|

市場調查報告書

商品編碼

1641858

託管IT基礎設施服務 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Managed IT Infrastructure Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

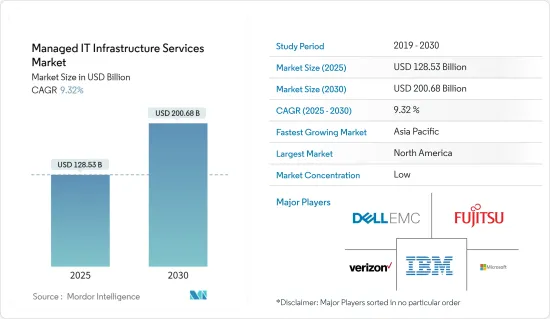

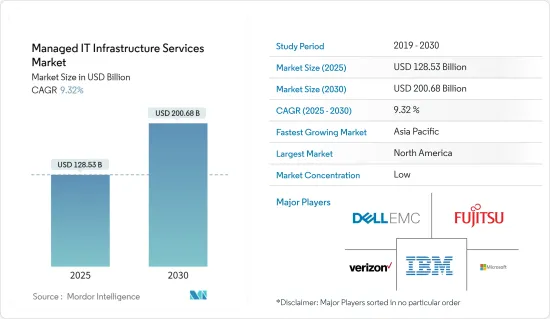

託管IT基礎設施服務市場規模在 2025 年估計為 1,285.3 億美元,預計到 2030 年將達到 2006.8 億美元,預測期內(2025-2030 年)的複合年成長率為 9.32%。

關鍵亮點

- 企業在努力維持IT基礎設施以最佳效能水準運作與管理相關成本之間取得平衡,擴大轉向供應商提供基礎架構服務。託管基礎設施服務可協助各行業專注於其核心業務。

- 這些服務主要應用於 IT 產業,該產業中成本最佳化、專注於核心競爭力和資料安全仍然是主要關注點。然而,最近雲端基礎的技術的廣泛採用和技術進步極大地促進了這一趨勢。

- 巨量資料等技術的廣泛應用進一步增加了外包IT服務的需求。透過利用巨量資料和雲端的結合,企業可以提供可擴展且經濟高效的解決方案。例如,亞馬遜的「Elastic Map Reduce」展示瞭如何利用雲端的彈性運算能力進行巨量資料處理。

- 此外,更新老化硬體的需求也是市場的一個促進因素。根據Spice works Inc. 的一項調查,在接受調查的700 家公司中,64% 的公司認為更新過時的資訊技術(IT) 基礎設施的必要性和安全性問題是IT 預算過高的主要原因。答案是肯定的。

託管IT基礎設施服務市場趨勢

雲端基礎的技術的傳播和發展將補充需求

- 在當前的市場情況下,對雲端服務的依賴性不斷增加以及基礎設施升級活動是推動託管IT基礎設施服務需求的關鍵因素。事實上,未來幾年大部分基礎設施開發將是為了支援日益成長的雲端服務需求。

- IT基礎設施本身的格局正在快速改變。隨著越來越多的企業將其大部分或全部 IT 服務和應用程式遷移到雲端,傳統的存儲伺服器正在迅速消失。因此,隨著企業增加對先進雲端基礎設施的投資,預計預測期內甚至對傳統IT基礎設施的投資也會下降。

- 此外,根據思科全球雲端指數報告,到今年,90% 以上的工作負載將雲端基礎。全球雲端流量將佔所有資料中心流量的95%。同時,傳統資料中心的工作量和計算實例預計在同一時期內也會下降。從歷史上看,單一伺服器負責一個工作負載和計算實例。然而,隨著伺服器運算能力和虛擬的增加,每個實體伺服器的多個工作負載和運算實例在雲端架構中變得越來越普遍。

北美佔有最大市場佔有率

- 由於技術採用速度快且 IT資料中心數量眾多,北美仍是託管IT基礎設施服務的最大市場。

- 由於強大的IT基礎設施、法律、標準和技術經驗,北美在過去幾年中經歷了雲端遷移的急劇成長。此外,北美雲端遷移服務市場的擴張也受到亞馬遜網路服務、IBM 公司、微軟公司、谷歌和思科系統公司等知名雲端運算公司的推動。

- 另一個因素是多個終端使用者產業的高度自動化和 IT 應用的大規模普及,使得該地區對IT基礎設施服務的需求持續存在。

管理IT基礎設施服務業概況

託管IT基礎設施服務市場競爭激烈,參與企業。隨著市場變得更加分散,擴大策略越來越專注於收購和細分市場。隨著所提供服務的性質不斷演變,所有參與企業必須繼續投資新時代的技能和技術,以保持相關性並在競爭中保持領先。只有透過聘用合適的研發人才或收購有可能顛覆這一領域的有趣的新興企業才能實現這一目標。與大公司相比,中小企業的優勢在於,由於他們的資料中心位於本地,因此可以更好地服務本地市場。因此,大公司被迫積極進行收購,以加強其全球企業發展。

2022年8月,戴爾科技宣布推出與VMware共同設計的全新基礎架構解決方案。

2022年3月,Verizon Communications Inc.表示,將在2022年終將其5G超寬頻網路擴展到1.75億人。該公司概述了幾個成長槓桿,包括5G移動性、全國寬頻、行動邊緣運算(MEC)、業務解決方案、價值市場和網路收益,這些將推動服務和其他收益成長。展望。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查假設和定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 擁抱市場動態

- 市場促進因素

- 透過引入託管服務來最佳化成本

- 雲端基礎技術的傳播和發展是促進因素

- 市場限制

- 安全和隱私問題是限制因素

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按服務類別

- 虛擬

- 聯網

- 貯存

- 伺服器

- 按公司規模

- 中小企業

- 大型企業

- 按部署

- 本地

- 雲

- 按最終用戶

- 資訊科技/通訊

- 零售

- 運輸和物流

- BFSI

- 製造業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Fujitsu Ltd.

- CSS Corp Pvt Ltd.

- Dell EMC(EMC Corporation)

- IBM Corporation

- Alcatel-Lucent SA(Nokia Corporation)

- Microsoft Corporation

- Verizon Communications Inc.

- Citrix Systems Inc.

- Tata Consultancy Services Limited

- Deutsche Telekom AG

第7章投資分析

第8章 市場機會與未來趨勢

The Managed IT Infrastructure Services Market size is estimated at USD 128.53 billion in 2025, and is expected to reach USD 200.68 billion by 2030, at a CAGR of 9.32% during the forecast period (2025-2030).

Key Highlights

- Companies struggling to strike a balance between ensuring their IT infrastructure functions at optimal performance levels and simultaneously managing the associated costs are increasingly hiring vendors offering infrastructure services. Managed infrastructure services help different industry verticals to focus only on their core business.

- These services are mostly being adopted in the IT industry, where cost optimization, emphasis on core competencies, and data security remain significant concerns. However, the recent proliferation of cloud-based technology and technological advancements is the major contributor to this trend.

- The proliferation of technologies like big data has further added to the need for outsourcing IT services. Companies can leverage the combination of both Big Data and the Cloud to provide scalable and cost-effective solutions. For example, Amazon's "Elastic Map Reduce" demonstrates how the power of cloud elastic computes is leveraged for big data processing.

- Further, the need to update outdated hardware is another major market driver. According to a survey conducted by Spice works Inc., 64% of the 700 companies involved in the study reported that the need to update outdated information technology (IT) infrastructure and security concerns are the major factors leading to high IT budgets.

Managed IT Infrastructure Services Market Trends

Technological Proliferation and Advancement of Cloud Based Technology Complement the Demand

- In the current market scenario, the increasing dependency on cloud services and infrastructure upgrading activities are the major factors driving the demand for managed IT infrastructure services. In fact, most of the infrastructure developments in the next few years are dedicated to supporting the increasing demand for cloud services.

