|

市場調查報告書

商品編碼

1687161

歐洲金屬罐:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

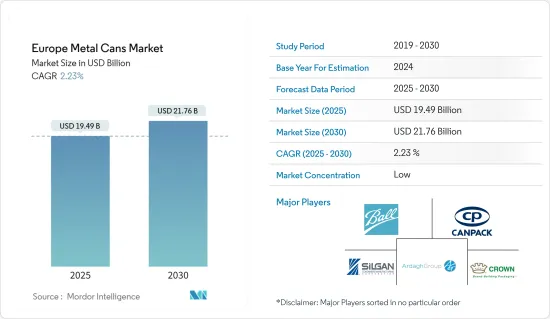

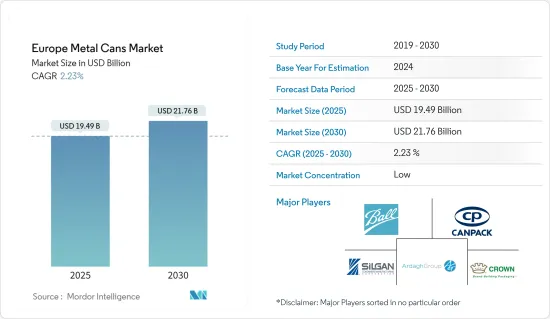

預計 2025 年歐洲金屬罐市場規模將達到 194.9 億美元,預計到 2030 年將達到 217.6 億美元,預測期內(2025-2030 年)的複合年成長率為 2.23%。

關鍵亮點

- 歐洲食品和飲料行業的強勁需求正在推動金屬罐市場的發展。金屬罐廣泛用於包裝蘇打水、啤酒、機能飲料以及湯和蔬菜等罐頭食品,具有保存期限長、避光防氣、便於運輸等優點。隨著方便已調理食品和飲料的日益普及,這一細分市場的穩定成長仍然強勁。

- 對永續包裝日益成長的需求正在推動市場擴張。鋁罐具有高度可回收性,這與消費者和監管機構遏制塑膠廢棄物的努力產生了共鳴。在歐洲,鋁罐回收率位居世界前列,對於希望維持環境標準的公司來說,鋁罐是最佳選擇。此外,歐洲關於包裝廢棄物和永續性的嚴格法規正在推動企業尋求環保解決方案,從而加強金屬罐市場。

- 除了永續性之外,優質包裝也受到人們的關注。該品牌利用金屬罐的實用性並將其作為行銷工具。由於印刷和設計技術的進步,品牌可以創造出視覺上引人注目的罐頭,從而吸引貨架上的注意力。這在飲料領域尤其明顯,引人注目的罐子可以提高產品知名度並傳達品牌形象。此外,人們越來越注重健康和即飲飲料的趨勢也推動了對金屬罐的需求。

- Ardagh Group、Ball Corporation 和 Crown Holdings 等歐洲製造商主導著金屬罐的生產和分銷。這些公司從全球供應商採購原料(主要是鋁和鋼),並在國際市場上交易成品。歐洲是金屬罐進出口的重要樞紐,主要受飲料產業需求的推動。

- 然而,歐洲金屬罐市場正面臨原料價格波動以及來自寶特瓶和紙盒等替代品的激烈競爭等挑戰。由於鋁生產的能源密集特性,存在環境問題。歐洲強大的回收基礎設施以及對永續和優質包裝的強勁需求預示著市場將持續成長。

歐洲金屬罐市場趨勢

酒精飲料銷量大幅成長

- 在歐洲,由於消費者越來越偏好便利性和便攜性,對酒精飲料領域金屬罐的需求正在穩步成長。罐頭比玻璃瓶更輕、更耐用,更易於運輸和儲存。這項好處對於戶外活動、節慶和都市區的行動消費有著巨大的影響。隨著消費者(尤其是年輕消費者)越來越注重便利性,包括啤酒、蘋果酒和即飲雞尾酒在內的罐裝酒精飲料市場持續擴大。金屬罐為這些產品提供了實用的包裝解決方案,推動了整個歐洲酒精飲料市場的採用。

