|

市場調查報告書

商品編碼

1683950

印度汽車 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

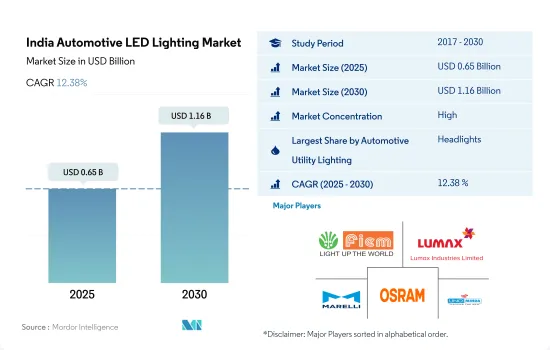

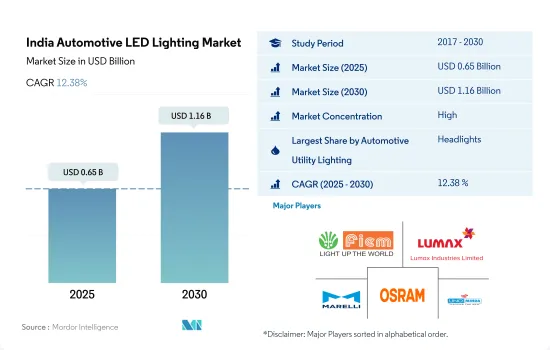

印度汽車 LED 照明市場規模預計在 2025 年為 6.5 億美元,預計到 2030 年將達到 11.6 億美元,預測期內(2025-2030 年)的複合年成長率為 12.38%。

就金額而言,頭燈預計將佔據最大的市場佔有率

- 從2017年的金額佔有率來看,頭燈佔了大部分,其次是方向燈和日間行車燈。預計頭燈和日間行車燈的市場佔有率將保持不變,而轉向訊號燈的市場佔有率預計在預測期內將略有下降。印度汽車照明市場的最大趨勢是在頭燈中增加帶有投影燈的DRL(日行燈)。塔塔、現代和馬恆達是幾個將在其即將推出的汽車中整合 LED 投影燈的知名例子。隨著事故趨勢的增加, LED燈的滲透率預計也會上升。 2021年,雨、霧、冰雹、雨夾雪等惡劣天氣條件下發生的事故佔所有交通事故的16.8%,與前一年同期比較增加了12.6%。

- 從出貨量佔有率來看,2017年方向燈佔最大佔有率,其次是頭燈和煞車燈。這些燈的市場佔有率保持穩定,預計未來不會發生變化。轉向訊號燈是任何車輛的主要部件,在發生輕微至重大事故時都可能受到影響並需要更換。 2017年總合發生道路交通事故464910起,到2021年下降到412432起,這也說明轉向訊號燈的數量在逐年減少。

- 在擴張和創新方面,2022年9月,馬瑞利將在印度南部班加羅爾開設一個新的技術研發中心,以增強公司在電子機械設計模擬和汽車照明產品方面的創新能力。

印度汽車 LED 照明市場趨勢

自主品牌大力推廣經濟型乘用車和商用車

- 印度汽車產量預計2022年將達2,747萬輛,2023年將達2,906萬輛。新冠肺炎疫情影響了整個汽車產業的運作。 2020年4月,汽車產業全面停滯,沒有銷售紀錄。銷售於 2020 年 5 月開始,但仍遠低於 2019 年的水準。印度汽車工業協會 (SIAM) 計算出,暫停營運的決定導致每天的生產損失為 2,300 億印度盧比(2.7707 億美元)。然而,預計市場將在 2021 年復甦,並在整個預測期內實現正成長。

- TATA Motors、Mahindra &Mahindra、Ashok Leyland Ltd、Maruti Suzuki、Bajaj Auto Ltd 等是印度頂級汽車製造商。印度汽車工業正在擴張,並非常重視替代燃料以及利用環保燃料來提高汽車經濟性。例如,塔塔汽車推出了Starbus電動巴士,這是一款以替代燃料為動力的乘用車,以滿足智慧城市當前和未來的客運需求。 LED 照明的節能性能和高流明輸出使得其在車輛中廣泛應用。

- 汽車照明仍然是關鍵因素。照明不僅可以增強車輛內部和外部的美觀度,還可以提高車輛的安全。例如,2021年9月,印度有50多家公司提交了與LED和其他產品生產掛鉤的獎勵申請,提案投資6,000億印度盧比(7.22億美元)。企業和政府的此類投資預計將推動印度全面採用 LED 照明。

政府政策協助擴大充電站網路

- 目前,印度正處於發展階段。到2023年3月,全國將有6,586個公共充電站(PCS)投入運作。印度政府一直致力於透過推出電動車舉措,將印度打造為電動車產業的主要參與者之一。

- 隨著印度的發展,電動車產業蓬勃發展,允許 100% 直接投資、建立新製造工廠並推動充電基礎設施建設。政府透過提供資本補貼(如 FAME-II、PLI SCHEME、電池更換政策、電動車區域和電動車稅收減免)來鼓勵安裝電動車充電站。 2019 年 4 月,FAME II 計畫啟動,預算為 12.0465 億美元,用於支援 50 萬輛電動三輪車、7,000 輛電動公車、5.5 萬輛電動二輪車。其目的是促進電動車在印度的普及。該計劃原定於 2022 年完成。 2021 年 9 月,內閣批准了針對汽車產業的生產連結獎勵計畫計畫 (PLI 計畫),以增加電動車和氫燃料電池汽車的產量。

- 此外,作為 PLI 計劃的增值部分,預計對 LED 照明市場的投資將達到 40% 至 75% 左右。這也將見證原本不在印度生產的零件和子組件的製造。預計此類政府投資將推動印度整體 LED 照明市場的發展,包括汽車 LED。此外,印度對電動車的需求進一步擴大,預計將推動對電動車充電基礎設施的需求,從而在預測期內產生對汽車 LED 的需求。

印度汽車LED照明產業概況

印度汽車LED照明市場相當集中,前五大廠商佔80.99%的市佔率。市場的主要企業有:汽車LED照明Fiem Industries Ltd.、Lumax Industries、Marelli Holdings、OSRAM GmbH。以及 Uno Minda Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 汽車持有量

- LED進口總量

- 家庭數量

- 道路網路

- 滲透率

- 法律規範

- 印度

- 價值鏈與通路分析

第5章 市場區隔

- 汽車實用照明

- 日間行車燈 (DRL)

- 轉向指示燈

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Fiem Industries Ltd.

- HELLA GmbH & Co. KGaA

- HYUNDAI MOBIS

- Lumax Industries

- Marelli Holdings Co., Ltd.

- Neolite ZKW Lightings Pvt. Ltd

- OSRAM GmbH.

- Uno Minda Limited

- Valeo

- Varroc Group

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001648

The India Automotive LED Lighting Market size is estimated at 0.65 billion USD in 2025, and is expected to reach 1.16 billion USD by 2030, growing at a CAGR of 12.38% during the forecast period (2025-2030).

Headlights are expected to hold the highest share by market value

- In terms of value share, in 2017, headlights accounted for the majority, followed by directional signal lights and DRL. The market share is expected to remain the same for headlights and DRL during the forecast period, with a small reduction in directional signal lights. The biggest trend in India's automotive lighting market is the addition of DRLs (daytime running lamps) with projector lights in frontal lighting. Tata, Hyundai, and Mahindra are among the few popular examples of integrating LED projector lights in upcoming vehicles. The fog LED lamp penetration rate is expected to increase with increasing accident trends. Accidents under adverse weather conditions such as rainy, foggy, and hail/sleet accounted for 16.8% of total road accidents in 2021, an increase of 12.6% from the prior year.

- In terms of volume share, in 2017, directional signal lights accounted for the majority, followed by headlights and stoplights. The market share is expected to remain the same with less fluctuation for these lights. Directional signal lights are the prime part with a high probability of getting affected in minor to major accidents in all types of vehicles and require replacement. In 2017, a total of 4,64,910 road accidents occurred, while in 2021, it decreased to 4,12,432. This also indicated the decrease in the volume of directional signal light every year.

- In terms of expansion and innovations, in September 2022, Marelli inaugurated its new Technical R&D Center in Bangalore, South India, boosting the company's innovation capability in Mechanical Design Simulations for Electronics and moving forward for automotive lighting products.

India Automotive LED Lighting Market Trends

Homegrown automotive brands are promoting economical passenger and commercial vehicles

- The total automobile vehicle production in India stood at 27.47 million units in 2022, and it was expected to reach 29.06 million units in 2023. The COVID-19 outbreak impacted the auto industry's entire operations. In April 2020, the auto industry was completely shut down, and no sales were recorded. Sales started in May 2020, but even then, they were far lower than they had been at the same point in 2019. According to a calculation by the Society of Indian Automobile Manufacturers (SIAM), the shutdown decision caused a daily output loss of INR 2,300 crore (USD 277.07 million). However, the market rebounded in 2021, and it is projected to witness positive growth throughout the forecast period.

- TATA Motors, Mahindra & Mahindra, Ashok Leyland Ltd, Maruti Suzuki, and Bajaj Auto Ltd, among others, are the country's top automakers. India's automotive industry is expanding, with businesses emphasizing alternative fuels and improving the vehicle economy with eco-friendly fuels. For instance, Tata Motors introduced the Starbus Electric Bus, a passenger vehicle driven by alternative fuels, to satisfy the present and future passenger transportation needs in smart cities. Due to the energy-saving capabilities and high-lumen output of LED lights, they are being increasingly adopted in vehicles.

- Vehicle lighting is still a crucial component. Lighting enhances the aesthetic appeal of a vehicle's interior and exterior while contributing to vehicle safety. For instance, in September 2021, more than 50 companies in India submitted applications for production-linked incentives for LEDs and other products, with a proposed investment of INR 6,000 crores (USD 722 million). Such investments by companies and the government are expected to drive the overall adoption of LED lighting in India.

Government policies are helping extend the network of charging stations

- Currently, India is in its developing phase. By March 2023, there were 6,586 public charging stations (PCS) operational in the country. The Government of India consistently demonstrates its commitment to establishing India as one of the significant players in the EV industry by introducing initiatives for electric vehicles.

- As India is developing, the electric vehicle industry is also picking pace, with the possibility of 100% FDI, new manufacturing plants, and an increased push to improve charging infrastructure. The government is promoting the installation of EV charging stations by providing capital subsidies, including FAME-II, PLI SCHEME, Battery Switching Policy, Special Electric Mobility Zone, and tax reduction on EVs. In April 2019, the FAME II plan was introduced with an USD 1204.65 million budget to support 500,000 e-three-wheelers, 7,000 e-buses, 55,000 e-passenger vehicles, and a million e-two-wheelers. The purpose was to encourage electric vehicle adoption in India. The plan was supposed to end in 2022. In September 2021, a PLI Scheme, or Production-Linked Incentive Scheme, for the automotive sector was approved by the Cabinet to increase the manufacturing of electric and hydrogen fuel cell vehicles.

- Additionally, as a value addition under the PLI scheme, investments in the LED lighting market are expected to be around 40% to 75%. This would also result in the manufacturing of components or sub-assemblies that were originally not manufactured in India. Such investments by the government are expected to drive the overall LED lighting market in India, including automotive LEDs. Further growing demand for EVs in India is expected to boost the demand for EV charging infrastructure, which would also create the need for automotive LEDs during the forecast period.

India Automotive LED Lighting Industry Overview

The India Automotive LED Lighting Market is fairly consolidated, with the top five companies occupying 80.99%. The major players in this market are Fiem Industries Ltd., Lumax Industries, Marelli Holdings Co., Ltd., OSRAM GmbH. and Uno Minda Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 India

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Fiem Industries Ltd.

- 6.4.2 HELLA GmbH & Co. KGaA

- 6.4.3 HYUNDAI MOBIS

- 6.4.4 Lumax Industries

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Neolite ZKW Lightings Pvt. Ltd

- 6.4.7 OSRAM GmbH.

- 6.4.8 Uno Minda Limited

- 6.4.9 Valeo

- 6.4.10 Varroc Group

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219