|

市場調查報告書

商品編碼

1683947

德國LED照明:市場佔有率分析、產業趨勢與成長預測(2025-2030年)Germany LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

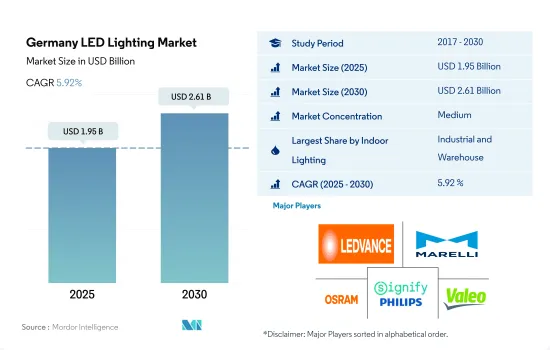

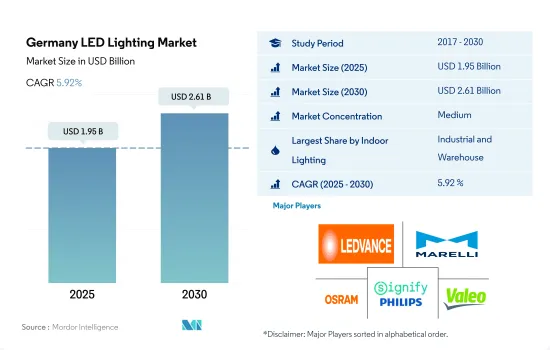

預計2025年德國LED照明市場規模為19.5億美元,到2030年將達到26.1億美元,預測期間(2025-2030年)的複合年成長率為5.92%。

工業領域的發展和住宅數量的增加預計將推動 LED 照明市場的成長。

- 就以金額為準,預計2023年工業和倉庫照明將佔據最大佔有率,其次是住宅、商業和農業照明。德國工業企業佔總研發支出的60%左右,為國家繁榮做出了重大貢獻。公司也參與策略發展。例如,2023 年,Osvetleni Cernoch sro 建造了一個新的生產和倉儲大廳,以提高其工業生產能力。這表明工業和倉庫數量的增加以及 LED 照明的使用量的增加。

- 以金額為準,2023年住宅照明將佔最大佔有率,其次是商業、工業、倉庫和農業照明。 2017年至2020年間,德國的房屋擁有率略有下降。 2021年,約有49.1%的人口居住在公寓中,但到了2022年,這一數字達到46.7%。這使得德國成為歐洲住房擁有率最低的國家之一,同時也是最大的租賃公寓市場。這導致租賃住宅數量顯著增加,並加速了該國對 LED 的採用。

- 在創新方面,飛利浦推出了適用於2023年的全新飛利浦TrueForce LED高棚通用燈,它易於安裝、初期投資低、節能,適合工業應用,特別是倉庫和零售區。 2019 年,我們開設了 TRILUX 燈光園區,擴大了我們在大教堂城市科隆的業務。這些發展正在推動LED照明市場的成長。

德國LED照明市場趨勢

家庭數量增加和政府補貼導致的電動車銷售增加將推動 LED 市場成長

- 截至2021年,德國人口為8,324萬人。比上年增加0.08人。德國每1000人粗出生率增加0.3人(與前一年同期比較增加3.23%)。結果,出生率在觀察期內達到峰值,達到每千人生育9.6人。德國每1,000名活產嬰兒的死亡人數與前一年相比減少了0.1人(-3.23%)。結果,2021年,德國嬰兒死亡率創下每千名新生兒死亡3人的歷史新低。出生率上升和死亡率下降推動了住宅銷售的增加,並增加了對 LED 照明的需求。

- 2021年,德國共有4,160萬戶家庭。 2021年,德國家庭數量年增率為0.2%。 2010年至2021年間,家庭數增加了3.2%。與十年前相比,單人家庭的數量增加。 2021年,德國將有16,619套住房由一個人居住。因此,德國家庭數量的成長將推動 LED 照明的需求。

- 2022年,德國汽車產量接近340萬輛。這一數字比前一年的 310 萬台有所增加。汽車產業是德國經濟的基石之一。德國政府也希望加快向電動車轉變。德國計劃透過增加 9,000 歐元(9,872.41 美元)的購買補貼來促進電動車銷售。政府希望到2030年道路上有1500萬輛電動車。未來幾年銷售更多汽車的計劃可能會推動市場擴張。

移民增加、消費者購買力增強以及能源效率計劃將推動 LED 照明的成長。

- 預計 2022 年德國人口將成長 1.3%(112.2 萬人),而前一年德國人口僅成長 0.1%(8.2 萬人)。到2022年終,德國人口將達到約8,440萬。這一發展趨勢是由淨移民人數大幅增加 145.5 萬人(2021 年:329,000 人)所推動的,這主要是由於來自烏克蘭的難民流動。因此,預計移民數量和人口成長將增加 LED 在該國照明需求中的普及率。 2017年至2020年間,德國的住宅率略有下降。 2021年,約有49.1%的人口擁有自己的房屋,2022年這一比例達到46.7%。這使得德國成為歐洲房屋自有率最低的國家之一,也是最大的租賃住宅市場之一。這顯示租賃住宅的成長以及該國LED普及率的快速上升。

- 德國較高的可支配收入賦予了人們更強的消費能力,使他們能夠將更多的錢投入新的住宅空間。 2022年12月,德國的人均收入達到48,562.1美元,而2021年12月為51,202.9美元。與一些已開發國家相比,儘管其人均收入較上年有所下降,但其購買力較高。例如,截至2021年,巴西為7,732.4美元,法國為25,337.7美元。 2021年1月,德國啟動「聯邦高效建築資助」計畫。任何在德國擁有房產或想要在德國購買房產的人都可以申請這項經濟援助。該能源效率計劃還包括照明節能建築。預計此類案例將進一步刺激該國對 LED 照明的需求。

德國LED照明產業概況

德國LED照明市場格局中度整合,前五大企業佔比54.03%。市場的主要企業有:LEDVANCE GmbH(MLS)、Marelli Holdings、OSRAM GmbH.、Signify(飛利浦)和Valeo。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 行駛車輛數

- LED進口總量

- 照明功耗

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 德國

- 戶外照明

- 德國

- 汽車照明

- 德國

- 室內照明

- 價值鍊和通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Dialight PLC

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- LEDVANCE GmbH(MLS Co Ltd)

- Liper Elektro GmbH

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Signify(Philips)

- TRILUX GmbH & Co. KG

- Valeo

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001645

The Germany LED Lighting Market size is estimated at 1.95 billion USD in 2025, and is expected to reach 2.61 billion USD by 2030, growing at a CAGR of 5.92% during the forecast period (2025-2030).

Increasing development in the industrial sector and an increase in the number of residential houses are expected to drive the growth of LED lighting market

- In terms of value, industrial and warehouse lighting was expected to hold the largest share in 2023, followed by residential, commercial, and agricultural lighting. German industrial companies make a significant contribution to the country's prosperity at around 60% of total R&D expenditure. Companies are also involved in strategic development. For instance, in 2023, Osvetleni Cernoch s.r.o. built a new production and storage hall to increase its industrial production capacity. This indicated an increase in the number of industries and storage areas and an increase in the use of LED lighting.

- In terms of value, residential lighting accounted for the largest share in 2023, followed by commercial, industrial and warehouse, and agricultural lighting. From 2017 to 2020, Germany's homeownership rate declined slightly. About 49.1% of the population lived in apartments in 2021, and in 2022 it reached 46.7%. This made Germany one of the countries with the lowest home ownership rates and the largest market for rental apartments in Europe. This marked the growth of rental accommodation, which also accelerated the adoption of LEDs in the country.

