|

市場調查報告書

商品編碼

1685942

殺線蟲劑:市場佔有率分析、產業趨勢與成長預測(2025-2030)Nematicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

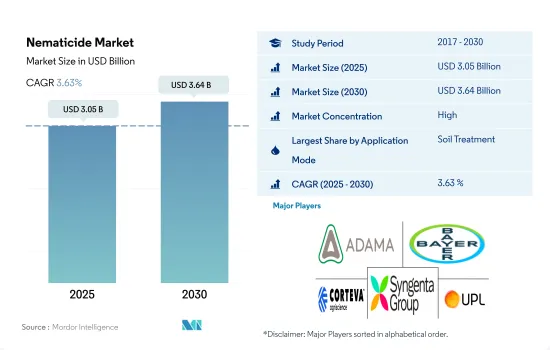

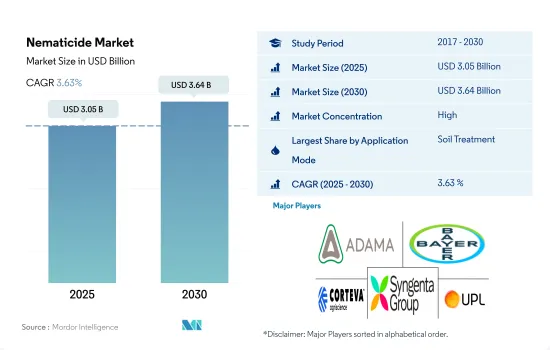

殺線蟲劑市場規模預計在 2025 年達到 30.5 億美元,預計到 2030 年將達到 36.4 億美元,預測期內(2025-2030 年)的複合年成長率為 3.63%。

土傳線蟲在作物生長初期造成的危害日益嚴重,使用殺蟲劑土壤處理的方式也越來越普遍。

- 乾旱、熱浪、溫暖潮濕等氣候變遷有利於農業中線蟲的繁殖。單一栽培、犁地和沙質土壤也有利於線蟲的生長。根據線蟲種類、地區和作物,農民實施不同的殺線蟲劑施用方法來改善線蟲管理並提高作物產量。

- 2022 年,透過土壤處理使用殺線蟲劑佔據了大部分市場佔有率,達到 70.3%,這主要歸功於該方法能夠有效減少土壤中的線蟲數量並提高作物產量。這是因為該方法可以有效減少土壤線蟲數量並提高作物產量。預計2023年至2029年間,土壤殺線蟲劑的使用量將增加約17,300噸。

- 葉面噴布殺線蟲劑是第二常用的施用方式,也是成長最快的領域,預計在預測期內複合年成長率為 3.4%。葉面殺線蟲劑的使用可以有效控制葉面線蟲,因為葉面線蟲以植物葉為食,會降低作物的產量。無人機噴灑等葉面噴布模式的進步以及其他技術和數位改進正在提升葉面噴布模式。

- 透過化學灌溉模式可以有效管理水和殺線蟲劑的劑量,2022年的市場佔有率為8.5%。先進的灌溉系統和日益嚴重的水資源短缺將導致化學灌溉的普及和殺線蟲劑應用的增加。

- 所有應用模式都旨在減少線蟲侵染並提高作物產量,預計將推動市場發展。

南美洲的線蟲感染日益嚴重,殺線蟲劑的使用也日益增多

- 除了氣候變遷和其他害蟲外,線蟲還對全球農業部門造成了巨大的破壞。已發現超過 4,100 種植物寄生線蟲,對世界各地的各種作物造成破壞。

- 根據美國植物病理學會統計,線蟲每年造成全球約 14% 的作物損失,相當於近 1,250 億美元的經濟損失。在各種線蟲中,根結線蟲(Meloidogyne spp.)、囊腫線蟲(Heterodera spp.、Globodera spp.)、根結線蟲(Pratylenchus spp.、Hirschmanniella spp.和Radopholus spp.)、莖線蟲(Ditylenchus spp.)和松材線蟲(sarlenchus spp.)透過影響水分和養分的吸收,對作物的生長和生產力造成嚴重的破壞。

- 農作物種植中殺線蟲劑的消費主要集中在南美洲,2022 年南美洲佔全球殺線蟲劑市場的 37.4%。這主要是由於線蟲造成的作物損失,每年損失約 65 億美元。大豆是主要的栽培作物,南美洲生產的大豆佔世界總產量的 50% 以上。線蟲導致該地區產量損失約 30%(價值 30 億美元)。過去一段時間,殺線蟲劑的消費量在2017年至2022年期間增加了約7,600噸,預計在2023年至2029年期間將進一步增加10,100噸以上。這凸顯了南美洲農業對殺線蟲劑的需求。

- 預計在預測期內(2023-2029 年),全球殺線蟲劑市場將以 3.7% 的複合年成長率成長,這得益於全球範圍內擴大採用殺線蟲劑來保護作物免受各種線蟲的侵害。

全球殺線蟲劑市場趨勢

集約化農業實踐增加了對殺線蟲劑噴霧的需求

- 2022年全球化學殺線蟲劑的平均消費量為每公頃農業用地2.1公斤。亞太地區是殺線蟲劑的最大消費地區,2022 年每公頃的消費量為 737.02 克。包括日本在內的亞洲國家普遍採用溫室種植和單一栽培等集約化農業方法。雖然這些做法提高了生產力,但也使作物更容易受到線蟲等土壤害蟲的侵害。因此,農民常常使用殺線蟲劑來保護作物。

- 2022 年,歐洲每公頃使用了 591.7 克殺線蟲劑,是每公頃消費量第二高的地區。歐洲國家正在擴大易受線蟲侵害的蔬菜、水果和觀賞植物等高價值作物的種植。植物寄生線蟲每年造成歐洲國家產量損失21.3%,損失總額達15.8億美元。因此,使用殺線蟲劑對於有效管理和控制歐洲的這些侵擾是必要的。

- 2022 年,南美洲是殺線蟲劑的第三大消費國,每公頃使用 570.14 克。根結線蟲侵染該地區多種植物的根和塊莖,包括番茄、馬鈴薯和胡蘿蔔。胡蘿蔔平均損失 20.0%,馬鈴薯損失則更高,達 33.0%。在北美國家,隨著犁地農業作物減少了土壤擾動,增加了作物殘留物的保留。鑑於這種情況,世界各地都在噴灑殺線蟲劑。

氣候條件的變化及其對線蟲侵染的影響可能會同時增加殺線蟲劑的需求和價格。

- 殺線蟲劑在農業中發揮重要作用,可以有效控制植物寄生線蟲,保護作物免受根部損害,確保最佳產量和生產率。

- 磺酸鹽是一種殺線蟲劑,屬於磺酸鹽化學類。用於防治多種作物的根結線蟲、胞囊線蟲、病線蟲、匕首線蟲等植物寄生線蟲。磺酸鹽的作用機制是干擾線蟲的神經系統,導致麻痺和死亡。透過針對線蟲,磺酸鹽可以減少線蟲數量並最大限度地減少它們對農作物造成的損害。 2022 年磺酸鹽的價格為每噸 19,000 美元。

- Avermectin因其對多種植物寄生線蟲的殺線蟲活性而聞名,包括根結線蟲(Pratylenchus penetrans)、腎形線蟲(Rotylenchus reniformis)、根結線蟲(Meloidogyne incognita)和囊腫線蟲(Heterodera schachtii)。它在控制這些線蟲方面的有效性使其成為農作物線蟲管理的寶貴工具。截至 2022 年,Avermectin的市場價值約為每噸 12,200 美元。

- 草氨醯是一種廣泛使用的殺蟲劑和殺線蟲劑,屬於氨基甲酸酯類。主要用於防治農作物中的各種植物寄生線蟲。作為殺蟲劑和殺線蟲劑,Oxamyl 的作用機制是抑制乙醯膽鹼酯酶的活性,乙醯膽鹼酯酶是昆蟲和線蟲神經功能所必需的酵素。透過抑制這種酶,草氨醯會引起神經過度刺激,從而導致害蟲癱瘓和死亡。 2022 年的價格為每噸 8,800 美元。

殺線蟲劑產業概覽

殺線蟲劑市場相當集中,前五大公司佔據了85.65%的市場。該市場的主要企業有:ADAMA Agricultural Solutions Ltd.、拜耳股份公司、Corteva Agriscience、先正達集團和Upl Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 澳洲

- 加拿大

- 中國

- 法國

- 德國

- 印度

- 印尼

- 義大利

- 日本

- 墨西哥

- 緬甸

- 荷蘭

- 巴基斯坦

- 菲律賓

- 俄羅斯

- 南非

- 西班牙

- 泰國

- 烏克蘭

- 英國

- 美國

- 越南

- 價值鍊和通路分析

第5章市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 地區

- 非洲

- 按國家

- 南非

- 其他非洲國家

- 亞太地區

- 按國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 緬甸

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 按國家

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

- 北美洲

- 按國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 按國家

- 阿根廷

- 巴西

- 智利

- 其他南美國家

- 非洲

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ADAMA Agricultural Solutions Ltd.

- Albaugh LLC

- American Vanguard Corporation

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Tessenderlo Kerley Inc.(Novasource)

- Upl Limited

- Vive Crop Protection

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 49674

The Nematicide Market size is estimated at 3.05 billion USD in 2025, and is expected to reach 3.64 billion USD by 2030, growing at a CAGR of 3.63% during the forecast period (2025-2030).

Increasing early crop growth damage by soil-borne nematodes raises the soil treatment application mode of nematicides

- The growth of nematodes in agriculture is favored by changing climates like drought, heat waves, and warm and humid conditions. Monoculture practices, no-tillage, and sandy soils also favor their growth. Based on the types of nematodes, regions, and crops, farmers implement various nematicide application modes for better nematode management and enhancing crop production.

- Nematicide application via soil treatment held a majority market share of 70.3% in 2022, which was majorly attributed to the effectiveness of this method in reducing soil-borne nematode populations and improving crop productivity. These can be applied prior to planting and after planting by soil drenching, which helps in faster crop germination. The soil treatment mode of nematicide application is expected to increase by around 17.3 thousand metric ton during 2023-2029.

- The foliar method of nematicide application was the next most used application mode and fastest-growing segment, which is anticipated to register a CAGR of 3.4% during the forecast period. The foliar nematicide application effectively manages the foliar nematodes that feed on the foliage of the plant and reduces the yield of food crops. Advancements in foliar mode, like drone applications and other technical and digital improvements, raise the foliar mode of application.

- Effective management of water and nematicide quantity can be achieved through the chemigation mode, which occupied the market share of 8.5% in 2022. Advanced irrigation systems and increased water scarcity will raise the chemigation adoption rate, increasing the nematicide application.

- All the application modes aim to reduce nematode infestations and increase crop productivity, which is expected to drive the market.

Increased nematode infestations and the growing adoption of nematicides stood South America in prominent position

- Apart from climate changes and other pests and diseases, nematodes cause significant damage to the agriculture sector worldwide. More than 4100 plant parasitic nematodes were identified, causing damage to various crops across the world.

- According to the American Society of Phytopathology, nematodes cause around 14% of the global crop loss annually, which is equal to an economic loss of almost USD 125 billion. Among various nematode species root-knot nematodes (Meloidogyne spp.), cyst nematodes (Heterodera spp., Globodera spp.), root-lesion nematodes (Pratylenchus spp., Hirschmanniella spp., and Radopholus spp.), stem nematodes (Ditylenchus spp.), and pine wood nematodes (Bursaphlenchus spp.) majorly damage the crop growth and productivity by effecting the water and nutrients absorption.

- The consumption of nematicides in its cultivation is majorly dominated by South America, which represented 37.4% of the global nematicide market in 2022. This is majorly attributed to the crop losses by nematodes, which are recorded at around USD 6.5 billion every year. Soybean is the major crop grown, and South America produces more than 50% of the soybeans produced in the world. Nematodes cause around 30% of yield loss worth USD 3 billion in the region. During the historical period, the consumption of nematicides increased by around 7.6 thousand metric ton between 2017 and 2022, which is further expected to increase by more than 10.1 thousand metric ton between 2023-2029. This emphasized the nematicide's necessity in the South American agriculture industry.

- The global nematicide market is anticipated to grow during the forecast period (2023-2029) with an estimated CAGR of 3.7%, which will be driven by the growing adoption of nematicides for crop protection from various nematodes globally.

Global Nematicide Market Trends

Intensive agricultural practices have increased the need for nematicide application

- The average global consumption of chemical nematicides was 2.1 kg per hectare of agricultural land in 2022. Asia-Pacific was the largest consumer of nematicides, with a per-hectare consumption of 737.02 grams in 2022. Asian countries, including Japan, commonly adopt intensive farming practices like greenhouse cultivation and monocropping. Although these methods enhance productivity, they also heighten crop vulnerability to soil-borne pests like nematodes. Consequently, farmers frequently resort to nematicides to protect their crops.

