|

市場調查報告書

商品編碼

1683981

非洲殺線蟲劑:市場佔有率分析、產業趨勢與成長預測(2025-2030)Africa Nematicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

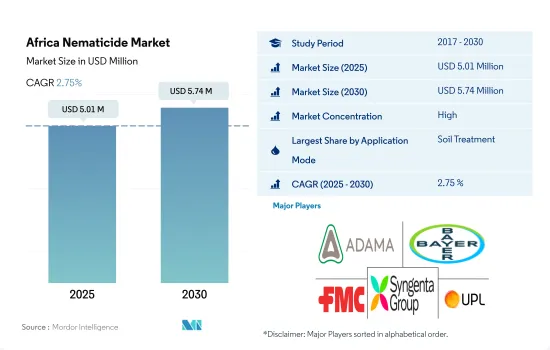

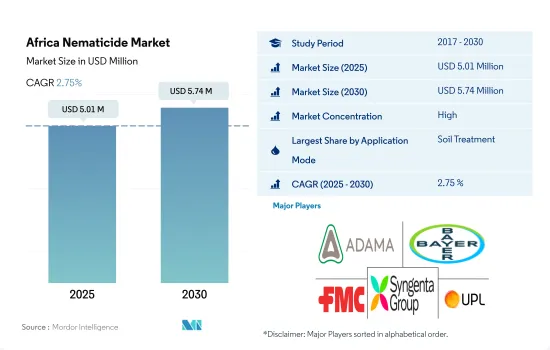

預計 2025 年非洲殺線蟲劑市場規模將達到 501 萬美元,到 2030 年將達到 574 萬美元,預測期內(2025-2030 年)的複合年成長率為 2.75%。

土壤施用殺線蟲劑佔據市場主導地位,因為接觸非目標生物的風險較小

- 在非洲,農業中透過使用各種方法施用殺線蟲劑可以有效控制線蟲。透過選擇正確的施用方法,農民可以有效地施用殺線蟲劑,覆蓋特定區域並減少浪費,從而降低成本。效率的提高可以實現最佳利用並降低農民的投入成本。

- 其他施用方法,例如土壤施用或葉面噴布線蟲,通常對非目標生物的暴露風險較小。土壤施用將成為農業實務中殺線蟲劑應用的主導,佔2022年總施用面積的68.2%。穀物和穀類佔據最大的市場佔有率,為46.0%。這是因為殺線蟲劑會殘留在目標線蟲主要棲息的土壤中,透過預防或減少線蟲,可以有效保護穀物和穀類的品質。

- 2022年,葉面噴布佔非洲殺線蟲劑市場的14.2%。其主要目的是控制花序和葉子中的線蟲侵染。菊花線蟲是一種葉線蟲,常見於花蕾和葉子上,但也可以在土壤中找到。這些線蟲也會破壞觀賞植物和玫瑰、番茄等作物,導致其生長不良、枯萎和產量下降。

- 在非洲,由於線蟲感染造成的農作物損失逐年增加,農民的擔憂日益加重。殺線蟲劑的使用正在增加,以提高作物的產量和盈利。殺線蟲劑的應用方法預計將經歷顯著成長,預測期內複合年成長率為 2.8%。

非洲農民正專注於線蟲管理,以最佳化作物健康並最大限度地提高產量,預計這將推動市場發展。

- 非洲的農業部門多種多樣。線蟲會對多種作物造成重大影響,包括穀物、水果和蔬菜,導致作物損失。因此,對殺線蟲劑的需求日益增加,以控制線蟲族群並減少作物損害。截至 2022 年,該地區在全球殺線蟲劑市場的價值為 460 萬美元。

- 2022年,非洲其他地區成為殺線蟲劑的最大購買者。非洲其他地區佔非洲殺線蟲劑市場總量的70.3%。隨著該地區的農民實施更有效的線蟲防治方法,對殺線蟲劑的需求預計將會增加,從而擴大非洲其他地區的市場佔有率。預計 2023 年至 2029 年的複合年成長率為 2.4%。

- 在預測期內(2023-2029 年),南非殺線蟲劑市場預計將以 3.7% 的複合年成長率成長,與其他國家相比成長率最高。在南非,植物線蟲估計造成穀物、蔬菜和水果作物每年產量損失約 14%。這導致對有效控制線蟲的殺線蟲劑的需求增加,預計市場將迅速擴大。

- 由於作物種植面積的擴大、人們對線蟲相關作物損害的認知不斷提高以及對先進農業實踐的日益關注,對殺線蟲劑作為有效的線蟲控制解決方案的需求預計會增加。因此,非洲殺線蟲劑市場預計在預測期內(2023-2029 年)的複合年成長率將達到 2.8%。

