|

市場調查報告書

商品編碼

1642097

越南廢棄物管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vietnam Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

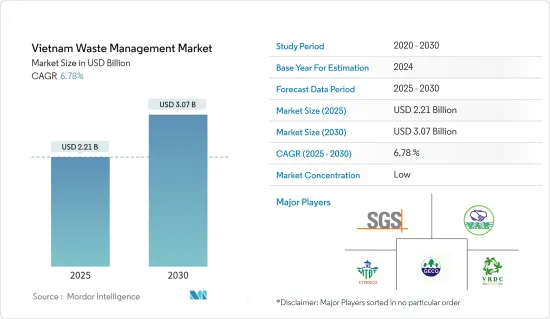

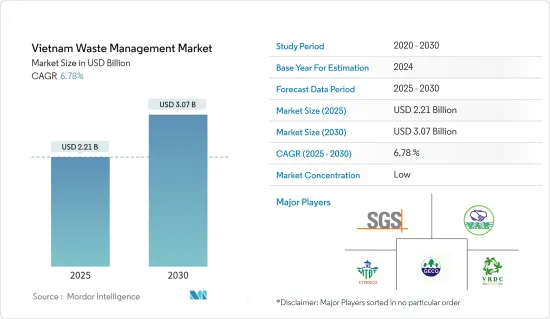

越南廢棄物管理市場規模預計在 2025 年將達到 22.1 億美元,預計在 2030 年將達到 30.7 億美元,市場估計和預測期(2025-2030 年)的複合年成長率為 6.78%。

廢棄物管理是一個綜合過程,包括系統性地處理、調節和清除人類活動所產生的物料輸送。廢棄物管理是現代社會應對不斷增加的廢棄物數量和種類所帶來的挑戰的努力的關鍵要素。目的是最大限度地減少廢棄物對環境、社會和健康的負面影響,同時最大限度地提高資源回收率並促進永續性。廢棄物處理過程由幾個基本步驟組成。首先,廢棄物從家庭、企業、工業和機構等各種來源收集。然後它將被運送到適當的設施進行進一步加工和處置。處理方法包括堆肥、焚燒、機械和生物過程,以減少廢棄物的體積並降低潛在風險。此外,透過再加工和再利用某些材料(如紙張、玻璃、塑膠和金屬),回收在減少對新資源的需求和減輕環境負擔方面發揮著重要作用。無法回收或進一步加工的廢棄物必須進行處理。這通常涉及掩埋,在某些情況下,還涉及將廢棄物轉化為能源。近年來,廢棄物管理已成為越南建設對環境負責、資源高效的社區以及解決廢棄物產生問題的關鍵要素,並取得了顯著進展。

越南產生了驚人的廢棄物數量。儘管如此,該國的廢棄物效率仍然很低。根據越南環境與自然資源部的國家環境狀況報告,越南的大部分廢棄物都被送往垃圾掩埋場,但只有 20% 的垃圾掩埋場符合該國的衛生要求。為了成功進行廢棄物管理,建立廢棄物收集和分類系統非常重要。其中最重要的五個城市是河內、胡志明市、海防、峴港和芹苴,佔越南廢棄物產生總量的 70% 以上。越南人口不斷成長、工業化和都市化快速發展,導致危險固態廢棄物快速增加,需要更有效的管理。解決管理不善的垃圾掩埋場產生的滲濾液和固態廢棄物管理等問題是越南政府的首要任務。

越南廢棄物管理市場的趨勢

越南快速工業化與環境挑戰

越南正在經歷快速工業化。這種成長對環境和自然資產產生了負面影響。根據世界銀行統計,自市場轉型以來,越南的人均溫室氣體排放量一直是成長率最快的國家之一。 《越南簡報》引述自然資源與環境部(MoNRE)的資料顯示,越南每天排放約 6 萬噸家庭垃圾。其中,光是河內和胡志明市兩市都市區就分別排放7,000至9,000噸垃圾,預計明年將增加10%至16%。垃圾排放的增加促使越南需要有效且有效率的垃圾處理方法。

越南工業成長迫切需要廢棄物管理解決方案

由於工業每天排放大量廢棄物,越南目前的廢棄物管理狀況面臨重大挑戰。預計越南的工業生產將保持積極趨勢,今年的工業生產指數(IIP)預計將比上年度有所成長。去年,重要工業產品需求較上季激增。這些產品包括糖、化學肥料、汽油和石油、電視機、化學塗料、服飾、壓延鋼材等。所有這些產品都會產生大量廢棄物,必須妥善管理。由於此類產品產量的增加,廢棄物管理的需求也日益增加。

越南廢棄物管理產業概況

越南的廢棄物管理市場比較分散。隨著國家經濟活動的增加,競爭也愈演愈烈,產生了大量需要有效管理技術的廢棄物。越南對廢棄物管理產業的投資正在不斷增加,以幫助防止下水道堵塞導致洪水氾濫。由於適度的工業滲透率和其他推動市場發展的因素,預計市場將在預測期內蓬勃發展。市場的主要企業包括 CITENCO、Tan Phat Tai、Green Environment Production-Services-Trade、SGS VietNam 和 Vietnam Australia Environment JSC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 嚴格的監管合規推動市場成長

- 增強健康環境意識

- 市場限制

- 基礎設施挑戰往往成為市場成長的限制因素

- 市場機會

- 技術進步推動市場成長

- 廢棄物管理的新興企業和新創新

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場創新洞察

- COVID-19 對市場的影響

第5章 市場區隔

- 依廢棄物類型

- 工業廢棄物

- 都市固態廢棄物

- 危險廢棄物

- 電子廢棄物

- 塑膠廢棄物

- 醫療廢棄物

- 按處置方式

- 掩埋

- 焚化

- 回收利用

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- CITENCO

- SGS VietNam

- Green Environment Production Services Trade Co. Ltd

- Vietnam Australia Environment JSC

- Dai Lam Son Co. Ltd(DALASO)

- VN Green Environment Joint Stock Company

- Vietnam Clean Environmental Treatment Co. Ltd

- Urban Environment Company

- Vietnam Waste Solutions

- INSEE ECOCYCLE

- Tan Phat Tai Co. Ltd*

第7章 市場趨勢

第8章 免責聲明及發布者

The Vietnam Waste Management Market size is estimated at USD 2.21 billion in 2025, and is expected to reach USD 3.07 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

Waste management is a comprehensive procedure that encompasses the organized handling, regulation, and elimination of waste materials produced by human activities. It constitutes the crucial element of contemporary society's endeavors to tackle the difficulties presented by the ever-growing quantity and variety of waste products. Its objective is to minimize the adverse environmental, social, and health impacts of waste while simultaneously maximizing the recovery of resources and promoting sustainability. The waste management procedure consists of several fundamental stages. Initially, waste is gathered from various origins, including households, businesses, industries, and institutions. It is then transported to suitable facilities for further processing or disposal. Treatment methods may involve composting, incineration, or mechanical and biological processes to decrease waste volume and mitigate potential risks. Additionally, recycling plays a pivotal role by allowing certain materials such as paper, glass, plastics, and metals to be reprocessed and reused, thereby reducing the need for new resources and alleviating environmental pressure. Disposal becomes necessary for debris that cannot be recycled or further processed. This typically involves landfilling or, in some cases, converting waste into energy. In recent years, waste management has gained significant momentum as a crucial component in constructing environmentally responsible and resource-efficient communities while addressing the challenges posed by waste generation throughout Vietnam.

Vietnam has been witnessing a staggering volume of waste generation. Despite this, waste treatment in the country is mainly ineffective. According to MoNRE's National Environmental Status Report, most of the waste in the country is taken to landfills, but only 20% of those landfill sites meet national sanitary requirements. Establishing a waste collection and sorting system for successful waste management is crucial. The five most significant cities, namely, Hanoi, Ho Chi, Haiphong, Da Nang, and Can Tho, are responsible for over 70% of the total waste generation. Vietnam's population growth, rapid industrialization, and urbanization have led to a surge in hazardous solid waste, necessitating more effective management. Addressing issues like leachate from poorly managed landfills and solid waste management is high on Vietnam's governmental agenda.

Vietnam Waste Management Market Trends

Vietnam's Rapid Industrialization and Environmental Challenges

Vietnam is witnessing a rapid growth in industrialization. This increase has caused negative impacts on the environment and natural assets. According to the World Bank, from the start of its market transformation, Vietnam emerged as one of the fastest-growing per-capita greenhouse gas emitters. Vietnam Briefing quoted data from the Ministry of Natural Resources and Environment (MoNRE), indicating that the country produces approximately 60,000 tonnes of household waste daily. Most notably, the urban areas of Hanoi and Ho Chi Minh City alone account for a significant portion, generating 7,000 to 9,000 tonnes of trash each, which is projected to increase by 10% to 16% by next year. This increase in waste production fuels the country's requirement for an effective and efficient waste management procedure.

Vietnam's Industrial Growth Drives Urgent Need for Waste Management Solutions

The current status of waste management in Vietnam presents significant challenges due to the vast amount of waste generated daily by industries. Vietnam's industrial production is expected to continue on a positive trend, with the industrial production index (IIP) estimated to rise in the current year compared to the previous year. Last year, the demand for essential industrial products increased sharply over the preceding period. These products include sugar, fertilizer, gasoline and oil, television, chemical paint, clothing, and rolled steel. All these products produce many by-products as waste, which should be managed properly. The need for waste management increases due to increased production of such products.

Vietnam Waste Management Industry Overview

The Vietnamese waste management market is fragmented. It is competitive because of the increasing economic activity in the country, leading to heavier amounts of wastage that need effective management techniques. In Vietnam, more and more investments in the waste management industry are helping the cities prevent drain clogging, which could result in flooding. The market is expected to flourish during the forecast period due to moderate penetration in the industry and other factors that will drive the market. Some of the key players in the market include CITENCO, Tan Phat Tai Co. Ltd, Green Environment Production - Services - Trade Co. Ltd, SGS VietNam, and Vietnam Australia Environment JSC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tight Regulatory Compliance Will Drive the Market's Growth

- 4.2.2 Growing Awareness About Healthy Environment

- 4.3 Market Restraints

- 4.3.1 Infrastructure Challenges Often Restraints the Growth of Market

- 4.4 Market Opportunities

- 4.4.1 Technological Advancements Will Drive the Growth of the Market

- 4.4.2 Startups and New Innovations for Waste Management

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology Innovation in the Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Waste Type

- 5.1.1 Industrial Waste

- 5.1.2 Municipal Solid Waste

- 5.1.3 Hazardous Waste

- 5.1.4 E-waste

- 5.1.5 Plastic Waste

- 5.1.6 Bio-medical Waste

- 5.2 By Disposal Method

- 5.2.1 Landfill

- 5.2.2 Incineration

- 5.2.3 Recycling

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 CITENCO

- 6.2.2 SGS VietNam

- 6.2.3 Green Environment Production Services Trade Co. Ltd

- 6.2.4 Vietnam Australia Environment JSC

- 6.2.5 Dai Lam Son Co. Ltd (DALASO)

- 6.2.6 VN Green Environment Joint Stock Company

- 6.2.7 Vietnam Clean Environmental Treatment Co. Ltd

- 6.2.8 Urban Environment Company

- 6.2.9 Vietnam Waste Solutions

- 6.2.10 INSEE ECOCYCLE

- 6.2.11 Tan Phat Tai Co. Ltd*