|

市場調查報告書

商品編碼

1637858

亞太資料中心冷卻:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)APAC Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

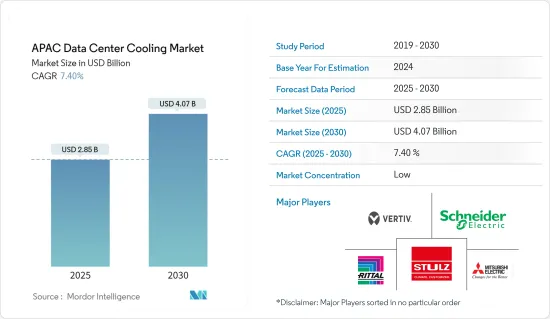

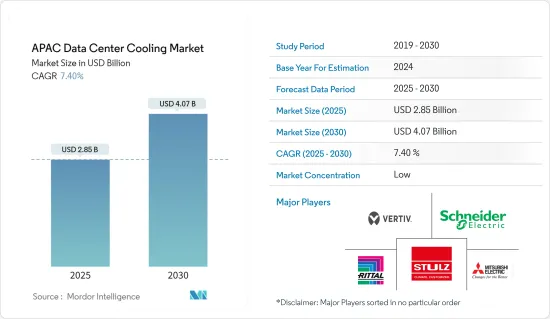

亞太地區資料中心冷卻市場規模預計在2025年為28.5億美元,預計到2030年將達到40.7億美元,預測期內(2025-2030年)的複合年成長率為7.4%。

由於亞太地區人工智慧(AI)和媒體應用的大量運算需求推動網路使用量和資料中心數量的激增,資料中心冷卻市場正在經歷大規模成長。

據國際能源總署 (IEA) 稱,對數位服務的需求正在不斷成長。自 2010 年以來,全球網路使用者數量幾乎加倍,全球網路流量增加了 20 倍。同時,能源效率的顯著提高限制了資料中心和資料傳輸系統的能源需求成長,這兩個領域分別佔全球電力使用量的1-1.5%。為了在 2050 年實現淨零排放,未來十年大幅減少能源需求和排放,需要政府和國際組織在能源效率、研發以及電力供應和供應鏈脫碳方面開展協調一致的合作。努力。

亞太地區新興國家IT基礎設施的發展正在推動市場的發展。根據國際能源總署2022年10月發布的資料,亞洲資料中心的能源需求預計將從2019年的66TWh成長到2022年的72TWh。

亞太地區的公司正嘗試透過建立綠色資料中心來解決這個問題,這些資料中心使用自然空氣冷卻系統取代傳統空調。使用綠色資料中心來管理、儲存和傳遞資訊的趨勢日益成長,這幫助許多軟體企業降低了能源消費量和整體能源成本。

然而,亞太地區的適應性需求和停電對市場成長構成了挑戰。典型的資料中心冷卻系統必須是預先設計的、標準化和模組化的。它還需要具有靈活性和擴充性,以滿足亞太地區資料中心的要求。對於希望透過不在高階定製冷卻系統上投入過多來削減成本的公司來說,這如今是一個挑戰。

市場參與者正在與冷卻劑供應商合作,為客戶提供更好的產品。例如,2023 年 8 月,新加坡的 SK Enmove 與戴爾和浸入式冷卻專家 GRC 合作,開始提供冷卻液。這家潤滑公司正在進軍浸入式冷卻領域。戴爾提供放入我們套件中的 GRC 槽中的介電冷卻劑,並由伺服器製造商供應和支援。 SK Enmove 將開發基於高品質潤滑油基油油的專用冷卻劑,而戴爾和 GRC 將生產專為浸入式冷卻而設計的伺服器設計和浴缸。

亞太資料中心冷卻市場趨勢

資訊科技產業將實現最高成長

資訊科技(IT)產業為各行各業帶來了變革性進步。由於 IT 創新而顯著成長的一個領域是研究市場。

此外,亞太地區該領域也正在經歷顯著的成長。作為技術和數位轉型蓬勃發展的需求中心,IT 產業正在迎接挑戰,推動研究市場發展邁向新的高度。

由於 SaaS 供應商的擴張使得雲端儲存供應商能夠擴大其容量,因此雲端儲存的使用量每年都在成長,這可能會增加對資料中心冷卻系統的需求。微軟、AWS 和Google等雲端儲存公司正在擴大其儲存容量,以實現更有效率的雲端工作流程。這些公司正在投資超大規模交易。

隨著資料驅動技術、雲端處理、人工智慧和物聯網 (IoT) 的不斷發展,對資料中心的需求正在激增。企業正在擴大其數位足跡,需要更大的資料中心或分佈在不同地區的多個小型設施。這種成長為管理如此龐大的基礎設施的冷卻需求帶來了新的挑戰。

中國可望佔主要市場佔有率

資料中心冷卻是一個快速擴張的市場,其驅動力來自於亞太地區資料中心基礎設施的成長、數位服務的日益普及以及雲端處理的興起。資料中心的需求正在急劇增加,其效率和最大運作變得尤為重要。

中國正在努力在資料中心建設方面超越全球競爭對手。隨著大型組織尋求擴大其資料中心規模以確保穩定可靠的資料服務,5G、穿戴式技術、物聯網 (IoT) 和人工智慧的使用將推動處理速度。

隨著人工智慧和類似工作負載在中國許多行業中變得越來越普遍,加速器處理器正在進入企業資料中心。所有對延遲敏感的服務都需要使用加速器系統快速處理資訊的零延遲技術。這些硬體加速器的冷卻需求很高,從 200W 以上不等。當與強大的伺服器結合時,單一機器的冷卻要求可接近1kW。該地區的資料中心擴大使用浸入式冷卻技術。

Microsoft Azure 和 Amazon Web Services 正在建立龐大的全球雲端資料中心網路。為了因應這些進步,中國最大電子商務公司的雲端處理部門阿里巴巴集團正在採用資料中心冷卻解決方案,將伺服器主機板浸入液體冷卻劑中。該技術利用了液體比空氣更有效地傳輸熱量的事實。浸入式冷卻解決方案的能源效率提高使資料中心的營運成本降低了 20%。

亞太資料中心冷卻市場概況

亞太地區的資料中心冷卻市場比較分散,預計技術帶來的好處以及政府透過對資料中心實施效率法規所提供的幫助將直接促進資料中心冷卻市場的成長。在現有市場中,大公司佔有重要地位,且市場滲透率不斷提高。對創新的日益關注推動了對新技術的需求,這反過來又刺激了對其進一步發展的投資。主要企業包括 Vertiv Co.、施耐德電機 SE 和 STULZ GMBH。

2024 年 5 月,Rittal 與多家超大規模資料中心業者合作開發了模組化冷卻系統。該解決方案透過直接水冷實現超過1MW的冷卻能力。專門針對高功率密度 AI 應用進行調整。

2024 年 4 月,Vertiv 宣布推出最新系列高密度資料中心基礎設施解決方案,專為擁抱人工智慧的企業而打造。 Vertiv 360AI 系列旨在滿足人工智慧主導的資料中心日益成長的冷卻和電力需求。

2024 年 3 月,Rittal Private Limited 在其位於印度班加羅爾的製造工廠開設了一個新的整合中心,專門從事冷卻裝置和液體冷卻包 (LCP) 解決方案。這項策略性舉措增強了 Rittal 的生產能力,使公司能夠滿足日益成長的工業冷卻解決方案需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況(範圍:包括與資料中心冷卻相關的當前區域趨勢的詳細分析)

- 冷卻的主要成本考量

- 分析與資料中心營運相關的主要成本開銷,重點關注資料中心冷卻

- 資料中心冷卻的關鍵創新和發展

- 資料中心採用的主要節能技術

第5章 市場動態

- 市場促進因素(關鍵因素包括日益關注能源消耗和轉向綠色解決方案,這些因素基於未來 5-7 年的相對影響進行繪製)

- 市場動態(監管的動態性質和不斷變化的客戶需求等關鍵因素將根據其在未來 5-7 年內的相對影響進行繪製)

- 市場機會

- 封閉式與非封閉式架空地板

- 產業生態系統分析

6. 區域資料中心足跡現況分析

- 資料中心 IT 負載能力與麵積分佈區域分析(2017-2030 年)

- 對亞太地區成熟的資料中心市場和新興資料中心熱點進行區域分析(內容將包括重點介紹主要的成熟和新興資料中心市場)

- 直流冷卻法規結構的區域分析

第 7 章資料中心冷卻市場細分

- 依冷卻技術分類(主要趨勢、2022-2029 年市場規模估計與預測、未來展望)

- 空氣冷卻

- CRAH

- 冷卻器和節熱器

- 冷卻塔(涵蓋直接冷卻、間接冷卻及雙級冷卻)

- 其他

- 液體冷卻

- 浸入式冷卻

- 晶片直接冷卻

- 後門式熱交換器

- 空氣冷卻

- 按最終用戶產業

- 資訊科技和電信

- 零售和消費品

- 衛生保健

- 媒體與娛樂

- 聯邦政府

- 其他最終用戶

- 按國家

- 中國

- 印度

- 日本

- 澳洲

- 紐西蘭

- 新加坡

- 韓國

- 馬來西亞

- 印尼

- 菲律賓

- 台灣

- 香港

- 泰國

- 越南

第8章 競爭格局

- 公司簡介

- Vertiv Group Corp.

