|

市場調查報告書

商品編碼

1683933

中國汽車 LED 照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

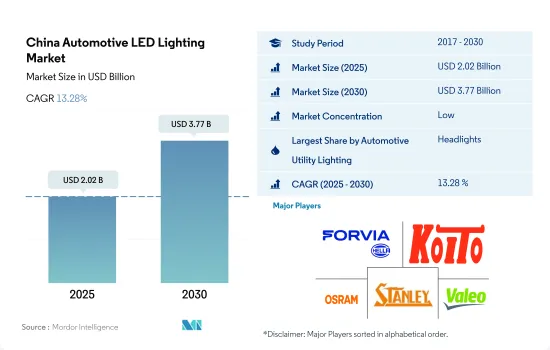

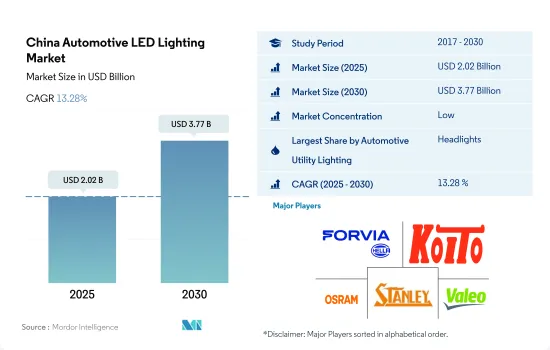

預計2025年中國汽車LED照明市場規模為20.2億美元,到2030年將達到37.7億美元,預測期間(2025-2030年)的複合年成長率為13.28%。

汽車採用 LED 燈可減少事故發生

- 2023年,頭燈將佔據中國汽車照明市場大部分金額佔有率,其次是其他燈和方向燈。轉向訊號燈和煞車燈的市場佔有率預計將保持不變,而前照燈的市場佔有率預計在預測期內將略有下降。市場上的一個新趨勢是將DRL(日間行車燈)與投影燈相結合的頭燈,上汽汽車、吉利汽車等知名廠商即將推出的車型將配備這種頭燈。此外,由於事故發生率呈上升趨勢, LED燈的採用率也預計將增加。 2019年,全國道路交通事故受傷人數為25,6101人,死亡人數為6,2,763人,較2016年有較大成長。

- 從出貨量佔有率來看,2022年方向燈將佔多數,其次是頭燈和其他。預計這些燈的市場佔有率將保持相對穩定,波動不大。在所有類型的車輛中,方向燈都是一個主要部件,在輕微至重大事故中很可能會受到影響並需要更換。

- 中國汽車市場競爭激烈,比亞迪、上汽、吉利、寶馬、賓士等老牌汽車製造商以及蔚來、小鵬、理想汽車等中國新能源汽車新興企業都在爭奪市場佔有率。對電動車的追求也吸引了小米和百度等科技巨頭的注意。因此,新能源汽車的成長可能會增加 LED 的市場滲透率。

中國汽車LED照明市場趨勢

亞太地區汽車 LED 照明技術創新不斷提升,將推動整體 LED 市場發展

- 預計2022年中國汽車總產量將達4,668萬輛,2023年將達4,949萬輛。中國汽車供應業受到新冠肺炎疫情的嚴重影響。海上運輸受到不利影響,由於工廠和組裝關閉導致需求大幅下降,關鍵的汽車零件不再透過大型貨櫃運往歐洲。結果,該航線的貨櫃船和生產商船隊數量減少了30%。汽車零件的中斷對汽車使用的 LED 照明產生了負面影響。

- 上汽汽車、吉利汽車、長城汽車、奇瑞汽車、一汽集團是中國頂級汽車製造商。上汽集團是一家知名公司,正在大力投資人工智慧(AI)技術、智慧燃料電池和汽車智慧互聯。由於這些發展,LED 作為汽車連網技術的使用預計會增加。

- LED 照明現在被視為汽車應用的明顯選擇,因為它環保且本質上節能。 LED 燈有助於創造創新的照明概念,從而增強汽車的外觀。主要企業正在合作開發用於汽車行業的技術 LED 產品。例如,2022年9月,ams Osram與TactoTek共同開發了一款搭載前衛RGB側視LED OSIRE E5515的示範器。它可以輕鬆整合到車輛中,實現更緊湊的設計。預計在預測期內,此類創新和即將到來的汽車 LED 照明投資將推動市場發展。

電動車需求成長將推動市場成長

- 儘管受到新冠疫情影響並導致供應鏈受限,中國的電動車 (EV) 市場仍呈現強勁成長。儘管近期電動車銷售遭遇挫折且原物料價格上漲導致生產成本上升,但電動車銷售仍持續快速成長。截至年終,中國將擁有約160萬座電動車充電站和521萬個充電樁(其中2022年已建成超過259萬個)。此外,至2022年,全國將建成換電站1973座,其中2022年建成換電站675座,動力電池回收服務店將超過1萬家。因此,充電設施的快速增加表明該國新能源汽車(NEV)產業的蓬勃發展。

- 在銷售成長放緩的情況下,中國計劃延長電動車稅收優惠政策。購買電動車和插電式混合動力汽車可減稅高達 30 萬元人民幣(42,062.76 美元)(最高減稅 195,000 元人民幣(27,340.03 美元))。在中國,高於這個標準的車都被廣泛歸類為豪華車,這使得人們更容易購買更實惠的清潔能源汽車。這些因素可能會推動中國電動車的普及,並幫助該國實現 2060 年實現淨零排放的目標。

- 2023年5月,羅傑斯宣布將在中國建造新基板,生產電源基板,以便更好地服務國內外客戶,滿足電動和混合動力汽車(EV/HEV)以及可再生能源應用領域對電源電路板日益成長的需求。擴建工程一期預計於2025年完工。為因應電動車日益成長的需求,汽車製造商競相開發生產新能源車,從而帶動了汽車LED的需求。 LED 汽車燈比鹵素燈泡消耗的能量更少,有助於節省能源並延長電動車的行駛里程。

中國汽車LED照明產業概況

中國汽車LED照明市場較為分散,前五大企業的市佔率達到35.95%。市場的主要企業是:HELLA GmbH & Co. KGaA (FORVIA)、KOITO MANUFACTURING、OSRAM GmbH.、Stanley Electric 和 Valeo(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 汽車持有量

- LED進口總量

- #家庭數量

- 道路網路

- 滲透率

- 法律規範

- 中國

- 價值鏈與通路分析

第5章 市場區隔

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Changzhou Xingyu Automotive Lighting System Co, Ltd.

- Hasco Vision Technology Co., Ltd.

- HELLA GmbH & Co. KGaA(FORVIA)

- HYUNDAI MOBIS

- KOITO MANUFACTURING CO., LTD.

- Nichia Corporation

- OSRAM GmbH.

- Stanley Electric Co., Ltd.

- Sunway Autoparts

- Valeo

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001631

The China Automotive LED Lighting Market size is estimated at 2.02 billion USD in 2025, and is expected to reach 3.77 billion USD by 2030, growing at a CAGR of 13.28% during the forecast period (2025-2030).

The use of LED lights in automobiles has resulted in a decrease in the number of accidents

- In 2023, headlights accounted for the majority of value share in the Chinese automobile lighting market, followed by others and directional signal lights. During the forecast period, the market share for directional signal lights and stoplights is expected to remain the same, with a slight decrease in headlights. An emerging trend in the market is the combination of DRLs (daytime running lamps) with projector lights in frontal illumination, which is being incorporated into forthcoming vehicles by notable manufacturers such as SAIC and Geely. The rising trend of accidents has also led to an anticipated increase in the penetration rate of fog LED lamps. In 2019, there were 256,101 injuries and 62,763 fatalities in traffic accidents in China, which has significantly increased since 2016.

- In terms of volume share, directional signal lights accounted for the majority in 2022, followed by headlights and others. The market share for these lights is expected to remain relatively stable with less fluctuation. In all types of vehicles, directional signal lights are the main component that has a high probability of getting affected in minor to major accidents and require replacement.

