|

市場調查報告書

商品編碼

1683206

北美殺線蟲劑市場:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)North America Nematicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

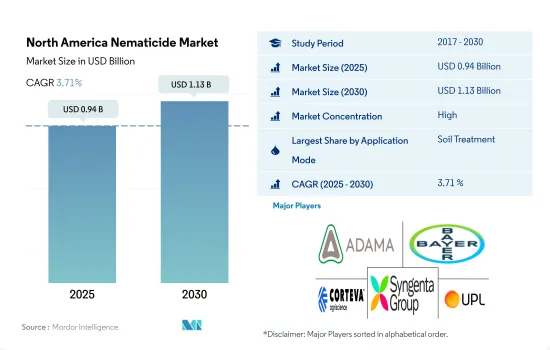

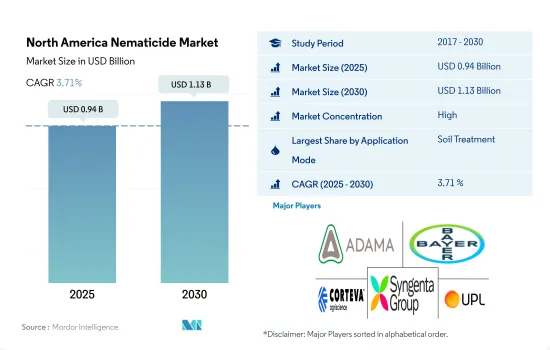

北美殺線蟲劑市場規模預計在 2025 年為 9.4 億美元,預計到 2030 年將達到 11.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.71%。

土壤應用主導殺線蟲劑市場

- 在北美,由於多種不同種類的線蟲會攻擊多種具有經濟價值的作物,因此對殺線蟲劑的需求日益增加。植物寄生線蟲不僅本身造成危害,也與其他微生物形成病害複合體,增加作物損失。在美國,每年因線蟲造成的作物損失估計為 80 億美元。殺線蟲劑的使用方法多種多樣,取決於害蟲的種類和作物的生長階段。

- 與葉面噴布(將殺線蟲劑直接施用於植物葉子)等其他施用方法相比,土壤施用線蟲通常對非目標生物(包括有益昆蟲和傳粉媒介)的暴露風險較小。因此,土壤應用將佔據70.7%的市場佔有率,2022年的市場規模將達到5.987億美元。

- 2022 年,葉面噴布佔北美線蟲市場的 10.9% 。葉面噴布的主要目的是控制花序和葉子受到線蟲的感染。例如,菊花線蟲是一種引起水稻白穗病的葉線蟲,而夏季捲曲線蟲則導致穀類在春季出現黃化病。

- 因線蟲侵染造成的作物損失逐年增加,已成為農民關注的一大問題,迫使他們使用殺線蟲劑。因此,預計預測期內市場複合年成長率將達到 3.2%。

北美農民正注重線蟲管理,以確保作物健康並最大限度地提高產量,這將推動市場的發展。

- 北美的農業部門多種多樣。線蟲可影響多種作物,包括穀物、水果、蔬菜和特色作物。因此,對殺線蟲劑的需求日益增加,以控制線蟲族群並減少作物損失。 2022年,該地區佔全球殺線蟲劑市場的30.7%的市場佔有率。

- 美國是殺線蟲劑的主要消費國。線蟲會對作物造成嚴重破壞,造成產量損失和經濟影響。農民認知到線蟲管理對於確保作物最佳健康和最大限度提高產量的重要性。因此,美國對殺線蟲劑的需求強勁,佔據了北美市場的大部分佔有率。

- 墨西哥殺線蟲劑市場正在快速成長。預計 2023 年至 2029 年的複合年成長率為 5.2%。墨西哥是該地區主要的農業出口國之一。由於墨西哥致力於滿足國際市場的嚴格品質標準和要求,因此越來越需要有效管理農作物中的線蟲族群。墨西哥農產品出口需求的不斷成長推動了該國殺線蟲劑市場的成長,使其成為北美成長最快的市場之一。

- 農民意識的提高、農業技術的進步和農業擴張等因素促進了殺線蟲劑市場的成長。因此,預計北美殺線蟲劑市場在預測期內(2023-2029 年)的複合年成長率為 3.9%。

北美殺線蟲劑市場趨勢

單一栽培和犁地農業實踐增加了線蟲密度,導致每公頃殺線蟲劑消費量增加

- 近年來,北美每公頃殺線蟲劑消費量大幅增加。 2022 年,這項消費量與 2017 年的水準相比大幅增加至每公頃 4 克。這一成長趨勢的主要促進因素是越來越依賴殺線蟲劑來控制線蟲。

