|

市場調查報告書

商品編碼

1683986

歐洲除草劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

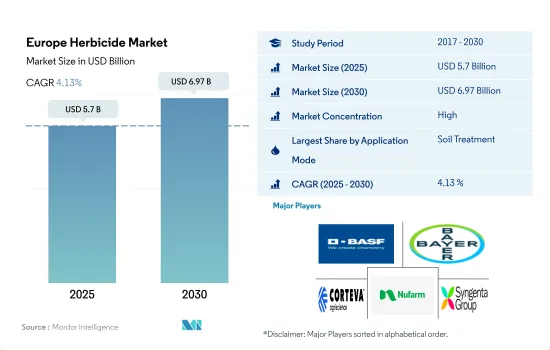

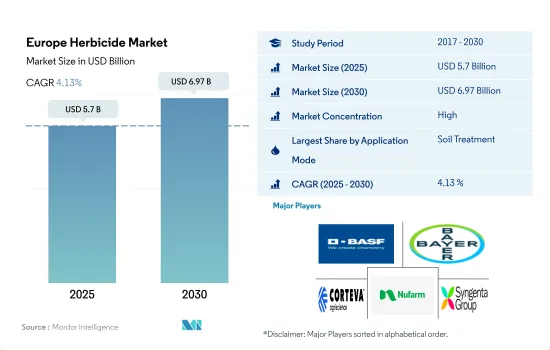

預計 2025 年歐洲除草劑市場規模為 57 億美元,到 2030 年將達到 69.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.13%。

在歐洲,土壤處理是迄今為止除草劑施用最重要的主要手段。

- 在歐洲,農業中使用不同的除草劑施用方法來有效管理雜草。選擇正確的施用方法可以幫助農民實現經濟有效的解決方案,準確覆蓋目標區域並最大限度地減少浪費。效率的提升將最佳化除草劑的使用,最終降低農民的投入成本。

- 在農業實務中,土壤施用是除草劑使用的主要方式,佔2022年除草劑總施用量的48.2%。這種方法主要用於穀物和穀類的種植,佔據最大的市場佔有率,為62.0%。除草劑土壤處理是首選,因為它們有助於透過防止或減少雜草生長來保護作物和穀類的品質。這些除草劑可以在雜草出現之前或生長初期有效控制雜草。

- 此外,葉面噴布法佔了第二大市場佔有率, 2022 年佔 30.6%。事實證明,這種施藥技術對雜草控制非常有利,特別是在需要精確定位的作物,例如直接噴灑到目標植物的葉子上。這種方法對於控制抽穗後的雜草非常有效,並且通常用於許多作物。

- 在歐洲農業領域,除草劑的使用主要是為了最佳化作物生產力和提高整體盈利。美國除草劑市場佔有率預計將以4.1%的複合年成長率成長,顯示該市場預計將經歷顯著成長。

小麥、玉米和甜菜等主要作物中雜草的侵染日益嚴重,以及這些作物種植面積的不斷擴大,可能會推動市場的發展。

- 除了真菌疾病和害蟲外,雜草對歐洲農業部門的威脅也越來越大,對該地區的主要作物造成了廣泛的破壞。該地區除草劑消費佔了大部分市場佔有率,佔歐洲作物保護化學品市場的34.7%,2022年價值為49.3億美元。

- 2022 年,穀物和穀類的市場佔有率為 61.7%,佔據歐洲除草劑市場的主導地位。這一優勢是由於種植面積的增加和這些作物雜草的感染增加。有很多雜草會造成作物損失。在進行的實驗中,研究人員發現法國小麥種植中存在 108 種雜草,歐洲五個國家(丹麥、芬蘭、德國、拉脫維亞和瑞典)小麥種植中存在 197 種雜草。這些雜草種類的增加已經對小麥、玉米和甜菜等主要作物造成了危害。平均每年,未控制的雜草會導致小麥作物損失 25-30%,玉米作物損失 60-85%,甜菜作物損失 90-95%。

- 在歐洲國家,土壤施用除草劑處理越來越受歡迎。這種施用模式在2022年佔據了48.2%的領先市場佔有率。這一優勢很大程度上與早期生長階段的雜草控制有效性有關,這使得作物出苗更快,並減少了後期對除草劑的需求。由於這些優勢,這種應用模式預計將成長,預測期內複合年成長率估計為 4.1%。

- 受主要作物雜草侵染加劇的推動,預測期內歐洲除草劑市場預計將以 4.0% 的複合年成長率成長。

歐洲除草劑市場趨勢

預計農民將更多地依賴除草劑作為應對雜草挑戰的關鍵工具

- 歐洲除草劑消費量大幅增加,主要原因有很多。其中一個關鍵因素是,由於數百萬人從農村遷移到都市區,手工除草勞動力短缺。因此,使用除草劑已成為提高作物產量和品質的有效且經濟的方法。這一趨勢在 2019 年至 2022 年尤為明顯,該地區的除草劑消費量增加了 31.4%。

- 在歐洲國家中,德國和法國的除草劑使用率高於該地區的其他國家。 2022 年,德國的使用率為每公頃 3,100,緊隨其後的是法國,為 2,800。這些國家嚴重依賴包括除草劑在內的化學農藥的使用來確保農業生產的穩定性、數量和糧食安全。雜草的持久性和適應性使得這些地區必須增加除草劑的施用率。

- 此外,預計未來30年歐洲人口成長將導致糧食需求急劇增加。因此,為了滿足日益成長的糧食生產需求,即提高產量並保護作物免受有害雜草的侵害,對除草劑的需求預計會增加。

- 因此,預計預測期內(2023-2029 年),糧食需求增加、勞動力短缺和氣候變遷將推動除草劑的消費。未來幾年,農民可能會更加依賴除草劑作為應對這些挑戰、滿足不斷成長的糧食需求和確保永續農業生產力的重要工具。

在歐洲國家中,德國和法國的2022年Glyphosate價格最高,為每噸1,150美元。

- 2022 年,甲草胺的價格為每噸 16,700 美元。甲草胺是一種合成有機化合物,廣泛用作選擇性控制某些闊葉雜草和禾本科雜草的除草劑。甲草胺可用於蔬菜和田間作物、休閒區的草坪和非農業用地。劑型包括可濕性粉劑、乳油、水分散性顆粒劑(乾流動劑)及流動濃縮劑。甲草胺可透過多種方法施用,包括空中施用、化學施用和地面施用。

- 苯二甲戊靈苯二甲戊靈是一種具有殘留活性的出苗前除草劑,可廣譜控制多種作物(包括園藝、草坪和林業)中的一年生雜草和闊葉雜草。其主要作用方式是抑制易感雜草的細胞分裂和伸長,阻止根和芽的生長。 2022年,這種除草劑的價格為每噸3,300美元。

- Glyphosate類除草劑仍是歐洲使用最廣泛的除草劑,佔歐盟除草劑市場的33%。 2022年Glyphosate除草劑的價格為每噸1,200美元。Glyphosate除草劑的使用量持續大幅成長,在歐洲,特別是在歐盟的農業大國,銷售量仍然很大。來自農業會計數據網路(FADN)的資料顯示,農業在農藥上的支出整體正在增加。

- 在歐盟國家中,2022年德國和法國的Glyphosate價格最高,均為每噸1,150美元,其次是英國,每噸1,140美元。

歐洲除草劑產業概況

歐洲除草劑市場比較集中,前五大公司佔了65.24%的市佔率。市場的主要企業有:BASF公司、拜耳公司、科迪華農業科技、紐髮姆有限公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 歐洲其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001688

The Europe Herbicide Market size is estimated at 5.7 billion USD in 2025, and is expected to reach 6.97 billion USD by 2030, growing at a CAGR of 4.13% during the forecast period (2025-2030).

In Europe, soil treatment holds the utmost importance as the primary mode of herbicide application

- In Europe, various modes of herbicide application are employed to efficiently manage weeds in agriculture. By selecting appropriate application methods, farmers can achieve cost-effective solutions, ensuring precise coverage of targeted areas and minimizing wastage. This enhanced efficiency optimizes herbicide usage, ultimately leading to reduced input costs for farmers.

- In agricultural practices, soil application stands out as the predominant mode of herbicide usage, which represented 48.2% of the total herbicide application segment in 2022. This method is majorly employed in the cultivation of grains and cereals, which holds the largest market share at 62.0%. The preference for soil treatment of herbicides is driven by their efficacy in protecting the quality of grains and cereals by preventing or minimizing weed growth. They are effective in controlling weeds during their pre-emergent and early growth stages.

- Furthermore, the foliar application method secured the second-largest market share by value, which accounted for 30.6% in 2022. This application technique has proven to be advantageous for weed control, particularly in crops that require accurate targeting, for instance, when applied directly onto the leaves of target plants. This method is effective for controlling post-emergence weeds and is commonly used in many agricultural crops.

- In the European agricultural sector, herbicide usage is focused on optimizing crop productivity and enhancing overall profitability. The market is expected to witness significant growth, with a projected CAGR of 4.1% in terms of the US herbicide market share.

Growing weed infestations in major crops like wheat, maize, and sugar beet and extending cultivation area under this crops may drive the market

- Apart from fungal diseases and insect pests, weeds are becoming a threat to the European agriculture sector, causing huge damage to the major crops in the region. The consumption of herbicides in the region occupied a majority market share, which accounted for 34.7% of the European crop protection chemical market, with a market value of USD 4.93 billion in 2022.

- Grains and cereal crops dominated the European herbicide market with a 61.7% market share in 2022. This dominance was attributed to the higher cultivation area and increased weed infections in these crops. There are numerous weed species causing crop losses. According to an experiment conducted, researchers found 108 weed species in France's wheat crops, and 197 weed species were found in five European countries' wheat cultivations (Denmark, Finland, Germany, Latvia, and Sweden). These increased weed species caused damage to major crops such as wheat, maize, sugar beet, and other crops. On average, every year, uncontrolled weeds cause wheat crop loss of 25-30%, maize crop loss of 60-85%, and sugar beet crop loss of 90-95%.

- The application of herbicide products through soil treatment is gaining popularity in European countries. This application mode occupied a major market share of 48.2% in 2022. The dominance is majorly related to the effectiveness of controlling weeds in the early growth stage, which could give more strength to the crops for faster germination, reducing the herbicide's necessity in the later stages. Due to these benefits, the application mode is projected to grow, registering an estimated CAGR of 4.1% during the forecast period.

- The European herbicides market is anticipated to grow, registering a CAGR of 4.0% during the forecast, driven by increased weed infestations in major crops.

Europe Herbicide Market Trends

Farmers are expected to increasingly rely on herbicides as a key tool to manage weed challenges

- Europe has experienced substantial growth in the consumption of herbicides, primarily driven by various factors. One significant factor is the shortage of workers available for manual weeding, as millions of people have migrated from rural to urban areas. As a result, herbicide usage has emerged as an effective and cost-efficient method to enhance both the quality and quantity of crop yields. This trend was particularly notable from 2019 to 2022, with herbicide consumption in the region increasing by 31.4%.

- Among European countries, Germany and France have high herbicide usage rates compared to others in the region. In 2022, Germany recorded a usage rate of 3.1 thousand per hectare, while France followed closely with 2.8 thousand per hectare. These countries heavily rely on the application of chemical pesticides, including herbicides, to ensure the stability, quantity, and food security of their agricultural production. The persistence and adaptability of weeds have necessitated higher rates of herbicide application in these regions.

- Furthermore, the increasing European population has projected a rapid growth in food demand over the next three decades. Consequently, the demand for herbicides is also expected to rise to meet the increasing need for food production by increasing the yield and protecting crops from harmful weeds.

- Therefore, the rising demand for food, labor shortages, and climate change are expected to drive the consumption of herbicides during the forecast period (2023-2029). Farmers will increasingly rely on herbicides as a key tool over the coming years to address these challenges and meet the increasing food demand, ensuring sustainable agricultural productivity.

Among countries in Europe, the price of glyphosate in 2022 was highest in Germany and France, priced at USD 1.15 thousand per metric ton

- In 2022, Metribuzin was valued at USD 16.7 thousand per metric ton. It represents a synthetic organic compound widely utilized as a herbicide with selective control over specific broadleaf weeds and grassy weed species. The applications of Metribuzin are used in vegetable and field crops, turf grasses in recreational areas, and non-crop areas. Its available formulations include wettable powder, emulsifiable concentrate, water-dispersible granules (dry flowable), and flowable concentrate. Various methods, such as aerial, chemigation, and ground application, are employed for Metribuzin's application.

- Pendimethalin is a pre-emergence herbicide with residual activities that deliver broad-spectrum control against annual grasses and broadleaf weeds across different crops, including horticultural, turf, and forestry. Its primary mode of action involves inhibiting cell division and elongation in susceptible weeds, thus impeding root and shoot growth. In 2022, this herbicide was priced at USD 3.3 thousand per metric ton.

- Glyphosate-based herbicides maintain their position as the most widely used herbicide in Europe, which accounts for 33% of the EU herbicide market. In 2022, the price of glyphosate-based herbicides stood at USD 1.2 thousand per metric ton. The usage of glyphosate-based herbicides continues to witness significant growth, while sales in Europe, especially in larger agricultural member states of the European Union, remain substantial. Data from the Farm Accountancy Data Network (FADN) indicates a general increase in farmers' spending on pesticides.

- Among EU countries, the price of glyphosate in 2022 was highest in Germany and France, each priced at USD 1.15 thousand per metric ton, followed by the United Kingdom at USD 1.14 thousand per metric ton.

Europe Herbicide Industry Overview

The Europe Herbicide Market is fairly consolidated, with the top five companies occupying 65.24%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219