- Stulz GmbH

- Schneider Electric SE

- Rittal Gmbh & Co. KG

- Mitsubishi Electric Corporation

- Johnson Controls Inc.

- Munters Group

- Eaton Corporation plc

- Daikin Industries Limited

- Asetek A/S

第9章投資分析

第10章 市場機會與未來趨勢

The APAC Data Center Cooling Market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 4.07 billion by 2030, at a CAGR of 7.4% during the forecast period (2025-2030).

Due to the surge in Internet usage and the number of data centers due to enormous computational requirements by artificial intelligence (AI) and media applications in Asia-Pacific (APAC), the data center cooling market has had massive growth.

According to the International Energy Agency (IEA), the need for digital services is continuously increasing. Since 2010, the global population of internet users has nearly doubled, while global web traffic has increased 20-fold. On the other hand, significant advances in energy efficiency have helped to restrain the increase in energy demand from data centers and data transmission systems, each contributing to 1-1.5% of worldwide power use. Substantial government and business efforts on energy efficiency, research and development, and decarbonizing power supply and supply chains are required to cut energy demand and emissions significantly over the next decade to meet the Net Zero by 2050 Scenario.

Development in IT Infrastructure in emerging countries of APAC is propelling the market. The data center energy demand increased from 66 TWh in 2019 to 72 TWh in 2022 in Asia, according to IEA data released in October 2022.

Companies in the APAC region are trying to tackle this issue by setting up Green data centers that use Free air cooling systems instead of traditional Air conditioners. The increasing trends toward deploying green data centers for managing, storing, and distributing information have helped many software businesses decrease energy consumption and total energy costs.

However, adaptability demands and power outages in Asia-Pacific are a challenge to the growth of the market. A typical data center cooling system must be pre-engineered, standardized, and modular. It is expected to be flexible and scalable to match the data center's requirements in the region. This is challenging today, with firms looking to lower costs and not spend much on high-end customized cooling systems.

The players in the market are collaborating with cooling fluids providers to provide better products to their customers. For instance, in August 2023, Singapore's SK Enmove partnered with Dell and immersion cooling expert GRC to provide cooling fluids. The lubrication company is moving into immersion cooling. It will provide dielectric coolants to fill GRC's tubs, which will hold the Dell kit and be supplied and supported by the server maker. SK Enmove will develop specialized cooling fluids based on its high-quality lube base oil, while Dell and GRC will produce server designs and tubs designed for immersion cooling.

APAC Data Center Cooling Market Trends

Information Technology Industry to Witness Highest Growth

The Information Technology (IT) vertical has driven transformative advancements in various industries. One area that has witnessed remarkable growth due to IT innovation is the market studied.

Moreover, Asia-Pacific is experiencing significant growth in this segment. As a thriving demand hub for technology and digital transformation, the IT sector has risen to the challenge, propelling the development of the market studied to new heights.

Cloud storage use has expanded over the years as SaaS provider expansion has enabled cloud storage providers to expand their capacity, which is likely to raise demand for data center cooling systems. Cloud storage companies like Microsoft, AWS, and Google are expanding their storage capacity to enable more efficient cloud workflow. These firms are investing in hyperscale transactions.

As data-driven technologies, cloud computing, artificial intelligence, and (IoT) continue to evolve, the demand for data centers has skyrocketed. Companies are expanding their digital footprints, requiring larger data centers or multiple smaller facilities spread across various regions. This growth has introduced new challenges in managing the cooling needs of these sprawling infrastructures.

China is Expected to Witness Significant Market Share

Data center cooling is a market that is expanding quickly in Asia-Pacific due to the region's growing data center infrastructure, rising adoption of digital services, and the emergence of cloud computing. The need for data centers is increasing significantly and placing a greater emphasis on effectiveness and maximum uptime.

China is putting much effort toward overtaking its competitors globally in the construction of data centers. The use of 5G, wearable technology, the Internet of Things (IoT), and artificial intelligence generates a booming demand for processing capacity as larger organizations attempt to scale up their data centers to assure the stability and reliability of data services.

Accelerator processors are entering the enterprise data center as artificial intelligence and comparable workloads become commonplace in numerous Chinese industries. All latency-sensitive services demand zero-latency technologies that use accelerating systems to handle information rapidly. The cooling requirements for these hardware accelerators are considerable and range from 200 W to more. The cooling requirements of a single machine can be almost 1 kW when paired with a powerful server. In the region's data centers, this has increased the use of immersion cooling technologies.

Microsoft Azure and Amazon Web Services are constructing massive global cloud data center networks. Alibaba Group, the cloud computing division of China's largest e-commerce company, uses a data center cooling solution that submerges server motherboards in liquid coolant to compete with these advancements. This technique makes use of liquid's more effective ability to transport heat than air. The energy efficiency enhancements of the immersion cooling solution led to a 20% decrease in data center operating expenses.

APAC Data Center Cooling Industry Overview

The Asia-Pacific data center cooling market is fragmented as the advantages offered by the technology and aid from the government by imposing efficiency regulations on data centers are expected to help the growth of the data center cooling market directly. Market penetration is growing with a strong presence of major players in established markets. With the increasing focus on innovation, the demand for new technologies is growing, which, in turn, is driving investments for further developments. Key players are Vertiv Co., Schneider Electric SE, STULZ GMBH, etc.

In May 2024, Rittal developed a modular cooling system in collaboration with multiple hyperscalers. This solution boasts a cooling capacity exceeding 1 MW, achieved through direct water cooling. It's specifically tailored to cater to the high power densities of AI applications.

In April 2024, Vertiv unveiled its latest lineup of high-density data center infrastructure solutions tailored specifically for enterprises delving into AI. The Vertiv 360AI series is crafted to cater to AI-driven data centers' augmented cooling and power demands.

In March 2024, Rittal Private Limited marked the opening of its new Integration Centre, specifically tailored for Cooling Units and Liquid Cooling Package (LCP) solutions, at its Bangalore, India manufacturing plant. This strategic move bolsters the company's production capabilities and positions it to cater to the escalating demand for Industrial Cooling Solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Coverage: A detailed analysis of the current regional trends related to Data Center Cooling are included in this section)

- 4.2 Key cost considerations for Cooling

- 4.2.1 Analysis of the key cost overheads related to DC operations with an eye on DC Cooling

- 4.2.2 Key innovations and developments in Data Center Cooling

- 4.2.3 Key energy efficiency practices adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers (Key factors such as the increased emphasis on energy consumption, move towards green solutions are mapped based on their relative impact over the next 5-7 years)

- 5.2 Market Challenges (Key factors such as the dynamic nature of regulations, evolving customer needs are mapped based on their relative impact over the next 5-7 years)

- 5.3 Market Opportunities

- 5.4 Comparison of raised floor with containment & raised floor without commitment

- 5.5 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT REGIONAL DATA CENTER FOOTPRINT

- 6.1 Regional Analysis of IT Load Capacity & Area Footprint of Data Centers (for the period of 2017-2030)

- 6.2 Regional Analysis of the Established DC Markets and Emerging DC Hotspots in APAC region (we will include coverage by highlighting major established and emerging DC markets)

- 6.3 Regional Analysis of Regulatory Framework On DC Cooling

7 DATA CENTER COOLING MARKET SEGMENTATION

- 7.1 By Cooling Technology (Key trends, market size estimates & projections for the period of 2022-2029 and future outlook)

- 7.1.1 Air-based Cooling

- 7.1.1.1 CRAH

- 7.1.1.2 Chiller and Economizer

- 7.1.1.3 Cooling Tower (covers direct, indirect & two-stage cooling)

- 7.1.1.4 Others

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By End-user Vertical

- 7.2.1 IT & Telecom

- 7.2.2 Retail & Consumer Goods

- 7.2.3 Healthcare

- 7.2.4 Media & Entertainment

- 7.2.5 Federal & Institutional agencies

- 7.2.6 Other end-users

- 7.3 By Country

- 7.3.1 China

- 7.3.2 India

- 7.3.3 Japan

- 7.3.4 Australia

- 7.3.5 New Zealand

- 7.3.6 Singapore

- 7.3.7 South Korea

- 7.3.8 Malaysia

- 7.3.9 Indonesia

- 7.3.10 Philippines

- 7.3.11 Taiwan

- 7.3.12 Hong Kong

- 7.3.13 Thailand

- 7.3.14 Vietnam

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Group Corp.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal Gmbh & Co. KG

- 8.1.5 Mitsubishi Electric Corporation

- 8.1.6 Johnson Controls Inc.

- 8.1.7 Munters Group

- 8.1.8 Eaton Corporation plc

- 8.1.9 Daikin Industries Limited

- 8.1.10 Asetek A/S