- 2022年,美國殺線蟲劑消費量顯著成長,達到每公頃82.9克,大幅超過其他國家。這種顯著的成長主要歸因於由於促進線蟲種群成長的各種因素導致對殺線蟲劑的需求和使用增加。造成這種成長趨勢的一個因素是採用犁地農業實踐,這種實踐減少了土壤擾動並增加了作物殘留物的保留。然而,犁地農業實踐會增加土壤中的線蟲數量。

- 特別是犁地農業實踐的採用對小麥(68%)、玉米(76%)、棉花(43%)和大豆(74%)等主要作物具有重要意義,進一步增加了對殺線蟲劑的需求。在該國的熱帶和亞熱帶地區,單一栽培是常態,這些地區溫暖潮濕的氣候為線蟲的生長提供了理想的環境。這導致每公頃土地使用的殺線蟲劑的數量增加。

- 在加拿大、墨西哥和北美其他地區,每公頃土地使用的殺線蟲劑數量幾乎沒有變化。氣候變遷、土壤條件和其他農業實踐是導致線蟲數量增加的原因,進一步增加了每公頃殺線蟲劑的消費量。

磺酸鹽的需求量很大,其價格是所有殺線蟲劑中最高的。

- 線蟲對農作物造成嚴重破壞,導致產量損失和經濟影響。農民認知到線蟲管理對於確保作物最佳健康和最大限度提高產量的重要性。美國是該地區殺線蟲劑的最大消費國。

- 磺酸鹽被歸類為氟烷基化學品,在農業中用於防治植物寄生線蟲。磺酸鹽的作用機制是破壞線蟲和昆蟲的神經系統,導致其癱瘓並最終死亡。它們被用於各種作物,包括蔬菜、水果和觀賞植物,以減少這些害蟲造成的損害來提高作物的產量和品質。 2022 年磺酸鹽的價格為每噸 19,100 美元。

- Avermectin是一種用於種子處理的系統性殺線蟲劑,它是一種有效的解決方案,可以最大限度地減少線蟲在早期生長階段對根部的感染,包括對根結線蟲的控制。Avermectin有效成分的成本不斷上漲,2022年將達到每噸12.3美元。

- Oxamyl 是一種氨基甲酸酯殺蟲劑和殺線蟲劑,常用於控制多種線蟲。將 Oxamyl 噴灑在蔬菜、水果和觀賞作物上,可以保護作物免受侵蝕植物根部的咀嚼式和刺吸式昆蟲和線蟲造成的損害。 Oxamyl 的作用是破壞這些害蟲的神經系統,導致其癱瘓並最終死亡。它們有各種劑型,包括顆粒劑和濃縮液,並根據目標害蟲和作物施用於土壤或葉子。 2022 年 Oxamyl 的價格為每噸 8,600 美元。

北美殺線蟲劑產業概況

北美殺線蟲劑市場相當集中,前五大公司佔據了89.63%的市場。該市場的主要企業是 ADAMA Agricultural Solutions Ltd、Bayer AG、Corteva Agriscience、Syngenta Group 和 Upl Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 加拿大

- 墨西哥

- 美國

- 價值鏈與通路分析

第 5 章。市場細分,包括市場規模(美元和數量)、2030 年預測和成長前景分析

- 應用模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- Albaugh LLC

- American Vanguard Corporation

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Tessenderlo Kerley Inc.(Novasource)

- Upl Limited

- Vive Crop Protection

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 64569

The North America Nematicide Market size is estimated at 0.94 billion USD in 2025, and is expected to reach 1.13 billion USD by 2030, growing at a CAGR of 3.71% during the forecast period (2025-2030).

Soil application dominated the nematicide market

- The demand for nematicides has been increasing due to the presence of various nematode species attacking the wide range of economically important crops in North America. Plant parasitic nematodes cause damage individually and form disease complexes with other microorganisms, thereby increasing crop loss. Annual crop losses due to nematodes are estimated at USD 8.0 billion in the United States. Nematicides can be applied through different methods depending on the type of pest and growth stage of the crop.

- Compared to other application methods, such as foliar application (spraying the nematicide directly onto the plant leaves), soil application of nematodes generally poses fewer risks of exposing non-target organisms, including beneficial insects and pollinators, as the nematicide remains primarily in the soil, where the target nematodes reside. Owing to this, soil application dominated the market with a share of 70.7%, valued at USD 598.7 million in 2022.

- Foliar applications accounted for 10.9% of the North American nematicide market in 2022. The main purpose of foliar application is to control the infestation of inflorescence and leaves by the nematodes. For instance, chrysanthemum nematodes are foliar nematodes that cause white rice tip, and summer crimp nematodes cause spring dwarf diseases in cereal crops.

- The crop losses due to nematode infestation are increasing every year, acting as a major concern for farmers and forcing them to use nematicides. Therefore, the market is anticipated to register a CAGR of 3.2% during the forecast period.

North American farmers' emphasis on nematode management for optimal crop health and yield maximization will drive the market

- North America has a diverse agricultural sector. Nematodes can impact a wide range of crops, including major commodities like grains, fruits, vegetables, and specialty crops. As a result, there is a growing demand for nematicides to control nematode populations and mitigate crop losses. In 2022, the region accounted for 30.7% market share value of the global nematicide market.

- The United States is a major consumer of nematicide products. Nematodes can cause substantial damage to crops, leading to yield losses and economic impact. The farmers recognize the importance of nematode management to ensure optimal crop health and maximize yields. As a result, there is a strong demand for nematicide products in the United States, contributing to its major share in the North American market.

- Mexico is experiencing rapid growth in its nematicide market. It is anticipated to register a CAGR of 5.2% during 2023-2029. Mexico is one of the leading exporters of agricultural products in the region. As Mexico aims to meet the stringent quality standards and requirements of international markets, there is an increasing need to effectively manage nematode populations in crops. The rising export demand for Mexican agricultural products is driving the growth of the nematicide market in the country, making it one of the fastest-growing markets in North America.

- Factors such as increasing awareness among farmers, advancements in agricultural technologies, and expansion of agriculture contribute to the growth of the nematicide market. Therefore, the North American nematicide market is expected to register a CAGR of 3.9% during the forecast period (2023-2029).

North America Nematicide Market Trends

Monoculture and no-tillage practices proliferate the nematode density, resulting in increased consumption of nematicides per ha

- In recent years, there has been a notable growth in the consumption of nematicide per hectare in North America. In 2022, this consumption witnessed a considerable increase of 4 g per ha compared to the levels recorded in 2017. The primary driving force behind this upward trend is the growing dependency on nematicides to control nematodes.

- In 2022, the United States stood out with a substantial consumption of nematicide, reaching 82.9 g per ha, which was significantly higher than other countries. This notable increase can be primarily attributed to various factors promoting the proliferation of nematode populations, leading to a higher demand for nematicides and increased usage levels. One of the contributing factors to this upward trend is the adoption of no-tillage practices, which reduce soil disturbance and increase the retention of crop residue. However, this practice also inadvertently results in a higher nematode population in the soil.

- Notably, major crops like wheat (68%), corn (76%), cotton (43%), and soybeans (74%) have recorded considerable adoption of no-tillage methods, further intensifying the need for nematicides. The country's tropical and subtropical regions predominantly adopt monoculture agricultural practices, and the warm and humid conditions in these areas create favorable environments for nematode growth. Therefore, the utilization of nematicides per ha is growing.

- There is a minimal change in the consumption of nematicides per ha in Canada, Mexico, and the Rest of North America. Climate changes, soil conditions, and other agricultural practices are reasons for nematodes' growth, further increasing the consumption of nematicides per ha.

Fluensulfone was priced highest among other nematicides due to the high demand

- Nematodes can cause substantial damage to crops, leading to yield losses and economic impact. The farmers recognize the importance of nematode management to ensure optimal crop health and maximize yields. The United States is a major consumer of nematicide products in the region.

- Fluensulfone falls under the fluoroalkyl chemical class and is used in agriculture to control plant-parasitic nematodes. Fluensulfone's mode of action involves disrupting the nervous systems of nematodes and insects, leading to their paralysis and eventual death. It is used in a variety of crops, including vegetables, fruits, and ornamental plants, to enhance crop yield and quality by reducing the damage caused by these pests. Fluensulfone was priced at USD 19.1 thousand per metric ton in 2022.

- Abamectin is a systemic nematicide utilized for seed treatment, providing an efficient solution to minimize early-growth root infections caused by nematodes, including controlling root-knot nematode species. The cost of abamectin's active ingredient has been on the rise, reaching USD 12.3 per metric ton in 2022.

- Oxamyl is a carbamate insecticide and nematicide that is commonly used to control a variety of nematodes. It is applied to crops like vegetables, fruits, and ornamental plants to protect them from damage caused by chewing and sucking insects, as well as nematodes that attack the plant roots. Oxamyl works by disrupting the nervous system of these pests, leading to paralysis and eventual death. It is available in various formulations, including granules and liquid concentrates, and is applied to the soil or foliage depending on the target pests and crops. Oxamyl was valued at USD 8.6 thousand per metric ton in 2022.

North America Nematicide Industry Overview

The North America Nematicide Market is fairly consolidated, with the top five companies occupying 89.63%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, Corteva Agriscience, Syngenta Group and Upl Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 Albaugh LLC

- 6.4.3 American Vanguard Corporation

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 Syngenta Group

- 6.4.7 Tessenderlo Kerley Inc. (Novasource)

- 6.4.8 Upl Limited

- 6.4.9 Vive Crop Protection

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219