|

市場調查報告書

商品編碼

1636223

歐洲電動車鋰離子電池:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

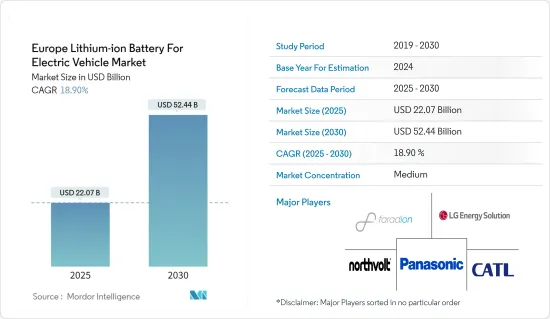

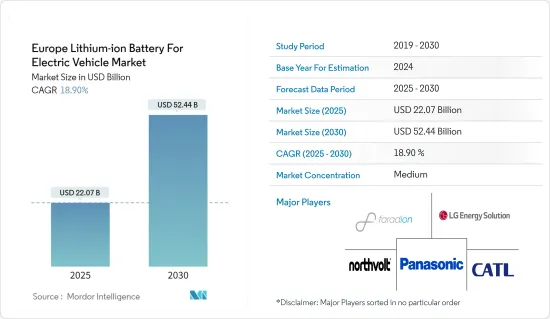

預計2025年歐洲電動車鋰離子電池市場規模為220.7億美元,2030年達524.4億美元,預測期間(2025-2030年)複合年成長率為18.9%。

主要亮點

- 從中期來看,政府政策和措施預計將推動電動車鋰離子電池的需求,並隨著瑞典、芬蘭和英國電動車普及率的提高。

- 另一方面,替代電池技術的興起和原料供需不匹配預計將阻礙預測期內的市場成長。

- 然而,電動車擴大採用固體鋰離子電池,預計將為歐洲電動車市場的鋰離子電池創造重大商機。

- 由於英國電動車的普及率不斷提高,預計英國將主導電動車鋰離子電池市場。

歐洲電動車鋰離子電池市場趨勢

純電動車(BEV)細分市場將顯著成長

- 純電動車(BEV)通常也被稱為帶有馬達的電動車。 BEV 是全電動汽車,這意味著它們沒有內燃機 (ICE)、燃料箱或排氣管,而是依靠電力來推進。車輛的能量來自電池組並透過電網充電。純電動車是零排放車,這意味著它們不會產生傳統汽油動力汽車造成的有害廢氣和空氣污染。

- 根據國際能源總署(IEA)預測,2023年歐洲純電動車銷量將達220萬輛。目前,歐洲各國混合動力化、電動化正在推進,各種類型的汽車上市。有多種類型,包括混合動力電動車(HEV)、插電式混合動力電動車和電動車(EV)。

- 此外,作為《巴黎協定》成員,歐洲正在推動從內燃機向電動車的轉變,並且近年來實現了高速成長。這些發展將為鋰離子電池在該地區的廣泛使用鋪平道路。

- 包括英國、德國和法國在內的多個國家正在推出稅額扣抵和補貼等舉措,以鼓勵採用純電動車(BEV)。同時,許多州都有逐步淘汰內燃機汽車 (ICE) 並推廣電動車的雄心勃勃的目標。因此,純電動車的採用激增預計將在未來幾年顯著增加對鋰離子電池的需求。

- 一些歐洲政府計劃在未來幾年加速電動車的採用。 2024年5月,法國政府設定國內汽車製造商在年終生產200萬輛電動或混合動力汽車的目標。根據財政部的簡報,根據與政府達成的新中期規劃協議,該行業將商定到 2027 年銷售 80 萬輛電動車的臨時目標。

- 此外,多家汽車製造商的目標是同期每年銷售 10 萬輛電動車。這些發展預計將對鋰離子電池等二次電動車電池產生巨大需求,以支持歐洲道路上不斷增加的電池式電動車數量。

- 由於上述因素,預計純電動車細分市場在預測期內將顯著成長。

英國預計將主導市場

- 在旨在減少碳排放和促進永續交通的政府法規和激勵措施的推動下,英國電動車產業正在蓬勃發展。英國政府制定了雄心勃勃的目標,包括到 2030 年禁止新的汽油和柴油汽車,並制定了到 2050 年實現淨零排放的整體策略。