非洲殺線蟲劑市場趨勢

殺線蟲劑的需求源自於其控制線蟲的有效性

- 2022年非洲每公頃農業用地平均殺線蟲劑消費量為233.9公克。根結線蟲和病線蟲在南非廣泛存在。根結線蟲造成的損失最大,馬鈴薯產量損失估計為16*7%或每年700萬美元,其次是斑點線蟲。金囊胞線蟲是南非偏遠地區發現的一種檢疫性害蟲。

- 據悉,根結線蟲病對非洲國家的各種作物造成了嚴重損失。例如,據報道,根結線蟲病造成坦尚尼亞一些菸草種植園的作物損失超過 30%,造成烏干達香蕉種植園的產量損失 50%。此類案例增加了該地區對殺線蟲劑的需求。此外,缺乏有效的替代策略將導致殺線蟲劑的使用增加,否則可能導致整個大陸的糧食危機。

- 在炎熱乾燥的夏季,線蟲在土壤中進入休眠狀態,使它們能夠在不利的條件下生存。當溫和潮濕的冬季到來時,線蟲再次活躍起來,迅速繁殖,對作物構成重大威脅。因此,冬季非洲的殺線蟲劑使用率較高。此外,農民對線蟲危害的認知不斷提高,而線蟲危害常常被誤認為是營養缺乏,這推動了殺線蟲劑市場的發展。

- 線蟲如果不加以控制將造成產量的嚴重損失,而且缺乏化學殺線蟲劑的有效替代品等因素迫使非洲國家的農民每公頃使用更高的殺線蟲劑劑量。

根結線蟲引起的線蟲侵染日益增多,推高了該地區殺線蟲劑的需求和價格。

- 植物寄生線蟲對該地區的農業部門構成重大威脅。犁地、單作等集約化農業實踐的盛行,加上氣候變化,特別是氣候變暖的影響,為線蟲的繁殖創造了有利環境,給農業部門帶來了重大損失。

- 磺酸鹽是該地區廣泛使用的殺線蟲劑,佔有重要地位,2022 年該活性成分的價格為每噸 19,038.9 美元。與 2017 年的價格相比,這一價格大幅上漲了 17.9%。這種活性成分是專門為控制各種作物中的根結線蟲而配製的,包括葫蘆科植物、水果和葉類蔬菜、某些根莖類作物、十字花科蔬菜、各種根類作物、甘蔗、咖啡、黑胡椒和大豆。這種活性成分的需求不斷成長,是因為其能夠有效控制根腫病。

- Avermectin是一種用於種子處理的系統性殺線蟲劑,可有效減少線蟲引起的早期根部感染,包括控制根結線蟲。Avermectin活性成分的成本不斷上漲,2022年將達到每噸12,276.6美元。南非和肯亞是Avermectin的主要進口國,主要從中國、印度、丹麥和美國採購。

- Oxamyl 是一種非燻蒸型殺線蟲劑和殺蟲劑,可控制花生、馬鈴薯、甘蔗和鳳梨中的根結線蟲。預計2022年該活性成分的價格為每噸8,803.3美元,與前一年同期比較呈現上漲趨勢。

非洲殺線蟲劑產業概況

非洲殺線蟲劑市場比較集中,前五大公司佔75.52%的市佔率。該市場的主要企業有:ADAMA Agricultural Solutions Ltd、拜耳股份公司、FMC Corporation、先正達集團和UPL Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 南非

- 價值鏈與通路分析

第5章 市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 南非

- 其他非洲國家

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- FMC Corporation

- Syngenta Group

- UPL Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001683

The Africa Nematicide Market size is estimated at 5.01 million USD in 2025, and is expected to reach 5.74 million USD by 2030, growing at a CAGR of 2.75% during the forecast period (2025-2030).

Soil application of nematicides dominated the market owing to fewer risks of exposing non-target organisms

- In Africa, nematodes in agriculture are effectively controlled through the use of various modes of applying nematicides. By selecting the appropriate application method, farmers can save costs, as they can efficiently apply the nematicides, cover specific areas, and reduce wastage. This improved efficiency leads to optimal usage and lowers input costs for farmers.

- Other application methods, such as soil application and foliar application of nematodes, generally pose fewer risks of exposing non-target organisms. The dominant mode of nematicide application in agricultural practices is soil application, accounting for 68.2% of the overall application segment in 2022. Grains and cereals hold the largest market share at 46.0%. This is because the nematicide remains primarily in the soil where the target nematodes reside and their effectiveness in protecting the quality of grains and cereals by preventing or reducing nematodes.

- In 2022, foliar applications accounted for 14.2% of the African nematicide market. Its primary purpose is to manage nematode infestations in inflorescences and leaves. Chrysanthemum nematodes, a type of foliar nematode, are typically found in buds and leaves but may also be present in soil. These nematodes can also harm ornamental plants and crops like roses and tomatoes, causing stunted growth, wilting, and reduced yields.

- In Africa, there is a growing concern among farmers due to the rising crop losses caused by nematode infestations each year. The use of nematicides is increasing to enhance crop productivity and profitability. The mode of nematicide application is expected to witness significant growth, with a projected CAGR of 2.8% during the forecast period.

The focus of African farmers on nematode management to achieve optimal crop health and maximize yield is expected to drive the market

- Africa has a diverse agricultural sector. Nematodes can have a significant impact on various crops, including grains, fruits, vegetables, and others, leading to crop losses. As a result, there is a growing need for nematicides to control nematode populations and reduce crop damage. As of 2022, the region accounted for a value of USD 4.6 million in the overall global nematicide market.

- In 2022, the Rest of Africa was the main purchaser of nematicide products. The Rest of Africa accounted for 70.3% of the total nematicide market's value in Africa. As farmers in the region implement more efficient nematode control methods, the demand for nematicides is expected to increase, leading to an increase in the market share of the Rest of Africa. It is expected to record a CAGR of 2.4% from 2023 to 2029.

- During the forecast period (2023-2029), the nematicide market in South Africa is projected to have the highest growth rate compared to other countries, with a CAGR of 3.7%. In South Africa, plant nematodes cause an estimated annual yield loss of approximately 14% in cereal, vegetable, and fruit crops. Due to this, there is an increased demand for nematicides to effectively control nematodes, leading to the expected rapid expansion of the market.

- With the expansion of crop cultivation, increased awareness of nematode-related crop damage, and the growing focus on advanced agriculture practices, the demand for nematicides as an effective solution for nematode control is expected to rise. Therefore, the African nematicide market is expected to record a CAGR of 2.8% during the forecast period (2023-2029).

Africa Nematicide Market Trends

The demand for nematicides is driven by their effectiveness in controlling nematodes

- The average nematicide consumption per hectare of agricultural land in Africa was recorded at 233.9 grams in the year 2022. The root-knot and lesion nematodes are widely distributed in South Africa. The root-knot nematode causes the most damage, and yield loss in potatoes was estimated to be 16*7%, accounting for USD 7.0 million annually, followed by the lesion nematode. The golden cyst nematode is a quarantine pest found in isolated areas in South Africa.

- Meloidogyne spp is known to cause severe losses in various crops across African countries. For instance, crop losses of 30% or more in tobacco farms in some parts of Tanzania and 50% yield loss in banana plantations in Uganda have been reported due to Meloidogyne spp. These instances are increasing the need for nematicides in the region. Moreover, the lack of alternative strategies that are effective may greatly contribute to increased usage of nematicides, which otherwise may lead to food crises across the continent.

- In the hot and dry summer seasons, nematodes can enter a state of dormancy in the soil, enabling them to survive unfavorable conditions. When mild and wet winters arrive, the nematodes become active again, resulting in rapid multiplication, which poses a significant threat to crops. Consequently, higher application rates of nematicides are observed during the winter season in Africa. Additionally, farmers' increasing awareness of nematode damage symptoms, often mistaken for nutrient deficiencies, is driving the market for nematicides.

- The factors like significant yield losses when nematodes are left uncontrolled and lack of other effective alternative solutions to chemical nematicides are forcing farmers to use higher amounts of nematicides per hectare in African countries.

Increasing nematode infestation caused by root-knot nematodes is raising the demand for nematicides and their prices in the region

- Plant parasitic nematodes have emerged as a substantial threat to the region's agriculture sector. The prevalence of intensive agriculture practices, such as no-tillage and monoculture, coupled with the impact of climate change, particularly the rise in warm conditions, has created a favorable environment for nematode growth, resulting in significant losses for the sector.

- Fluensulfone holds a prominent position as a widely used nematicide in the region, and its active ingredient was priced at USD 19,038.9 per metric ton in 2022. This marked a significant increase of 17.9% compared to its price in 2017. The active ingredient is specifically formulated to combat root-knot nematodes in various crops, including cucurbits, fruiting vegetables, leafy vegetables, certain berry crops, brassica vegetables, various root and tuber crops, sugar cane, coffee, black pepper, and soybean. The increasing demand for the active ingredient is driven by its effectiveness in controlling root-knot species.

- Abamectin serves as a systemic nematicide utilized for seed treatment, providing an efficient solution to minimize early-growth root infections caused by nematodes, including the control of root-knot nematode species. The cost of Abamectin's active ingredient has been on the rise, reaching USD 12,276.6 per metric ton in 2022, driven by growing demand and limited availability within the region. South Africa and Kenya are the primary importers of Abamectin, sourcing it from China, India, Denmark, and the United States.

- Oxamyl is a non-fumigant nematicide and insecticide available in various forms, capable of controlling root-knot nematodes in groundnuts, potatoes, sugarcane, and pineapples. The price of the active ingredient was USD 8,803.3 per metric ton in 2022, which is increasing Y-O-Y.

Africa Nematicide Industry Overview

The Africa Nematicide Market is fairly consolidated, with the top five companies occupying 75.52%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 South Africa

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 South Africa

- 5.3.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 Bayer AG

- 6.4.3 FMC Corporation

- 6.4.4 Syngenta Group

- 6.4.5 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219