|

市場調查報告書

商品編碼

1687952

印度二手車融資:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Used Car Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

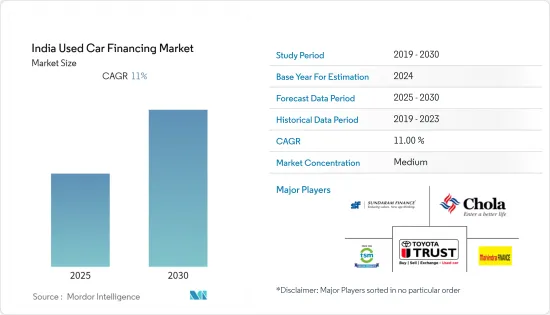

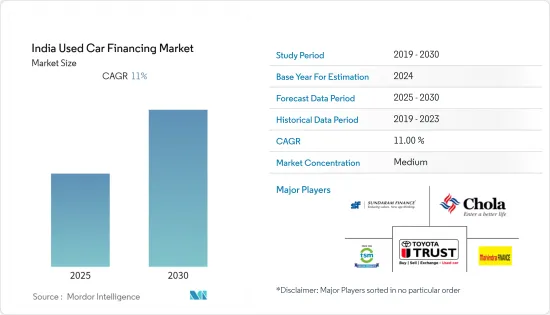

預計預測期內印度二手車融資市場的複合年成長率將達到 11%。

由於新車銷售大爆發,全國主要消費者都面臨財務挑戰。因此,市場可能會經歷顯著成長。消費者越來越偏好擁有汽車並避免乘坐公共運輸,這也是全國二手車市場的關鍵因素。擁有一輛汽車曾經是身份的象徵,但如今它已成為一種必需品。汽車產業自誕生以來一直經歷快速成長。消費者對二手車的青睞程度比以往任何時候都要高,有些人甚至比二手更喜歡二手車。

如今,大多數顧客在購買汽車時都會獲得某種形式的經濟援助。目前二手車融資利率約為13-15%,這對製造商和金融機構來說是一個巨大的機會。目前,印度的二手車產業規模約為新車產業的1.3倍,這可能會在市場上創造機會。

印度將於2020年起引入BS-VI標準,屆時必要的安全設備將成為強制性要求,因此新車價格預計會上漲。此外,由於很少有製造商逐步淘汰柴油汽車產品,那些喜歡耐用性和燃油經濟性的柴油汽車的消費者也開始轉向二手車市場。預計這些因素將再次提振二手車融資。

二手車融資市場趨勢

二手車產業快速成長帶動融資市場

過去幾年,印度的二手車業務呈指數級成長。 2016年二手車銷售約330萬輛,2019年突破400萬輛,二手車銷售超過新車銷售。預計21會計年度印度二手車銷售將達到約440萬輛,將為二手車融資市場創造機會。

數位化的提高和新經營模式的新興企業正在推動二手車融資市場的發展。數位化有助於儲存、保留和搜尋資料。幾乎所有資訊都是數位形式。這減少了所需的資本資源,也減少了文件儲存的問題。汽車金融數位化的提高,延伸至端到端,包括電子簽章和數位貸款文件,機會會讓您在市場上佔據優勢。

- 2022年2月,Kuwy為線上汽車經銷商推出了端到端數位借貸平台。該平台將使汽車製造商、經銷商、聚合平台和貸方能夠為其客戶提供數位零售。

全國共享出行服務的興起很可能成為二手車融資市場的主要驅動力。此外,二手車消費稅稅率從28%下調至12-18%也是推動市場發展的因素。隨著各公司逐漸將重點放在減少柴油產量上,例如瑪魯蒂鈴木決定在 2020 年 4 月前退出柴油市場,預計也將刺激二手車市場對小型柴油車的需求(主要原因是行駛里程數更高),除非出現對柴油車的強烈抵制。

瑪魯蒂鈴木和塔塔汽車等OEM製造商佔有重要地位,吸引了消費者對二手車的需求。奧迪等豪華汽車廠商也紛紛進入二手車市場,豪華車的二手車銷售量不斷成長。豪華車的需求也穩定成長,2018 年銷量約為 50,000 輛,而上一年銷量約為 40,800 輛。直到幾年前,由於經濟困難,擁有豪華車對許多消費者來說還是一個夢想,但這種情況正在慢慢改變,因為現在消費者可以輕鬆購買二手豪華車,而且市場變得更加有序,可以輕鬆獲得融資選擇、年度維護合約和更低的入門價格。

非銀行金融公司傾向為二手車二手融資,以擺脫市場低迷

疫情過後,非銀行金融公司 (NBFC) 的二手車融資需求正在增加。在基礎設施租賃和金融服務公司 (IL&FS) 違約引發的流動性緊縮中,Mahindra Finance、Shriram Finance 和 Magma Fincorp 等大型 NBFC 正努力應對資金成本上升的問題。金融機構也正在加強借款人審查,並避免向風險相對較高的群體發放貸款。針對這種情況,一些金融機構紛紛轉向二手車基金,以確保利潤空間。例如

- Cholamandalam Investments & Finance Company (Chola) 的二手車融資佔有率在 21 會計年度和 22 會計年度為 27%,比 20 會計年度成長了 1%。光是上一會計年度(FY22)第四季度,獲得融資的二手車數量就達到約 57,000 輛,與 2021 會計年度第四季相比大幅增加了 17,000 輛。

BS-VI 預購和流動性條件放寬將導致交易量回升,預計將為二手車金融業提供更多機會。 Cars24 是一家領先的線上汽車買賣平台,目前正進軍融資業務。該公司於 2019 年 7 月從印度儲備銀行獲得 NBFC 許可證,並計劃在第一年貸款約 2,500 萬美元。

二手車金融業概況

印度的二手車金融市場較為分散。大量有組織和無組織的參與企業的存在導致了這種市場局面。除了提供自己的融資外,大多數汽車製造商還與銀行和其他金融機構合作,為客戶提供更多選擇。然而,由於從各個 NBFC 籌集貸款的程序相對簡單,預計市場將向它們傾斜。 Maruti Suzuki Limited、Mahindra Finance、Poonawalla Fincorp、Sundaram Finance、Bluecarz、TSM Cars 等是該市場的主要企業。大型OEM已與 NBFC 合作,為消費者提供貸款。例如

- 2021 年 8 月,塔塔汽車與 Sundaram Finance 合作,為購買該公司乘用車系列的客戶提供專屬優惠。 Sundaram Finance 與塔塔汽車 (Tata Motors) 合作,在其新的「Forever」系列中列出了六年期貸款。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 汽車模型

- 掀背車

- 轎車

- 運動型多用途車

- 多用途車輛

- 投資者

- OEM

- 銀行

- 金融機構

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Blue Carz

- Toyota Trust

- Mahindra Finance

- Tata Capital

- Bajaj Finserv

- Maruti Suzuki True Value

- Droom Credit

- TSM Cars

- Poonawalla Fincorp

- Sundaram Finance Ltd

- CHOLAMANDALAM

第7章 市場機會與未來趨勢

The India Used Car Financing Market is expected to register a CAGR of 11% during the forecast period.

Major consumers across the country are facing financial issues due to the pandemic surge in the selling of newer cars. This is likely to witness major growth for the market. Rising consumer preference for owning a vehicle and avoiding public transportation is also a key factor for the used car market across the country. Ownership of cars, which used to be a status symbol long ago, has become a necessity in recent times. The automotive industry has witnessed exponential growth since its inception. Consumers are looking at used cars ever more than before, and some are even preferring them over two-wheelers.

Nowadays, the majority of customers opt to purchase an automobile, depending on some type of financial assistance. The current rate of financing for used cars is just around 13-15% and offers a tremendous opportunity for manufacturers as well as financial institutions alike. Currently, the used car industry is around 1.3 times the new car industry in India which is likely to create an opportunity for the market.

With BS-VI rolling out in the country from the year 2020 and subsequent mandates for necessary safety features, the cost of new cars is expected to grow up. Also, few manufacturers are phasing out their diesel portfolio, and consumers who prefer diesel cars for their durability and mileage figures are also looking toward the used car space. These factors are again expected to drive used car financing.

Second Hand Car Finance Market Trends

Burgeoning Used Car Industry Subsequently Driving the Financing Market

The used car business in India has been picking up pace over the past few years. In 2016, roughly 3.3 million used cars were sold, and in FY2019, the number breached the 4 million mark, with pre-owned cars registering more sales than new cars. In FY2021, around 4.4 million used cars were sold in India, which is likely to create an opportunity for the used car financing market.

Growing digitization and startup with new business models is promoting the used car financing market. Digitization helps to store, retain and retrieve data. Almost all information is in digital format. This reduces the capital resources required and reduces the problem of storing documents. An increase in digitization in auto finance will extend end to end, including e-signatures and digital loan documents have an opportunity to gain an advantage over the market. For instance,

- In February 2022, Kuwy launched end to end digital lending platform for online car sellers. The platform allows car manufacturers, dealers, aggregator platforms, and lenders to offer digital retailing to their customers.

The rise in shared mobility services across the country is likely to be a key factor for the used car financing market. Also, the revision of the GST rate on used cars from 28% to 12 - 18% is also acting as a driver of the market. With companies gradually focusing on reducing the production of diesel cars, for instance, Maruti Suzuki's decision to exit the diesel car segment by April 2020 is also expected to increase the demand for compact diesel cars (mainly due to their higher mileage figures) in the used car market, unless there is a backlash against diesel cars.

The major presence of OEMs, including Maruti Suzuki, Tata Motors, and others, are attracting consumers for used cars and offering better financing options owing to which the demand for used cars is increasing. Even luxury car makers, including Audi, also entered the used car market, which increased the sale of used premium cars. The demand for luxury cars is also witnessing a continual increase, with nearly 50,000 units sold in 2018 compared to around 40,800 in the previous year. Until a few years ago, owning a luxury car used to be a dream for numerous consumers, owing to financial hurdles, but this is gradually changing, as the consumers can easily buy pre-owned luxury vehicles, as the market is becoming more organized with easy access to financing options, annual maintenance contracts, and lower entry prices.

NBFC's inclined towards funding used cars to recover from market slump

Non-Banking Financial Companies (NBFCs) are witnessing an increase in demand for financing for used vehicles post-Covid. Leading NBFCs such as Mahindra Finance, Shriram Finance, and Magma Fincorp have been forced to struggle with the rising cost of funds amid a liquidity squeeze that was sparked by the default by Infrastructure Leasing & Financial Services (IL&FS). Even financiers have tightened screening of borrowers and are now going slow on the relatively higher risk segments. In lieu of this situation, several lenders have turned to fund used cars to protect their margins. For instance,

- Cholamandalam Investments & Finance Company (Chola) witnessed a share of used vehicle finance in FY21 and FY22 was 27%, an increase of 1% over FY20. In Q4 last fiscal (FY22) alone, the number of used vehicles that were financed rose to around 57,000, a jump by 17,000 vehicles, when compared with the corresponding fourth quarter of FY21.

Anticipatory volume recovery led by BS-VI pre-buying and easing of the liquidity situation is expected to provide further opportunity to the used car financing sector. Cars24, a leading online platform that facilitates buying and selling of cars, is now venturing into the financing business. The company acquired NBFC license from the Reserve Bank of India in July 2019 and is aiming for disbursement of nearly US$ 25 million in its maiden year.

Second Hand Car Finance Industry Overview

The market for used car financing in India is on the fragmented side. The presence of many organized and un-organized players has created such a market scenario. Also, most auto manufacturers, apart from offering their own financing, have tie-ups with banks and other financial institutions to offer a wider choice for their customers. But the relatively easier procedures to procure a loan from various NBFCs are expected to tilt the market in their favor. Maruti Suzuki Limited, Mahindra Finance, Poonawalla Fincorp, Sundaram Finance, Bluecarz, TSM Cars, etc., are some of the major players in the market. Major OEMs are partnering with the NBFCs to provide loans for the consumer. For instance,

- In August 2021, Tata Motors partnered with Sundaram Finance to offer exclusive offers to customers opting to purchase its range of passenger cars. Under the partnership with TATA Motors, Sundaram Finance would offer six-year loans on the new 'Forever' range of cars, and with 100% financing, that would require a minimal down payment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Car Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicle

- 5.1.4 Multi-purpose Vehicle

- 5.2 Financier

- 5.2.1 OEMs

- 5.2.2 Banks

- 5.2.3 NBFCs

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Blue Carz

- 6.2.2 Toyota Trust

- 6.2.3 Mahindra Finance

- 6.2.4 Tata Capital

- 6.2.5 Bajaj Finserv

- 6.2.6 Maruti Suzuki True Value

- 6.2.7 Droom Credit

- 6.2.8 TSM Cars

- 6.2.9 Poonawalla Fincorp

- 6.2.10 Sundaram Finance Ltd

- 6.2.11 CHOLAMANDALAM