- 永續性議題對歐洲金屬罐的需求產生了重大影響。消費者對環境議題的認知正在推動人們對環保包裝的偏好日益成長。鋁罐是可回收的,該地區的鋁回收率在全球名列前茅。隨著歐洲各國政府加強對塑膠包裝和廢棄物管理的監管,酒精飲料品牌開始轉向金屬罐作為永續的解決方案。這種變化與消費者對環保產品和包裝的需求相吻合,使得金屬罐對生產者和消費者都有好處。

- 歐洲的優質化趨勢導致酒精飲料市場對金屬罐的需求增加。精釀啤酒、硬蘇打水和優質即飲雞尾酒的成長促使製造商使用設計時尚的高品質鋁罐。印刷和裝飾技術的進步使得創建充滿活力的客製化包裝成為可能,從而提高了品牌知名度和產品差異化。隨著消費者追求優質體驗,品牌正在使用金屬罐來提升品質和創新,並支持歐洲市場的成長。

- 歐洲健康飲料的出現將影響金屬罐的需求。低酒精、低卡路里和無酒精飲料,如硬蘇打水、機能飲料和無酒精啤酒,越來越受歡迎。由於金屬罐包裝方便、重量輕,因此經常用於包裝這些飲料。隨著健康趨勢繼續影響歐洲酒精飲料市場,金屬罐成為這些新興產品的有效包裝解決方案,增加了市場影響。

- 預計德國啤酒產量將從 2024 年 3 月的 5,336,340 百公升增加到 2024 年 5 月的 6,768,340 百公升,從而推動包裝市場對金屬罐的需求。啤酒市場的成長,尤其是在春季和夏季,增加了對提供便利性、耐用性和永續性的包裝解決方案的需求。金屬罐,尤其是鋁罐,由於其重量輕、可回收且能夠保持飲料質量,是首選的啤酒包裝。

- 德國啤酒產量的成長與支持金屬罐需求的市場趨勢相吻合。消費者對攜帶式飲料包裝的偏好使得罐裝飲料成為製造商和消費者高效且經濟的選擇。戶外活動和節日期間啤酒銷售的增加需要能夠確保運輸和處理過程中產品完整性的包裝解決方案。金屬罐有效地滿足了這些要求,因此成為德國啤酒製造商和供應商的首選。

英國佔有較大的市場佔有率

- 英國金屬罐包裝市場持續擴大,尤其是在飲料領域,啤酒、軟性飲料、能量飲料和即飲雞尾酒的銷售量都在成長。鋁罐因其重量輕、可回收和產品保存能力強等特點,已成為許多品牌的主要包裝選擇。這些屬性與英國消費者對便攜性和環保包裝的偏好相一致。

- 消費者對永續包裝的需求對英國採用金屬罐產生了重大影響。旨在減少塑膠廢棄物的環境法規的實施使鋁罐成為可行的替代品。罐頭的無限可回收性支持了英國的循環經濟目標。政府措施包括塑膠包裝稅和生產者延伸責任(EPR)計劃,鼓勵企業採用金屬罐包裝。英國到 2050 年實現淨零排放的目標增強了永續包裝選擇的市場潛力,例如金屬罐取代玻璃和塑膠替代品。

- 健康和保健趨勢也影響了英國金屬罐包裝的興起。消費者越來越尋求低酒精、低卡路里和機能飲料(如硬蘇打水、康普茶和健身飲料)。這些產品通常採用罐裝,消費者認為這樣既方便又環保。罐子的重量輕和可回收特性吸引了注重健康的人們,他們正在尋找既能補充他們積極的生活方式又能支持永續性的產品。包裝保持了飲料的新鮮度和碳酸化,這對於硬蘇打水和精釀啤酒等產品尤其重要。

- 在英國,精釀啤酒運動和酒精飲料的優質化正在推動高品質金屬罐包裝的需求。精釀啤酒廠和精品啤酒生產商選擇罐裝啤酒是因為其實用性以及展示創新設計和品牌的能力。金屬罐可印上鮮豔的自訂圖形和精細的藝術品,吸引注重設計的消費者。鋁罐可以保護精釀啤酒免受光照和氧氣的侵害,從而保持其品質。產品保存期限和設計的結合使得罐頭成為優質飲料的首選包裝,支持了英國金屬罐市場的成長。

- 在英國,由於紅牛(5.1073億美元)、怪獸(4.4453億美元)和Lucozade(2.8507億美元)等主要能量飲料品牌的零售額高,對金屬罐包裝的需求正在成長。這些公司選擇金屬罐是因為其方便、便攜,並且能夠保持產品的新鮮度和碳酸化,滿足了消費者隨時隨地消費的偏好。鋁罐的可回收性也吸引了有環保意識的消費者。 Prime 和 Euro Shopper 等高階品牌和平價品牌都在採用金屬罐包裝來格式其產品品質並滿足永續性要求,這表明能量飲料市場對金屬罐的需求持續成長。

- 英國金屬罐包裝的流行趨勢受到多種因素的推動,包括永續性、便利性、消費者對更健康飲料的需求以及酒精飲料的優質化。鋁罐可回收、高效且對消費者友好,因此其在各種飲料類別中的受歡迎程度可能會持續成長。隨著消費者偏好轉向更環保和便捷的包裝,英國金屬罐市場預計將在設計、功能和永續性創新的推動下實現持續成長。

歐洲金屬罐產業概況

歐洲金屬罐市場是分散的,有多家公司在該地區運作。主要企業包括 Ball Corporation、Ardagh Group SA、Crown Holdings, Inc. 和 Silgan Holdings Inc. 這些公司透過各種策略舉措爭奪市場佔有率。併購有助於企業擴大其地理影響力和生產能力。

透過合作,各公司正在加強其供應鏈網路並提高其市場地位。產品創新使公司能夠滿足不斷變化的消費者需求並在市場上保持競爭優勢。公司也專注於永續性計劃和技術進步,以使自己與競爭對手區分開來。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 金屬包裝回收率高

- 隨著永續性變得越來越重要,金屬罐因其高回收性而大放異彩

- 市場問題

- 替代包裝解決方案的可用性

第6章市場區隔

- 依材料類型

- 鋁

- 鋼

- 按類型

- 食品罐

- 蔬菜

- 水果

- 寵物食品

- 湯和調味品

- 其他食品罐(嬰兒食品、乳製品、果菜汁、水產品、肉類和家禽罐頭)

- 飲料罐

- 酒精飲料

- 非酒精性

- 氣霧罐

- 個人護理和化妝品

- 家庭和居家醫療

- 其他氣霧罐

- 其他罐頭

- 食品罐

- 按國家

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 波蘭

第7章競爭格局

- 公司簡介

- Ball Corporation

- Ardagh Group

- Crown Holdings, Inc.

- Silgan Holdings Inc.

- CAN-PACK SA

- Massilly Holding SAS

- Tecnocap Group

- Tata Europe Ltd

- ASA Group

- Eurobox Metal Packaging

第8章投資分析

第9章:未來市場展望

The Europe Metal Cans Market size is estimated at USD 19.49 billion in 2025, and is expected to reach USD 21.76 billion by 2030, at a CAGR of 2.23% during the forecast period (2025-2030).

Key Highlights

- The food and beverage sector's robust European demand propels the metal cans market. Widely utilized for packaging carbonated drinks, beer, energy drinks, and canned foods like soups and vegetables, metal cans boast advantages such as extended shelf life, protection from light and air, and transport ease. With the rising popularity of convenient ready-to-eat meals and beverages, this sector's steady growth is still strong.

- A surging demand for sustainable packaging is driving the market's expansion. Aluminum cans, being highly recyclable, resonate with the mounting consumer and regulatory push to curb plastic waste. Europe, boasting one of the world's highest recycling rates for aluminum cans, positions these cans as the top choice for companies aiming to uphold environmental standards. Furthermore, stringent European regulations on packaging waste and sustainability are nudging businesses towards eco-friendly solutions, bolstering the metal cans market.

- Beyond sustainability, there's a notable pivot towards premium packaging. Brands are leveraging metal cans for their practicality and as a marketing tool. Thanks to advancements in printing and design, brands can craft visually striking cans that capture attention on shelves. This is particularly evident in the beverage sector, where eye-catching cans enhance product visibility and convey brand identity. Additionally, the rising trend of health-conscious, ready-to-drink beverages amplifies the demand for metal cans.

- European manufacturers, including Ardagh Group, Ball Corporation, and Crown Holdings, dominate the production and distribution of metal cans. These companies source raw materials from global suppliers, primarily aluminum and steel, and trade their finished products in international markets. Europe is a significant hub for importing and exporting metal cans, mainly driven by demand from the beverage industry.

- However, the European metal cans market grapples with challenges, including volatile raw material prices and stiff competition from alternatives like plastic bottles and cartons. The energy-intensive nature of aluminum manufacturing raises environmental concerns. Nevertheless, Europe's strong recycling infrastructure and a persistent demand for sustainable, convenient, and premium packaging bodes well for the market's continued growth.

Europe Metal Cans Market Trends

Alcoholic Beverages to Register Significant Growth Rate

- In Europe, the demand for metal cans in the alcoholic beverage sector has increased steadily due to consumers' growing preference for convenience and portability. Cans are lighter and more durable than glass bottles, making them easier to transport and store. This advantage is significant for outdoor events, festivals, and on-the-go consumption in urban areas. As consumers, particularly younger demographics, prioritize convenience, the market for canned alcoholic beverages, including beer, cider, and ready-to-drink cocktails, continues to expand. Metal cans provide a practical packaging solution for these products, driving their adoption across the European alcoholic beverage market.

- Sustainability concerns significantly influence the demand for metal cans in Europe. Consumer awareness of environmental issues has increased the preference for eco-friendly packaging. Aluminum cans are recyclable, and the region maintains one of the highest aluminum recycling rates globally. As European governments implement stricter regulations on plastic packaging and waste management, alcoholic beverage brands are adopting metal cans as a sustainable solution. This shift aligns with consumer demand for environmentally responsible products and packaging, making metal cans advantageous for producers and consumers.

- The premiumization trend in Europe contributes to the increased demand for metal cans in the alcoholic beverage market. The growth of craft beers, hard seltzers, and premium ready-to-drink cocktails has prompted manufacturers to use high-quality aluminum cans with refined designs. Printing and decoration technology improvements enable vibrant and customized packaging that enhances brand visibility and product differentiation. As consumers seek premium experiences, brands use metal cans to demonstrate quality and innovation, supporting European market growth.

- The emergence of health-conscious drinking in Europe affects metal can demand. Low-alcohol, low-calorie, and alcohol-free beverages, including hard seltzers, functional drinks, and alcohol-free beers, have gained popularity. Due to their convenience and lightweight properties, these beverages frequently use metal can packaging. As health trends continue to influence the European alcoholic beverage market, metal cans serve as an effective packaging solution for these emerging products, increasing their market presence in the region.

- The beer sales volume in Germany increased from 5,336.34 thousand hectoliters in March 2024 to 6,768.34 thousand hectoliters in May 2024, driving the demand for metal cans in the packaging market. The beer market growth, particularly during the spring and summer, increases the requirement for packaging solutions that provide convenience, durability, and sustainability. Metal cans, specifically aluminum cans, are preferred for beer packaging due to their lightweight nature, recyclability, and ability to preserve beverage quality.

- The increasing beer sales volumes in Germany correspond with market trends supporting metal can demand. Consumer preferences for portable and convenient beverage packaging make cans an efficient and cost-effective option for manufacturers and consumers. The increase in beer sales during outdoor events and festivals requires packaging solutions that ensure product integrity during transport and handling. Metal cans effectively meet these requirements, making them a primary choice for beer producers and suppliers in Germany.

United Kingdom to Hold Significant Market Share

- The metal can packaging market in the UK continues to expand, particularly in the beverage sector, with growth across beer, soft drinks, energy drinks, and ready-to-drink cocktails. Aluminum cans have emerged as a primary packaging option for many brands due to their lightweight properties, recyclability, and product preservation capabilities. These characteristics align with UK consumer preferences for portable and environmentally responsible packaging.

- Consumer demand for sustainable packaging has significantly influenced the adoption of metal cans in the UK. Implementing environmental regulations targeting plastic waste reduction has positioned aluminum cans as a viable alternative. The infinite recyclability of cans supports the UK's circular economy objectives. Government policies, including the Plastic Packaging Tax and Extended Producer Responsibility (EPR) schemes, have encouraged companies to adopt metal can packaging. The UK's net zero emissions target by 2050 reinforces the market potential for sustainable packaging options like metal cans over glass and plastic alternatives.

- Health and wellness trends have also influenced the rise of metal can packaging in the UK. Consumers increasingly seek low-alcohol, low-calorie, and functional beverages like hard seltzers, kombucha, and fitness-focused drinks. These products are often packaged in cans, which consumers perceive as convenient and environmentally responsible. The lightweight nature of cans, combined with their recyclability, appeals to health-conscious individuals seeking products that complement their active lifestyles while supporting sustainability. The packaging maintains beverage freshness and carbonation, which is particularly important for products like hard seltzers and craft beers.

- The craft beer movement and premiumization of alcoholic beverages in the UK have increased demand for high-quality metal can packaging. Craft breweries and boutique producers select cans for their practicality and capacity to showcase innovative designs and branding. Metal cans enable vibrant, custom graphics and detailed artwork that appeal to design-conscious consumers. Aluminum cans preserve craft beer quality by protecting against light and oxygen exposure. This combination of product preservation and design capabilities has established cans as a preferred packaging choice for premium beverages, supporting metal can market growth in the UK.

- The high retail sales revenue of major energy drink brands in the UK, including Red Bull (USD 510.73 million), Monster (USD 444.53 million), and Lucozade (USD 285.07 million), drives the demand for metal can packaging. These companies choose metal cans for their convenience, portability, and ability to maintain product freshness and carbonation, which suits consumer preferences for on-the-go consumption. The recyclability of aluminum cans also attracts environmentally conscious consumers. Both premium and value brands, such as Prime and Euro Shopper, are adopting metal can packaging to improve product presentation and meet sustainability requirements, indicating continued growth in metal can demand within the energy drink market.

- The metal can packaging trend in the UK is driven by a convergence of factors, including sustainability, convenience, consumer demand for healthier drinks, and the premiumization of alcoholic beverages. With aluminum cans offering a recyclable, efficient, and consumer-friendly solution, their popularity is likely to continue rising across various beverage categories. As consumer preferences shift toward more eco-conscious and convenient packaging, the metal can market in the UK is poised for sustained growth, fueled by design, functionality, and sustainability innovations.

Europe Metal Cans Industry Overview

The European metal cans market is fragmented, with multiple companies operating in the region. Major players include Ball Corporation, Ardagh Group S.A., Crown Holdings, Inc., and Silgan Holdings Inc. These companies compete for market share through various strategic initiatives. Mergers and acquisitions help companies expand their geographical presence and production capabilities.

Companies strengthen their supply chain networks and enhance their market position through collaborations. Product innovations enable companies to meet evolving consumer demands and maintain competitive advantages in the market. Companies also focus on sustainability initiatives and technological advancements to differentiate themselves from competitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macro-economic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 Sustainability Gains Importance, Metal Cans Shine with Their High Recyclability

- 5.2 Market Challenge

- 5.2.1 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Type

- 6.2.1 Food Cans

- 6.2.1.1 Vegetables

- 6.2.1.2 Fruits

- 6.2.1.3 Pet Food

- 6.2.1.4 Soups and Condiments

- 6.2.1.5 Other Food Cans (Baby Food, Dairy, Fruit/Vegetable Juices, Seafood, and Meat and Poultry Cans)

- 6.2.2 Beverage Cans

- 6.2.2.1 Alcoholic

- 6.2.2.2 Non-Alcoholic

- 6.2.3 Aerosol Cans

- 6.2.3.1 Personal care and Cosmetics

- 6.2.3.2 Household and Homecare

- 6.2.3.3 Other Aerosol Cans

- 6.2.4 Other Cans

- 6.2.1 Food Cans

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Poland

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group

- 7.1.3 Crown Holdings, Inc.

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 CAN-PACK SA

- 7.1.6 Massilly Holding SAS

- 7.1.7 Tecnocap Group

- 7.1.8 Tata Europe Ltd

- 7.1.9 ASA Group

- 7.1.10 Eurobox Metal Packaging