|

市場調查報告書

商品編碼

1683984

中國除草劑市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

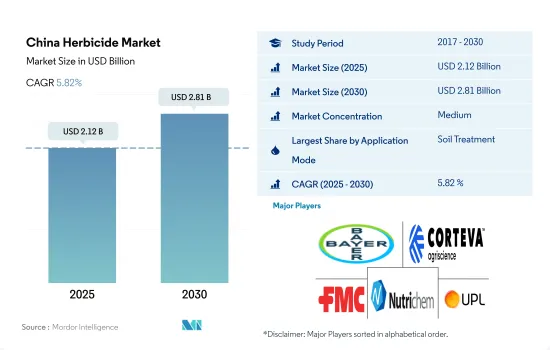

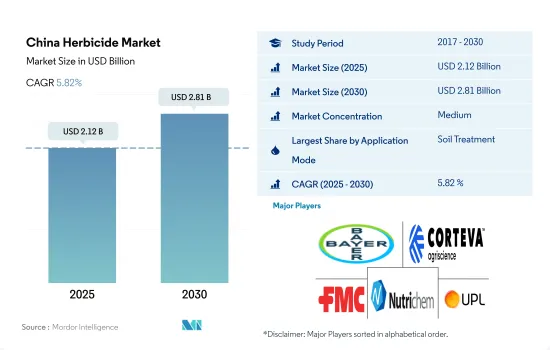

預計 2025 年中國除草劑市場規模為 21.2 億美元,到 2030 年將達到 28.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.82%。

市場受到有效除草劑控制需求的驅動。

- 中國農民使用多種方法來施用除草劑。所有這些方法的總市場規模預計到 2022 年將達到 17.8 億美元。

- 2022年,土壤治療方法佔最高市場佔有率,為8.415億美元,佔整個除草劑市場的47.2%。土壤處理之所以受歡迎,是因為其有效性,特別是使用出苗前除草劑,它可以在作物播種前針對雜草種子並抑制其發芽。葉面噴布除草劑的市場佔有率在 2022 年達到 31.9%,為雜草控制帶來了許多好處。這樣可以實現精確定位,因為除草劑可以直接與雜草葉子接觸並透過葉子表面吸收。

- 化學灌溉從2017年的1.994億美元增加到2022年的3.398億美元。 2022年主要用於穀物和穀類領域,佔市場佔有率的52.3%。這是因為微灌系統在這些作物中很普遍,並且非常適合化學灌溉。

- 葉面噴布在雜草控制方面具有多種優勢。葉面噴布可使除草劑直接與雜草葉片接觸,產生更有針對性的除草效果。

- 燻蒸除草方法不如其他噴灑方法常見,因為燻蒸方法的高度特異性和環境因素限制了其應用範圍。但它能有效控制其他方法無法控制的頑固雜草。

- 考慮到每種施用方法對農民的有效性、特殊性及其重要性,除草劑市場預計在預測期內(即 2023-2029 年)的複合年成長率為 6.1%。

中國除草劑市場趨勢

採用輪作等替代方案以及除草劑應用技術進步-控制除草劑的使用有助於減少每公頃的消費量

- 由於幾個重要因素,中國的除草劑使用量大幅下降。造成這種情況的一個因素是,人們越來越認知到並採用輪作和生物防治作為農業、園藝和景觀美化等各個領域有效管理雜草的重要工具。

- 輪作是指在較長時間內在同一塊土地上依照特定順序種植不同作物。不同作物有不同的生長模式和營養需求,有助於打斷雜草的生命週期。透過作物,中國農民擾亂了雜草的生長週期,減少了雜草數量,並最大限度地減少了大量使用除草劑的需要。

- 中國農民成功地利用生物防治劑有效管理了多種作物中的雜草,大大減少了除草劑的使用。引入此類生物防治劑非常有益,減少了對各種農業實踐中噴灑除草劑的依賴。

- 中國農民正在使用無人駕駛航空器系統(UAS) 影像分析和電腦視覺技術來加強雜草管理。這種方法使我們能夠找出哪些行長滿了雜草,並有選擇地精確施用除草劑,而保留沒有雜草的行。這種創新方法避免了不必要的噴灑,有效地減少了除草劑的浪費,從而整體減少了每公頃除草劑的消費量。

- 透過種植基改作物,農民可以最大限度地減少額外投資的需要,並顯著減少每公頃除草劑的消費量。

中國是世界上最大的Glyphosate生產國和出口國。

- 雜草是作物生產的主要限制因素,對中國的糧食安全至關重要。 500多種入侵雜草對中國的農業生產和生態系統構成威脅。Atrazine、Paraquat和Glyphosate是中國常用的除草劑。

- Atrazine是一種廣泛用於控制多種闊葉雜草和禾本科植物的除草劑。中國每年消耗超過16,000噸的Atrazine(技術上佔97%)。Atrazine主要用於控制玉米和甘蔗田的一年生雜草。中國是世界主要的莠Atrazine供應國之一。 2022 年的價格為每噸 13,700 美元。

- Paraquat是克無蹤的活性成分,可以控制雜草和草類。它也用於在收穫前乾燥棉花等作物。 2022年Paraquat的價格為每噸4,600美元。中國是Paraquat的主要出口國,其80%以上的Paraquat產量出口到世界各國。

- Glyphosate是一種頻譜廣譜系統性除草劑和作物乾燥劑。 2022 年的價格為每噸 1,100 美元。Glyphosate主要用於控制禾本科植物、莎草科植物和闊葉雜草。中國是世界上最大的Glyphosate生產國和出口國。中國Glyphosate產量從2010年的31.6萬噸增加至2017年的約50.5萬噸。 2017年,中國出口Glyphosate原藥超過30萬噸,滿足了全球一半以上的Glyphosate需求。

- 國家的天氣、雜草感染、能源價格和人事費用等因素顯著影響活性成分的價格。

中國除草劑產業概況

中國除草劑市場格局適度整合,前五大企業市佔率合計為64.14%。該市場的主要企業有:拜耳股份公司、科迪華農業科技、FMC集團、紐奇莫和UPL有限公司(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 中國

- 價值鍊和通路分析

第5章 市場區隔

- 執行模式

- 化學噴塗

- 葉面噴布

- 燻蒸

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Lianyungang Liben Crop Technology Co. Ltd

- Nutrichem Co. Ltd

- Rainbow Agro

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001686

The China Herbicide Market size is estimated at 2.12 billion USD in 2025, and is expected to reach 2.81 billion USD by 2030, growing at a CAGR of 5.82% during the forecast period (2025-2030).

The market is driven by the need for effective control of herbicides

- Farmers in China employ various methods of herbicide application. The market for all these methods was valued at USD 1.78 billion in 2022.

- In 2022, the soil treatment method had the highest market share of USD 841.5 million, accounting for 47.2% of the total herbicide market. The popularity of soil treatment is due to its efficacy in utilizing pre-emergent herbicides, specifically targeting weed seeds, inhibiting their germination before crop sowing. With a market share of 31.9% in 2022, foliar application of herbicides offers numerous benefits in weed control. It provides precise targeting as the herbicides directly contact the weed's foliage, facilitating absorption through the leaf surfaces.

- The chemigation method grew from USD 199.4 million in 2017 to USD 339.8 million in 2022. In 2022, it was predominantly used in the grains and cereals segment, representing 52.3% of the market share. This is due to the prevalence of micro-irrigation systems in these crops, making them well-suited for chemigation.

- The foliar application offers several advantages in weed control. It provides targeted action, as the herbicides come into direct contact with the weed's foliage.

- The fumigation method of weed control is less common than other application methods due to its limited applicability attributed to its high specificity of usage and environmental concerns. However, it effectively controls a few tough weeds that other methods cannot.

- Considering the effectiveness, specificity, and essentiality of each application method for farmers, the market for herbicides is projected to register a CAGR of 6.1% during the forecast period from 2023 to 2029.

China Herbicide Market Trends

Adoption of alternative methods like crop rotation and technical advancements in herbicide application-controlled herbicide application contributes to lower consumption per hectare

- The usage of herbicides in China has reduced significantly due to several key factors. Some factors contributing to this are the growing recognition and adoption of crop rotation and biological controls as essential tools for effective weed management in various sectors, such as agriculture, horticulture, and landscaping.

- Crop rotation is a practice where different crops are grown in a specific sequence on the same land over time. This helps break the lifecycle of weeds, as different crops have different growth patterns and nutritional needs. By alternating crops, Chinese farmers have disrupted weed growth cycles, reduced weed populations, and minimized the need for higher use of herbicides.

- Chinese farmers skillfully employ biocontrol agents to effectively manage weeds in a wide array of crops, thereby leading to a notable decrease in the usage of herbicides. The implementation of these biocontrol agents is highly beneficial, resulting in reduced reliance on herbicide applications throughout various agricultural practices.

- Chinese farmers use unmanned aerial systems (UAS) imagery analysis and computer vision techniques to enhance weed management practices. By employing this approach, they identify weed-infested rows and selectively apply herbicides accurately, leaving non-weed-infested rows untouched. This innovative method effectively minimizes the wastage of herbicides by avoiding unnecessary applications and reducing overall herbicide consumption per hectare.

- Farmers adopt genetically modified organism (GMO) crops to minimize additional investment requirements, resulting in a significant reduction in herbicide consumption per hectare.

China is the world's largest producer and exporter of glyphosate

- Weeds are a major constraint to crop production, which is crucial for food security in China. Over 500 invasive weeds are an increasing threat to agricultural production and ecosystems in China. Atrazine, paraquat, and glyphosate are commonly used herbicides in China.

- Atrazine is an herbicide widely used to control various broadleaved weeds and grasses. China consumes more than 16,000 ton (97% technical) of atrazine annually. Atrazine is mainly used to control annual weeds in corn or sugarcane fields. China is one of the major suppliers of atrazine worldwide. It was priced at USD 13.7 thousand per metric ton in 2022.

- Paraquat is the active ingredient of gramoxone, which controls weeds and grasses. It is also used for desiccating crops, like cotton, before harvest. Paraquat was valued at USD 4.6 thousand per metric ton in 2022. China is a major paraquat export country, and over 80% of its paraquat output is exported to countries worldwide.

- Glyphosate is an organophosphorus broad-spectrum systemic herbicide and crop desiccant. It was priced at USD 1.1 thousand per metric ton in 2022. Glyphosate is mainly used to control weeds like grasses, sedges, and broadleaves. China is the world's largest producer and exporter of glyphosate in the world. The output of glyphosate in China increased from 316,000 ton in 2010 to about 505,000 ton in 2017. In 2017, China exported over 300,000 ton of glyphosate technical, which satisfied more than half of the global glyphosate demand.

- Factors like weather conditions, weed infestation, energy prices, and labor costs in the country majorly influence the prices of active ingredients.

China Herbicide Industry Overview

The China Herbicide Market is moderately consolidated, with the top five companies occupying 64.14%. The major players in this market are Bayer AG, Corteva Agriscience, FMC Corporation, Nutrichem Co. Ltd and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.6 Lianyungang Liben Crop Technology Co. Ltd

- 6.4.7 Nutrichem Co. Ltd

- 6.4.8 Rainbow Agro

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219