|

市場調查報告書

商品編碼

1683937

歐洲室內 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

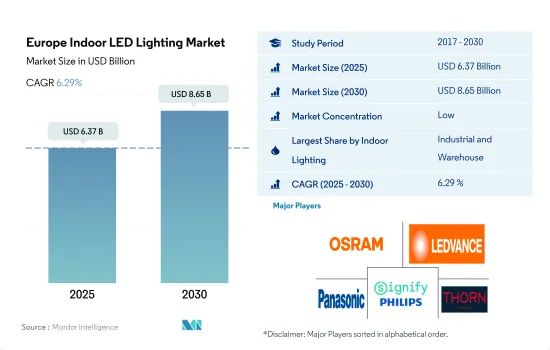

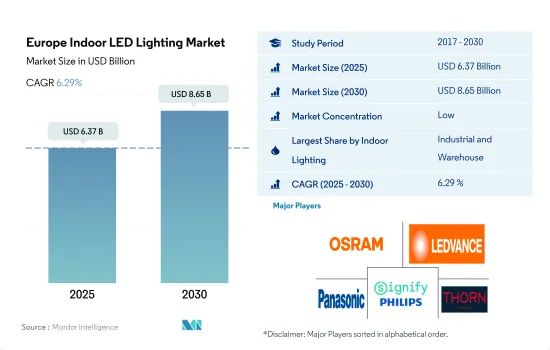

預計 2025 年歐洲室內 LED 照明市場規模為 63.7 億美元,到 2030 年將達到 86.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.29%。

工業和住宅領域的發展不斷加快,推動市場成長

- 就以金額為準,到 2023 年,工業和倉庫照明將佔據最大佔有率,其次是商業、住宅和農業照明。法國、俄羅斯和波蘭佔倉庫建設的大部分。新冠肺炎疫情危機加速了法國恢復工業能至疫情前水準的努力。 2022年12月,法國工業生產成長1.1%,11月則成長了2%。波蘭擁有近440萬平方公尺的土地。到 2022 年中期,波蘭將建造近 450 萬平方公尺的倉庫和工業空間。

- 在商業設施中,醫院、學校和機場佔據了大部分市場。在受訪的42個國家中,可支配所得差異很大。列支敦士登、瑞士和盧森堡的可支配收入最高,因此人們更容易負擔學校或大學的學費。

- 截至 2023 年,住宅領域將佔最大佔有率。在強勁需求的支撐下,義大利住宅市場保持穩定。 2021年第四季住宅房地產交易量年增14.1%至263,795套。所有地區的銷售額均強勁成長。自 2022 年 1 月上一次封鎖結束以來,儘管許多企業正處於轉型期,但辦公室入住率仍持續呈上升趨勢。截至 2022 年第三季度,辦公大樓領域的平均折扣為 26%,低於 31% 的整體平均值。 年終整體空置率為7.2%,與年終相比大致穩定(+10bp)。整體而言,辦公室及住宅的吸收率呈上升趨勢,帶動LED需求大幅增加。

工業生產成長與住宅需求旺盛推動市場需求

- 截至 2023 年,就金額和數量而言,其他歐洲國家佔最大佔有率,其次是法國、德國和英國。其他歐洲國家包括瑞典、義大利、西班牙、俄羅斯、波蘭和荷蘭。來自美國和斯堪的納維亞半島的外國買家正在西班牙南海岸購買住宅。儘管房屋抵押貸款利率大幅上升,但 2022 年房地產需求依然強勁,交易數量較 2021 年激增 16%,房屋抵押貸款發放數量增加 11%。在歐洲,波蘭以約 440 萬平方公尺的土地面積處於領先地位。到 2022 年中期,波蘭將建造近 450 萬平方公尺的倉庫和工業空間。總體而言,由於該地區倉庫建設的增加和住宅的蓬勃發展,預計 LED 的需求將會增加。

- 在法國(馬約特島除外),2022 年前 11 個月的新建築許可證年增 5.6%,至 448,416 套,而 2021 年全年則成長了 18.5%。自從新冠疫情封鎖以來,法國許多人從大城市搬到了鄉村。總體而言,預計未來幾年住宅市場將更加穩定。

- 德國工業企業佔德國全國研發支出總額的60%左右,為德國的繁榮做出了重大貢獻。企業也正在進行策略發展。例如,2023 年,Osvetlenyi Cernoch SRO 建造了一個新的生產和倉儲大廳,以提高其工業生產能力。這種擴張意味著工業和倉儲空間的增加以及 LED 照明的使用。

歐洲室內 LED 照明市場趨勢

可支配收入的增加和政府獎勵可能會增加 LED 的採用

- 2022年,歐盟共有1.98億個居住,平均每個居住有2.2人。該地區人口在2020年為7.462億,但預計到2023年將減少至7.422億。歐盟住房自有率從2021年的69.90%下降到2022年的69.10%。這些案例表明,儘管家庭數量略有下降,但住宅開發計劃比平時少。因此,預計 LED 滲透率將呈正成長,但與先前相比,其在住宅領域的成長速度較低。

- 在歐洲,大多數國家的可支配收入都很高,這反過來又增加了個人消費能力,尤其是在新住宅空間方面的消費能力。 2022年英國的人均所得達到3,3,138美元,法國達到2,5,337.7美元。

- 在歐洲,各國政府正在提供獎勵計劃來促進 LED 的普及。英國政府公佈了節能照明的新提案。根據該提案,耗能較低的照明設備(如 LED)將取代舊款鹵素燈泡。此類措施可以在燈泡的使用壽命內為家庭節省 2,000 至 3,000 英鎊。 2021年1月,德國啟動「聯邦資助高效建築」計畫。任何在德國擁有或考慮購買房產的人都可以申請這筆資金。該能源效率計劃還包括照明節能建築。 2017年6月,法國政府宣布了一項能源效率證書計劃,允許家庭根據其收入獲得最高LED燈泡價格100%的補貼。預計此類案例將在預測期內推動該地區對 LED 照明的需求。

政府專案和鹵素燈銷售禁令或將刺激 LED 照明成長

- 工業部門是歐盟主要的能源消耗部門之一,2021年佔總能源消費量的25.6%,其次是住宅和商業部門,是最大的能源用戶。隨著大量家庭轉向智慧家庭技術,住宅等室內空間照明控制的需求正在以意想不到的速度成長。 2020 年 9 月宣布的《歐洲綠色交易》的核心內容是歐盟政府實施的住宅改造計畫。這些項目正在幫助該地區擴大 LED 照明。

- 商業用電需求往往在8-10小時左右,而工業用電全天和全年保持一致。住宅用電需求在7-9小時左右波動。市長會議示範產業計畫維修了坎泰米爾市的 27 條道路,並安裝了 419 盞智慧 LED 燈。在奧國田,約有 386 個低效率燈泡已被更換,以減少排放到大氣中的二氧化碳量,導致該地區 LED 的使用量增加。

- 2018年9月,該地區也禁止銷售非定向鹵素燈泡。這些法律的變化使消費者更容易逐步從傳統照明轉向 LED 技術。該地區的各國政府也正在逐步淘汰老舊、效率較低的技術,以提高消費者對 LED 產品的接受度,並提供補貼和獎勵,以提高該地區 LED 的整體效率。

歐洲室內LED照明產業概況

歐洲室內LED照明市場較為分散,前五大企業佔比為37.37%。該市場的主要企業是:ams-OSRAM AG、LEDVANCE GmbH(MLS)、松下控股公司、Signify(飛利浦)和Thorn Lighting Ltd.(Zumtobel Group)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明電力消耗量

- 家庭數量

- LED滲透率

- 園藝區

- 法律規範

- 法國

- 德國

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅

- 國家名稱

- 法國

- 德國

- 英國

- 其他歐洲國家

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ams-OSRAM AG

- Dialight

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- Panasonic Holdings Corporation

- Signify(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Europe Indoor LED Lighting Market size is estimated at 6.37 billion USD in 2025, and is expected to reach 8.65 billion USD by 2030, growing at a CAGR of 6.29% during the forecast period (2025-2030).

Increasing development in the industrial and residential sectors drives market growth

- In terms of value, as of 2023, industrial and warehouse had a major share, followed by commercial, residential, and agricultural lighting. France, Russia, and Poland had the majority of warehouse constructions. The COVID-19 crisis accelerated France's efforts to return industrial production capacities to the pre-pandemic levels. French industrial production increased by 1.1% over one month in December 2022, after +2% in November 2022. Poland has close to 4.4 million sq. m of space. By the middle of 2022, almost 4.5 million sq. m of warehouse and industrial space was under construction in Poland.

- In commercial, hospitals, schools, and airports comprise the majority of the share. The disposable net income among the 42 countries surveyed varies significantly. Liechtenstein, Switzerland, and Luxembourg have the highest disposable net income by a wide margin, which means more affordability for schools and college studies.

- In terms of volume, as of 2023, the residential sector had a major share. Italy's housing market remains stable, supported by strong demand. In Q4 2021, residential property transactions increased by 14.1% to 263,795 units compared to a year earlier. All regions saw a strong sales increase during the period. Despite many businesses remaining in transition, office usage rates continued on an upward trend from the end of the last lockdown in January 2022. As of Q3 2022, the office sector traded at an average discount of 26%, which was below the 31% overall average. The overall vacancy rate stood at 7.2% at the end of 2022, almost stable compared to the end of 2021 (+10bp). Overall, there is a positive trend toward a higher office and residential absorption rate, leading to a major increase in the demand for LEDs.

Growing number of industrial production and surge in residential property drive the demand for market

- In terms of value and volume, as of 2023, the Rest of Europe held the major share, followed by France, Germany, and the United Kingdom. The Rest of Europe comprises Sweden, Italy, Spain, Russia, Poland, Netherlands, and others. Foreign buyers from the United States and northern Europe have been buying homes on Spain's southern coast. Despite a significant rise in mortgage rates, demand for real estate remained strong in 2022, with a 16% surge in transactions and an 11% uptick in mortgage production compared to 2021. In Europe, Poland was at the top with nearly 4.4 million sq. m of space. By the middle of 2022, almost 4.5 million sq. m of warehouse and industrial space was under construction in Poland. Overall, the demand for LEDs is expected to increase with increasing warehouse construction and a surge in residential property in the region.

- In the first eleven months of 2022, new dwellings authorized in France, excluding Mayotte, rose by 5.6% to 448,416 units compared to the same period the previous year, following an 18.5% increase during 2021. Since COVID-19 confinements, many people have moved from the major cities to the provinces in France. Overall, the residential market is expected to be more stable in the coming years.

- In Germany, with around 60% of total R&D expenditure, German industrial companies significantly contribute to the country's prosperity. Companies also engage in strategic development. For instance, in 2023, Osvetleni Cernoch SRO built a new production and storage hall to increase its industrial production capacity. Such expansions indicate an increase in the number of industries and storage areas and the use of LED lighting.

Europe Indoor LED Lighting Market Trends

Increasing disposable income and government incentives may lead to more LED penetration

- In 2022, 198 million households resided in the EU, with 2.2 members per household on average. The region's population was 746.2 million in 2020, which reduced to 742.2 million by 2023. Homeownership rates in the EU declined by 69.10% in 2022 from 69.90% in 2021. Such instances suggest that housing development projects are less than in previous years despite a slight decline in the number of households. Thus, LED penetration is expected to grow positively but less in the residential segment compared to previous years.

- In Europe, disposable income is high for most countries, resulting in rising spending power of individuals, especially on new residential spaces. The United Kingdom's per capita income reached USD 33,138 in 2022, while that of France reached USD 25,337.7.

- In Europe, the governments provide incentive programs to create more LED penetration. The UK government announced the launch of a new energy-efficient lighting proposal. Under this, lighting, such as low energy-use LEDs, would replace old halogen bulbs. Such initiatives could save households between GBP 2,000 and GBP 3,000 over the lifetime of these bulbs. The "Federal Funding for Efficient Buildings" program was launched in January 2021 in Germany. Anyone who owns a property in Germany or who is looking to buy property in the country can apply for the funding. The energy efficiency program also includes lighting energy efficiency buildings. In June 2017, the French government announced the Energy Savings Certificate scheme, which allows people to get subsidies that can cover up to 100% of the price of LED bulbs based on the householder's income. Such instances are expected to boost the demand for LED lighting in the region during the forecast period.

Government programs and the prohibition of the sale of halogen bulbs may drive the growth of LED lighting

- One of the main energy consumers in the EU, the industry sector accounted for 25.6% of total energy consumption in 2021, followed by the household and commercial sectors, which used the most energy. A significant number of households are converting to smart home technologies, which has increased the demand for lighting control in indoor spaces, such as residential buildings, at unexpected rates. The central feature of the European Green Deal, which was unveiled in September 2020, is the Housing Renovation Program, which was implemented by the EU administration. Such programs are assisting the expansion of LED lighting in the region.

- The demand for electricity in the commercial sector tends to be around 8-10 hours, while electricity use in the industrial sector does not fluctuate throughout the day or year. Electricity demand in the residential sector varies for about 7-9 hours. The Covenant of Mayors - Demonstration Projects scheme refurbished 27 roadways in Cantemir and installed 419 smart LED lighting. About 386 inefficient bulbs were replaced in Ocnita to lower the amount of CO2 released into the atmosphere, thus causing a rise in the use of LEDs in the region.

- In September 2018, the region also prohibited the sale of non-directional halogen bulbs. These legislative changes have made it easier for consumers to progressively switch from conventional lighting to LED technology. The governments in the region are also phasing out older, less efficient technologies to boost consumer acceptance of LED items, as well as giving subsidies and incentives to enhance the overall efficiency of LEDs in the region.

Europe Indoor LED Lighting Industry Overview

The Europe Indoor LED Lighting Market is fragmented, with the top five companies occupying 37.37%. The major players in this market are ams-OSRAM AG, LEDVANCE GmbH (MLS Co Ltd), Panasonic Holdings Corporation, Signify (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 France

- 4.8.2 Germany

- 4.8.3 United Kingdom

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 United Kingdom

- 5.2.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ams-OSRAM AG

- 6.4.2 Dialight

- 6.4.3 EGLO Leuchten GmbH

- 6.4.4 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.5 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.6 Panasonic Holdings Corporation

- 6.4.7 Signify (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms