|

市場調查報告書

商品編碼

1683968

英國室內 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)UK Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

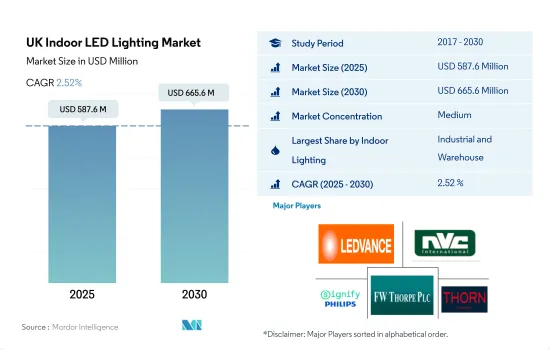

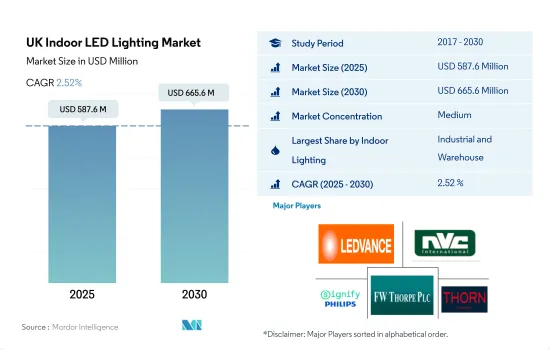

英國室內 LED 照明市場規模預計在 2025 年為 5.876 億美元,預計到 2030 年將達到 6.656 億美元,預測期內(2025-2030 年)的複合年成長率為 2.52%。

工業產量成長和對科技新興企業的投資推動市場成長

- 就金額佔有率而言,工業和倉儲 (I&W) 部門將在 2023 年佔據最高的市場佔有率(46.8%),其次是商業 (33.8%)、住宅(19.2%) 和農業。預計未來幾年 I&W 和住宅領域的市場佔有率將會成長。英國工業界面臨多重內部和外部阻力,包括新冠疫情期間的晶片短缺、工廠關閉和供應鏈中斷。不過,該國 2021 年的工業生產維持不變,產值 2,748.7 億美元,比 2020 年成長 16.57%。因此,工業生產的擴張可能會在未來幾年產生對室內照明的需求。

- 電動車、自動駕駛和網路連線技術等新技術得到了政府的支持,為該產業提供了巨大的推動力。預計這些因素將在預測期內推動室內 LED 的需求。 2023年4月,捷豹路虎宣布計劃未來五年向英國製造工廠投資數十億美元,以增加電動車和彈性汽車的生產。

- 由於生活成本危機持續惡化,2023年5月英國零售下滑速度放緩。 2023年5月零售額成長0.3%,低於上個月0.5%的增幅。預計網路購物的激增將導致全國各地新倉庫的增加,從而推動室內照明的需求。

- 英國的科技新興企業成長率令人矚目。光是 2021 年,英國科技新興企業宣布的股權交易價值就達到 241 億美元,而 2020 年為 108 億美元,大幅成長了 123%。這些發展將會促進商業領域的需求。預計這些因素將在未來幾年推動室內 LED 的需求。

英國室內 LED 照明市場趨勢

人均收入的提高和政府推廣節能照明的政策可能會促進 LED 的使用

- 2022年,英國家庭數量預計將達到1,940萬戶,比2012年的1,840萬戶增加5.7%。預計2022年英國家庭數將達2,820萬戶,較2012年(2,660萬戶)增加6.1%。因此,家庭和戶數的增加可能會增加該國對LED的需求。 2021年至2022年間,擁有房屋的家庭數量將達到1,560萬戶,佔全國所有家庭的64%。這一比例比 2016-2017 年的 63% 有所增加,但在 2020-2021 年保持不變。過去十年來,情況一直如此。

- 英國的可支配所得較高,導致個人消費能力上升,新生活空間的支出也增加。 2022 年 12 月,英國的人均收入達到 33,138 美元,而 2021 年 12 月為 36,516.3 美元。與一些已開發國家相比,儘管英國的人均收入較上年有所下降,但 2021 年的購買力仍然較高。例如,截至 2021 年,巴西為 7,732.4 美元,法國為 25,337.7 美元。住宅新屋開工量從 2022 年第三季的 43,140 套下降至 2022 年第四季的 39,220 套。儘管住宅計劃已經減少,但對 LED 的需求仍然存在。不過,住宅領域與上一季相比有所下降。政府宣布啟動關於節能照明新提案的諮詢。該提案將使用 LED 等低能耗照明取代舊式鹵素燈泡,在燈泡的使用壽命內可節省 2,000 英鎊(2,523.76 美元)至 3,000 英鎊(3,785.64 美元)。預計這些案例將在未來推動對 LED 照明的需求。

住宅購買量的高成長和鹵素燈的逐步淘汰可能推動 LED 照明的成長

- 2018年,英國國內建築能源消耗佔全國能源消耗的29.5%左右。 2020年,疫情對英國建築市場產生了負面影響,整體產出與前一年同期比較%。不過,2021年與2020年相比錄得正成長率。 2021年,倫敦以外的每個地區都建造了更多的住宅,其中東北部、東米德蘭茲和東部地區的成長率達到45%以上。因此,建築數量的增加表明將建造更多的住宅和建築物,從而增加對 LED 的需求。

- 商業部門的電力需求約為8-10小時,而工業部門的用電量全天或全年都沒有波動。住宅用電需求在7-9小時左右波動。根據倫敦照明系統在2018年的表現,該國的整體照明政策進行了調整。為減少燈光照射到居住者住宅內,走廊的燈已被調低或移除,但恢復後的公共空間仍保持照明。由社區發起的照亮老建築的計劃。作為「照亮河流」計劃的一部分,這座橋煥然一新,採用了 LED 照明。這些努力正在推動LED照明市場的發展。

- 英國政府實施了綠色家園津貼計劃,鼓勵英國公民選擇 LED 照明而非傳統照明燈具。英國政府在禁止使用白熾燈後,將於 2021 年開始逐步淘汰鹵素燈泡。該法案的目標是每年減少二氧化碳排放126萬噸。一旦白熾燈和鹵素燈被徹底淘汰,許多人可能會轉而使用 LED 照明解決方案。

英國室內LED照明產業概況

英國室內LED照明市場適度整合,前五大企業佔比為45.61%。市場的主要企業有:LEDVANCE GmbH(MLS)、NVC INTERNATIONAL HOLDINGS LIMITED、Signify(飛利浦)、Thorlux Lighting(FW Thorpe Plc)和Thorn Lighting Ltd.(Zumtobel Group)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明耗電量

- 家庭數量

- LED滲透率

- 園藝區

- 法律規範

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Crompton Lamps Limited(GCH Corporation Limited)

- EGLO Leuchten GmbH

- Feilo Sylvania(Shanghai Feilo Acoustics Co., Ltd)

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- Signify(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The UK Indoor LED Lighting Market size is estimated at 587.6 million USD in 2025, and is expected to reach 665.6 million USD by 2030, growing at a CAGR of 2.52% during the forecast period (2025-2030).

The growing industrial production and investments in technology startups driving the market's growth

- In terms of value share, in 2023, the industrial and warehouse (I&W) segment accounted for the highest market share (46.8%), followed by commercial (33.8%), residential (19.2 %), and agricultural. The market share of the I&W and residential segments is expected to grow in the coming years. UK industries faced several internal and external headwinds, such as chip crunch, plant closures, and supply chain disruptions during the COVID-19 pandemic. However, the country sustained its industrial production in 2021 and produced a total of USD 274.87 billion, a 16.57% increase over 2020. Thus, the growing industrial production will generate demand for indoor lighting in the coming years.

- New technologies such as EVs, as well as autonomous and connected technology, are supported by the government, which is a major boost to the industry. These will continue to boost the demand for indoor LEDs during the study period. In April 2023, Jaguar Land Rover announced plans to invest billions over the next five years in its UK manufacturing plants to ramp up EV and flexible production.

- As the cost-of-living crisis continued to worsen, UK retail sales declined at a slower pace in May 2023. Retail sales rose by 0.3% in May 2023 after growing by 0.5% in the previous month. The rapid increase in online shoppers is expected to boost new warehouses in the country, resulting in more demand for indoor lighting.

- In the UK, technology startups have recorded a remarkable growth rate. In 2021 alone, USD 24.10 billion worth of announced equity deals were raised by UK technology startups, compared to USD 10.80 billion in 2020, a massive 123% surge. Such developments boost the demand in the commercial segment. These factors are expected to generate more demand for indoor LEDs over the coming years.

UK Indoor LED Lighting Market Trends

Increasing per capita income and the government policy to roll out the use of energy-efficient lighting may boost use of LEDs

- In 2022, the number of UK families was projected to reach 19.4 million, an increase of 5.7% from 18.4 million in 2012. The expected number of households in the United Kingdom in 2022 was 28.2 million, 6.1% more than that in 2012 (26.6 million). Thus, the increasing number of families and households may create more demand for LEDs in the country. During 2021-2022, there were 15.6 million owner-occupied households, representing 64% of all households in the country. This percentage increased from 63% during 2016-2017 but remained constant during 2020-2021. It has been consistent throughout the past 10 years.

- The disposable income in the United Kingdom is high, resulting in rising spending power of individuals and more spending on new residential spaces. The country's per capita income reached USD 33,138.0 in December 2022 compared to USD 36,516.3 in December 2021. Compared to some developed nations, the United Kingdom had high purchasing power in 2021, even though per capita income decreased compared to the previous year. For instance, in Brazil, it was USD 7732.4, while in France, it was USD 25,337.7 as of 2021. Housing starts in the country decreased to 39,220 units in Q4 2022 from 43,140 units in Q3 2022. Even though housing projects declined, the demand for LEDs existed. However, it was less in the residential segment compared to previous quarters. The government announced the launch of a consultation on a new energy-efficient lighting proposal. Under this proposal, lighting such as low energy-use LEDs will be rolled out to replace old halogen bulbs, which could save households between GBP 2,000 (USD 2523.76) and GBP 3,000 (USD 3785.64) over the lifetime of the bulbs. Such instances are further expected to boost the demand for LED lighting in the country in the future.

High growth rates for new house purchases and the phasing out of halogen lights may drive the growth of LED lights

- In 2018, domestic buildings in the United Kingdom were responsible for about 29.5% of energy consumption. In 2020, the pandemic negatively impacted the UK construction market, with overall output decreasing by 40% Y-o-Y. However, in 2021, positive growth rates were registered compared to 2020. More new homes were built in 2021 in every region outside London, with growth rates in the Northeast, East Midlands, and Eastern regions reaching above 45%. Consequently, the rise in construction indicates more houses and buildings being built, thus increasing the demand for LEDs.

- Electricity demand in the commercial sector tends to be around 8-10 hours, while electricity use in the industrial sector does not fluctuate throughout the day or year. Electricity demand in the residential sector varies for about 7-9 hours. Adjustments were made to the nation's general lighting policy in accordance with how well London's lighting system functioned in 2018. While hallway lights have been lowered or removed to lessen spill into resident residences, a restored public space is illuminated. A project started by the community to illuminate old structures. Bridges now have new illumination as part of Illuminated River, a project that uses LED lighting. Such initiatives are boosting the market for LED lights.

- The UK government implemented the "Green Home Grant Scheme," which encourages English citizens to choose LED lighting over traditional lighting fixtures. The UK government began the phase-out of halogen light bulbs in 2021 after outlawing the use of incandescent lightbulbs. A 1.26 million tonne reduction in carbon emissions annually is the goal of the legislation. Many people will likely switch to LED lighting solutions once incandescent and halogen light bulbs are completely phased out.

UK Indoor LED Lighting Industry Overview

The UK Indoor LED Lighting Market is moderately consolidated, with the top five companies occupying 45.61%. The major players in this market are LEDVANCE GmbH (MLS Co Ltd), NVC INTERNATIONAL HOLDINGS LIMITED, Signify (Philips), Thorlux Lighting (FW Thorpe Plc) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 United Kingdom

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Crompton Lamps Limited (GCH Corporation Limited)

- 6.4.4 EGLO Leuchten GmbH

- 6.4.5 Feilo Sylvania (Shanghai Feilo Acoustics Co., Ltd)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.8 Signify (Philips)

- 6.4.9 Thorlux Lighting (FW Thorpe Plc)

- 6.4.10 Thorn Lighting Ltd. (Zumtobel Group)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms