|

市場調查報告書

商品編碼

1683932

亞太地區汽車 LED 照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

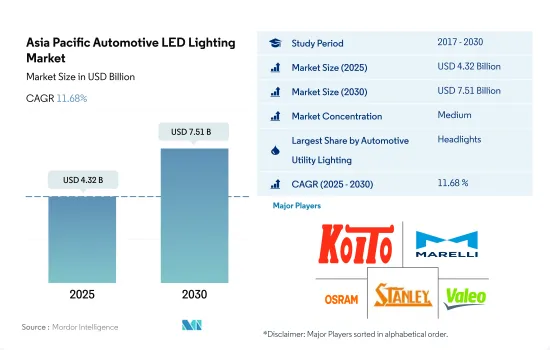

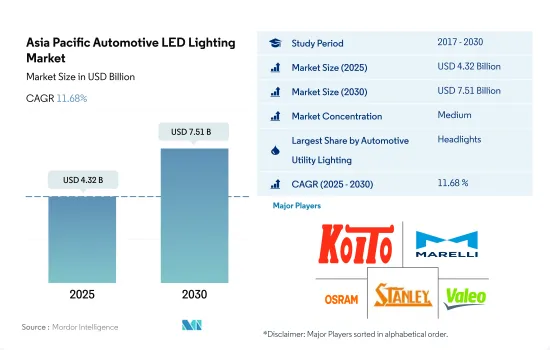

亞太地區汽車 LED 照明市場規模預計在 2025 年為 43.2 億美元,預計到 2030 年將達到 75.1 億美元,預測期內(2025-2030 年)的複合年成長率為 11.68%。

汽車 LED 照明技術創新減少事故,推動亞太地區市場需求

- 就金額佔有率而言,頭燈將在 2022 年佔據市場主導地位,其次是其他燈和轉向訊號燈。轉向訊號燈和煞車燈的市場佔有率預計將保持幾乎相等,而預測期內頭燈的波動預計較小。中國是汽車零件製造領域的領先國家,預計在預測期內仍將保持主導地位。

- 從出貨量佔有率來看,2022年轉向訊號燈將佔據多數,其次是頭燈和其他。這些燈的市場佔有率保持穩定,預計未來不會發生變化。塔塔、現代、上汽和吉利是少數幾家將在即將推出的汽車中配備 LED 投影燈的主要企業。隨著事故率上升,LED 霧燈預計會變得更加受歡迎。中國、印度和日本等國家正在透過在車輛上採用LED燈來降低事故率。例如,2017年總合發生4,64,910起道路交通事故,2021年這數字下降到4,12,432起。因此,車輛使用LED燈可望減少各國交通事故造成的死亡和受傷人數。

- 此外,LED 還有助於開發創新照明概念,從而增強車輛的外觀。兩家公司共同合作,為汽車產業開發技術 LED 產品。例如,2022 年 9 月,ams Osram 和 TactoTek 宣布合作開發一款以前衛 OSIRE E5515 側視 RGB LED 為特色的示範器。它可以輕鬆整合到車輛內部,從而實現更緊湊的設計。預計在預測期內,此類技術創新和未來對汽車 LED 照明的投資將推動市場發展。

韓國、中國、印度和其他亞太主要國家的電動車成長預計將推動 LED 照明的銷售。

- 從金額佔有率來看,2022年中國將佔據亞太汽車LED照明市場的大部分佔有率,其次是日本和印度。由於中國製造業的成長和技術創新的加強,預計到 2030 年,中國的市場佔有率將會增加。由於大多數國內汽車公司加強對電動車的投資,且政府加強對電動車發展的扶持舉措,印度的市場佔有率預計也將成長。

- 從單位佔有率來看,中國將在2022年佔據大部分市場佔有率,其次是印度、日本和亞太地區的其他國家。韓國的市佔率最低,預計在整個預測期內仍將維持少數地位。中國是世界其他地區的進出口中心,也是主要半導體製造業的位置。 2019年,中國生產了2,600多萬輛汽車,其中大部分出口到其他國家。

- 在韓國,2022 年的銷量與 2021 年相比有所下降。這是由於地緣政治問題導致中國和俄羅斯的銷售量疲軟。然而,隨著越來越多的政府補貼在國內推廣電動車,電動車產業預計將在未來幾年內實現成長。

- 2021年電動車銷量的成長主要由中國推動,中國佔成長的一半。因此,電動車的整體成長,加上 LED 技術創新的不斷增加以及物流行業的成長,預計將推動全球汽車產業 LED 的整體成長。

亞太地區汽車 LED 照明市場趨勢

增加電動車獎勵以銷售更多電動車將推動 LED 市場成長

- 預計2022年亞太地區汽車總產量將達1.0429億輛,2023年將達1.0965億輛。新冠疫情對亞太汽車市場產生了重大影響。例如,與2019年3月相比,紐西蘭的汽車和商用車銷量下降了37%。 2020年3月23日,本田、印度馬達等汽車製造商暫停在巴基斯坦的生產。亞太地區的其他國家也面臨類似的情況。因此,在新冠疫情期間,汽車產業對 LED 的需求整體有所下降。

- 塔塔汽車、馬恆達汽車、上汽汽車、吉利汽車、長城汽車、奇瑞汽車和豐田是該地區的一些主要汽車製造商。所有這些公司現在都專注於生產電動車。亞太地區的汽車創新正在迅速發展,預計到 2022 年,僅中國就將佔全球電動車銷量的約 65%。由於 LED 效率高,預計在電動車中的使用將會增加。例如,在電動車上添加 LED 可透過減少電池電流消耗將單次充電的行駛里程延長多達六英里。

- 電動車(EV)是一種使用馬達代替內燃機的汽車,並且相容於 LED 車燈。環境效益、較低的運行成本和技術進步意味著電動車在該地區正在蓬勃發展。 LED車燈使用壽命長達10,000小時,減少對環境的影響。由於LED燈在汽車行業的眾多優勢,LED的需求和成長在預期期內可能會增加。

電池更換站、電池回收服務店和電動車補貼的快速成長將推動 LED 市場

- 中國是亞太地區最大的汽車市場,也是高性能電動車最大的區域市場,其次是日本。亞太地區針對混合動力汽車和電動車的排放法規和補貼幫助這些國家佔據了整個電動和混合動力汽車市場的很大佔有率。截至年終,中國將擁有約160萬座電動車充電站和521萬個充電樁(其中2022年已建成超過259萬個)。十多年來,中國一直致力於推動電動車產業的發展,為消費者提供豐厚的獎勵,並為汽車製造商提供補貼。例如,電動車購買者曾享受約 6 萬元人民幣的折扣,但這項折扣在 2022 年結束了。

- 截至2022年,日本共有28,546個充電站。 2022會計年度日本進口電動車銷量創下1,6464輛的新高,與前一年同期比較成長65%。 2022 會計年度,日本銷售的 361 萬輛新乘用車中約有 77,000 輛是電動車。到 2023 年 3 月,印度將投入運作6,586 個公共充電站 (PCS)。此外,政府也透過提供資本補貼(如FAME-II、PLI SCHEME、電池更換政策和電動車稅收優惠)來鼓勵安裝電動車充電站。 2019 年 4 月,FAME II 計畫啟動,預算為 1,000 億印度盧比(12 億美元),用於支援 50 萬輛電動三輪車、7,000 輛電動公車、55,000 輛電動乘用車和 100 萬輛電動兩輛電動公車、55,000 輛二輪車。其目的是促進電動車在印度的普及。該計劃原定於2022年完成。因此,上述案例將由於開發中國家對電動車的需求不斷成長而導致新發電廠的開發和生產,從而推動對汽車LED的需求。

亞太地區汽車 LED 照明產業概況

亞太汽車LED照明市場呈現適度整合,前五大廠商佔56.82%。該市場的主要企業是:KOITO MANUFACTURING、Marelli Holdings、OSRAM GmbH.、Stanley Electric 和 Valeo(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 汽車持有量

- LED進口總量

- 家庭數量

- 道路網路

- 滲透率

- 法律規範

- 中國

- 印度

- 日本

- 韓國

- 價值鏈與通路分析

第5章 市場區隔

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

- 國家名稱

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- Hyundai Mobis

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- Nichia Corporation

- OSRAM GmbH.

- Stanley Electric Co., Ltd.

- Uno Minda Limited

- Valeo

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Asia Pacific Automotive LED Lighting Market size is estimated at 4.32 billion USD in 2025, and is expected to reach 7.51 billion USD by 2030, growing at a CAGR of 11.68% during the forecast period (2025-2030).

Increasing innovations in LED lighting in automobiles to reduce accidents in Asia-Pacific drive the market demand

- In terms of value share, in 2022, headlights accounted for the majority of the market, followed by others and directional signal lights. The market share is expected to remain almost the same for directional signal lights and stop lights during the forecast period, with a small variation in headlights. China is the major country in terms of manufacturing automotive components, and it is expected to maintain its dominance over the forecasted period.

- In terms of volume share, in 2022, directional signal lights accounted for the majority, followed by headlights and others. The market share is expected to remain the same with less fluctuation for these lights. Tata, Hyundai, SAIC, and Geely are among the few major companies incorporating LED projector lights in their upcoming vehicles. As the accident rate rises, LED fog lamps are expected to become more popular. Countries such as China, India, and Japan have reduced accident rates by using LED lamps in their vehicles. For example, there were a total of 4,64,910 traffic accidents in 2017, but it dropped to 4,12,432 in 2021. Thus, using LED lamps in vehicles is expected to reduce the number of casualties in traffic accidents in countries.

- In addition, LEDs contribute to developing innovative lighting concepts that enhance the appearance of vehicles. Companies work together to develop technical LED products for the automotive industry. For example, in September 2022, ams OSRAM and TactoTek announced their collaboration on the development of a demonstrator featuring the avant-garde OSIRE E5515 side-view RGB LED. It can be easily integrated into the car interior, resulting in a more compact design. Such innovations and future investments in automotive LED lighting are expected to drive the market during the forecast period.

The growth of EVs in South Korea, China, India, and other major countries in Asia-Pacific would boost the sales of LED lights

- In terms of value share, China accounted for the majority of the share of the Asia-Pacific automotive LED lighting market in 2022, followed by Japan and India. The market share is expected to increase for China in 2030 owing to the growth in the manufacturing sector and increasing innovation in automotive industries across the country. The market share of India is also expected to increase as the majority of automotive companies in the country are investing in EVs, and government initiatives to support the growth of EVs are also rising.

- In terms of volume share, China accounted for the majority of the market share in 2022, followed by India, Japan, and the Rest of Asia-Pacific. South Korea has the least volume share, and it is expected to remain in the minority throughout the forecast period. China is the export and import hub for the rest of the world, and major semiconductor manufacturing industries are located in the country. In 2019, China produced more than 26 million vehicles, and the majority of the vehicles were exported to various countries.

- In South Korea, sales were down in 2022 compared to 2021. This was due to weaker sales in China and Russia due to geopolitical issues. However, with rising government subsidiaries to promote EVs in the country, the EV automotive industry is expected to grow in the coming years.

- The increase in electric vehicle sales in 2021 was primarily driven by China, which accounted for half of the growth. Thus, overall EV growth, with rising LED innovation and a growing logistical sector, is expected to increase overall LED growth globally in the automotive industry.

Asia Pacific Automotive LED Lighting Market Trends

Increasing EV incentives to sell more electric vehicles to drive the growth of the LED market

- The total automobile vehicle production in Asia-Pacific was 104.29 million units in 2022, and it was expected to reach 109.65 million units in 2023. The COVID-19 pandemic had a significant effect on the Asia-Pacific automotive market. For instance, compared to March 2019, automotive and commercial vehicle sales in New Zealand were down by 37%. On March 23, 2020, automakers like Honda and Indus Motor stopped producing in Pakistan. The remainder of the Asia-Pacific nations experienced a similar situation. As a result, during the COVID-19 pandemic, the overall demand for LEDs in the automobile industry decreased.

- TATA Motors, Mahindra & Mahindra, SAIC Motor, Geely, Great Wall Motor, Chery, Toyota, and others are major automotive manufacturers in the region. All these companies are increasing their focus on the production of EVs. In Asia-Pacific, automotive innovations are growing rapidly, with China alone expected to account for around 65% of global EV sales in 2022. Due to their efficiency, LEDs are projected to be used more in EVs. For example, when LEDs are fitted on an EV, the decrease in battery current consumption can enhance range by as much as six miles on a single charge.

- Electric vehicles (EVs), automobiles with electric motors instead of internal combustion engines, are compatible with LED car lighting. Due to advantages for the environment, lower running costs, and technological advancements, EVs are growing in the region. Since LED car lights can last up to 10,000 hours, they can reduce environmental impact. The demand for and growth of LEDs will increase in the anticipated term due to the numerous advantages of LED lights in the automobile industry.

Rapid growth of battery swapping station, battery recycling service outlets, and EV subsidies are driving the LED market

- China, the region's largest automobile market, is also the region's largest market for high-performance EVs, followed by Japan. The Asia-Pacific region's emission regulations and subsidies for hybrid and electric vehicles aided it in capturing a sizable share of the overall electric and hybrid vehicle market. China had around 1.6 million EV charging stations and 5.21 million charging points at the end of 2022, including over 2.59 million that were built in 2022. China has been promoting its EV industry for more than a decade with generous incentives to consumers and subsidies to automakers. For instance, buyers received discounts of around CNY 60,000 at one point for purchasing EVs, but those ended in 2022.

- As of 2022, there were 28,546 charging stations in Japan. The number of imported electric vehicles sold in Japan during FY 2022 rose 65% from a year earlier to a record 16,464 units. There were 3.61 million passenger cars newly sold in Japan, and about 77,000 were EVs during FY 2022. By March 2023, there were 6586 public charging stations (PCS) operational in India. Furthermore, the government is promoting the installation of EV charging stations by providing capital subsidies, including FAME-II, PLI SCHEME, Battery Switching Policy, and Tax Reduction on EVs. In April 2019, the FAME II plan was introduced with an INR 10,000 crore (USD 1.2 billion) budget to support 500,000 e-three-wheelers, 7,000 e-buses, 55,000 e-passenger vehicles, and a million e-two-wheelers. The purpose was to encourage electric vehicle adoption in India. The plan was supposed to end in 2022. Thus, the above instances lead to the development and production of new power stations due to the growing demand for EVs across developing nations, which boosts the demand for automotive LEDs.

Asia Pacific Automotive LED Lighting Industry Overview

The Asia Pacific Automotive LED Lighting Market is moderately consolidated, with the top five companies occupying 56.82%. The major players in this market are KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd., OSRAM GmbH., Stanley Electric Co., Ltd. and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 China

- 4.11.2 India

- 4.11.3 Japan

- 4.11.4 South Korea

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

- 5.3 Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 Hyundai Mobis

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Nichia Corporation

- 6.4.7 OSRAM GmbH.

- 6.4.8 Stanley Electric Co., Ltd.

- 6.4.9 Uno Minda Limited

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms