|

市場調查報告書

商品編碼

1683964

南美LED照明:市場佔有率分析、產業趨勢與成長預測(2025-2030年)South America LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

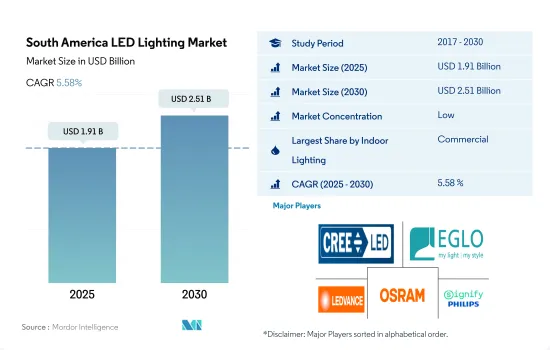

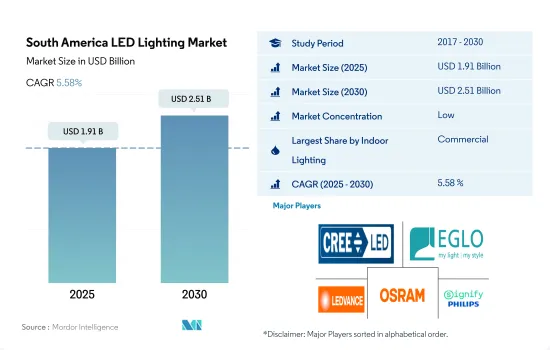

南美 LED 照明市場規模預計在 2025 年為 19.1 億美元,預計到 2030 年將達到 25.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.58%。

可支配收入增加、政府投資和商業建設增加推動區域 LED 照明市場成長

- 預計到 2023 年,商業領域將佔據最大佔有率,無論是數量或以金額為準,其次是住宅、工業/倉庫和農業照明。預計未來幾年南美室內商業市場將會成長。 2020 年,新冠疫情對商業建築業產生了重大影響,迫使辦公室和商業空間關閉,隨後維修並適應新的現實。受疫情嚴重打擊的一個細分市場是辦公室和商業建築,此類空間的需求下降。但隨著經濟復甦,南美市場正在進一步發展。巴西的月收入從 2016 年 12 月的 4,272.3 美元增加到 2017 年 12 月的 4,779.7 美元。巴西和阿根廷的可支配收入正在增加,這反過來又提高了個人的購買力,使他們能夠在零售商品上花費更多。

- 此外,墨西哥在 2017 年投資超過 1 億美元用於改善普埃布拉的學校基礎設施。該國建設活動的活性化導致 LED 照明的使用增加。這種成長最終將導致建築物數量的增加和 LED 照明燈具使用量的增加。

- 此外,智利政府也設定目標,在2023年公開招標14個特許經營競標,總價值46億美元。該計劃包括建造一條價值3.98億美元的機場輕軌線路和一條連接國際機場和聖地牙哥的12公里輕軌路線。該項目將把聖地牙哥的地鐵系統與機場連接起來。這項商業發展要求該地區更多地使用 LED 照明。

南美洲LED照明市場趨勢

汽車生產推動LED照明市場

- 截至 2021 年,拉丁美洲人口為 6.56 億,約佔世界人口的 8.37%。 2022年拉丁美洲人口較2021年成長近0.9%。與2019年相比,2020年拉丁美洲和加勒比地區的總合生育率沒有顯著變化,仍維持在每位婦女1.99個孩子左右。隨著人口的成長,許多人為了尋求更好的就業和教育機會而遷移到大都會圈。隨著城市人口的成長,拉丁美洲城市的住宅需求不斷增加。一些拉丁美洲政府正在努力發展城市基礎設施以支持貧困階級,特別是在住宅方面。預計住宅需求的增加將推動南美洲對 LED 的需求。

- 預計2022年南美洲汽車產量將達963總合,2023年將增加至983萬輛。拉丁美洲道路上的電動車數量正在成長。例如,電動車銷量的成長是由拉丁美洲的高檔汽車購買者推動的。 2021 年該地區的電動車銷量將達到約 25,000 輛,是 2020 年銷量的兩倍多。雖然各地區存在差異,但 2021 年電動車銷量佔從墨西哥到智利所有汽車銷量的 0.7%。銷量最高(13,000 輛)且比例最高(售出的所有汽車中有 2.7% 配備了插頭)的國家是哥斯達黎加。因此,預計汽車產業對 LED 照明的需求將會增加。

該地區不斷成長的人口和經濟適用住宅計劃將推動 LED 照明市場的成長

- 在南美洲,巴西、哥倫比亞和阿根廷是收益和人口領先的國家。到2020年,巴西將以2.125億人口成為該地區人口最多的國家,其次是哥倫比亞,人口為5,080萬人。 85.5%的人口居住在都市區。該地區人口成長率為0.8%。因此,預計人口的成長將導致 LED 的使用量增加以及照明需求的增加。

- 巴西的可支配收入正在增加,這反過來又增強了個人的消費能力,使他們能夠將更多的錢投入新的生活空間。巴西的月收入從2016年12月的4,272.3美元增加到2017年12月的4,779.7美元。阿根廷的月收入從2021年12月的3,539.2美元增加到2022年12月的4,354.6美元。

- 巴西的經濟適用住宅計畫正在恢復。巴西總統宣布,計劃於 2023 年 2 月重啟一項針對低收入者的全國性聯邦住宅計劃。該計劃最初於 2009 年由總統創建,名為「我的家,我的生活」(Minha Casa, Minha Vida)。目前,住宅銷售量正在增加,建築業也在回升。 2022 年前三個季度,聖保羅全市住宅銷售量年增 7.9% 至 50,728 套,而推出的房屋數量增加 4.3% 至 51,715 套。上述例子表明,由於政府增加住宅計劃、住宅銷售和新房屋住宅,未來幾年住宅率將會上升。預計此類案例將推動該地區對 LED 照明的需求激增。

南美洲LED照明產業概況

南美洲LED照明市場較為分散,前五大企業佔了27.57%的市場。市場的主要企業有:Cree LED(SMART Global Holdings, Inc.)、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、OSRAM GmbH。以及 Signify(飛利浦)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 持有汽車數量

- LED進口總量

- 照明功耗

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 阿根廷

- 巴西

- 戶外照明

- 阿根廷

- 巴西

- 汽車照明

- 阿根廷

- 巴西

- 室內照明

- 價值鍊和通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Cree LED(SMART Global Holdings, Inc.)

- EGLO Leuchten GmbH

- HELLA GmbH & Co. KGaA

- KOITO MANUFACTURING CO., LTD.

- LEDVANCE GmbH(MLS Co Ltd)

- OPPLE Lighting Co., Ltd

- OSRAM GmbH.

- Signify(Philips)

- Stanley Electric Co., Ltd.

- Valeo

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The South America LED Lighting Market size is estimated at 1.91 billion USD in 2025, and is expected to reach 2.51 billion USD by 2030, growing at a CAGR of 5.58% during the forecast period (2025-2030).

Increasing disposable incomes, government investments, and rising commercial constructions to drive the growth of the regional LED lighting market

- In terms of volume and value, the commercial segment was expected to hold the largest share in 2023, followed by residential, industrial and warehouse, and agricultural lighting. The South American indoor commercial market is expected to grow over the coming years. In 2020, the COVID-19 pandemic had a major impact on the commercial construction industry as offices and commercial spaces had to be closed and later needed to be refurbished or adapted to the new reality. The market segment that was hit badly by the pandemic was office and commercial construction, as demand for such spaces declined. However, further developments are occurring in the South American market as the economy regains strength. Monthly income in Brazil increased to USD 4,779.7 in December 2017, up from USD 4,272.3 in December 2016. In Brazil and Argentina, disposable income is increasing, which, in turn, increases the purchasing power of individuals, enabling them to spend more money on retail goods.

- Additionally, Mexico invested more than USD 100 million in improving school infrastructure in Puebla in 2017. Increased construction activity in the country has increased the use of LED lighting. The growth will ultimately lead to an increase in the number of buildings and an increase in the use of LED lighting fixtures.

- In addition, the Chilean government had set a goal of opening public tenders for 14 concession contracts worth a total of USD 4.6 billion in 2023. The project includes a USD 398 million airport light rail and the construction of a 12 km light rail linking the international airport with Santiago. The effort will connect Santiago's underground metro system to the airport. These developments in the commercial sector are demanding greater use of LED lighting in the region.

South America LED Lighting Market Trends

Automobile production to boost the LED lighting market

- With 656 million people as of 2021, Latin America made up around 8.37% of the world's population. The population of Latin America increased by almost 0.9% in 2022 compared to 2021. Compared to 2019, the total fertility rate in Latin America and the Caribbean did not significantly change in 2020 and stayed at about 1.99 children per woman. Many people are relocating to metropolitan regions as the population grows in search of better employment and educational possibilities. The demand for residential properties in Latin American cities is rising as a result of the growing urban population. Some Latin American governments have taken action to support pro-poor urban infrastructure, particularly with respect to housing. The increase in the demand for residential properties will increase the demand for LED in South America.

- In South America, a total of 9.63 million cars were produced in 2022, and that number is projected to rise to 9.83 million in 2023. The number of EVs is rising in Latin America. For instance, a rise in the sales of electric vehicles is being driven by premium car purchasers in Latin America. In the region, about 25,000 EVs were sold in 2021, more than twice as many as were sold in 2020. With regional differences, EV sales in 2021 were 0.7% of all auto sales from Mexico to Chile. The country with the biggest sales (13,000 units) and the highest percentage (2.7% of all sold automobiles had a plug) was Costa Rica. As a result, it is predicted that the demand for LED lighting is expected to increase in the automotive industry.

Increasing population and affordable housing plans in the region to drive the growth of the LED lighting market

- In South America, Brazil, Colombia, and Argentina are the main countries in terms of revenue and population. In this region, Brazil occupied a major share of the population, which accounted for 212.5 million, followed by Colombia with 50.8 million in 2020. 85.5 % of the population lives in urban areas. The population in this region is growing at a rate of 0.8% change. Thus, the increase in population is expected to create more LED penetration and increase the need for illumination in the country.

- In Brazil, disposable income is growing, which results in the rising spending power of individuals and affording more money on new residential spaces. Brazil's monthly earnings increased up to USD 4,779.7 in December 2017 from USD 4,272.3 in December 2016. In Argentina, monthly earnings increased to USD 4,354.6 in December 2022 from USD 3,539.2 in December 2021.

- Brazil's affordable housing program is making a return. Brazil's president announced plans to restart the nationwide federal housing program for low-income individuals in February 2023. President initially created the program, named "Minha Casa, Minha Vida," which translates to "My Home, My Life," in 2009. Sales of homes are increasing, and construction work is picking up. The overall number of residential sales in Sao Paulo increased by 7.9% year-over-year to 50,728 units in the first three quarters of 2022, and the number of launches increased by 4.3% to 51,715 units. The above instance suggests that the rate of house ownership will increase in the coming years because, as stated above, the government offering housing programs, sales of homes, and new constructions of homes are increasing. Such instances are expected to surge the demand for LED lighting in the region.

South America LED Lighting Industry Overview

The South America LED Lighting Market is fragmented, with the top five companies occupying 27.57%. The major players in this market are Cree LED (SMART Global Holdings, Inc.), EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OSRAM GmbH. and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Argentina

- 4.14.1.2 Brazil

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Argentina

- 4.14.2.2 Brazil

- 4.14.3 Automotive Lighting

- 4.14.3.1 Argentina

- 4.14.3.2 Brazil

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Cree LED (SMART Global Holdings, Inc.)

- 6.4.2 EGLO Leuchten GmbH

- 6.4.3 HELLA GmbH & Co. KGaA

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify (Philips)

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms