|

市場調查報告書

商品編碼

1639420

中國資料中心冷卻:市場佔有率分析、產業趨勢與統計、成長預測(2025-2031)China Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

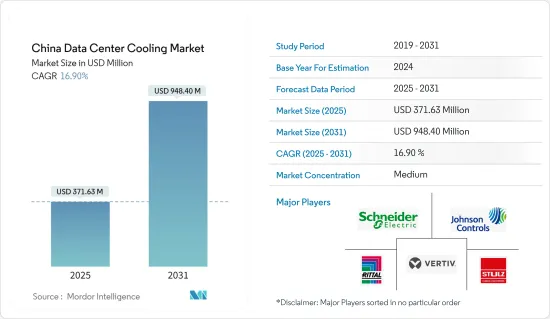

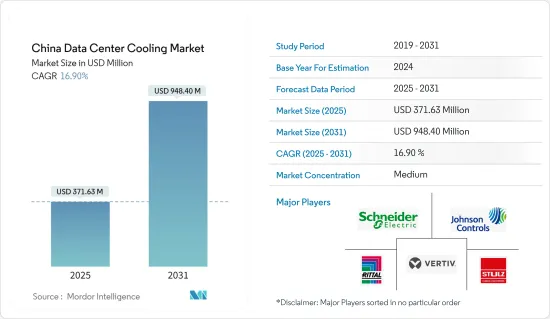

預計2025年中國資料中心冷卻市場規模為3.7163億美元,預估至2031年將達9.484億美元,預測期間(2025-2031年)複合年成長率為16.9%。

主要亮點

- 中小企業擴大採用雲端運算、政府對資料安全的嚴格要求以及國內企業加大投資等因素是推動中國資料中心需求的關鍵因素。

- 預計2030年,中國資料中心市場未來IT負載容量將達到4,000MW以上。此外,到 2030 年,中國的占地面積預計將超過 1,200 萬平方英尺。

- 到2030年,預計全國將安裝超過60萬個機架。北京、廣東、河北、江蘇和上海在機架安裝方面處於領先地位。珠江流域年平均氣溫超過20度C,影響資料中心設施的冷卻需求。

- 中國已有近 19 個海底電纜系統投入運作,還有多個正在建設中。值得注意的是,2023年4月,中國官方通訊宣布了價值5億美元的大規模海底光纖網路的計畫。該網路連接亞洲、中東和歐洲,定位為對美國類似舉措的直接挑戰。

中國資料中心散熱市場趨勢

液體冷卻將成為預測期內成長最快的領域之一

- 技術進步簡化了液體冷卻的維護、可擴展性和經濟性。這使得熱帶地區的資料中心流體消費量減少了 15% 以上,在溫暖地區則減少了 80%。此外,在液冷運作期間利用的能量可以重新用於建築和水加熱。此外,先進合成冷媒的引入有助於減少與空調系統相關的碳排放。

- 水冷卻在控制排放和減緩氣候變遷方面發揮著至關重要的作用。與風冷資料中心相比,使用水冷卻的資料中心消耗的能源大約減少 10%,二氧化碳排放減少 10%。此外,2023年11月,中國開始在海南省三亞市沿海建設最先進的商業水下資料中心。這項開創性計劃旨在透過利用深海、節約能源和土地來實現工業轉型。隨著中國資料中心數量的增加,擴大採用液體冷卻來防止機架伺服器過熱。

- 直接液體冷卻解決方案的部分電源使用效率 (PUE) 為 1.02 至 1.03,略高於最高效的空氣冷卻系統。令人驚訝的是,直接液體冷卻 (DLC) 系統的能源效率並不是主要取決於 PUE。在傳統設定中,伺服器風扇從機架獲取電力,並且此電力消耗會計入 PUE 計算的 IT 電力部分。

IT 和通訊將對 2023 年的市場佔有率做出重大貢獻

- 到2024年初,中國的網路用戶數量將超過印度和美國,領先全球。中國網路用戶規模達10.9億,普及率已超過75%。此外,中國社群媒體用戶規模已達10.6億,佔總人口的74%以上。中國正積極加強5G網路建設,推動6G研究,打造製造業和數位經濟強國。隨著這些技術的擴展,對資料中心冷卻的需求隨著對資料中心的依賴的增加而增加。

- 網路對中國的影響是巨大的。網路技術在推動研發、增強中國經濟以及連接廣大人口方面發揮著至關重要的作用。根據工信部報告,截至2023年6月,中國已部署5G基地台超過293萬個。此次推出恰逢 5G 智慧型手機用戶數量激增至超過 6.76 億,物聯網連接設備數量激增至 21.2 億。

- 人工智慧的興起正在增加資料中心冷卻水的消費量。為此,中國政府於2020年推出了「東方資料、西方計算」計劃。該措施旨在將資料中心從人口稠密的沿海地區轉移到該國的西部地區。自然冷卻、較低的電費、綠色能源的可用性和較低的土地成本等因素正在推動這項策略轉變。這些措施是為了滿足資料中心不斷成長的冷卻需求。

中國資料中心冷凍產業概況

中國資料中心冷卻市場的競爭並不激烈,但近年來已經出現了重要的競爭對手。從市場佔有率來看,該市場由少數大公司主導,包括Stulz GmbH、施耐德電氣和Vertiv Group Corp。 STULZ GmbH、Schneider Electric SE 和 Vertiv Group Corp. 等公司提供液體和空氣冷卻產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 考慮關鍵的冷卻成本

- 從直流冷卻角度分析與直流運轉相關的主要成本開銷

- 透過設計複雜性、PUE 優點、缺點和自然天氣條件覆蓋範圍等關鍵因素,對與每種冷卻技術相關的成本和操作考慮因素進行比較研究。

- 資料中心冷卻的關鍵創新和發展

- 資料中心使用的關鍵能源效率方法

第5章市場動態

- 市場促進因素

- 創新的資料中心冷卻技術推動市場成長

- 對資料中心的需求不斷成長推動市場成長

- 市場問題

- 資料中心冷卻的能源消耗增加和水資源短缺阻礙了市場成長

- 市場機會

- 永續性且節能的資料中心冷卻解決方案提供市場機會

- 產業生態系分析

第6章 中國資料中心足跡現況分析

- 資料中心IT負載能力與佔地面積分析(2017-2030年期間)

- 目前中國DC熱點及未來拓展前景分析

- 中國主要資料中心承包商和營運商分析

第7章 市場區隔

- 透過冷卻技術

- 空氣冷卻

- 冷卻器和節熱器

- CRAH

- 冷卻塔(包括直接冷卻、間接冷卻、兩級冷卻)

- 其他風冷技術

- 液基冷卻

- 浸沒式冷卻

- 晶片間直接冷卻

- 後門熱交換器

- 空氣冷卻

- 按類型

- 超大規模資料中心業者(自有和租賃)

- 企業(本地)

- 搭配

- 按最終用戶產業

- 資訊科技和電訊

- 零售/消費品

- 醫療保健

- 媒體娛樂

- 聯邦機構

- 其他

第8章 競爭格局

- 公司簡介

- Schneider Electric SE

- Johnson Controls Inc.

- GIGA-BYTE Technology Co. Ltd

- Vertiv Group Corp.

- Carrier Global Corporation

- Rittal Gmbh & Co. KG

- Munters Group

- Stulz GmbH

- Kstar Ltd

- Alfa Laval AB

第9章投資分析

第10章市場機會與未來趨勢

第11章 關於出版商

The China Data Center Cooling Market size is estimated at USD 371.63 million in 2025, and is expected to reach USD 948.40 million by 2031, at a CAGR of 16.9% during the forecast period (2025-2031).

Key Highlights

- Factors such as the rising adoption of cloud computing by SMEs, stringent government mandates on local data security, and increased investments by domestic enterprises are key drivers fueling the demand for data centers in the nation.

- The upcoming IT load capacity of the Chinese data center market is expected to reach more than 4,000 MW by 2030. The country's construction of raised floor area is expected to increase to more than 12 million sq. ft by 2030.

- By 2030, the country is projected to install over 600,000 racks. Beijing, Guangdong, Hebei, Jiangsu, and Shanghai are poised to lead in rack installations. The Pearl River Valley maintains an average annual temperature exceeding 20°C, influencing the need for cooling in data center facilities.

- China boasts nearly 19 operational submarine cable systems, with several more in construction. Notably, in April 2023, China's state-owned news agency unveiled plans for a significant undersea fiber optic network valued at USD 500 million. This network is designed to link Asia, the Middle East, and Europe, positioning itself as a direct competitor to analogous US initiatives.

China Data Center Cooling Market Trends

Liquid-based Cooling to be One of the Fastest-growing Segment During the Forecast Period

- Technological advancements have streamlined the maintenance, scalability, and affordability of liquid cooling. This has led to a reduction in data center liquid consumption by over 15% in tropical regions and a substantial 80% in more temperate zones. Moreover, the energy harnessed during liquid cooling operations can be repurposed to heat both buildings and water. Additionally, the deployment of advanced artificial refrigerants is proving instrumental in curbing the carbon footprint associated with air conditioning systems.

- Water cooling plays a pivotal role in curbing emissions and mitigating climate disruptions. Data centers that leverage water for cooling consume roughly 10% less energy than their air-cooled counterparts, resulting in a corresponding 10% reduction in CO2 emissions. Moreover, in November 2023, China began constructing a cutting-edge commercial underwater data center off the coast of Sanya in the Hainan province. This pioneering project seeks to transform the industry by tapping into the ocean's depths, conserving energy and land. With the rising number of data centers in China, the adoption of liquid cooling is on the rise, aiming to safeguard rack servers from overheating.

- Direct liquid cooling solutions boast a partial power usage effectiveness (PUE) ranging from 1.02 to 1.03, edging out the most efficient air cooling systems by a slim margin. Surprisingly, the energy gains of Direct Liquid Cooling (DLC) systems are not primarily attributed to their PUE. In traditional setups, server fans draw power from the rack, and this power consumption is factored into the IT power section of the PUE calculation, as these fans are integral components of the data center's overall energy consumption.

IT and Telecommunication Contributed Significant Market Share in 2023

- By the beginning of 2024, China had led the globe in terms of internet user numbers, outstripping India and the United States. The country boasted a staggering 1.09 billion internet users, with a penetration rate exceeding 75%. Furthermore, China's social media user base reached 1.06 billion, representing over 74% of its population. The country is actively enhancing its 5G network and advancing 6G research to establish China as a manufacturing and digital economic powerhouse. As these technologies expand, the demand for data center cooling rises in tandem with the growing reliance on data centers.

- The internet's influence on China is profound. Internet technologies drive research and development and play a pivotal role in bolstering the nation's economy and linking its vast population. MIIT reported that by June 2023, China had deployed over 2.93 million 5G base stations. This rollout coincided with a surge in 5G smartphone users, surpassing 676 million, and a substantial 2.12 billion Internet of Things-connected devices.

- The rise of AI has led to heightened water consumption for data center cooling. In response, the Chinese government introduced the "Eastern-Data, Western-Computing" initiative in 2020. This initiative aims to relocate data centers from densely populated coastal areas to the country's western regions. Factors such as natural cooling, reduced electricity costs, availability of green energy, and lower land expenses are driving this strategic shift. These measures are designed to meet the escalating demands for data center cooling.

China Data Center Cooling Industry Overview

The Chinese data center cooling market is moderately competitive but has gained a significant competitive edge in recent years. A handful of major players, including Stulz GmbH, Schneider Electric SE, and Vertiv Group Corp., dominate the market in terms of market share. Companies such as STULZ Gmbh, Schneider Electric SE, and Vertiv Group Corp. offer liquid and air-based cooling products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of the Key Cost Overheads Related to DC Operations with an Eye on DC Cooling

- 4.2.2 Comparative Study of the Cost and Operational Considerations Related to Each Cooling Technology Based on Key Factors Such as Design Complexity, PUE Advantages, Drawbacks, Extent of Utilization of Natural Weather Conditions

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Innovative Data Center Cooling Technologies To Drive Market Growth

- 5.1.2 Increasing Data Center Demand To Drive Market Growth

- 5.2 Market Challenges

- 5.2.1 Higher Energy Consumption And Water Scarcity For Data Center Cooling To Hinder Market Growth

- 5.3 Market Opportunities

- 5.3.1 Sustainability and Energy Efficient Data Center Cooling Solutions To Provide Market Opportunity

- 5.4 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN CHINA

- 6.1 Analysis of IT Load Capacity and Area Footprint of Data Centers (for the period of 2017-2030)

- 6.2 Analysis of the current DC hotspots and scope for future expansion in China

- 6.3 Analysis of major Data Center Contractors and Operators in China

7 MARKET SEGMENTATION

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH

- 7.1.1.3 Cooling Tower (Covers Direct, Indirect, and Two-stage Cooling)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-chip Cooling

- 7.1.2.3 Rear-door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Type

- 7.2.1 Hyperscaler (Owned and Leased)

- 7.2.2 Enterprise (On-premise)

- 7.2.3 Colocation

- 7.3 By End-user Industry

- 7.3.1 IT and Telecom

- 7.3.2 Retail and Consumer Goods

- 7.3.3 Healthcare

- 7.3.4 Media and Entertainment

- 7.3.5 Federal and Institutional agencies

- 7.3.6 Other End-user Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Schneider Electric SE

- 8.1.2 Johnson Controls Inc.

- 8.1.3 GIGA-BYTE Technology Co. Ltd

- 8.1.4 Vertiv Group Corp.

- 8.1.5 Carrier Global Corporation

- 8.1.6 Rittal Gmbh & Co. KG

- 8.1.7 Munters Group

- 8.1.8 Stulz GmbH

- 8.1.9 Kstar Ltd

- 8.1.10 Alfa Laval AB