- In the area of innovation, Philips unveiled the new Philips TrueForce LED high bay universal lamp in 2023. It is easy to install, has a low initial investment, saves energy, and is especially suitable for industrial applications in warehouses and retail areas. In 2019, the company expanded its presence in the cathedral city of Cologne with the opening of the TRILUX Light Campus. These developments are driving the growth of the LED lighting market.

Germany LED Lighting Market Trends

Increase in the number of household and government subsidies to increase EV sales and drive the growth of LED market

- In 2021, there were 83.24 million people living in Germany. When compared to the previous year, it went up by 0.08. The crude birth rate in Germany grew over the previous year by 0.3 live births per 1,000 people (+3.23%). The rate thus reached its peak during the observed period at 9.6 live births per 1,000 people. In Germany, there were 0.1 fewer infant deaths per 1,000 live births (-3.23%) than the year before. As a result, in 2021, Germany's infant mortality rate reached its all-time low of three fatalities per 1,000 live births. The rise in birth rates and decline in death rates encourage selling more homes, increasing the need for LED lighting.

- In 2021, Germany had 41.6 million households. In Germany, the number of households increased by 0.2% on an annual basis in 2021. The number of households increased by 3.2% between 2010 and 2021. There are now more one-person families than there were ten years ago. 16,619 German houses only had one person in 2021. As a result, Germany's demand for LED lighting will be aided by an increase in the number of households.

- In 2022, almost 3.4 million German automobiles were produced. This was an increase from the 3.1 million cars sold the year before. One of the foundations of the German economy is the auto sector. The German government also wants to speed up the transition to more electric vehicles on the road. Germany will increase electric vehicle sales by increasing the help-to-buy subsidy by EUR 9,000 (USD 9872.41). By 2030, the government wants 15 million all-electric vehicles on the road. The market's expansion will be facilitated by the plan to sell more cars in the upcoming years.

Rise in number of immigrants, high purchasing power of consumers, and energy efficient programs to drive the growth of LED lights

- Germany's population increased by 1.3% (+1,122,000 people) in 2022, following only 0.1% (+82,000 people) the year before. At the end of 2022, there were about 84.4 million people living in Germany. This development is due to a substantial increase in net immigration to 1,455,000 people (2021: 329,000), mainly caused by the refugee movements from Ukraine. Thus, the growing number of immigrations and population is expected to create more LED penetration for the need for illumination in the country. Between 2017 and 2020, the homeownership rate in Germany decreased slightly. In 2021, about 49.1% of the population lived in an owner-occupied dwelling, and in 2022, it reached 46.7%. This makes Germany one of the countries with the lowest homeownership rate and the biggest rental residential real estate market in Europe. This indicates the growth of rental accommodations, which also surges the LED penetration in the country.

- In Germany, disposable income is high, which results in the rising spending power of individuals and affording more money on new residential spaces. Germany's per Capita income reached USD 48,562.1 in December 2022, compared to USD 51,202.9 in December 2021. Compared to some developed nations, it has high purchasing power even though per capita income was decreasing compared to the previous year. For instance, as of 2021, Brazil had USD 7732.4, and France had USD 25,337.7. In January 2021, the "Federal Funding for Efficient Buildings" program was launched in Germany. Anyone who owns property in Germany or who is looking to buy property in Germany can apply for the funding. The energy efficiency program also includes lighting energy efficiency building. Such instances are further expected to surge the demand for LED lighting in the country.

Germany LED Lighting Industry Overview

The Germany LED Lighting Market is moderately consolidated, with the top five companies occupying 54.03%. The major players in this market are LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co., Ltd., OSRAM GmbH., Signify (Philips) and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Germany

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Germany

- 4.14.3 Automotive Lighting

- 4.14.3.1 Germany

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Dialight PLC

- 6.4.2 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.3 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.4 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.5 Liper Elektro GmbH

- 6.4.6 Marelli Holdings Co., Ltd.

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify (Philips)

- 6.4.9 TRILUX GmbH & Co. KG

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219