發現社交媒體貼文中的隱藏模式。

- 由於塔吉特和沃爾瑪等零售商依賴不斷成長的消費者支出,並面臨電子商務平台的激烈競爭,他們需要採用人工智慧來提高銷售額和客戶忠誠度。

- 2022 年 7 月,Google與跨國時尚零售商 H&M 集團合作。透過此次合作,兩家公司計劃設計和建構企業資料主幹,包括核心資料平台、尖端的機器學習和人工智慧功能以及資料產品。

- 此外,2022 年 3 月,微軟與英國時尚零售商 ASOS 合作。兩家公司已同意在新的計劃上進行合作,這將加速微軟的策略成長目標。此外,此次合作預計將使企業滿足對改善產品可用性和無縫個人化數位體驗日益成長的需求。

預計北美將佔據較大的市場佔有率

- 近年來,隨著更多資金投入改善人工智慧技術解決方案,該地區的表現越來越好。

- 2022 年 4 月,政府活動和投資正在支持市場成長。例如,加拿大政府致力於投資企業和創新技術。安大略省南部聯邦經濟發展機構 FedDev Ontario 宣布將向人工智慧 (AI) 企業 Canvass Analytics Inc.(Canvass AI)投資 570 萬美元。

- 各公司對人工智慧的投資不斷增加,預計將推動該地區社交媒體市場的人工智慧發展。例如,2022 年 10 月,Alphabet Inc. 的子公司谷歌正在洽談向加拿大新興企業Cohere Inc. 投資約 2 億美元。這家人工智慧新興企業已與Google簽署了一項長期協議,以提供訓練其軟體模型的處理能力。

- 社群媒體平台是行銷產品和服務的首選之一。因此,BFSI、電子商務和零售業的終端用戶正在轉向人工智慧,以提高他們在社群媒體管道上的表現。

此外,根據政府的人工智慧(AI)準備指數排名,美國將以88.16的指數得分成為2021年全球排名第一的國家。

社群媒體中的AI產業概況

市場競爭激烈,微軟公司、Google有限責任公司和亞馬遜網路服務等公司主導市場競爭。市場似乎變得分散。人工智慧在社群媒體的應用日益廣泛,主要企業實施合作夥伴關係、產品創新、合併和收購等策略。

2022 年 10 月,Google Cloud 宣布與 Snap Inc. (Snap) 建立合作關係,利用 Google 的資料、AI/ML 和分析技術推動 Snapchat 的發展。經過十多年的合作,Snap 將更能利用 Google Cloud 來改善客戶體驗並提供更客製化的解決方案。

2022 年 8 月 - 超廣泛企業人工智慧 (AI) 平台 aiWARE 供應商 Veritone, Inc. 宣布正在擴大與亞馬遜網路服務 (AWS) 的合作,以更好地服務媒體和娛樂 (M&E) 客戶。去年,Veritone 加入了 AWS 媒體和娛樂計劃,以幫助版權所有者、內容創作者、分銷商和製作人快速識別特定產業的AWS 功能,並加速他們在五個關鍵行業創新中心的轉型。透過持續支援 AWS 媒體與娛樂計劃,Veritone 展示了其持續致力於讓各種規模的 IP 所有者更輕鬆地創建、分發並最終將其內容收益。

2022 年 7 月-Facebook 母公司 Meta 推出了新的 AI 工具 Sphere。該工具有助於打擊和檢測網路上的錯誤訊息(也稱為「假新聞」)。 Meta 聲稱自己是第一個能夠同時掃描大量引文並確定它們是否真正支持相關主張的 [AI] 系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎疫情對市場的影響

- 技術藍圖

- 市場促進因素與限制因素簡介

- 市場促進因素

- 整合社交媒體和人工智慧技術以實現有效廣告

- 透過智慧型手機增加社群媒體的用戶參與度

- 擴大使用人工智慧來了解市場趨勢並獲得競爭優勢

- 市場限制

- 人工智慧技術專家數量有限

- 新興經濟體人工智慧採用率低

- 市場機會

第5章 市場區隔

- 技術領域

- 機器學習和深度學習

- 自然語言處理 (NLP)

- 應用

- 客戶體驗管理

- 銷售與行銷

- 影像識別

- 風險預測

- 其他應用

- 服務

- 託管服務

- 專業服務

- 組織規模

- 中小企業

- 大型企業

- 最終用戶產業

- 零售

- 電子商務

- 銀行、金融服務和保險(BFSI)

- 媒體/廣告

- 教育

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Google LLC

- Microsoft Corporation

- Meta

- Amazon Web Services, Inc

- IBM Corporation

- Adobe Systems Incorporated

- Salesforce.com Inc.

- Baidu Inc.

- Snap Inc.

- Clarabridge Inc.

- HootSuite Media Inc.

- Meltwater News US Inc.

- Crimson Hexagon Inc.

- Sprout Social Inc.

第7章投資分析

第 8 章:市場的未來

The AI in Social Media Market size is estimated at USD 2.69 billion in 2025, and is expected to reach USD 9.25 billion by 2030, at a CAGR of 28.04% during the forecast period (2025-2030).

Social media has become one of the primary sources of customer intelligence data. With the growth in social media users, the demand for AI solutions to understand customer preferences is projected to increase over the forecast period.

Key Highlights

- Integration of artificial intelligence technology with social media for effective advertising and to gain a competitive edge is driving the market. Investing a lot in banking assistants, many institutions now use chatbots with AI interfaces to talk to their clients in the BFSI sector.

- E-commerce companies are leveraging AI technology for personalized product recommendations on social media users' profiles. For example, Amazon's AI-driven product recommendations are built into every step of the buying process.

- Moreover, the increased use of AI tools is projected to boost demand for AI in social media. For instance, in January 2022, Cadbury launched an initiative to allow small business owners to make free advertisements using an AI tool that uses a celebrity's face and voice.

- By gathering data from social media platforms, AI was able to predict the spread of COVID-19 infections, create early warning systems, and provide useful information about sensitive locations as well as predict illness and mortality.

However, AI is a complex technology, and firms need a workforce with specific skill sets to manage, create, and integrate AI systems. For instance, employees working with AI systems should be familiar with technologies such as machine learning and deep learning, cognitive computing, and image recognition. The limited number of AI technology experts is expected to hamper market growth.

AI in Social Media Market Trends

Retail Industry to Witness a Significant Growth

- The growing social media usage for online shopping and other e-commerce activities is expected to propel the retail segment's growth. Social media platforms are becoming increasingly popular as retail businesses use them to strengthen customer relationships. AI in social media helps retail brands predict marketing trends, make their promotions more effective, rank higher than their competitors, and get other benefits.

- AI makes it possible for the retail industry to offer personalized product suggestions, in-store experiences that are based on data, and image recognition searches through social media posts to find hidden patterns.

- Retailers like Target, Walmart, and others need to use AI to boost sales and customer loyalty because they depend on consumers spending more and face tough competition from e-commerce platforms.

- In July 2022, Google partnered with the H&M Group, a multinational fashion retailer. The firms plan to design and create a corporate data backbone through this partnership, including a core data platform, cutting-edge ML and AI capabilities, and data products.

- Moreover, in March 2022, Microsoft collaborated with ASOS, a British fashion retailer. The firms agreed to collaborate on a new project to accelerate Microsoft's strategic growth ambitions. Furthermore, this collaboration is expected to enable businesses to fulfill the growing demand for improved product availability and seamless and personalized digital experiences.

North America is Expected to Hold Significant Market Share

- In the last few years, the area has been getting better because more money has been put into it to improve AI technology solutions.

- In April 2022, government activities and investments assist market growth. For instance, the Government of Canada declared that it would invest in enterprises and innovative technology. The Federal Economic Development Agency for Southern Ontario, FedDev Ontario, has announced a USD 5.7 million investment in the artificial intelligence (AI) business Canvass Analytics Inc. (Canvass AI).

- The growing investment in AI by various companies is expected to drive AI in the social media market in the region. For instance, in October 2022, Google, a subsidiary of Alphabet Inc., will be in talks to invest around USD 200 million in the Canadian start-up Cohere Inc. The startup in artificial intelligence made a long-term deal with Google to provide processing power for training its software models.

- Social media platforms are one of the first choices for marketing products and services. As a result, end users, such as BFSI, e-commerce, retail, and others, are shifting toward artificial intelligence to bolster their performance on social media channels.

Further, the United States, with an index score of 88.16, is the top-ranked nation worldwide in 2021, according to the government's artificial intelligence (AI) readiness index rankings.

AI in Social Media Industry Overview

The competitive rivalry in market is highly competitive with the dominance of players like Microsoft Corporation, Google LLC, and Amazon Web Services, among others. The market appears to be fragmented. Due to the growing use of AI in social media, significant players are implementing strategies such as partnerships, product innovation, mergers, and acquisitions.

In October 2022, Google Cloud announced a partnership with Snap Inc. (Snap), in which the firm will use Google's data, AI/ML, and analytics technologies to enable Snapchat's development. After working together for more than ten years, Snap will use Google Cloud more to improve the customer experience and offer more customized solutions.

August 2022 - Veritone, Inc., the provider of aiWARE, a hyper-extensive corporate artificial intelligence (AI) platform, announced an expansion of its collaboration with Amazon Web Services (AWS) to better serve its Media & Entertainment (M&E) customers. Veritone joined the AWS for Media & Entertainment program last year, which assisted rights holders, content creators, distributors, and producers in quickly identifying industry-specific AWS capabilities and accelerating transformation across five key industry innovation hubs. By continuing to support the AWS for Media & Entertainment program, Veritone shows that it is still committed to making it easier for IP owners of all sizes to create, distribute, and eventually make money from their content.

July 2022 - Meta, Facebook's parent company, will unveil Sphere, a new AI-powered tool. The tool helps to address and detect misinformation, also known as "fake news," on the internet. Meta claims to be the first [AI] system capable of scanning many citations at once to determine whether they genuinely support the relevant assertions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assesment of Impact of COVID-19 on the market

- 4.4 Technology Roadmap

- 4.5 Introduction to Market Drivers and Restraints

- 4.6 Market Drivers

- 4.6.1 Integration of Artificial Intelligence Technology with Social Media for Effective Advertising

- 4.6.2 Increase in User Engagement on Social Media by Using Smartphones

- 4.6.3 Rise in Use of AI in Understanding Market Trends and Gaining Competitive Edge

- 4.7 Market Restraints

- 4.7.1 Limited Number of Artificial Intelligence Technology Experts

- 4.7.2 Low Adoption of AI in Developing Economies

- 4.8 Market Opportunities

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Machine Learning and Deep Learning

- 5.1.2 Natural Language Processing (NLP)

- 5.2 Application

- 5.2.1 Customer Experience Management

- 5.2.2 Sales and Marketing

- 5.2.3 Image Recognition

- 5.2.4 Predictive Risk Assessment

- 5.2.5 Other Applications

- 5.3 Service

- 5.3.1 Managed Service

- 5.3.2 Professional Service

- 5.4 Organization Size

- 5.4.1 Small and Medium Enterprises

- 5.4.2 Large Enterprises

- 5.5 End-User Industry

- 5.5.1 Retail

- 5.5.2 E-commerce

- 5.5.3 Banking, Financial Services and Insurance (BFSI)

- 5.5.4 Media and Advertising

- 5.5.5 Education

- 5.5.6 Other End-user Industries

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 US

- 5.6.1.2 Canada

- 5.6.2 Europe

- 5.6.2.1 UK

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Latin America

- 5.6.5 Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Google LLC

- 6.1.2 Microsoft Corporation

- 6.1.3 Meta

- 6.1.4 Amazon Web Services, Inc

- 6.1.5 IBM Corporation

- 6.1.6 Adobe Systems Incorporated

- 6.1.7 Salesforce.com Inc.

- 6.1.8 Baidu Inc.

- 6.1.9 Snap Inc.

- 6.1.10 Clarabridge Inc.

- 6.1.11 HootSuite Media Inc.

- 6.1.12 Meltwater News US Inc.

- 6.1.13 Crimson Hexagon Inc.

- 6.1.14 Sprout Social Inc.