|

市場調查報告書

商品編碼

1683205

亞太殺線蟲劑市場:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Nematicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

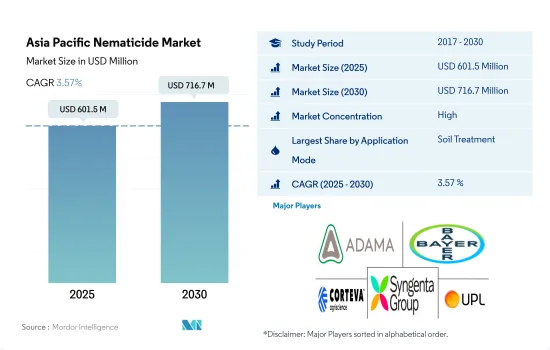

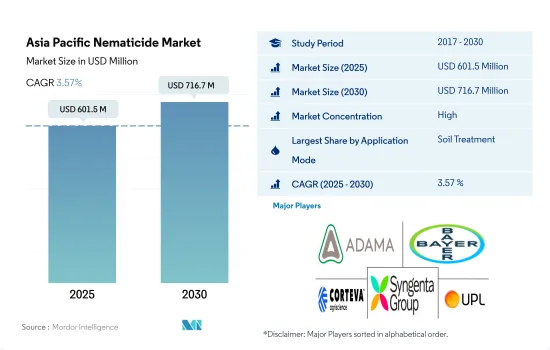

預計 2025 年亞太殺線蟲劑市場規模將達到 6.015 億美元,到 2030 年預計將達到 7.167 億美元,預測期內(2025-2030 年)的複合年成長率為 3.57%。

土壤施用殺線蟲劑因降低接觸非目標生物的風險而佔據市場主導地位

- 以植物部位為食的線蟲稱為植物寄生線蟲(PPN)。殺線蟲劑可透過多種施用方法來控制這些線蟲,包括葉面噴布、化學施用和土壤處理。

- 與葉面噴布等其他施用方法相比,土壤施用殺線蟲劑通常對非目標生物(包括有益昆蟲和傳粉昆蟲)的暴露風險較小。這是因為殺線蟲劑主要留在目標線蟲生活的土壤中。因此,到 2022 年,土壤應用將佔據市場主導地位,佔有 69.3% 的佔有率。

- 2022 年,葉面噴布佔亞太殺線蟲劑市場的 12.8% 。葉面噴布的主要目的是控制花序和葉片受到線蟲(例如小麥線蟲,也稱為小麥和其他穀類的病原線蟲)的感染。葉面噴布對抗線蟲有效,因為它們使用了溴甲烷、草胺酸和巴拉松等活性成分。

- 2022 年,化學灌溉佔亞太殺線蟲市場的 8.0%。中國在化學灌溉領域佔有 36.2% 的市場佔有率,2022 年市場規模將達到 1,640 萬美元。穀類胞囊線蟲 Heterodera avenae 是中國青藏高原和黃河流域的主要線蟲害蟲之一,據報導可導致小麥等主要作物10-90% 的產量損失。

- 因線蟲侵染造成的農作物損失逐年增加,為農民帶來了重大問題。

由於糧食需求的增加,對作物保護的需求推動了市場的成長。

- 在亞太地區,農業蓬勃發展,糧食需求不斷增加,使用殺線蟲劑保護作物免受線蟲侵擾的情況正在增加。到 2022 年,該地區將佔全球作物保護市場以金額為準的 19.8%。

- 該地區以農業為主,主要貢獻者包括中國、印度、日本和澳洲。為了滿足日益成長的需求並確保作物質量,農民正在採取措施保護作物免受線蟲侵害,從而推動了市場成長。

- 預計 2023 年至 2029 年間,市場規模將成長 1.389 億美元。農民越來越意識到線蟲對作物產量的有害影響。線蟲侵染會導致生產力下降、生長遲緩甚至作物減產。這種意識促使農民投資殺線蟲劑來保護作物。

- 商業性農業的擴張推動了對殺線蟲劑的需求,尤其是在印尼、泰國、中國和印度等國家。大規模農業作業容易受到線蟲侵擾,因為作物集中在有限的區域內。因此,商業農民經常使用殺線蟲劑來保護作物並確保更高的產量。

- 由於對農產品的需求不斷增加、對線蟲造成農作物損失的認知不斷提高以及商業性農業的擴張,預計預測期內(2023-2029 年)亞太殺線蟲劑市場以金額為準的複合年成長率將達到 3.8%。隨著該地區農業的進一步發展以及應對線蟲侵染的挑戰,這些趨勢預計將持續下去。

亞太線蟲市場趨勢

農民對線蟲防治重要性的認知不斷提高,導致殺線蟲劑的使用增加。

- 日本是每公頃殺線蟲劑消費量最高的國家,2022年每公頃農地平均消費量為478.7公克。然而,到2022年,日本的農業用地僅佔該地區總農業用地的0.45%,即僅290萬公頃。在日本,溫室種植和單一栽培等集約化農業方式十分普遍。這些耕作方法雖然具有最大限度提高生產力的優勢,但也使作物更容易受到線蟲等土壤害蟲的侵害,導致日本農民轉而使用殺線蟲劑來保護作物。

- 澳洲將成為每公頃殺線蟲劑消費量第二高的國家,到 2022 年每公頃消耗量將達到 63.6 克。這可能是因為植物寄生線蟲為澳洲種植者和草坪管理者帶來巨大的隱性成本。在澳大利亞,估計多達 1,900 萬公頃的耕地和休閒草坪受到寄生線蟲的不利影響,每年造成 3 億美元的損失。

- 緊隨澳洲之後的是菲律賓和越南,2022 年殺線蟲劑使用量分別為每公頃 46.3 克和 41.1 克。根結線蟲是菲律賓面臨的一個主要問題。特別是番茄等蔬菜作物,已知會造成 20% 至 85% 的損失,具體取決於品種和地區。

- 隨著線蟲侵染的增加,中國、泰國、緬甸和印度是該地區殺線蟲劑的其他主要消費國。然而,隨著農民意識的增強和保護作物的需要,殺線蟲劑的使用正在增加。

因線蟲侵染造成的農作物損失逐年增加,影響了殺線蟲劑的價格。

- 植物寄生線蟲(PPN)是對糧食安全和植物健康最臭名昭著且最被低估的威脅之一。例如,在印度,主要植物寄生線蟲造成的年度作物損失估計為 19.6% 或 2,4,210 億印度盧比。在蔬菜栽培中,植物寄生線蟲被認為是主要害蟲之一。磺酸鹽、Avermectin和草氨醯是亞太地區常用的殺線蟲劑。

- 2022 年磺酸鹽的價格為每噸 19,000 美元。磺酸鹽用於防治根結線蟲 (Meloidogyne spp.)、馬鈴薯胞囊線蟲、針線蟲、披針形線蟲、刺線蟲、矮根線蟲 (Trichodorus spp. 和 Paratrichodorus spp.) 和斑點線蟲等線蟲。

- 已知Avermectin對幾種植物寄生線蟲 (Rotylenchulus reniformis)、根結線蟲 (Meloidogyne incognita) 和囊腫線蟲 (Heterodera schachtii)。 2022 年Avermectin的價格為每噸 12,200 美元。

- Oxamyl 是一種氨基甲酸酯殺線蟲劑,有液體和顆粒形式。草氨醯是唯一具有向下遷移系統活性的殺線蟲劑,因此可用於葉面殺線蟲,有助於減少短體線蟲。 2022 年,Oxamyl 的價格為每噸 8,700 美元。

- 因線蟲侵染造成的農作物損失逐年增加,已成為農民關注的一大問題,迫使他們使用殺線蟲劑來保護農作物。預計該因素將影響殺線蟲劑的價格。

亞太殺線蟲劑產業概覽

亞太殺線蟲劑市場相當集中,前五大公司佔了86.26%的市佔率。該市場的主要企業是 ADAMA Agricultural Solutions Ltd、Bayer AG、Corteva Agriscience、Syngenta Group 和 UPL Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 緬甸

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 價值鏈與通路分析

第5章 市場區隔

- 應用模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 緬甸

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- American Vanguard Corporation

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- UPL Limited

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 64382

The Asia Pacific Nematicide Market size is estimated at 601.5 million USD in 2025, and is expected to reach 716.7 million USD by 2030, growing at a CAGR of 3.57% during the forecast period (2025-2030).

Soil application of nematicides dominated the market owing to fewer risks of exposing non-target organisms

- Nematodes that feed on plant parts are called plant parasitic nematodes (PPN). Nematicides are used to control these nematodes through various application methods like foliar application, chemigation, and soil treatment.

- Compared to other application methods, such as foliar application, soil application of nematicides generally poses fewer risks of exposing non-target organisms, including beneficial insects and pollinators. This is because the nematicide remains primarily in the soil, where the target nematodes reside. Owing to this, soil application dominated the market with a share of 69.3% in 2022.

- Foliar applications accounted for 12.8% of the Asia-Pacific nematicide market in 2022. The main purpose of the foliar application is to control the infestation of inflorescence and the infestation of leaves by nematodes such as the Anguina tritici (seed gall nematode), also known as seed gall disease-causing nematodes, which are present in cereals such as wheat. Foliar application is effective against nematodes due to the use of active ingredients like methyl bromide, Oxamyl, and parathion.

- Chemigation accounted for 8.0% of the Asia-Pacific nematicide market in 2022. China dominated the chemigation segment with a market share of 36.2%, valued at USD 16.4 million in 2022. The cereal cyst nematode, Heterodera avenae, is one of the major nematode pests in the Qinghai-Tibetan Plateau and Yellow River regions of China; it is reported to cause 10-90% yield losses in major crops like wheat.

- Crop losses due to nematode infestation are increasing every year and are acting as a major concern for farmers, forcing them to use nematicides in order to protect the crops.

