|

市場調查報告書

商品編碼

1629766

中東和非洲的資料中心冷卻:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)MEA Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

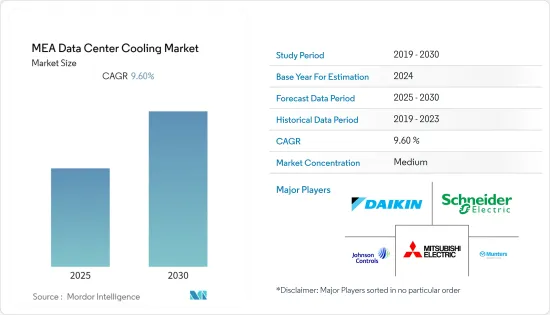

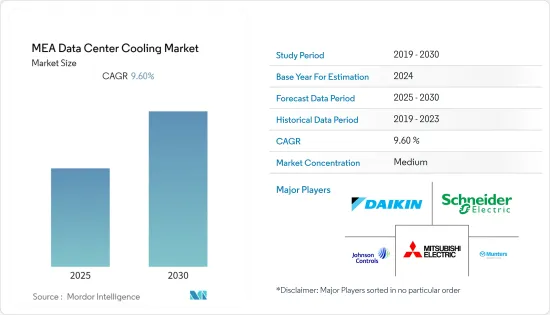

中東和非洲資料中心冷卻市場預計在預測期內複合年成長率為 9.6%

主要亮點

- 該地區的市場受到政府和企業不斷開發數位基礎設施以支援金融服務、通訊零售和製造等各種最終用戶垂直領域的自動化的推動。

- 許多主要的雲端公司正在進入該地區,以抓住這個尚未開發的市場機會。因此,資料中心冷卻的需求預計將會增加。此外,該地區的氣候也使冷卻解決方案成為資料中心的首要任務。

- 非洲正在成為資料中心的潛在市場。 Liquid Telecom 的子公司 Africa Data Centers 已安裝另一層樓,為其位於肯亞內羅畢的設施增加 160 個機架空間。新開放的樓層是對非洲對託管和託管服務巨大需求的直接回應。

- COVID-19 和油價暴跌的雙重影響對整個沿岸地區的經濟產生了複雜的影響。儘管景氣衰退,但網路服務供應商(ISP)、資訊科技 (IT) 基礎設施供應商和資料中心等經濟部門的需求卻有所增加,這主要是由於人們轉向在家工作和遠端工作。這顯示該地區資料中心冷卻市場的需求不斷增加。

中東和非洲資料中心冷卻市場趨勢

醫療保健呈現顯著成長

- 透過電子健康記錄(EMR) 實現的消費者健康記錄數位化正在促進資料成長。醫療設備的最新創新和傳統作業系統的現代化,包括勞動力管理和患者互動系統的改進,正在產生大量資料,進一步增加了對資料中心的需求。這些資料中心需求正在推動資料中心冷卻的需求。

- 對醫療保健技術的投資被認為是重中之重,其中數位化的影響最大。根據 Omnia Health Insights 2020 年 6 月發布的一份報告,遠端醫療對於診所和醫療實踐來說是一個關鍵的發展,尤其是營業額在500 萬美元至1000 萬美元之間的診所和醫療實踐,並且據說這種趨勢比該地區更強。

- 例如,2020 年 7 月,TVM Capital Healthcare 籌集了第二隻成長資本基金,專注於海灣地區的投資。新基金將重點關注海灣合作理事會,特別是沙烏地阿拉伯。新的以海灣地區為重點的基金將尋求投資於除綜合醫院之外的所有醫療保健領域。這進一步增加了患者資料記錄的創建,進而增加了該地區對資料中心冷卻技術的需求。

沙烏地阿拉伯市場佔有率最高

- 沙烏地阿拉伯最近已成為中東和非洲地區的技術中心之一。隨著主要 IT 和醫療保健公司進入市場,該地區對資料中心的需求正在迅速成長。

- 此外,根據沙烏地阿拉伯的 2030 年願景目標,Google、微軟和 IBM 等科技巨頭在該國設立了資料中心,並計劃擴大其設施。

- 目前,該國六個地區有 22 個託管資料中心,為世界各地的私人和公共公司提供服務。此外,2021 年 1 月,中東領先的雲端和託管 IT 服務供應商 BIOS Middle East 宣佈在利雅德和吉達開設兩個新的雲端站點,為沙烏地阿拉伯王國的客戶提供服務。此類案例預計將增加該國資料中心冷卻解決方案的需求。

中東和非洲資料中心冷凍產業概況

中東和非洲資料中心冷卻市場適度分散,由多家公司組成。從市場佔有率來看,目前該市場由幾家大型企業主導。然而,憑藉創新和永續的包裝,許多公司正在透過贏得新契約和開發新市場來擴大其市場佔有率。

- 2021 年 5 月 - 全球科技公司 SAP 宣布與位於阿拉伯聯合大公國的國際主要企業區域供冷開發商 The National Central Cooling Company PJSC (Tabreed) 建立合作夥伴關係。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 新興國家IT基礎設施發展

- 綠色資料中心的出現

- 市場限制因素

- 適應要求和停電

- 產業政策

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按解決方案

- 空調/處理器

- 立柱/機架/門/天花板冷卻系統

- 冷卻器

- 液體冷卻系統

- 節熱器系統

- 按服務

- 安裝部署

- 諮詢、支援及維護服務

- 按行業分類

- 資訊科技

- BFSI

- 通訊

- 衛生保健

- 政府機構

- 其他行業

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和北非國家

第6章 競爭狀況

- 公司簡介

- Vertiv Co.

- Schneider Electric SE

- STULZ GMBH

- Daikin Industries Ltd

- Trane Inc.

- Johnson Controls International Plc

- Mitsubishi Electric Corporation

- Rittal GmbH & Co. KG

- Nortek Air Solutions LLC

- Munters Group AB

- Asetek A/S

- Chilldyne Inc.

- CoolIT Systems Inc.

- Liquid Cool Solutions

- Green Revolution Cooling Inc.

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 56285

The MEA Data Center Cooling Market is expected to register a CAGR of 9.6% during the forecast period.

Key Highlights

- The market in the region is driven by a consistent storm of government and enterprise, developing a digital infrastructure to support automation adoption across a variety of end-user verticals, including financial services, telecommunications retail, and manufacturing.

- Many major cloud players are entering the region to grab the opportunity of this untapped market. Hence this will also develop the demand for data center cooling. Additionally, the regional weather also makes cooling solutions a priority for data centers.

- Africa is emerging as a potential market for data centers. Africa Data Centers, a subsidiary of Liquid Telecom, has fitted out another floor for adding enough space for another 160 racks in its facility in Nairobi, Kenya. The newly-opened floor is a direct response to the massive demand for colocation and hosting services in Africa.

- The dual effects of COVID-19 and sharp oil price reduction have had manifold economic consequences across the Gulf region. Despite the downturn, one sector of the economy, namely internet service providers (ISPs), information technology (IT) infrastructure providers, and data centers, has seen demand increase primarily as a result of the shift towards home and remote working. This indicates the rising demand for the Data center cooling market in the region.

MEA Data Center Cooling Market Trends

Healthcare to Show Significant Growth

- Digitization of consumer health records in the form of electronic medical records (EMR) contributes to data increment. The latest innovations in the medical equipment and modernization of legacy operating systems, such as management of personnel, improvement in the patient response systems, etc., generate a multitude of data, further necessitating the need for data centers. This need for data centers, in turn, drives the demand for data center cooling.

- With digitization creating the most significant impact, investment in healthcare technology has been considered as a key priority. According to a report published by Omnia Health Insights in June 2020, telemedicine was also identified as a crucial development for clinics and medical practices, particularly those with a turnover of USD 5-10 million, and more so in the GCC and the Middle East than other regions.

- For instance, in July 2020, TVM Capital Healthcare raised a second growth capital fund focused on investment in the Gulf. The new fund will have a strong focus on the GCC, but also Saudi Arabia specifically. For its new Gulf-focused fund, the company will look to invest in all areas of health care, except for general hospitals. This has further increased the generation of data records of patients, and in turn, increased the demand for data center cooling technologies in the region.

Saudi Arabia to Hold the Highest Market Share

- Saudi Arabia has recently become one of the technology hubs of the Middle East and Africa region. With major IT and Healthcare firms gaining access to the market, there has been a steep increase in demand for data centers in the region such that the companies can keep their data within the boundaries of the country.

- Further, Saudi Arabia's Vision 2030 objectives have led to the technology giants, like Google, Microsoft, and IBM, setting up data centers in the country, with plans to extend the facilities as well.

- Currently, six areas of the country offer 22 colocation data centers for several private and public enterprises across the globe. Further, in January 2021, BIOS Middle East, a leading provider of cloud and managed IT services in the Middle East, announced it has established two new cloud footprints in Riyadh and Jeddah to serve customers in the Kingdom of Saudi Arabia. Such instances are expected to increase the demand for data center cooling solutions in the country.

MEA Data Center Cooling Industry Overview

The Middle East and Africa Data Center cooling market is moderately fragmented and consists of several players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- May 2021 - Global technology company SAP has announced its partnership with The National Central Cooling Company PJSC (Tabreed), the leading UAE-based international district cooling developer, in a move that will contribute to the digital transformation of the district cooling industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Development in IT Infrastructure in the Emerging Countries

- 4.3.2 Emergence of Green Data Centers

- 4.4 Market Restraints

- 4.4.1 Adaptability Requirements and Power Outages

- 4.5 Industry Policies

- 4.6 Industry Value Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Air Conditioners/Handlers

- 5.1.2 Row/Rack/Door/Overhead Cooling Systems

- 5.1.3 Chillers

- 5.1.4 Liquid Cooling Systems

- 5.1.5 Economizer Systems

- 5.2 By Service

- 5.2.1 Installation and Deployment

- 5.2.2 Consulting, Support and Maintenance Services

- 5.3 By End-User Vertical

- 5.3.1 Information Technology

- 5.3.2 BFSI

- 5.3.3 Telecommunication

- 5.3.4 Healthcare

- 5.3.5 Government

- 5.3.6 Other End-User Verticals

- 5.4 By Country

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Rest of MENA

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vertiv Co.

- 6.1.2 Schneider Electric SE

- 6.1.3 STULZ GMBH

- 6.1.4 Daikin Industries Ltd

- 6.1.5 Trane Inc.

- 6.1.6 Johnson Controls International Plc

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 Rittal GmbH & Co. KG

- 6.1.9 Nortek Air Solutions LLC

- 6.1.10 Munters Group AB

- 6.1.11 Asetek A/S

- 6.1.12 Chilldyne Inc.

- 6.1.13 CoolIT Systems Inc.

- 6.1.14 Liquid Cool Solutions

- 6.1.15 Green Revolution Cooling Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219