|

市場調查報告書

商品編碼

1683991

印度除草劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

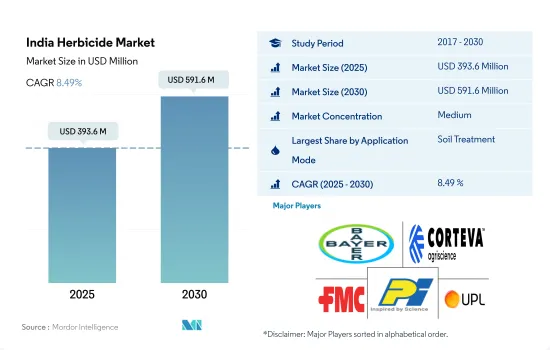

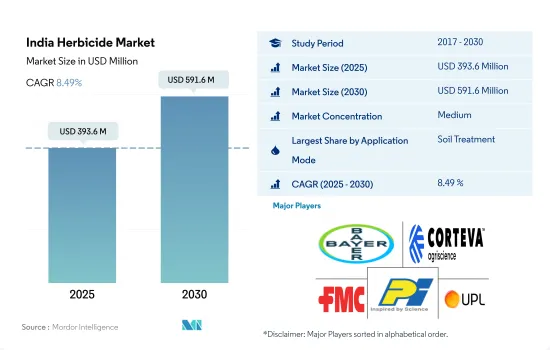

印度除草劑市場規模預計在 2025 年為 3.936 億美元,預計到 2030 年將達到 5.916 億美元,預測期內(2025-2030 年)的複合年成長率為 8.49%。

除草劑應用最重要的主要方式是土壤處理應用。

- 雜草對印度農業部門構成重大威脅,每年造成約 45.0% 的作物損失。農民實施各種策略來控制雜草,包括輪作、耕作、人工除草和使用化學除草劑。

- 然而,替代方案帶來的生產成本上升,導致更多農民採用化學除草劑來對抗作物中的雜草。透過使用除草劑,農民可以有效地控制雜草的生長,並最大限度地減少其對農業產量的負面影響。

- 除草的噴灑方法多種多樣。使用除草劑進行土壤處理佔據了很大的市場佔有率,因為它能夠有效地在雜草生長的早期階段進行控制。這種施用方法因其在抽穗前控制雜草的優勢而受到種植穀類的農民的歡迎。

- 土壤處理包括將除草劑直接施用於土壤,有效地針對雜草種子和新生的幼苗,抑制它們的生長和建立。土壤處理使農民能夠主動解決雜草問題並在關鍵的早期階段促進作物健康生長。

- 除土壤處理外,葉面噴布噴灑和化學噴霧等其他除草方法也在該國迅速流行起來。這些模式已證明了其有效性,並在提高作物產量方面提供了多重益處。 2022 年,葉面噴布的市場佔有率顯著上升,為 33.2%,化學噴劑的市佔率為 18.7%。

印度除草劑市場趨勢

預計除草劑消耗量的增加將用於應對因作物損失增加而帶來的雜草問題。

- 機械化和基於化學方法的除草方法正在迅速取代傳統的手工除草方法。農民使用除草劑是一種經濟有效的方式來控制小型和大型農業作業中的雜草。

- 在印度,農民實行作物集約化種植,即一年內多次重複作物週期,以提高作物產量。作物集約化種植往往會導致雜草壓力增加,因此需要使用除草劑來維持作物的生產力。每公頃除草劑消費量平均為49.7公克/公頃。

- 每公頃除草劑的消費量取決於許多方面,例如作物類型、雜草侵染程度、農業實踐和雜草管理策略。 2017 年至 2022 年,印度每公頃除草劑消費量增加了 6.0%。印度人均除草劑使用量增加,從而提高了每公頃平均農業產量。農民對除草劑益處的認知不斷提高,加上市場上除草劑種類繁多,導致了除草劑使用量的增加。

- 具有耐除草劑特性的基因改造作物(如耐除草劑棉花(Bt棉))的出現,以及使用「Burnase/Burstar」技術進行基因改造的雜交芥菜(如DMH-11)的開發,使農民能夠使用更廣泛的除草劑來控制雜草。這些改良作物經過基因改造,能夠耐受特定的除草劑,使農民能夠更有效地控制雜草。

Atrazine、Paraquat和Glyphosate是印度使用的主要除草劑。

- 印度擁有多種多樣的農業氣候和土壤。不同的農業和耕作系統受到多種類型的雜草問題的困擾。雜草不僅影響產品品質、對健康和環境造成危害,還會造成作物產量損失10%至80%。Atrazine、Paraquat和Glyphosate是該國使用的主要除草劑。

- Atrazine是一種廣泛用於印度玉米和水稻作物的除草劑,以控制稗草、刺莧屬植物和莧菜等闊葉雜草和禾本科雜草。 2022年,該除草劑的價值為13,500美元。印度是世界上最大的莠Atrazine技術進口國,主要來自中國、義大利和以色列。

- Paraquat是一種廣譜接觸性除草劑,2022 年的市場價值為 4,600 美元。在印度,Paraquat二氯化物總合14 個商品名。它用於大約 25 種作物,包括穀物、豆類、油籽、蔬菜和經濟作物。然而,中央殺蟲劑委員會和登記委員會(CIBRC)僅核准在 9 種作物上使用該產品。

- Glyphosate是一種非選擇性除草劑,用於控制狗牙根、白茅和野古草等雜草。根據印度政府2022年9月發布的通知,Glyphosate只能用於茶園和非農業用地。 2022 年其價值為 1,100 美元。

- 印度政府一直提供持續的預算支持,以促進農村經濟發展並增加農民收入。 2022 財政年度預算提案並宣布了多項旨在改善農業部門和農村經濟的政策和措施。預計這將對該國的除草劑價格產生進一步影響。

印度除草劑產業概況

印度除草劑市場適度整合,前五大公司佔61.28%的市佔率。市場的主要企業是:拜耳股份公司、科迪華農業科技、FMC 公司、PI Industries 和 UPL 有限公司(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 印度

- 價值鍊和通路分析

第5章 市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Gharda Chemicals Ltd

- PI Industries

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001693

The India Herbicide Market size is estimated at 393.6 million USD in 2025, and is expected to reach 591.6 million USD by 2030, growing at a CAGR of 8.49% during the forecast period (2025-2030).

The primary mode of herbicide application of utmost significance is the soil treatment application

- Weeds pose a significant threat to the agricultural sector in India, resulting in substantial annual crop losses of around 45.0%. Farmers are implementing various strategies, including crop rotation, cultural practices, manual weeding, and spraying chemical herbicides to control weeds.

- However, due to rising production costs associated with alternative methods, more farmers are adopting chemical herbicides to tackle weeds in their crops. Farmers can efficiently control weed growth and minimize the detrimental effects on their agricultural yield by spraying herbicides.

- There are various application modes for weed control. Soil treatment using herbicides holds a prominent share due to its effectiveness in managing weeds during their early growth stages. This application method has gained popularity among farmers cultivating grain and cereal crops due to its advantageous effects in controlling pre-emergence weeds.

- Soil treatment involves applying herbicides directly to the soil, where they can effectively target weed seeds and emerging seedlings, inhibiting their growth and establishment. By employing soil treatment applications, farmers can proactively address weed issues and promote healthier crop growth in the crucial early stages.

- Following the soil treatment mode, other application modes such as foliar and chemigation have witnessed a surge in popularity for weed control in the country. These modes have demonstrated their effectiveness and offered various benefits in enhancing crop productivity. In 2022, foliar and chemigation registered a significant market share of 33.2% and 18.7%, respectively.

India Herbicide Market Trends

Herbicide consumption is anticipated to expand to manage the weed challenges due to growing losses of crops

- Mechanized and chemical-based weed control approaches are rapidly replacing traditional manual weeding methods. Farmers use herbicides as a cost-effective and efficient way to manage weeds in small-scale and large-scale farming operations.

- With the aim of increasing crop productivity, farmers in India have been practicing crop intensification, which involves repeated cropping cycles within a year. This intensification frequently results in increased weed pressure, necessitating the application of herbicides to maintain crop productivity. The average herbicide consumption per hectare accounted for 49.7 g/ha.

- Herbicide consumption per hectare can vary based on numerous aspects such as crop type, weed infestation level, agricultural practices, and weed management strategies. The consumption of herbicides in India per hectare increased by 6.0% from 2017 to 2022. Herbicide usage per capita in India increased to boost the average agricultural output per hectare. Farmers' growing awareness of the advantages of herbicides, along with the availability of a wide range of herbicides on the market, has contributed to their increased usage.

- The utilization of genetically modified (GM) crops that possess herbicide-tolerant characteristics, like herbicide-tolerant cotton (Bt cotton), and the development of hybridized mustard such as DMH-11 using the "barnase/barstar" technique for genetic modification has enabled farmers to employ herbicides more extensively in weed management. These modified crops are designed to endure specific herbicides, empowering farmers to utilize herbicides to a greater extent for effective weed control.

Atrazine, paraquat, and glyphosate are major herbicides used in the country

- India has a wide range of agroclimates and soil types. The highly diverse agriculture and farming systems are beset with different types of weed problems. Weeds cause 10% to 80% crop yield losses, besides impairing product quality and causing health and environmental hazards. Atrazine, paraquat, and glyphosate are major herbicides used in the country.

- Atrazine is an herbicide widely used to control broadleaf and grassy weeds like Echinocloa, Elusine spp, and Amaranthus viridis in maize and rice crops in India. The herbicide was valued at USD 13.5 thousand in 2022. India is the world's largest importer of Atrazine technical and imports majorly from China, Italy, and Israel.

- Paraquat is a broad-spectrum contact herbicide, accounting for USD 4.6 thousand in 2022. A total of 14 commercial names of paraquat dichloride are sold in India. It is used in about 25 crops, including cereals, pulses, oil seeds, vegetables, and cash crops. However, the Central Insecticide Board & Registration Committee (CIBRC) has approved its use in only nine crops.

- Glyphosate is a non-selective herbicide used to control weeds like Cynodon dactylon, Imperata cylindrica, and Arundinella bengalensis. As per the notice issued by the Government of India in September 2022, glyphosate can be used only in tea gardens and non-crop areas. It was valued at USD 1.1 thousand in 2022.

- The Government of India has continuously provided budgetary support to revive the rural economy and increase farmers' income. A number of measures and initiatives were proposed and announced during the FY22 budget for the improvement of the agriculture sector and the rural economy. This is expected to influence the prices of herbicides in the country further.

India Herbicide Industry Overview

The India Herbicide Market is moderately consolidated, with the top five companies occupying 61.28%. The major players in this market are Bayer AG, Corteva Agriscience, FMC Corporation, PI Industries and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Gharda Chemicals Ltd

- 6.4.7 PI Industries

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219