|

市場調查報告書

商品編碼

1550263

人力資本諮詢服務:市場佔有率分析、產業趨勢、成長預測(2024-2029)Human Capital Advisory Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

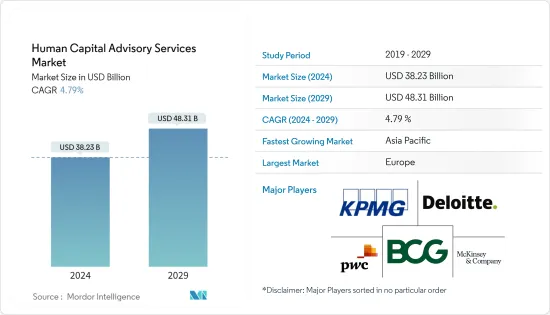

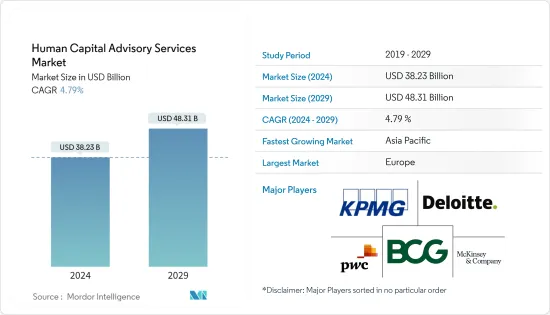

人力資本諮詢服務市場規模預計到 2024 年為 382.3 億美元,預計到 2029 年將達到 483.1 億美元,在預測期內(2024-2029 年)複合年成長率為 4.79%。

主要亮點

- 人力資本諮詢服務市場的成長受到各種宏觀和微觀因素的影響。例如,經濟成長往往會導致業務擴張,從而增加對人力資本諮詢服務的需求。相反,當經濟低迷時,隨著公司尋求最佳化勞動力和降低成本,需求就會增加。

- 此外,在競爭激烈的勞動力市場中,對人才管理和保留的興趣的增加將增加對人力資源諮詢服務的需求。遠距工作和零工經濟的興起需要新的人力資源策略和政策。勞動法的變化,例如最低工資調整、醫療保健規定和多元化要求,也正在影響市場。實施人工智慧、人力資源分析和自動化工具等人力資源技術需要專門的諮詢服務。

- 就業率的上升直接帶動了對人力資本諮詢服務的需求。例如,隨著組織擴大員工隊伍,他們需要大量的人才管理策略來吸引、留住和培養頂尖人才。人力資源顧問專注於績效管理、職涯發展和繼任規劃。

- 此外,隨著公司規模的擴大,常常需要重組其組織或創造新的框架。在這種情況下,人力資源諮詢服務至關重要,可以提供有關組織設計、變革管理和文化整合的見解。

- 預計還有各種技術趨勢將推動市場發展。例如,資料分析透過查看競爭基準化分析、能力差距分析、學習機會、勞動力模式、人才需求等,幫助人力資源部門管理整個人才生命週期。從技術和分析的角度來看,人力資源職能正在不斷擴展。

- 例如,2024 年 5 月,人力資源和薪資技術公司 PeopleStrong 與 Google Cloud 合作,採取策略性舉措,推動亞洲公司的人力資源轉型和創新。此次合作將把 Google Cloud 的先進人工智慧工具(例如 Vertex AI 和 Gemini 模型)整合到 PeopleStrong 已經強大的人力資源技術平台中。 PeopleStrong 的 HR Tech 4.0 平台脫穎而出,成為由先進生成人工智慧提供支援的印度開創性 HR Tech 解決方案。平台擁有超過2,200個開放API,打造無縫人力資源生態系統,提升員工體驗與管理效率。

- 另一方面,由於對外包機構的依賴日益增加,市場成長面臨挑戰。這個市場涉及公司將其人力資源職能委託給外部服務提供者。公司可以簡化人力資源業務、降低成本、提高效率並減輕業務負擔。然而,將績效管理和員工回饋等關鍵職能移交給外包公司可能會面臨放棄控制權並加劇員工不滿的風險。雖然人力資源外包帶來了專業技能和擴充性,但它對 IT 和酒店業等行業尤其有利。

人力資本諮詢服務的市場趨勢

中小企業成長顯著

- 中小型企業越來越依賴人力資本諮詢服務來應對人力資源 (HR) 轉型、人力資源分析和技術整合的複雜性。這一趨勢是由小型企業特有的挑戰所推動的,包括有限的內部專業知識、資源限制和快速的技術創新。

- 當中小型企業努力保持競爭力時,他們往往缺乏有效管理人力資源職能和利用資料分析進行策略決策所需的專業知識。人力資本諮詢公司透過提供針對這些中小企業的特定需求和成長階段的解決方案來提供必要的支援。

- 中小企業面臨的主要挑戰之一是先進人力資源技術的整合。雖然大公司可能擁有無縫實施新技術的基礎設施和預算,但小型企業往往在選擇、實施和最佳化人力資源軟體解決方案方面遇到困難。這些技術對於自動化管理業務、提高員工敬業度和推動資料主導的人力資源策略至關重要。

- 研究表明,89% 的企業面臨技術整合挑戰,尤其是擁有 0 至 25 名員工的小型企業。這凸顯了技術引導的重要性,也凸顯了產業對數位化適應不足而落後的風險。

- 此外,人力資源挑戰和團隊文化也被認為是並行的挑戰。研究表明,70% 的公司很難找到合適的團隊成員,儘管只有 33% 的公司對現有團隊感到滿意。此外,我們發現 75% 的公司強烈希望加強企業文化並創造積極的職場環境。

- 此外,人力資源、薪資和社會福利軟體供應商 Zenefits 還透過技術整合幫助中小型企業簡化人力資源流程。透過提供針對小型企業需求量身定做的易於使用的平台,Zenefits 使他們能夠更有效地處理人力資源職能,釋放資源以專注於成長和創新。

- 據歐盟委員會稱,到 2023 年,歐盟 (EU) 將有約 2,440 萬家中小企業。另外還有 132 萬家小型企業和 202,278 家中型企業。中小企業是歐洲經濟的支柱。這些企業約佔歐洲所有活躍企業的99.8%,創造了歐盟總付加價值的近52%。

歐洲預計將佔據較大市場佔有率

- 在對組織轉型、市場開拓和有效的勞動力管理策略的日益關注的推動下,歐洲人力資本諮詢市場正在經歷顯著成長。各行業的公司都認知到,最佳化人力資源對於在快速發展的商業環境中獲得競爭優勢和永續成長至關重要。當公司尋求適應市場動態、技術進步和監管變化時,組織轉型和發展服務至關重要。

- 2023 年 11 月,Cendyn 與 SiteMinder 建立策略合作夥伴關係,以增強 70,000 多家飯店的收益管理能力。此次合作使 Cendyn 客戶能夠利用 SiteMinder 的收益平台,補充其現有的中央預訂系統 (CRS) 功能。 SiteMinder 的收益平台為 Cendyn 的用戶提供了透過 SiteMinder 處理費率方案和庫存的可能性。此外,您還可以存取 SiteMinder 的完整分銷管道(酒店業的大型生態系統),使您能夠捕獲更動態的收益流組合併加快上市速度。

- 2023 年 11 月,全球數位工程和技術解決方案供應商 Nagarro 將與 UKG 加強合作,作為其策略技術合作夥伴生態系統的一部分,為每個人提供人力資源、薪資和勞動力管理解決方案。

- 透過此次合作,Nagarro 和 UKG 將透過 Ginger AI 整合徹底改變勞動力管理,以簡化業務並提高效率。利用 Nagarro 和 UKG Pro Workforce Management(以前稱為 UKG Dimensions)的組織可以透過 Microsoft Teams 利用 Nagarro 的企業 AI 平台 Ginger AI 的強大功能,使他們能夠滿足 Masu 的日常工作需求。 Ginger AI 簡化了關鍵勞動力管理功能的處理,消除了多次登入和平台切換的麻煩。

- 隨著企業意識到有效的組織變革、勞動力管理和人才開拓策略的策略價值,歐洲人力資本諮詢市場正在不斷成長。這些顧問利用他們的專業知識幫助企業克服挑戰、利用機會並培養有彈性的人才,從而在充滿活力的經濟環境中取得長期成功。

人力資本諮詢服務業概述

人力資本諮詢服務市場高度分散,主要參與者包括畢馬威、德勤、普華永道、波士頓顧問集團和麥肯錫公司。市場參與者正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 11 月 - 德勤印度與全球薪資核算技術供應商 Ramco Systems Limited 建立策略夥伴關係。此次合作將 Ramco 的先進薪資核算平台與德勤的專業諮詢和管理服務結合。兩家公司都致力於提供全面的薪資核算解決方案。該解決方案涵蓋營運服務、確保合規性、提供無縫的用戶體驗,並在 150 多個國家/地區提供廣泛的覆蓋範圍。所有這些功能都可以透過統一的薪資核算平台方便地存取。

- 2023 年 11 月 - 普華永道印度公司宣布與基於軟體即服務 (SaaS) 的人力資源 (HR) 科技公司 Darwinbox 建立策略合作夥伴關係,幫助印度各地的組織轉變其人力資源轉型解決方案。普華永道印度公司和 Darwinbox 合作,為印度的組織提供人力資源轉型解決方案。透過利用 Darwinbox 在整個員工生命週期中先進的人力資本管理 (HCM) 技術以及普華永道印度公司的行業專業知識,我們的目標是推動印度公司的數位轉型。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭程度

- 替代品的威脅

第5章市場動態

- 市場促進因素

- 經濟成長和新業務增加

- 併購增加

- 市場限制因素

- 成立內部顧問小組

- 獨立顧問興起導致人才短缺

- 人力資本諮詢市場的技術格局

第6章 市場細分

- 按服務類型

- 人力資源外包

- 人力資源諮詢

- 組織變革/組織發展

- 員工管理

- 合規與道德

- 人力資源轉型

- 文化與變革

- 其他

- 學習與發展

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶

- 資訊科技

- 衛生保健

- BFSI

- 工業/製造業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- KPMG

- Deloitte

- PWC

- Boston Consulting Group

- McKinsey & Company

- Capgemini

- Bain and Company

- Accenture

- Mercer

- Korn Ferry

- Aon Plc(Aon Hewitt India)

- Jombay(CIEL HR)

- Ernst & Young Global Limited

- Basiltree Consulting Private Limited

- Robert Half Inc.

- Think Talent Services

- Vendor Positioning Analysis

第8章 未來市場展望

The Human Capital Advisory Services Market size is estimated at USD 38.23 billion in 2024, and is expected to reach USD 48.31 billion by 2029, growing at a CAGR of 4.79% during the forecast period (2024-2029).

Key Highlights

- The growth of the HR advisory market is influenced by various macro and micro factors. For instance, Economic growth often leads to business expansions, increasing the demand for HR advisory services. Conversely, economic downturns drive demand as companies seek to optimize their workforce and reduce costs.

- Moreover, a heightened focus on talent management and retention in competitive labor markets raises the demand for HR advisory. The rise in remote work and the gig economy necessitates new HR strategies and policies. Changes in labor laws, such as minimum wage adjustments, healthcare mandates, and diversity requirements, also impact the market. Adopting HR technologies like AI, HR analytics, and automation tools requires specialized advisory services.

- An increase in employment rates directly drives demand for HR advisory services. For instance, as organizations expand their workforce, they require substantial talent management strategies to attract, retain, and nurture top talent. HR advisors specialize in performance management, career development, and succession planning.

- Moreover, as companies scale, they often require organizational restructuring or the creation of new frameworks to support their growing staff. In such scenarios, HR advisory services are pivotal, offering insights into organizational design, change management, and cultural integration.

- There are various technological trends that are expected to drive the market. For example, Data analysis assists HR in managing the entire talent lifecycle by looking into competitive benchmarking, competency gap analysis, learning opportunities, workforce patterns, talent demands, etc. The human resource function is expanding from both a technological and an analytics perspective.

- For instance, in May 2024, PeopleStrong, an HR and payroll tech company, teamed up with Google Cloud in a strategic move to drive HR transformation and innovation across Asian businesses. This partnership will see the integration of Google Cloud's advanced AI tools, such as Vertex AI and Gemini models, into PeopleStrong's already robust HR tech platform. PeopleStrong's HR Tech 4.0 platform stands out as India's pioneer HR tech solution, leveraging advanced Generative AI. Boasting over 2,200 open APIs, the platform fosters a seamless HR ecosystem, enhancing employee experiences and administrative efficiency.

- On the contrary, Market growth faces a challenge with the rising reliance on outsourcing agencies. This market involves companies delegating their HR functions to external service providers. Businesses can streamline HR tasks, cut costs, boost efficiency, and lighten their administrative load. Yet, entrusting agencies with critical functions like performance management and employee feedback risks ceding control and could spark employee discontent. While outsourcing HR can bring specialized skills and scalability, it's particularly beneficial for industries such as IT and hospitality.

Human Capital Advisory Services Market Trends

SMEs to Register Significant Growth

- Small and medium-sized enterprises (SMEs) are increasingly relying on human capital advisory services to navigate the complex landscape of human resources (HR) transformation, HR analytics, and technology integration. This trend is driven by several challenges unique to SMEs, including limited internal expertise, resource constraints, and the rapid pace of technological change.

- As SMEs strive to remain competitive, they often lack the specialized knowledge required to effectively manage HR functions and leverage data analytics for strategic decision-making. Human capital advisory firms provide essential support by offering tailored solutions that align with the specific needs and growth stages of these smaller businesses.

- One significant challenge SMEs face is the integration of advanced HR technologies. While larger corporations may have the infrastructure and budgets to adopt new technologies seamlessly, SMEs often struggle with selecting, implementing, and optimizing HR software solutions. These technologies are crucial for automating administrative tasks, improving employee engagement, and facilitating data-driven HR strategies.

- According to the survey, 89% of businesses face challenges with technology integration, particularly smaller enterprises with 0 to 25 employees. This underscores the importance of technical guidance and highlights the risk of falling behind due to inadequate adaptation to industry digitization.

- Additionally, HR challenges and team culture were identified as parallel issues. According to the research, The survey found that 70% of businesses struggle to find suitable team members, despite only 33% being satisfied with their current teams. Additionally, 75% of businesses express a strong desire to enhance company culture and create positive work environments.

- In addition to this, Zenefits, a company that provides HR, payroll, and benefits software, has been instrumental in helping SMEs streamline their HR processes through technology integration. By offering a user-friendly platform tailored to the needs of smaller businesses, Zenefits enables SMEs to handle HR functions more efficiently, freeing up resources to focus on growth and innovation.

- According to the European Commission, there were approximately 24.4 million small and medium-sized enterprises in the European Union in 2023. A further 1.32 million enterprises were small firms, while 202,278 were medium-sized firms. Small and medium-sized enterprises form the backbone of the European economy. These companies comprise around 99.8 percent of all active European businesses, producing almost 52% of the total value added in the EU.

Europe is Expected to Hold Significant Market Share

- The human capital advisory market in Europe is experiencing significant growth, driven by the increasing focus on organizational change and development, as well as effective employee management strategies. Companies across various sectors are realizing the critical importance of optimizing their human resources to achieve competitive advantage and sustained growth in a rapidly evolving business landscape. Organizational change and development services are crucial as businesses seek to adapt to market dynamics, technological advancements, and regulatory changes.

- In November 2023, Cendyn and SiteMinder formed a strategic partnership to enhance revenue management capabilities for over 70,000 hotels. Through this collaboration, Cendyn customers gained access to SiteMinder's revenue platform, complementing their existing central reservation system (CRS) capabilities. SiteMinder's revenue platform offers Cendyn's users the potential to handle their rate plans and inventory through SiteMinder. Moreover, they will have access to SiteMinder's complete ecosystem of distribution channels, the big ecosystem for the hotel industry, in order to gain a more dynamic mix of revenue streams and increase their speed-to-market.