The need to protect the crops due to rising food demand is driving the growth of the market

- Asia-Pacific, with its large agricultural industry and increasing demand for food, has witnessed a rise in the use of nematicides to protect crops from nematode infestations. In 2022, the region accounted for 19.8% of the global crop protection market by value.

- The region has a substantial agricultural industry, with countries like China, India, Japan, and Australia being major contributors. Farmers are adopting measures to protect their crops from nematodes to meet the growing demand and ensure the quality of crops, thus driving the market's growth.

- The market is expected to grow by USD 138.9 million during 2023-2029. Farmers are becoming more aware of the detrimental effects of nematodes on crop yields. Nematode infestations can lead to reduced productivity, stunted growth, and even crop failure. This awareness has prompted farmers to invest in nematicides to protect their crops.

- The expansion of commercial farming, particularly in countries like Indonesia, Thailand, China, and India, has driven the demand for nematicides. Large-scale farming operations are more susceptible to nematode infestations due to the concentration of crops in a confined area. Therefore, commercial farmers often rely on nematicides to protect their crops and ensure higher yields.

- The Asia-Pacific nematicide market is projected to register a CAGR of 3.8% by value during the forecast period (2023-2029) due to the increasing demand for agricultural products, rising awareness about nematode-related crop losses, and expansion of commercial farming. These trends are expected to continue as the region's agricultural industry further develops and addresses the challenges posed by nematode infestations.

Asia Pacific Nematicide Market Trends

Growing awareness among farmers about the importance of nematode control is increasing the application of nematicides

- Japan is the largest consumer of nematicides per hectare, with an average consumption of 478.7 grams per hectare of agricultural land in 2022. However, Japan only accounted for 0.45% of the total agricultural land in the region, with just 2.9 million hectares in 2022. Intensive farming practices, such as greenhouse cultivation and monocropping, are prevalent in Japan. While these practices have their advantages in maximizing productivity, they also increase the vulnerability of crops to soil-borne pests like nematodes, leading the farmers in Japan to rely on nematicides to safeguard their crops.

- Australia is the second-highest consumer of nematicides per hectare, with a consumption of 63.6 grams per hectare in 2022. This could be attributed to the huge hidden cost posed by plant parasitic nematodes to Australian producers and turf managers. It has been estimated that up to 19 million hectares of cultivated land and amenity turf are negatively impacted by parasitic nematodes in Australia, resulting in annual losses of USD 300 million.

- Australia is closely followed by the Philippines and Vietnam, with nematicide consumptions of 46.3 and 41.1 grams per hectare, respectively, in 2022. Root-knot nematode is a major problem in the Philippines. It is known to cause losses between 20% and 85%, especially in vegetable crops like tomatoes, based on the cultivar and region grown.

- China, Thailand, Myanmar, and India are other countries in the region that consume significant amounts of nematicides, owing to the increasing incidences of nematode infestation, which are often neglected by the farmers because of their hidden nature. However, the usage of nematicides is increasing with growing awareness among farmers and the need to protect the crops.

Crop losses due to nematode infestation are increasing every year, influencing the prices of nematicides

- Plant parasitic nematodes (PPNs) are among the most notorious and underrated threats to food security and plant health. For instance, in India, the annual crop losses due to major plant parasitic nematodes are estimated to be 19.6%, valued at INR 242.1 billion. In vegetable cultivation, plant parasitic nematodes are considered among the major pests. Fluensulfone, Abamectin, and Oxamyl are commonly used nematicides in Asia-Pacific.

- Fluensulfone was valued at USD 19.0 thousand per metric ton in 2022. It can be used to suppress nematodes, including root-knot nematodes (Meloidogyne spp.), potato cyst nematodes, needle nematodes, lance nematodes, sting nematodes, stubby root nematodes (Trichodorus and Paratrichodorus spp.), and lesion nematodes.

- Abamectin is known to have nematicidal activity against some plant parasitic nematodes, including the root lesion nematode (Pratylenchus penetrans), the reniform nematode (Rotylenchulus reniformis), the root-knot nematode (Meloidogyne incognita), and the cyst nematode (Heterodera schachtii). Abamectin was valued at USD 12.2 thousand per metric ton in 2022.

- Oxamyl is a carbamate nematicide that is manufactured in liquid and granular forms. Oxamyl is the only nematicide with downward-moving systemic activity; thus, it has foliar nematicidal applications that help to reduce Pratylenchus nematodes. Oxamyl was valued at USD 8.7 thousand per metric ton in 2022.

- Crop losses due to nematode infestation are increasing every year and are acting as a major concern for farmers, forcing them to use nematicides in order to protect the crops. This factor is expected to influence the prices of nematicides.

Asia Pacific Nematicide Industry Overview

The Asia Pacific Nematicide Market is fairly consolidated, with the top five companies occupying 86.26%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, Corteva Agriscience, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Myanmar

- 4.3.7 Pakistan

- 4.3.8 Philippines

- 4.3.9 Thailand

- 4.3.10 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Myanmar

- 5.3.7 Pakistan

- 5.3.8 Philippines

- 5.3.9 Thailand

- 5.3.10 Vietnam

- 5.3.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 Syngenta Group

- 6.4.6 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219