- Europe was the second largest per-hectare consumer of nematicides, with 591.7 grams per hectare in 2022. European countries are expanding the cultivation of high-value crops, including vegetables, fruits, and ornamentals, which tend to be more susceptible to nematode damage. The plant-parasitic nematodes cause an annual yield loss of 21.3%, amounting to USD 1.58 billion in European countries. As a result, the use of nematicides becomes necessary to effectively manage and control these infestations in Europe.

- South America was the third largest per-hectare consumer of nematicides, with 570.14 grams per hectare in 2022. Root-knot nematodes attack the roots and tubers of various plants, including tomatoes, potatoes, and carrots in the region. Carrots are susceptible to considerable losses, averaging up to 20.0%, while potatoes can experience even higher losses of up to 33.0% due to infestations caused by these nematode species. The nematode population in North American countries is increasing with the increasing adoption of no-tillage practices, which reduce soil disturbance and increase the retention of crop residue. These circumstances are leading to the application of nematicides globally.

Changing climatic conditions and their effect on nematode infestations may raise the demand for nematicides and their prices simultaneously

- Nematicides play a crucial role in agriculture by effectively controlling plant-parasitic nematodes, protecting crops from root damage, and ensuring optimal yield and productivity.

- Flufensulfone is a nematicide belonging to the chemical class of arylsulfonates. It is used to control plant-parasitic nematodes, such as root-knot nematodes, cyst nematodes, lesion nematodes, and dagger nematodes in various agricultural crops. The mode of action of flufensulfone involves interfering with the nervous systems of nematodes, leading to paralysis and death. By targeting nematodes, flufensulfone helps reduce their populations and minimize the damage they can cause to crops. Flufensulfone was priced at USD 19.0 thousand metric ton in 2022.

- Abamectin is known for its nematocidal activity against several plant-parasitic nematodes, including the root lesion nematode (Pratylenchus penetrans), the reniform nematode (Rotylenchus reniformis), the root-knot nematode (Meloidogyne incognita), and the cyst nematodes (Heterodera schachtii). Its efficacy in controlling these nematodes makes it a valuable tool for nematode management in agricultural crops. As of 2022, the market value of abamectin was approximately USD 12.2 thousand per metric ton.

- Oxamyl is a widely used insecticide and nematicide belonging to the chemical class of carbamates. It is primarily used to control a variety of plant-parasitic nematodes in agricultural crops. Oxamyl's mode of action as an insecticide and nematicide involves inhibiting the activity of acetylcholinesterase, an enzyme essential for nerve function in insects and nematodes. By disrupting this enzyme, oxamyl causes nerve overstimulation, leading to paralysis and eventual death of the pests. It was priced at USD 8.8 thousand per metric ton in 2022.

Nematicide Industry Overview

The Nematicide Market is fairly consolidated, with the top five companies occupying 85.65%. The major players in this market are ADAMA Agricultural Solutions Ltd., Bayer AG, Corteva Agriscience, Syngenta Group and Upl Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 Canada

- 4.3.3 China

- 4.3.4 France

- 4.3.5 Germany

- 4.3.6 India

- 4.3.7 Indonesia

- 4.3.8 Italy

- 4.3.9 Japan

- 4.3.10 Mexico

- 4.3.11 Myanmar

- 4.3.12 Netherlands

- 4.3.13 Pakistan

- 4.3.14 Philippines

- 4.3.15 Russia

- 4.3.16 South Africa

- 4.3.17 Spain

- 4.3.18 Thailand

- 4.3.19 Ukraine

- 4.3.20 United Kingdom

- 4.3.21 United States

- 4.3.22 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Myanmar

- 5.3.2.1.7 Pakistan

- 5.3.2.1.8 Philippines

- 5.3.2.1.9 Thailand

- 5.3.2.1.10 Vietnam

- 5.3.2.1.11 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Ukraine

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.4.1.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Chile

- 5.3.5.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 Albaugh LLC

- 6.4.3 American Vanguard Corporation

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 Syngenta Group

- 6.4.7 Tessenderlo Kerley Inc. (Novasource)

- 6.4.8 Upl Limited

- 6.4.9 Vive Crop Protection

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219