|

市場調查報告書

商品編碼

1683941

法國室內 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)France Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

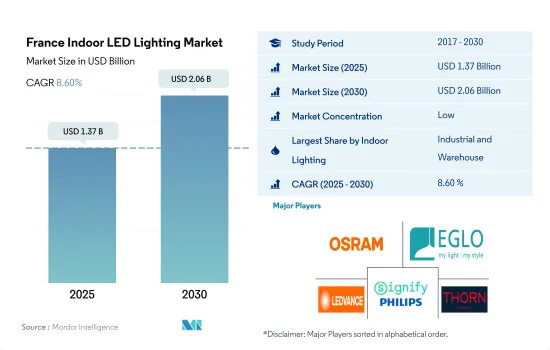

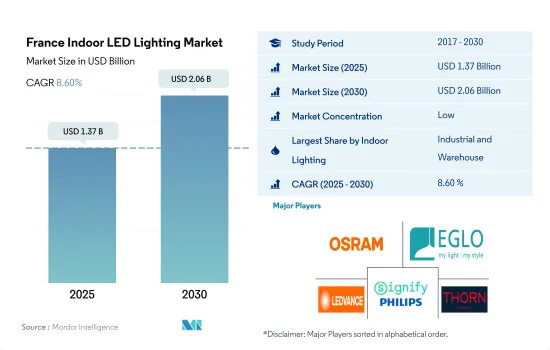

預計 2025 年法國室內 LED 照明市場規模為 13.7 億美元,到 2030 年將達到 20.6 億美元,預測期內(2025-2030 年)的複合年成長率為 8.60%。

工業和住宅領域的發展以及商業辦公領域的外國直接投資流入正在推動市場成長

- 從金額佔有率來看,工業和倉庫將在 2023 年佔據室內照明領域的大部分佔有率。新冠疫情似乎正在加速法國將工業能轉移回國內的努力。法國12月工業生產季增1.1%,11月成長2%。 2022 年 12 月製造業產量較上季成長 0.3%,而 2022 年 11 月則成長了 2.4%。儘管該領域的市場在 LED 需求方面已經飽和狀態,但由於倉庫數量的增加,該領域的成長預計將繼續推動需求。

- 從數量上看,2023 年住宅將佔最大佔有率。近年來,住宅建設活動表現好壞參半。 2022年1月至11月,法國(不包括馬約特島)新建築許可數量較去年同期增加5.6%至448,416份,而2021年則成長了18.5%。 2023年,法國住宅預計將保持相對穩定(成長率可能低於5%),每年的房產銷售數量預計將維持在100多萬套。自從新冠疫情導致居家隔離以來,法國許多人從大城市遷移到鄉村。預計未來幾年住宅室內照明市場將保持更加穩定。

- 由於居家辦公條件以及開發和銷售低迷,辦公大樓市場的佔有率在疫情期間有所下降,預計從 2023 年開始該佔有率將增加。受新冠疫情影響,法國的外國直接投資流入量有所下降,但在 2021 年有所恢復(成長 191.4%),但仍低於危機前的水準。 2022年,法國的FDI計劃成長了3%(1,259個計畫)。由於辦公領域銷售的復甦,預計 LED 的需求將會增加。

法國室內 LED 照明市場趨勢

高人均收入和節能政策推動LED照明的普及

- 2022 年法國平均家庭規模為 2.2 人。截至 2023 年 6 月,法國現有人口為 6,570 萬,每年以約 0.2% 的中等速度成長。 81.5% 的人口居住在城鎮(2020 年為 5,320 萬)。因此,預計人口的成長將導致 LED 的採用率提高,從而增加該國的照明需求。

- 2017年至2020年間,德國的住宅率略有下降。 2021年,約有64.7%的人口住在自己的家中,2022年這數字達到63.4%。這使得法國成為世界上房屋自有率最高的國家之一,但預計未來幾年這一數字將緩慢下降,並導致該國租賃房地產市場進一步成長,目前該國的租賃住宅市場已經處於最低水平。這些案例表明,LED 正變得越來越流行,但它們在住宅領域的應用並不像以前那麼先進。

- 法國的可支配所得較高,因此個人消費能力較強,可以把更多的錢投入新的住宅空間。 2022年12月,法國人均收入達25,337.71美元,而2021年12月為27,184.2美元。與一些已開發國家相比,法國的購買力較高。例如,截至 2021 年,巴西的匯率較低,為 7,732.4 美元,而截至 2017 年,義大利的匯率較低,為 15,321.9 美元。

- 2017年6月,法國政府宣布了一項能源效率證書計劃,允許家庭根據其收入獲得最高LED燈泡價格100%的補貼。隨著此類體系的建立,預計該國對LED照明的需求將進一步大幅增加。

能源維修和能源效率計劃推動 LED 市場成長

- 2019 年,最終用電量最高的領域是商業和專業(47%),其次是住宅(近 38%)和重工業(16%)。由於人們在家中度過更多時間(例如遠距和兼職工作),住宅領域的消費者支出在第一次封鎖期間增加了近 5%。此外,法國復甦計畫中新增的「Ma PrimeRenov」計畫所推動的能源維修計劃成為此活動的重要支持來源。因此,建築業的增加意味著建造更多的住宅和建築物,從而增加了對 LED 的需求。

- 商業部門的電力需求往往在工作時間最高,而在夜間和週末則會大幅下降。通常一天的工作時間是大約 8 到 10 個小時。工業部門的用電量在一天或一年內波動的幅度往往不如住宅和商業部門那麼大,尤其是每天 24 小時運作的製造工廠。住宅用電需求波動在7-9小時左右。此外,巴黎政府也積極將2,500多盞路燈更換為LED路燈,力爭在2017年實現綠色照明,這些努力正在推動國內LED照明市場的發展。

- 此外,Citeos(VINCI Energy)協助3,000多個城市提高能源效率。例如,巴黎郊外的塞爾吉蓬圖瓦茲市承諾在18年內透過維修80%的建築來減少47%的能源消耗。該計劃透過安裝額外的 7,000 盞節能 LED 燈來取代該國現有的照明基礎設施,從而刺激了 LED 照明產業的發展。

法國室內LED照明產業概況

法國室內LED照明市場較為分散,前五大企業佔比為23.66%。市場的主要企業是:ams-OSRAM AG、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、Signify(飛利浦)和Thorn Lighting Ltd.(Zumtobel Group)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明電力消耗量

- 家庭數量

- LED滲透率

- 園藝區

- 法律規範

- 法國

- 價值鏈與通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Airis LED

- ams-OSRAM AG

- BEGA Lighting

- CisLED

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Signify(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The France Indoor LED Lighting Market size is estimated at 1.37 billion USD in 2025, and is expected to reach 2.06 billion USD by 2030, growing at a CAGR of 8.60% during the forecast period (2025-2030).

Increasing developments in the industrial and residential segments, along with FDI flows in the commercial office segment, driving the market's growth

- In terms of value share, in 2023, industrial and warehouse accounted for the majority share among indoor lighting segments. The COVID-19 pandemic seems to have accelerated France's efforts to return industrial production capacities to the country. French industrial production increased by 1.1% over one month in December 2022, after +2% in November 2022. Manufacturing output rose by 0.3% M-o-M in December 2022, after +2.4% in November 2022. While the market in this segment is saturating in terms of LED demand, the growth in the segment with an increasing number of warehouses is expected to continue boosting the demand.

- In terms of volume, in 2023, residential accounted for the highest share. Residential construction activity has been showing mixed results in recent years. In the first 11 months of 2022, new dwellings authorized in France, excluding Mayotte, rose by 5.6% Y-o-Y to 448,416 units, following an 18.5% Y-o-Y increase in 2021. During 2023, house prices in France were expected to stabilize a bit (perhaps growth would drop below 5%), and the number of property sales would remain just above 1 million during the year. Since the COVID-19 pandemic-induced confinements, many people have moved from the major cities to the provinces in France. The market in the residential indoor lighting segment is expected to get more stable over the coming years.

- The office segment's share was expected to increase from 2023 after declining during the pandemic due to WFH conditions and low development and sales. After dropping due to the COVID-19 pandemic, FDI flows to France rebounded in 2021 (+191.4%) but remained below pre-crisis levels. In 2022, FDI projects increased by 3% (1,259 projects) in France. Rebound sales in the office segment are expected to increase demand for LEDs.

France Indoor LED Lighting Market Trends

High per capita income and energy saving scheme to promote use of LED lights

- The average household size is 2.2 people per household in France in 2022. The current population of France is 65.7 million as of June 2023, increasing at a slow pace of around 0.2% yearly. 81.5 % of the population is urban (53.2 million people in 2020). Thus, the increase in population is expected to create more LED penetration and increase the need for illumination in the country.

- Between 2017 and 2020, the homeownership rate in Germany decreased slightly. In 2021, about 64.7% of the population lived in an owner-occupied dwelling, and in 2022, it reached 63.4%. This makes France one of the countries with the highest homeownership rate, but in coming years, it is expected to decline slowly, and the lowest rental residential real estate market is expected to grow further in the country. These instances suggest that LED penetration is there, but the penetration is less compared to previous years in the residential segment.

- In France, disposable income is high, which results in the rising spending power of individuals and affording more money on new residential spaces. France's per Capita income reached USD 25,337.71 in December 2022, compared to USD 27,184.2 in December 2021. Compared to some developed nations, it has high purchasing power. For instance, Brazil had USD 7732.4 as of 2021, and Italy had USD 15,321.9 as of 2017, which is lower.

- In June 2017, the French government announced the Energy Savings Certificate scheme, which allows people to get subsidies that can cover up to 100% of the price of LED bulbs based on the householder's income. Such instances are further expected to surge the demand for LED lighting in the country.

Energy renovation and energy efficient projects to drive the growth of the LED market

- The segment with the biggest final electricity usage was business and professionals (47%), followed by residential (almost 38%) and heavy industry (16%) in 2019. Consumer expenditure in the residential sector increased by almost 5% during the first lockdown as a result of people spending more time at home (remote or part-time employment, etc.). Furthermore, the energy renovation projects that were promoted by the "Ma PrimeRenov" program added to the French recovery plan were the main source of support for this activity. Consequently, the rise in construction indicates more houses and buildings to be built, thus increasing the demand for LED.

- Electricity demand in the commercial sector tends to be highest during operating business hours; it decreases substantially on nights and weekends. Usually, in a day, it is around 8-10 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year as in the residential and commercial sectors, particularly at manufacturing facilities that operate around the clock, i.e., 24 hours. Electricity demand in the residential sector varies for about 7 to 9 hours. Additionally, the government of Paris is aggressively replacing more than 2,500 LED-based streetlights in order to convert to green in 2017. The nation's market for LED lights is driven by such initiatives.

- Additionally, Citeos (VINCI Energies) supports more than 3,000 municipalities in enhancing their energy efficiency. For instance, Cergy-Pontoise, a city outside of Paris, has pledged to cut its energy use by 47% over 18 years by rehabilitating 80% of its buildings. By installing 7,000 more energy-efficient LED lights in place of the nation's existing lighting infrastructure, this project is fueling the growth of the LED light industry.

France Indoor LED Lighting Industry Overview

The France Indoor LED Lighting Market is fragmented, with the top five companies occupying 23.66%. The major players in this market are ams-OSRAM AG, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), Signify (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 France

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Airis LED

- 6.4.2 ams-OSRAM AG

- 6.4.3 BEGA Lighting

- 6.4.4 CisLED

- 6.4.5 EGLO Leuchten GmbH

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Signify (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms