|

市場調查報告書

商品編碼

1521422

三片式金屬罐:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)3 Piece Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

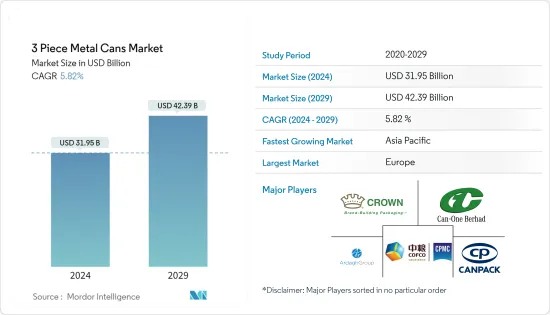

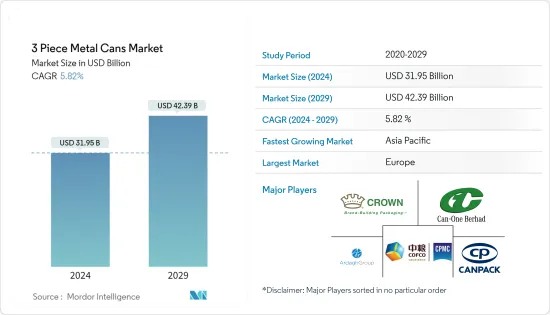

2024年三片式金屬罐市場規模預計為319.5億美元,預計2029年將達到423.9億美元,在預測期內(2024-2029年)複合年成長率預計為5.82%。

主要亮點

- 三片罐具有多種環境效益,包括與玻璃等材料相比更高的回收率。鋁等金屬可以在不損失性能的情況下進行回收,而且回收鋁比消費量原料生產鋁消耗的能源大約少 95%。

- 因此,回收三片罐的動力非常強烈。對可回收三片罐的需求不斷成長,預計將為市場成長創造利潤豐厚的機會。飲料應用主導全球三片罐市場。由於世界各地對碳酸軟性飲料的需求不斷增加,預計該行業將顯著成長。

- 世界對酒精和碳酸飲料的需求正在迅速成長,從而增加了對金屬罐的需求。到2022年,全球將使用約1758億個鋁罐,特別是啤酒和蘇打水。

- 美國擁有成熟的飲料市場,包括酒精飲料和非酒精飲料。 2021年,美國啤酒市場總額為1,002億美元,其中精釀啤酒佔268億美元(21.0%)。啤酒釀造商協會指出,精釀啤酒銷量成長了 7.9%,相當於約 2,450 萬桶。因此,美國市場對金屬罐的需求明顯激增。

- 隨著人們轉向食品保存並傾向於減少與他人的接觸,COVID-19 推動了市場的發展,從而導致對罐頭產品的需求增加。

三片式金屬罐市場趨勢

透過罐頭食品增加衛生食品的消費

- 罐頭是保存食品並延長其保存期限的一種方法。保留食品營養成分,防止陽光、空氣等外在因素造成的腐敗變質。

- 許多速食連鎖店和餐廳廣泛使用罐頭食品,這種食品易於準備,並可提供長期保護,防止污染和腐敗。罐裝水果通常添加到沙拉、冰沙、飲料中,或單獨食用,因為它保留了營養價值且不含污染物。這些食品消費趨勢很大程度上是由消費者對衛生和簡便食品的偏好所推動的。

- 生活忙碌的人,尤其是沒有烹飪技巧或因快節奏的生活而感到疲倦的人,覺得食品很方便。消費者人口結構的變化是推動衛生食品市場的主要因素。市場對食品和飲料產品的反應表明銷售與其提供的便利和衛生之間存在很強的相關性。

亞太地區主導市場

- 由於該地區對三片罐的需求不斷成長,亞太地區在三片罐市場的市場佔有率方面佔據主導地位。這一優勢得益於消費者對環境永續性意識的增強以及該地區對技術進步和研發 (R&D) 的大量投資。

- 對肉類、蔬菜和水果等包裝食品的需求不斷增加,導致亞太地區食品包裝產業金屬罐的使用激增。金屬罐以其卓越的防腐性能和結構完整性而聞名,可延長保存期限。

- 2021年,中國以59%的收益佔有率引領亞太金屬包裝被覆劑市場,其次是日本和印度,分別佔11%和9%的佔有率。金屬罐和容器具有多種優點,包括增強產品保護、耐用性、永續性、經濟性和減輕重量,使其成為食品和飲料包裝的理想選擇。金屬包裝塗料在保護金屬表面免受腐蝕和磨損、確保食品和飲料包裝的耐用性方面發揮著重要作用。

三片金屬罐產業概況

本報告重點介紹了三片金屬罐市場的主要企業。從市場佔有率來看,市場主要由中小型企業佔據,企業競爭激烈,但佔有率不高。因此,市場競爭激烈且分散。

我們看到主要企業正在向新的區域擴張,從而擴大其地理覆蓋範圍。新的競爭對手正在透過客製化的特定產業服務進入三片式金屬罐市場。

主要參與者包括 Crown、Ardagh Group SA、CPMC Holdings Limited、Can-One Berhad 和 CanPack。三片罐市場的參與者表現出與其他參與者合作的意願,以降低成本並利用相互的競爭優勢。此外,技術的實施也有助於降低營運成本並提高效率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 包裝食品的需求不斷擴大

- 塗料產業需求不斷成長

- 市場限制因素

- 原料成本上漲

- 對金屬包裝認知不足

- 市場機會

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 政府法規和重大舉措

- COVID-19 對市場的影響

第5章市場區隔

- 按材質

- 鋁

- 鋼

- 其他材料

- 按內壓程度

- 加壓罐

- 真空罐

- 按用途

- 飲料

- 罐頭食品

- 畫

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 義大利

- 西班牙

- 德國

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 新加坡

- 泰國

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 市場競爭概況

- 公司簡介

- Crown

- Ardagh Group SA,

- CPMC Holdings Limited

- Can-One Berhad

- CanPack

- Universal Can Corporation

- Interpack Group Inc

- Showa Denko KK

- Ball Corporation

- Silgan Containers*

- 其他公司

第7章 市場機會及未來趨勢

第8章附錄

The 3 Piece Metal Cans Market size is estimated at USD 31.95 billion in 2024, and is expected to reach USD 42.39 billion by 2029, growing at a CAGR of 5.82% during the forecast period (2024-2029).

Key Highlights

- Three-piece cans have several environmental advantages, including a higher recycling rate compared to materials like glass. Metals like aluminum can be recycled without any loss in performance, and recycling aluminum uses about 95% less energy than producing it from raw materials.

- This makes recycling three-piece cans a strong incentive. The increasing demand for recyclable three-piece cans is expected to create profitable opportunities for market growth. Beverage applications dominate the global three-piece cans market. The segment is expected to witness significant growth on account of the increasing demand for carbonated soft drinks across the globe.

- The global demand for alcoholic and carbonated drinks is growing rapidly, leading to an increased need for metal cans. In 2022, around 175.8 billion aluminum cans were used worldwide, particularly for beer and soda.

- The United States has a well-established beverage market, encompassing both alcoholic and non-alcoholic drinks. In 2021, the total beer market in the United States was valued at USD 100.2 billion, with craft beer accounting for USD 26.8 billion (21.0%). The Brewers Association noted a 7.9% increase in craft beer sales, equivalent to approximately 24.5 million barrels. Consequently, there is a notable surge in demand for metal cans in the United States market.

- COVID-19 drove the market as people switched to storing food or preferring items that were less in contact with other humans, resulting in a higher demand for canned products.

3 Piece Metal Cans Market Trends

Increase in Hygienic Food Consumption Through Canned Foods

- Canning is a method for preserving food products and providing them with an extended shelf life. It preserves the nutrients of the food and prevents spoilage due to external factors such as sunlight and air.

- Many fast-food chains and restaurants widely utilize canned food products due to their convenience in cooking and their ability to remain free from contamination and spoilage for a longer period. Since canned fruits are free from contaminants while retaining all their nutritional qualities, they are often used in salads, smoothies, and drinks or consumed directly. The trend of consuming these foods is largely attributed to consumers' preference for hygienic and convenient food products.

- People with busy lifestyles, especially those lacking cooking skills or experiencing fatigue due to the fast pace of life, find canned foods convenient. Changes in consumer demographics are major factors driving the hygienic foods market. Market sentiments for food and beverages indicate a strong correlation between sales and the degree of convenience and hygiene they offer

Asia-Pacific Dominates The Market

- The Asia-Pacific region dominates the three-piece cans market in terms of market share, driven by the increasing demand for such cans in the region. This dominance is attributed to growing consumer awareness of environmental sustainability, coupled with significant investments in technological advancements and research and development (R&D) in the area.

- There is a rising demand for packaged food products, including meat, vegetables, and fruits, leading to a surge in the use of metal cans in the food packaging industry across Asia-Pacific. The metal cans, known for their excellent preservative properties and structural integrity, offer extended shelf life.

- In 2021, China led the Asia-Pacific metal packaging coatings market with a revenue share of 59%, followed by Japan and India with shares of 11% and 9%, respectively. Metal cans and containers provide various benefits, such as enhanced product protection, durability, sustainability, affordability, and being lightweight, making them ideal for packaging food and beverages. Metal packaging coatings play a crucial role in protecting the metal surface from corrosion and abrasion, ensuring durability in the packaging of food and beverage products.

3 Piece Metal Cans Industry Overview

The report covers the major players operating in the 3 piece metal can market. In terms of market share, the companies compete heavily with no major share as small and medium-sized players majorly occupy the market. Hence, the market is highly competitive and fragmented.

Major regional players have been observed to venture into new regions, allowing the companies to improve their geographic reach. New competitors are entering the three-piece metal can market with customized and industry-specific services.

Some major players include Crown, Ardagh Group S.A, CPMC Holdings Limited, Can-One Berhad and CanPack. The three-piece metal can market players have been showing a willingness to partner with other players to reduce cost and leverage on mutual competitive advantage. Additionally, technology adoption has also helped reduce operational costs and improve efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand of Packed Food

- 4.2.2 Rising Demand in Paint Industry

- 4.3 Market Restraints

- 4.3.1 Increasing Cost of Raw Materials

- 4.3.2 Lack of Awareness of Metal Packaging

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Snapshot

- 4.8 Government Regulations & Key Initiatives

- 4.9 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Aluminum

- 5.1.2 Steel

- 5.1.3 Other Materials

- 5.2 By Degree of Internal Pressure

- 5.2.1 Pressurized Cans

- 5.2.2 Vacuum Cans

- 5.3 By Application

- 5.3.1 Beverage

- 5.3.2 Canned Food

- 5.3.3 Paints

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Italy

- 5.4.2.4 Spain

- 5.4.2.5 Germany

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Singapore

- 5.4.3.6 Thailand

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 UAE

- 5.4.4.3 Egypt

- 5.4.4.4 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Crown

- 6.2.2 Ardagh Group S.A,

- 6.2.3 CPMC Holdings Limited

- 6.2.4 Can-One Berhad

- 6.2.5 CanPack

- 6.2.6 Universal Can Corporation

- 6.2.7 Interpack Group Inc

- 6.2.8 Showa Denko K.K

- 6.2.9 Ball Corporation

- 6.2.10 Silgan Containers*

- 6.3 Other Companies