|

市場調查報告書

商品編碼

1628809

託管通訊服務:市場佔有率分析、產業趨勢、成長預測(2025-2030)Managed Communication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

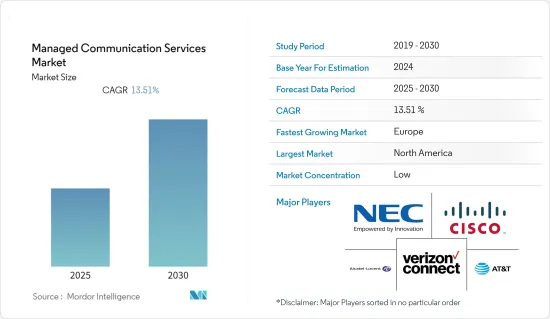

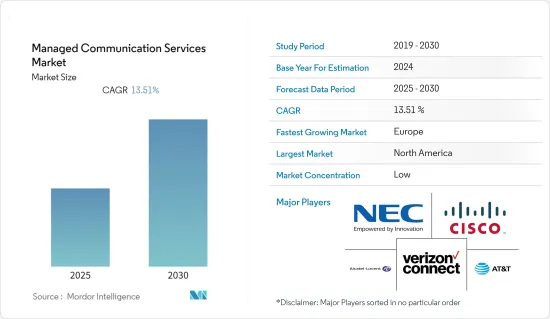

管理通訊服務市場預計在預測期內複合年成長率為 13.51%

主要亮點

- 整合通訊(UC) 正在成為一種經濟高效的解決方案,適用於所有行業(包括醫療保健、BFSI 和零售)的企業。整合通訊(UC) 市場傳統上以單一產品為中心。過去,公司選擇單獨的產品來滿足特定的需求。例如,公司購買用於通訊的電子郵件伺服器、用於團隊合作的團隊室、用於組織資訊共用的入口網站、以及用於電話服務的 PBX 和語音郵件。如今,客戶正在根據協作堆疊功能和整合來制定策略性技術決策,以部署整合通訊和協作環境。

- 供應商建立了各種夥伴關係,促進了市場的成長。例如,2021年7月,Synoptech宣布收購Juxto的直接即時通訊(RTC)業務用戶端,並創建整合Synoptech和Juxto能力的即時通訊實務。透過將 Synoptek 作為 IT 整合商的全球經驗與 Juxto 為 Teams 語音交付構建的北美營運商級網路相結合,我們編寫了一款語音通訊解決方案,可以滿足並超越最苛刻的客戶要求。

- CenturyLink 的新 Engage 產品組合列出了中型組織的雲端基礎的電話和通訊服務。 CenturyLink 的 Engage 解決方案讓企業可以透過利用自己和/或 CenturyLink 連接來利用雲端基礎的通訊服務的優勢。該服務現已向全美 50 個州的企業客戶開放。

- COVID-19 導致的遠端工作要求鼓勵服務供應商推廣基於軟體的通訊,將其作為業務永續營運的關鍵推動因素,從而提高通訊服務在容量調整和服務交付方面的靈活性(無論位於何處)。來展示。預計這一趨勢將支持市場成長。 Voxborn 最近發布了一份報告,強調了病毒對其網路的影響。根據該研究,隨著企業尋找減輕團體聚會和通勤時間等威脅的方法,COVID-19 顯著增加了對雲端通訊的需求。

託管通訊服務市場的趨勢

VoIP佔有很大佔有率

- 隨著自帶設備 (BYOD) 和其他行動解決方案的快速採用,我們預計 VoIP 等通訊解決方案將進一步採用。 BYOD 已成為一種重要的新時代趨勢,為跨組織和世界各地工作的員工提供靈活的網路訪問,隨著 IT 和其他行業對基礎設施增強的投資不斷增加,從而提高職場的生產力。據思科稱,實施 BYOD 計畫的公司每年為每位員工平均節省 350 美元。

- 據 HubSpot, Inc. 稱,人工智慧將作為 VoIP 的趨勢在 2021 年繼續成長。 VoIP服務供應商將能夠根據座席的熟練程度、緊急程度和技能更好地識別和分配傳入通訊。一些人工智慧甚至可以識別一個人聲音的真實性,並使用生物識別指標來防止詐騙。據 Nuance 稱,該公司為 85% 的財富 500 強組織提供詐騙語音保護,作為收集已知虛假語音的更大詐騙偵測系統的一部分。

- 然而,近年來,使用 VoIP 的安全漏洞已成為頭條新聞。例如,一次網路攻擊針對的是一位名人的 WhatsApp 帳號。他們甚至不必接聽電話,而且通常會被記錄在通話記錄中。

- VoIP 服務與更大的銷售和支援堆疊的日益整合是 2021 年最突出的 VoIP 趨勢之一。在為您的公司決定最佳的 VoIP 服務時,請考慮該平台如何與您的其他產品整合。

歐洲預計將實現顯著成長

- 歐洲市場成長的主要驅動力是零售業中 UC&C使用案例的增加。英國零售商正專注於商店互動,以吸引回頭客。為此,您需要提供便捷、無摩擦的店內體驗。除此之外,知識淵博的銷售人員可以解釋產品,從而推動溝通服務而非氛圍成為消費者在商店中的首要偏好。

- 英國是零售業的主要參與者,總部位於美國的 8x8 是擁有超過 100 萬用戶的最大 UCaaS 提供者之一,在兩次收購英國公司後,其在歐洲市場的成長顯著,我們看到了潛在的成長。

- 該國通訊業者的整合服務 逐步淘汰數位網路服務的努力正在鼓勵通訊業者和客戶遷移到網際網路通訊協定連接服務。這一重大轉變正在推動下一代商業通訊解決方案的採用,例如託管專用交換器 (PBX) 和 UCaaS 解決方案。

- 此外,我們擴大在市場上建立夥伴關係,有助於提高我們的解決方案的知名度。 2020年7月,Atos將其在比利時、盧森堡、瑞典和芬蘭的部分整合通訊和協作業務轉移給領先的ICT託管服務和解決方案提供商Damovo。此次合作能夠快速回應企業領域對創新 UC 解決方案不斷成長的需求,也是 Atos 透過間接通路合作夥伴提高其 UCC 產品組合市場佔有率的全球雄心的一部分。

託管通訊服務產業概述

託管通訊服務市場競爭非常激烈。產品研究、不斷上升的研發成本、聯盟和收購是公司在激烈的競爭中生存所採取的關鍵成長策略。近期趨勢如下。

- 2021 年 10 月,Verizon 選擇由 Fortinet Secure SD-WAN 提供支援的 Verizon Software-Defined Secure Branc 部署到其全球 SD-WAN 服務(託管服務)。該系統旨在為企業提供整合的網路和安全解決方案,以保護和連接混合和遠端員工,包括企業和商業市場的客戶。

- 2021 年 2 月,託管 SD-WAN服務供應商Masergy 將思科著名的 Webex 視訊會議解決方案新增至其整合通訊服務。 Masergy 現有的整合通訊平台和 Webex 將整合到一個應用程式中,該應用程式與 Fortinet 提供的該公司的 SD-WAN 和 SASE 服務介接。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 中小型企業需求的增加預計將推動招聘

- 基於雲端基礎的託管服務的增加

- 市場限制因素

- 對向 MSP 揭露機密資訊的擔憂

第6章 市場細分

- 按部署模型

- 本地

- 雲

- 按類型

- 整合通訊

- 電子郵件

- VoIP

- 其他

- 按最終用戶

- 零售

- BFSI

- 醫療保健

- 公共部門

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Polycom Inc.(Plantronics)

- Avaya Inc.

- NEC Corporation

- Ringcentral Inc.

- 8x8 Inc.

- Vidyo Inc.(Enghouse Systems Limited)

- Arkadin Cloud Communications(NTT)

- Alcatel Lucent Enterprise International

- Dialpad Inc.

- Mitel Network Communications

- Verizon Communications Inc.

- AT&T Inc.

- West Corporation

- BT Group

- Comcast Corporation

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 54882

The Managed Communication Services Market is expected to register a CAGR of 13.51% during the forecast period.

Key Highlights

- Unified communications have emerged as a cost-effective solution for businesses across industries, such as healthcare, BFSI, and retail. The unified communications market has historically revolved around individual products. In the past, companies chose individual products to meet particular needs. For example, organizations bought email servers for messaging, team rooms for teamwork, portals for organizational information sharing, and PBX and voicemail for telephony services. Now, customers are making strategic technology decisions to deploy unified communications and collaboration environments based on the capability and integration of the collaboration stack.

- Vendors are undergoing various partnerships, proving to augment the market growth. For instance, In July 2021, Synoptek has announced the purchase of Juxto's direct real-time communications (RTC) business clients and the establishment of a Real-Time Communications Practice combining Synoptek and Juxto capabilities. Synoptek's global experience as an IT integrator, combined with Juxto's North American Carrier-Grade network purpose-built for Teams Voice delivery, provides a voice communication solution that meets and surpasses the most stringent client requirements.

- CenturyLink's new Engage portfolio will provide medium-sized organizations with cloud-based phone and communications services. CenturyLink's Engage solution enables organizations to take advantage of the benefits of cloud-based communications services by leveraging either their own or CenturyLink's connectivity or both. Business clients in all 50 states can use the service right now.

- Remote work mandates caused by COVID-19 are creating an unprecedented opportunity for service providers to promote software-based communications as a key enabler of business continuity and demonstrate the flexibility of communication services in terms of capacity adjustments and services delivery (irrespective of location). This trend is expected to support market growth. Voxbone recently published a report highlighting the virus's impact on its network. According to the study, COVID-19 has pushed a massive increase in demand for cloud communications as businesses look for ways to reduce the threats of things, such as group gatherings and the work commute.

Managed Communications Services Market Trends

VoIP occupies Significant Share

- The rapidly increasing adoption of the Bring Your Own Device (BYOD) trend and other mobility solutions is expected to drive the adoption of communication solutions, such as VoIP, even further. BYOD has emerged as a significant trend in this new era of flexibility, and network accessibility for employees working around the world for various organizations, making the workplace more productive as IT and other industries are investing in strengthening the infrastructure. According to Cisco, enterprises with a BYOD policy in place save on average USD 350 per year per employee.

- According to HubSpot, Inc., AI will continue to grow in strength as a VoIP trend for 2021. VoIP service providers will be better at identifying and assigning incoming communications depending on agent proficiency, urgency, and skill set. Some AI can even identify inauthenticity in a person's voice and prevent fraud using biometric indicators. According to Nuance, it delivers anti-fraud speech measures to 85 percent of Fortune 500 organizations as part of a larger fraud detection system, which uses a collection of known fake voices.

- However, In recent years, security breaches using VoIP have made front-page news. For example, a cyberattack targeted several high-profile WhatsApp accounts, which might install malware onto their phones - and take data - just by contacting them. They didn't even have to pick up the phone, and the calls frequently went unnoticed in the phone's record.

- VoIP services being increasingly integrated with larger sales and support stacks is one of the most prominent VoIP trends for 2021. When deciding on the finest VoIP service for your company, consider how the platform will integrate with your other products.

Europe is Expected to Witness Significant Growth

- The major driving factor for the market growth in Europe is the increasing use cases of UC&C in the retail industry. The UK retailers are looking to attract customers to interact with them in-store so that they keep coming back. To do this, they need to provide a convenient and frictionless in-store experience, with the added advantage of knowledgeable sales staff that can explain product offerings and the number-one preference of in-store shoppers, ahead of ambiance, which is propelling the adoption of communication services.

- The United Kingdom has witnessed a potential growth in the retail industry with major players, like 8x8, a US-based company, which is one of the largest UCaaS providers comprising more than 1 million users, expanded significantly in the European market after it made two acquisitions of the UK-headquartered enterprises.

- The country's carriers' efforts to discontinue the integrated services digital network services are driving the carrier and customer migration to Internet protocol connectivity services. This huge shift is driving the adoption of next-generation business communication solutions, such as hosted private branch exchange (PBX) and UCaaS solutions.

- The market is also witnessing partnerships, which is helping to increase the awareness of the solutions. In July 2020, Atos transferred a portion of its unified communications and collaboration activities in Belgium, Luxembourg, Sweden, and Finland to Damovo, a leading provider of ICT-managed services and solutions. The partnership enables a faster response to the increasing demand for innovative UC solutions in the enterprise sector and is part of Atos' global ambition to grow its market share for its UCC portfolio through indirect channel partners.

Managed Communications Services Industry Overview

The managed communication services market is highly competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies to sustain the intense competition. Some of the recent developments are -

- October 2021, Verizon has opted to introduce Verizon Software-Defined Secure Branch with Fortinet Secure SD-WAN to its worldwide SD-WAN offering (managed services). The system is meant to give enterprises a converged networking and security solution "in-a-box" to protect and connect hybrid and remote workforces, including enterprise and business market clients.

- In February 2021, Masergy (a managed SD-WAN service provider) has added Cisco's renowned Webex video conferencing solution to its unified communications-as-a-service offerings. Masergy's existing unified communications platform and Webex are combined into a single application that interfaces with the company's SD-WAN and SASE services, which are powered by Fortinet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand from SME's expected to drive adoption

- 5.1.2 Increasing Cloud-based Managed Services

- 5.2 Market Restraints

- 5.2.1 Concerns about disclosing confidential information to MSPs

6 MARKET SEGMENTATION

- 6.1 By Deployment Model

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Unified Communication

- 6.2.2 E-mail

- 6.2.3 VoIP

- 6.2.4 Other Types

- 6.3 By End-User

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Public Sector

- 6.3.5 Other End-Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Polycom Inc. (Plantronics)

- 7.1.3 Avaya Inc.

- 7.1.4 NEC Corporation

- 7.1.5 Ringcentral Inc.

- 7.1.6 8x8 Inc.

- 7.1.7 Vidyo Inc. (Enghouse Systems Limited)

- 7.1.8 Arkadin Cloud Communications (NTT)

- 7.1.9 Alcatel Lucent Enterprise International

- 7.1.10 Dialpad Inc.

- 7.1.11 Mitel Network Communications

- 7.1.12 Verizon Communications Inc.

- 7.1.13 AT&T Inc.

- 7.1.14 West Corporation

- 7.1.15 BT Group

- 7.1.16 Comcast Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219