- The Chinese automobile market is highly competitive, with Chinese NEV (New Electric Vehicle) start-ups such as NIO, XPeng, and Li Auto vying for market share alongside established automakers such as BYD, SAIC Motors, Geely, BMW, and Mercedes-Benz. The quest for electric vehicles has also attracted tech giants such as Xiaomi and Baidu. Thus, the growth in NEV would increase the penetration of LED in the market.

China Automotive LED Lighting Market Trends

Growing innovation in automotive LED light in the Asia-Pacific region will boost the overall LED market

- The total automobile vehicle production in China was 46.68 million units in 2022, and it is expected to reach 49.49 million units in 2023. The automotive supply industry in China was severely affected by COVID-19. Maritime transportation was negatively impacted, and critical automotive parts were no longer sent in large quantities of containers to Europe, mainly because of a substantial decline in demand brought on by the closure of plants and assembly lines. Thus, the fleets of container carriers and producers on trade routes decreased by 30%. This disruption in automotive parts negatively impacted LED lights used in automobiles.

- SAIC Motor, Geely, Great Wall Motor, Chery, FAW Group, and other companies are among the nation's top automakers. One prominent business, SAIC Motor, is making significant investments in artificial intelligence (AI) technology, smart fuel cells, and intelligent interconnection for use in automobiles. The use of LEDs as a connected technology in vehicles is anticipated to increase due to this progress.

- Due to LED lights' environmental friendliness and innate energy efficiency, they are currently seen as a natural choice in automotive applications. They help create innovative lighting concepts that enhance a vehicle's looks. Companies are working together to develop technological LED products for the automobile industry. For instance, ams OSRAM and TactoTek collaborated to create a demonstrator in September 2022 that featured an avant-garde RGB side-looker LED OSIRE E5515. It can be easily incorporated into the interior of a car to create a more compact design. Such innovations and future investments in automotive LED lights will drive the market during the forecast period.

Growing demand for EVs drives the market growth

- Despite the COVID-19 pandemic and the ensuing supply chain constraints, the electric vehicle (EV) market has grown significantly in China. EV sales are continuing to increase rapidly despite recent obstacles and rising production costs due to rising raw material prices. China had around 1.6 million EV charging stations and 5.21 million charging points at the end of 2022, including over 2.59 million built in 2022. Furthermore, by 2022, the country had 1,973 battery swapping stations, including 675 built in 2022, adding that China has over 10,000 power battery recycling service outlets. Thus, the rapid growth in charging facilities indicates the booming new energy vehicle (NEV) sector in the country.

- China is set to extend EV tax incentives as sales growth slows. The purchase tax break for EVs and plug-in hybrids costs less than CNY 300,000 (USD 42062.76) (CNY 195,000 (USD 27340.03)). Vehicles over that amount are broadly classed as luxury vehicles in China, making it easier for people to buy more affordable, clean cars. These factors would boost the nation's EV adoption rate and further its goal of reaching net zero emissions by 2060.

- In May 2023, Rogers announced the construction of a new factory in China to produce its power substrates to serve both its local and international clients better and to meet the rising demand for power substrates used in electric and hybrid electric vehicles (EVs/HEVs) and renewable energy applications. The expansion's first phase is expected to be finished in 2025. Automobile manufacturers are racing to develop and produce new energy vehicles because of the growing demand for EVs, which boosts the demand for automotive LEDs. LED car lights can help EVs save energy and extend their driving range, as they consume less power than halogen bulbs.

China Automotive LED Lighting Industry Overview

The China Automotive LED Lighting Market is fragmented, with the top five companies occupying 35.95%. The major players in this market are HELLA GmbH & Co. KGaA (FORVIA), KOITO MANUFACTURING CO., LTD., OSRAM GmbH., Stanley Electric Co., Ltd. and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 China

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Changzhou Xingyu Automotive Lighting System Co, Ltd.

- 6.4.2 Hasco Vision Technology Co., Ltd.

- 6.4.3 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.4 HYUNDAI MOBIS

- 6.4.5 KOITO MANUFACTURING CO., LTD.

- 6.4.6 Nichia Corporation

- 6.4.7 OSRAM GmbH.

- 6.4.8 Stanley Electric Co., Ltd.

- 6.4.9 Sunway Autoparts

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219