|

市場調查報告書

商品編碼

1636204

北美廢棄物管理:市場佔有率分析、產業趨勢和成長預測(2025-2030)North America Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

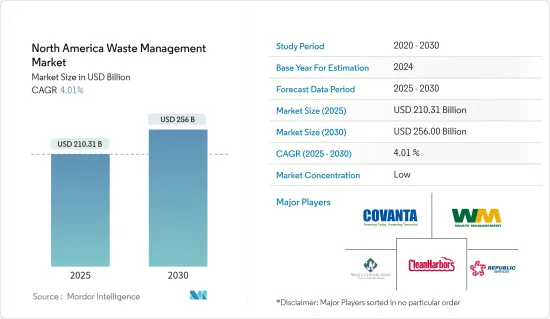

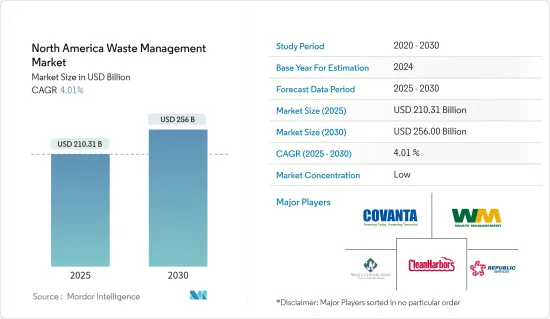

北美廢棄物管理市場規模預計到 2025 年為 2,103.1 億美元,預計到 2030 年將達到 2,560 億美元,預測期內(2025-2030 年)複合年成長率為 4.01%。

根據 2024 年 7 月宣布的新聯邦塑膠污染策略,到 2035 年,一次性塑膠將逐步從美國政府的所有業務中淘汰。該政策列舉了塑膠造成的海洋污染和空氣污染的嚴峻情況。

預計逐步淘汰將增加對先進回收技術和設施的需求,這些技術和設施可以處理替代材料和管理殘留塑膠。廢棄物管理公司可能需要開發新的系統和基礎設施來滿足這些不斷變化的需求。

隨著廢棄物技術的發展和廢棄物方法的改進,這個市場的發展也不斷進步,反映出向綠色和循環經濟原則的轉變。此類技術的例子包括等離子弧氣化、熱解和迴轉窯。

2024年3月,美國能源局生質能源技術辦公室(BETO)和國家可再生能源實驗室(NREL)啟動了下一階段的廢棄物技術援助。該計劃擴大到州政府,也包括廢棄物資源。

該計劃將透過擴大州政府的參與資格並進一步擴大其範圍以納入廢棄物資源,從而推動北美廢棄物管理市場的發展。這項措施將促進垃圾焚化發電技術的傳播,並有望擴大廢棄物管理市場。

北美廢棄物管理市場趨勢

由於塑膠廢棄物問題日益嚴重,廢棄物管理市場激增

- 根據美國人口普查局統計,2023年美國廢棄塑膠出口量約9.2億磅,與前一年同期比較減少4.6%,比2015年減少近80%。加拿大和墨西哥是主要出口目的地,占美國塑膠廢料出口的一半以上。

- 這種下降表明塑膠廢料加工對國際市場的依賴減少,並表明越來越需要加強國內回收和廢棄物管理解決方案。隨著出口機會的減少,美國越來越需要在國內開發更強大的回收基礎設施和廢棄物管理系統。

- 在加拿大,2022 年各種排放的廢棄物處理量增加了 50 萬噸(+1.91%),達到 2,662 萬噸。這一成長對應於觀察期間廢棄物處置的最高值。這一成長凸顯了需要有效管理的廢棄物量的增加,以及對改善廢棄物管理策略、加強回收計畫和全面廢棄物減少措施的需求。

塑造北美廢棄物管理的國家策略

- 2024 年 6 月,美國農業部 (USDA)、美國環保署 (EPA)、美國食品藥物管理局(FDA) 和白宮推出。

- 該計劃旨在到 2030 年將糧食損失和浪費減少 50%,同時增加有機回收。該策略支持應對氣候變遷、改善糧食安全和促進環境正義等更廣泛的目標。

- 為了實現這些目標,美國農業部、環保署和食品藥物管理局(FDA) 正在資助新的研究、進行宣傳宣傳活動,並專注於建立社區範圍的回收基礎設施。我們也與熱衷於減少廢棄物的行業領導者建立夥伴關係。

- 該策略預計將透過增加對先進解決方案的需求對廢棄物管理市場產生重大影響。隨著有機廢棄物數量的增加,企業必須擴大服務範圍並加強回收流程。需求的增加預計將推動該行業的成長。此外,該策略將鼓勵加強合作和更有效的資源分配,並改善北美的整體廢棄物管理實踐。

北美廢棄物管理產業概述

北美廢棄物管理市場的特點是競爭激烈,多家主要企業提供各種解決方案。廢棄物管理公司(Waste Management Inc.)和共和服務公司(Republic Services Inc.)是該地區廣泛的收集、回收和處置網路的主要領導者。 Waste Connections Inc. 也佔有重要地位,提供全面的廢棄物和回收服務,特別是在中小型市場。

永續性、創新和合規性是這個市場的關鍵驅動力。例如,廢棄物管理公司正在大力投資垃圾垃圾掩埋沼氣發電工程,從垃圾掩埋場捕獲甲烷來生產可再生能源,減少溫室氣體排放並永續性。同樣,共和服務公司也制定了先進的回收計劃和零廢棄物舉措,以轉移廢棄物垃圾掩埋場的廢棄物並促進循環經濟。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 科技趨勢

- 洞察供應鏈/價值鏈分析

- 產業監管洞察

- 洞察產業技術進步

第5章市場動態

- 市場促進因素

- 環保意識不斷增強

- 廢棄物管理技術的創新

- 市場限制因素

- 資本和營運成本高

- 市場機會

- 增加回收和堆肥計劃

- 新的廢棄物發電解決方案

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 依廢棄物類型

- 工業廢棄物

- 都市固態廢棄物

- 電子廢棄物

- 塑膠廢棄物

- 生物醫藥+其他(含建築廢棄物)

- 依加工方法分

- 掩埋

- 焚化

- 回收

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- Waste Management, Inc.

- Republic Services, Inc.

- Waste Connections, Inc.

- Clean Harbors, Inc.

- Covanta Holding Corporation

- Veolia North America

- Rumpke Waste & Recycling

- Heritage Environmental Services

- Waste Pro USA

- EnviroServe*

- 其他公司

第8章 市場機會及未來趨勢

第9章 附錄

The North America Waste Management Market size is estimated at USD 210.31 billion in 2025, and is expected to reach USD 256.00 billion by 2030, at a CAGR of 4.01% during the forecast period (2025-2030).

Single-use plastic will be phased out of all US government operations by 2035 under a new federal plastic pollution strategy unveiled in July 2024. The policy cites a crisis of littered oceans and poisoned air due to plastics.

The phase-out is expected to boost the need for advanced recycling technologies and facilities capable of processing alternative materials and managing residual plastics. Waste management companies will need to develop new systems and infrastructure to handle these evolving requirements.

The market studied is also witnessing growth in the development of waste-to-energy technologies and improved waste processing methods, reflecting a shift toward more eco-friendly and circular economy principles. Examples of these technologies are plasma arc gasification, pyrolysis, and rotary kilns.

In March 2024, the US Department of Energy's Bioenergy Technologies Office (BETO) and the National Renewable Energy Laboratory (NREL) launched the next phase of Waste-to-Energy Technical Assistance. The program eligibility has been expanded to include state governments, and the scope now includes additional waste resources.

The program promotes the North American waste management market by broadening state governments' eligibility and expanding the scope to include additional waste resources. This initiative encourages more widespread adoption of waste-to-energy technologies, which can drive growth in the waste management market.

North America Waste Management Market Trends

Waste Management Market Surges in Response to Escalating Plastic Waste Concerns

- In 2023, the United States exported approximately 920 million pounds of scrap plastic, marking a 4.6% decrease from the previous year and a nearly 80% drop from 2015, according to the US Census Bureau. Canada and Mexico were the leading destinations for these exports, accounting for over half of the US plastic scrap exports.

- This decline suggests a reduced reliance on international markets for plastic scrap disposal, signaling a growing need for enhanced domestic recycling and waste management solutions. As export opportunities contract, there is an increasing imperative for the United States to develop a more robust recycling infrastructure and waste management systems within its borders.

- In Canada, waste disposal from all sources increased by 0.5 million tonnes (+1.91%) in 2022, reaching 26.62 million tonnes. This rise represents the highest waste disposal level in the observed period. The increase underscores a growing volume of waste that needs effective management, highlighting the demand for improved waste management strategies, enhanced recycling programs, and comprehensive waste reduction measures.

National Strategy Shaping North American Waste Management

- In June 2024, the US Department of Agriculture (USDA), US Environmental Protection Agency (EPA), US Food and Drug Administration (FDA), and the White House launched the National Strategy for Reducing Food Loss and Waste and Recycling Organics.

- This initiative aims to reduce food loss and waste by 50% by 2030 while enhancing the recycling of organic materials. The strategy supports broader objectives of combating climate change, improving food security, and promoting environmental justice.

- The USDA, EPA, and FDA will fund new research, launch awareness campaigns, and focus on building community-scale recycling infrastructure to achieve these goals. They will also foster partnerships with industry leaders dedicated to waste reduction.

- This strategy is expected to significantly impact the waste management market by increasing the demand for advanced solutions. As the volume of organic waste rises, companies must expand their services and enhance recycling processes. This increased demand is anticipated to drive growth in the sector. Moreover, the strategy encourages greater collaboration and more efficient resource allocation, improving overall waste management practices in North America.

North America Waste Management Industry Overview

The North American waste management market is characterized by a competitive landscape with several key players offering various solutions. Waste Management Inc. and Republic Services Inc. are significant leaders, dominating the region's extensive collection, recycling, and disposal networks. Waste Connections Inc. also holds a significant position, providing comprehensive waste and recycling services, especially in smaller and mid-sized markets.

Sustainability, technological innovation, and regulatory compliance are major drivers in this market. For instance, Waste Management Inc. has invested heavily in landfill gas-to-energy projects, capturing methane from landfills to produce renewable energy, which helps reduce greenhouse gas emissions and supports energy sustainability. Similarly, Republic Services Inc. has implemented advanced recycling programs and zero-waste initiatives to divert waste from landfills and promote a circular economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Awareness

- 5.1.2 Innovations In Waste Management Technologies

- 5.2 Market Restraints

- 5.2.1 High Capital and Operational Costs

- 5.3 Market Opportunities

- 5.3.1 Growth in Recycling and Composting Programs

- 5.3.2 Emerging Waste-to-Energy Solutions

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Waste type

- 6.1.1 Industrial waste

- 6.1.2 Municipal solid waste

- 6.1.3 E-waste

- 6.1.4 Plastic waste

- 6.1.5 Biomedical + Others (Including Construction Waste)

- 6.2 By Disposal methods

- 6.2.1 Landfill

- 6.2.2 Incineration

- 6.2.3 Recycling

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Waste Management, Inc.

- 7.2.2 Republic Services, Inc.

- 7.2.3 Waste Connections, Inc.

- 7.2.4 Clean Harbors, Inc.

- 7.2.5 Covanta Holding Corporation

- 7.2.6 Veolia North America

- 7.2.7 Rumpke Waste & Recycling

- 7.2.8 Heritage Environmental Services

- 7.2.9 Waste Pro USA

- 7.2.10 EnviroServe*

- 7.3 Other Companies