- The landscape of IT infrastructure itself is changing rapidly. Traditional racks of servers stored in cages are quickly disappearing as more companies migrate most or all of their IT services and applications to the cloud. As a result, even investments in traditional IT infrastructure are expected to decline over the forecast period as companies increasingly invest in advanced cloud infrastructure.

- Moreover, according to the Cisco Global Cloud Index Report, more than 90 percent of all workloads will be cloud-based by this year. Global cloud traffic will represent 95 percent of total data center traffic. Whereas traditional data center workloads and compute instances are expected to decline during the same period. Historically, one server carried one workload and computed instance. But with increasing server computing capacity and virtualization, multiple workloads and compute instances per physical server are common in cloud architectures.

North America Region to Hold the Largest Market Share

- North America remains the largest market for managed IT infrastructure services because of the early adoption of technology and numerous IT data centers.

- North America has seen a dramatic increase in cloud migration over the years, mostly because of the region's strong IT infrastructure, laws, standards, and access to technological experience, among other factors. Additionally, the expansion of the cloud migration services market in North America has been aided by the existence of illustrious cloud firms like Amazon Web Services, IBM Corporations, Microsoft Corporation, Google, and Cisco Systems.

- The other factor is the high degree of automation and immense penetration of IT applications in several end-user industries, creating a constant demand for IT infrastructure services in the region.

Managed IT Infrastructure Services Industry Overview

The managed IT infrastructure services market is highly competitive due to the presence of many large and small players. The fragmented nature of the market is leading to acquisitions or a growing focus on niche segments as strategies to scale up. The continuously evolving nature of the services offered has made it imperative for all players to keep investing in new-age skills and technologies to stay relevant and ahead of the competition. This can only be achieved by hiring the right R&D talent and/or by acquiring any interesting start-ups that have the potential to disrupt the space. The major advantage that the smaller players have over the bigger ones is their ability to serve the local markets better because of the presence of their data centers locally. This forces bigger players to go for aggressive acquisitions to enhance their global footprint.

In August 2022, Dell Technology announced the launch of new infrastructure solutions, co-engineered with VMware, these new infrastructure solutions increase automation and performance for businesses adopting multi-cloud and edge strategies.

In March 2022, Verizon Communications Inc. announced the expansion of its 5G Ultra Wideband network to an expected 175 million people by year-end 2022. The company outlined several growth avenues, including 5G mobility, nationwide broadband, mobile edge computing (MEC), business solutions, the value market, and network monetization, with the expectation that these will help the company achieve service and other revenue growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

- 4.3 Market Drivers

- 4.3.1 Cost Optimization with the Adoption of Managed Services

- 4.3.2 Technological Proliferation and Advancement of Cloud Based Technology will Act as a Driver

- 4.4 Market Restraints

- 4.4.1 Concerns Over Security and Privacy will Act as a Restraint

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Category

- 5.1.1 Virtualization

- 5.1.2 Networking

- 5.1.3 Storage

- 5.1.4 Servers

- 5.2 By Enterprise Size

- 5.2.1 Small & Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Deployment

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.4 By End-User

- 5.4.1 IT & Telecommunication

- 5.4.2 Retail

- 5.4.3 Transportation & Logistics

- 5.4.4 BFSI

- 5.4.5 Manufacturing

- 5.4.6 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujitsu Ltd.

- 6.1.2 CSS Corp Pvt Ltd.

- 6.1.3 Dell EMC (EMC Corporation)

- 6.1.4 IBM Corporation

- 6.1.5 Alcatel-Lucent SA (Nokia Corporation)

- 6.1.6 Microsoft Corporation

- 6.1.7 Verizon Communications Inc.

- 6.1.8 Citrix Systems Inc.

- 6.1.9 Tata Consultancy Services Limited

- 6.1.10 Deutsche Telekom AG