- In November 2023, Nagarro, a global provider of digital engineering and technology solutions, introduced an enhanced collaboration with UKG, which is a provider of HR, payroll, and workforce management solutions for all people, as part of its strategic technology partner ecosystem.

- Through this collaboration, Nagarro and UKG revolutionized workforce management with Ginger AI integration, simplifying operations and boosting efficiency. Organizations leveraging Nagarro and UKG Pro Workforce Management (formerly UKG Dimensions) can harness the power of Nagarro's enterprise AI platform, Ginger AI, through Microsoft Teams, meeting the world of work where they are every day. Ginger AI simplifies the handling of crucial workforce management functions, eliminating multiple login hassles or platform-switching.

- Overall, the human capital advisory market in Europe is expanding as businesses recognize the strategic value of effective organizational change, employee management, and talent development strategies. By leveraging specialized expertise, these advisors enable companies to navigate challenges, capitalize on opportunities, and foster a resilient workforce capable of driving long-term success in a dynamic economic environment.

Human Capital Advisory Services Industry Overview

The Human Capital Advisory Services Market is highly fragmented with the presence of major players like KPMG, Deloitte, PWC, Boston Consulting Group, and McKinsey & Company. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Deloitte India and Ramco Systems Limited, a global payroll technology provider, signed a strategic partnership. This collaboration integrated Ramco's advanced payroll platform with Deloitte's specialized advisory and managed services. Together, they committed to providing a comprehensive payroll solution. This solution covers operational services, ensures compliance, offers a seamless user experience, and provides extensive coverage across 150+ countries. All these features are conveniently accessible through a unified payroll platform.

- November 2023 - PwC India announced a strategic partnership with Darwinbox, a Software as a Service (SaaS) based human resource (HR) technology firm, to assist organizations throughout India to revolutionize HR transformation solutions. PwC India and Darwinbox have joined forces to enhance HR transformation solutions for Indian organizations. By leveraging Darwinbox's advanced Human Capital Management (HCM) technology across the entire employee lifecycle, along with PwC India's industry expertise, they aim to drive digital transformations in Indian enterprises.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Economic Growth and the Growing Number of New Businesses

- 5.1.2 Increased Mergers and Acquisitions

- 5.2 Market Restraints

- 5.2.1 Organizations Establishing in-house Advisory Groups

- 5.2.2 Lack of Talent Due to the Rise of Independent Consultants

- 5.3 Technology Landscape of Human Capital Advisory Market

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 HR Outsourcing

- 6.1.2 HR Consulting

- 6.1.2.1 Organizational Change and Development

- 6.1.2.2 Employee Management

- 6.1.2.3 Compliance and Ethics

- 6.1.2.4 HR Transformation

- 6.1.2.5 Culture and Change

- 6.1.2.6 Others

- 6.1.3 Learning and Development

- 6.2 By Organization Size

- 6.2.1 SMEs

- 6.2.2 Large Enterprise

- 6.3 By End Users

- 6.3.1 Information Technology

- 6.3.2 Healthcare

- 6.3.3 BFSI

- 6.3.4 Industrial and Manufacturing

- 6.3.5 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KPMG

- 7.1.2 Deloitte

- 7.1.3 PWC

- 7.1.4 Boston Consulting Group

- 7.1.5 McKinsey & Company

- 7.1.6 Capgemini

- 7.1.7 Bain and Company

- 7.1.8 Accenture

- 7.1.9 Mercer

- 7.1.10 Korn Ferry

- 7.1.11 Aon Plc (Aon Hewitt India)

- 7.1.12 Jombay (CIEL HR)

- 7.1.13 Ernst & Young Global Limited

- 7.1.14 Basiltree Consulting Private Limited

- 7.1.15 Robert Half Inc.

- 7.1.16 Think Talent Services

- 7.2 Vendor Positioning Analysis