|

市場調查報告書

商品編碼

1683989

歐洲殺線蟲劑:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Europe Nematicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

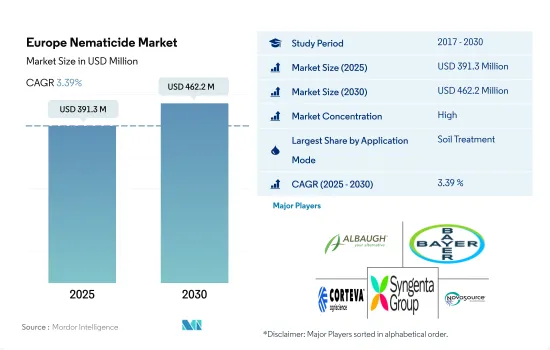

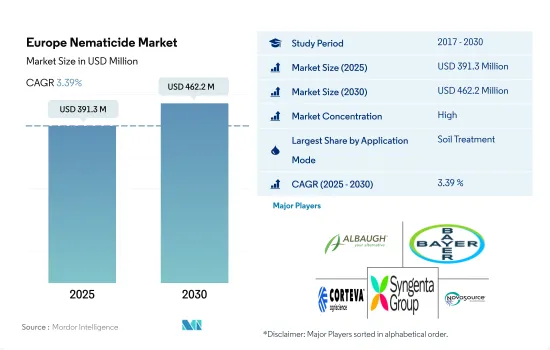

預計 2025 年歐洲殺線蟲劑市場規模為 3.913 億美元,到 2030 年將達到 4.622 億美元,預測期內(2025-2030 年)的複合年成長率為 3.39%。

土壤應用因具有保護有益昆蟲和傳粉者等好處而在非目標生物暴露市場中佔據主導地位。

- 以植物部位為食的線蟲稱為植物寄生線蟲(PPN)。在歐洲,最具破壞性的植物寄生線蟲是胞囊線蟲、根瘤線蟲、根結線蟲(RKN)、莖和球莖線蟲、柑橘線蟲和傳播病毒的線蟲。與這種線蟲感染相關的症狀與根部生長和功能受損引起的症狀相似。因此它可以模擬乾旱或營養缺乏等生物壓力,或莖腐病或根腐病等生物因素。線蟲引起的常見症狀包括變黃、發育不良和枯萎,並伴隨產量下降。

- 與葉面噴布等其他施用方法相比,土壤施用線蟲通常對非目標生物(包括有益昆蟲和傳粉媒介)的暴露風險較小。這是因為殺線蟲劑主要留在目標線蟲棲息的土壤中。因此,到 2022 年,土壤應用將佔據市場主導地位,佔有 68.5% 的佔有率。

- 2022 年,葉面噴布佔歐洲殺線蟲劑市場的 11.6% 。葉面噴布的目的是控制線蟲(例如小麥線蟲,Anguina tritici)對花序和葉子的侵染,小麥線蟲也被稱為小麥等穀類種子疾病的病原線蟲。葉面噴布可有效殺滅線蟲,其有效成分包括溴甲烷、草氨醯及巴拉松。

- 因線蟲侵染造成的農作物損失逐年增加,已成為農民關注的一大議題,鼓勵他們使用殺線蟲劑來保護農作物。預計該市場在預測期內的複合年成長率將達到 3.3%。

農業的擴張和對線蟲造成的農作物損害的認知不斷提高將推動該行業的成長

- 歐洲各國的殺線蟲劑市場都在經歷成長。法國的農業部門十分重要,作物生產多樣化。該國種植多種作物,包括穀物、油籽、水果和蔬菜。法國農業界充分認知到作物保護(包括線蟲防治)的重要性。因此,法國已成為歐洲殺線蟲劑的最大消費國,佔了很大的市場佔有率。

- 在俄羅斯,農業的擴張以及人們對線蟲造成的作物損害的認知不斷提高,推動了殺線蟲劑市場的成長。隨著全國農民採取更有效的殺線蟲劑防治措施,對殺線蟲劑的需求正在增加。因此,俄羅斯獲得了相當大的市場佔有率,預計 2023-2029 年期間的複合年成長率為 2.5%。

- 與其他國家相比,西班牙預計將見證殺線蟲劑市場最快的成長,預測期內(2023-2029 年)的複合年成長率為 3.0%。西班牙農業產業強大,專注於發展水果、蔬菜和觀賞植物等高價值作物。這些作物特別容易受到線蟲的侵害。隨著西班牙高價值作物種植範圍的擴大,對有效控制線蟲的殺線蟲劑的需求預計將增加,從而推動市場成長。

- 考慮到高價值作物種植的擴大、對線蟲造成的作物損害的認知不斷提高以及對採用先進農業實踐的日益重視等因素,歐洲農業對作為有效的線蟲控制解決方案的殺線蟲劑的需求預計將會增加。

歐洲殺線蟲劑市場趨勢

農民對線蟲防治重要性的認知不斷提高,從而提高了施用率

- 在歐洲,殺線蟲劑廣泛應用於各種作物類型,包括農業、園藝、高爾夫球場和運動草坪,以保護作物免受線蟲危害並減少潛在的產量損失。這些殺線蟲劑可以在種植時或播種前施用於土壤。 2022年該地區每公頃農地的平均殺線蟲劑使用量為700.7公斤。

- 歐洲使用的殺線蟲劑的數量因國家和耕作方式而異。義大利是每公頃殺線蟲劑消費量最大的國家,2022年每公頃農地平均消費量為195.8公克。

- 2022 年每公頃殺線蟲劑使用量排名第二的是荷蘭,其每公頃殺線蟲劑使用量為 119.7 克。緊隨其後的其他歐洲國家、德國和法國,每公頃分別使用109克、78.3克和69克殺線蟲劑。這些數字顯示了用於控制影響作物的各種線蟲害蟲(根結線蟲、胞囊線蟲、病變線蟲、腎線蟲、杓狀線蟲、莖皮線蟲等)的殺線蟲數量。

- 2022年,歐洲殺線蟲劑的使用價值金額與前一年同期比較增10.8%。這種成長是由於易受線蟲感染的蔬菜、水果和觀賞植物等高價值作物的種植面積擴大所致。單一栽培和連作等集約化農業實踐創造了有利於土壤中線蟲種群繁衍的條件,從而導致線蟲問題加劇。因此,必須使用殺線蟲劑來有效地管理和控制這些侵染。

磺酸鹽的價格最高,2022年將達到每噸19,100美元。殺線蟲劑的需求增加預計將推高殺線蟲劑成分的價格。

- 殺線蟲劑在綜合蟲害管理系統中對抗植物寄生線蟲發揮重要作用。在各種施用方法中,種子施用殺線蟲劑在歐洲已變得流行並且是連續作物農業中最常用的技術之一。

- 磺酸鹽是一種氟烷基非燻蒸殺線蟲劑,可有效控制葫蘆科植物和果菜中的根結線蟲、胞囊線蟲、病斑線蟲和匕首線蟲等植物寄生線蟲。其作用機制是破壞線蟲的神經系統,導致癱瘓並隨後死亡。磺酸鹽針對的是線蟲,可以減少線蟲的數量以及對作物的潛在損害。 2022年磺酸鹽的價格為每噸19,100美元。

- 2022 年活性成分Avermectin的價格為每噸 12.3 美元。Avermectin屬於阿維菌素化學類,對根結線蟲(Pratylenchus penetrans)、腎形線蟲(Rotylenchus reniformis)、根結線蟲(Meloidogyne incognita)和胞囊線蟲(Heterodera chacht)等線蟲具有很高的內在活性。已知它具有強大的殺線蟲作用。Avermectin即使在低濃度下也能有效抑制線蟲感染。

- 草氨醯是系統性殺線蟲劑中的活性成分,廣泛用於控制土壤線蟲。它特別適合用作註冊的葉面殺線蟲劑,因為它表現出向下遷移的系統活性。 2022年,草氨醯的價格為每噸8900美元。

歐洲殺線蟲劑產業概況

歐洲殺線蟲劑市場比較集中,前五大公司佔了86.40%的市佔率。該市場的主要企業是:Albaugh LLC、Bayer AG、Corteva Agriscience、Syngenta Group 和 Tessenderlo Kerley Inc. (Novasource)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 價值鍊和通路分析

第5章 市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 歐洲其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Albaugh LLC

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Tessenderlo Kerley Inc.(Novasource)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001691

The Europe Nematicide Market size is estimated at 391.3 million USD in 2025, and is expected to reach 462.2 million USD by 2030, growing at a CAGR of 3.39% during the forecast period (2025-2030).

Soil application dominated the market exposing non-target organisms due to its benefits like protecting beneficial insects and pollinators

- Nematodes that feed on plant parts are called plant parasitic nematodes (PPNs). In Europe, the most damaging plant parasitic nematodes are cyst nematodes, root-lesion nematodes, root-knot nematodes (RKNs), stem and bulb nematodes, citrus nematodes, and virus vector nematodes. Symptoms associated with this nematode infection are similar to those caused by impaired root growth and function. Therefore, they may resemble abiotic stress like drought and nutritional deficiencies, as well as biotic factors like stem and root rots. General symptoms from nematodes include yellowing, stunting, and wilting, accompanied by a yield decline.

- Compared to other application methods, such as foliar application, soil application of nematodes generally poses fewer risks of exposing non-target organisms, including beneficial insects and pollinators. This is because the nematicide remains primarily in the soil, where the target nematodes reside. Owing to this, soil application dominated the market with a share of 68.5% in 2022.

- Foliar applications accounted for 11.6% of the European nematicide market in 2022. The purpose of the foliar application is to control the infestation of inflorescence and leaves by nematodes such as Anguina tritici, also known as seed gall disease-causing nematodes, which are present in cereals such as wheat. The foliar application was effective against the nematodes due to the use of active ingredients like methyl bromide, oxamyl, and parathion.

- The increase in crop losses due to nematode infestation is increasing every year and acting as a major concern for farmers, thus encouraging them to use nematicides to protect crops. The market is anticipated to record a CAGR of 3.3% during the forecast period.

The expansion of agriculture and the increasing awareness of nematode-related crop damage are driving the growth of the segment

- Europe is experiencing growth across all the countries in the nematicide market. France has a significant agricultural sector with diverse crop production. The country cultivates a wide range of crops, including grains, oilseeds, fruits, and vegetables. The importance of crop protection, including nematode control, is well-recognized in the French agricultural sector. As a result, France has been a major consumer of nematicides in Europe, contributing to its significant share in the market.

- In Russia, the expansion of agriculture, along with the increasing awareness of nematode-related crop damage, has driven the growth of the nematicide market. As farmers in the country adopt more effective nematode control measures, the demand for nematicides is increasing, resulting in Russia gaining a substantial market share, which is anticipated to record a CAGR of 2.5% during 2023-2029.

- Spain is expected to witness the fastest growth in the nematicide market compared to other countries, recording a CAGR of 3.0% during the forecast period (2023-2029). Spain has a strong agricultural sector, with a focus on high-value crops, such as fruits, vegetables, and ornamentals. These crops are particularly susceptible to nematode damage. As the cultivation of high-value crops expands in Spain, the demand for nematicides for effective nematode control is expected to rise, leading to growth in the market.

- Considering factors such as the expansion of high-value crop cultivation, rising awareness of nematode-related crop damage, and the rising focus on the adoption of advanced agricultural practices, the demand for nematicides as an effective solution for nematode control is expected to increase in European agriculture.

Europe Nematicide Market Trends

Growing awareness among the farmers about the importance of nematode control is increasing their application rate

- In Europe, nematicides are widely used in various crop types, including agriculture, horticulture, golf courses, and sports turfs, to safeguard crops from nematode damage and mitigate potential yield losses. These nematicides can be used by soil application during planting or prior to sowing. The average consumption of nematicides in the region was 700.7 kg per hectare of agricultural land in 2022.

- Nematicide usage in Europe varies across countries and agricultural practices. Italy is the largest consumer of nematicides per hectare, with an average consumption of 195.8 g per hectare of agricultural land in 2022.

- In 2022, the Netherlands ranked second in terms of nematicide consumption per hectare, using 119.7 g per hectare. The Rest of Europe, Germany, and France followed with nematicide consumption rates of 109, 78.3, and 69 grams per hectare, respectively. These figures indicate the quantities of nematicides applied to control various types of nematode pests that affect crops, including root-knot nematodes, cyst nematodes, lesion nematodes, reniform nematodes, lance nematodes, and stem and bulb nematodes.

- In 2022, the use of nematicides in Europe witnessed a growth of 10.8% in terms of value share compared to the previous year. This increase can be attributed to the expanding cultivation of high-value crops, including vegetables, fruits, and ornamentals, which tend to be more susceptible to nematode damage. Intensive agricultural practices like monoculture and continuous cropping contribute to the increase of nematode issues by creating favorable conditions for nematode populations to thrive in the soil. As a result, the use of nematicides becomes necessary to effectively manage and control these infestations.

Fluensulfone was priced the highest at USD 19.1 thousand per metric ton in 2022. The growing demand for Nematicides is expected to fuel the prices of acitve ingredients.

- Nematicides play a crucial role in integrated pest management systems to combat plant-parasitic nematodes. Among various application methods, seed-applied nematicides have gained popularity in Europe and become one of the most frequently utilized techniques in row crop agriculture.

- Fluensulfone, a non-fumigant nematicide falling under the fluoroalkyl chemical class, effectively controls plant-parasitic nematodes like root-knot nematodes, cyst nematodes, lesion nematodes, and dagger nematodes in cucurbits and fruiting vegetables. Its mode of action disrupts nematode nervous systems, leading to paralysis and subsequent death. By targeting nematodes, fluensulfone helps reduce their populations, mitigating potential crop damage. In 2022, fluensulfone was priced at USD 19.1 thousand per metric ton.

- Abamectin, an active ingredient, was valued at USD 12.3 per thousand per metric ton in 2022. It belongs to the avermectin chemical class and demonstrates high intrinsic activity against nematodes like the root lesion nematode (Pratylenchus penetrans), reniform nematode (Rotylenchus reniformis), root-knot nematode (Meloidogyne incognita), and cyst nematodes (Heterodera chacht). It is known for its potent nematicidal properties. Even at low concentrations, abamectin inhibits nematode infections effectively.

- Oxamyl is an active ingredient used as a systematic nematicide widely employed for soil nematode control. Particularly, it exhibits downward-moving systemic activity, rendering it suitable for registered foliar nematicidal applications. In 2022, oxamyl was priced at USD 8.9 thousand per metric ton.

Europe Nematicide Industry Overview

The Europe Nematicide Market is fairly consolidated, with the top five companies occupying 86.40%. The major players in this market are Albaugh LLC, Bayer AG, Corteva Agriscience, Syngenta Group and Tessenderlo Kerley Inc. (Novasource) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Albaugh LLC

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 Syngenta Group

- 6.4.5 Tessenderlo Kerley Inc. (Novasource)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219