- 為了支持這項轉變,各國政府實施了一系列獎勵,包括對電動車的補貼以及對家庭和公共充電基礎設施的補貼。這些政策不僅減輕了消費者的經濟負擔,也鼓勵製造商增加電動車車型陣容。

- 此外,根據國際能源總署(IEA)的數據,到2023年,英國電池式電動車銷量將達30萬輛。英國政府也致力於擴大支援電動車和電池基礎設施所需的基礎設施,這對於廣泛採用至關重要。這包括對全國充電網路進行大量投資,目的是大幅增加快速充電站的數量。倫敦等都市區降低電動車停車費和免除堵塞費等政策使電動車更具吸引力。政府的承諾體現在對電動車家庭充電計劃(EVHS)等計劃的支持上,該計劃為安裝家用充電器提供資金並提高了電動車擁有的實用性。

- 此外,2023年11月,英國政府宣布了一項20億歐元(25億美元)的新電池戰略,其中包括一項新的電池戰略,該戰略將投入5000萬歐元的政府資金,以在2030年先前提供具有國際競爭力的電池供應鏈。此舉旨在隨著向純電動車(BEV)生產的過渡繼續進行,汽車製造商透過本地化電池生產來增強供應鏈彈性。

- 此外,製造商正在透過確保電動車專用生產線並投資電動車和電池的本地生產來響應支援性法規結構,以確保英國電動車電池產業為未來做好準備。

- 因此,鑑於以上幾點,預計英國將成為預測期內歐洲電動車鋰離子電池市場的主導國家。

歐洲電動車鋰離子電池產業概況

歐洲電動車鋰離子電池市場較為分散。市場的主要企業包括Panasonic控股、Faradion Limited(英國)、寧德時代新能源科技(CATL)、LG Energy Solution Ltd 和 Northvolt AB。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 鋰離子電池價格下降

- 電動車的擴張

- 抑制因素

- 新的替代電池技術

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按車型分類

- 客車

- 商用車

- 其他車輛(摩托車、Scooter等)

- 依推進類型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 按地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 其他歐洲國家

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Holdings Corporation

- Faradion Limited(UK)

- Contemporary Amperex Technology Co. Ltd(CATL)

- LG Energy Solution Ltd

- Northvolt AB

- BMZ GmbH

- Saft Groupe SA

- FIAMM Energy Technology

- VARTA AG

- Samsung SDI Co. Ltd

- Tesla Inc.

- 其他主要企業名單(公司名稱、總部、相關產品/服務、聯絡資訊等)

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車採用固體鋰離子電池

簡介目錄

Product Code: 50003486

The Europe Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 22.07 billion in 2025, and is expected to reach USD 52.44 billion by 2030, at a CAGR of 18.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles across Sweden, Finland, and the United Kingdom and supportive government policies and initiatives are expected to drive the demand for the lithium-ion battery in electric vehicles market during the forecast period.

- On the other hand, the emerging alternative battery technologies and the demand-supply mismatch of raw materials are expected to hinder the market's growth during the forecast period.

- Nevertheless, the increasing adoption of solid-state lithium-ion batteries for electric vehicles is anticipated to create vast opportunities for lithium-ion batteries in the European electric vehicles market.

- The United Kingdom is expected to dominate the lithium-ion battery for electric vehicles market due to the increasing adoption of electric vehicles in the country.

Europe Lithium-ion Battery for Electric Vehicle Market Trends

Battery Electric Vehicles (BEVs) Segment to Witness Significant Growth

- Battery electric vehicles (BEVs) are also commonly known as electric vehicles with an electric motor. BEVs are fully electric vehicles that typically do not include an internal combustion engine (ICE), fuel tank, or exhaust pipe and rely on electricity for propulsion. The vehicle's energy comes from the battery pack, which is recharged from the grid. BEVs are zero-emission vehicles, as they do not generate harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- According to the International Energy Agency (IEA), battery electric vehicle sales in Europe amounted to 2.2 million units in 2023. Various vehicle types are now available across European countries, featuring increasing degrees of hybridization and electrification. There are various types of vehicles, including hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles, and electric vehicles (EVs).

- Moreover, as the initiator of the Paris Climate Pact, Europe promoted the shift from internal combustion vehicles to EVs while registering high growth over recent years. Such developments, in turn, create avenues for the penetration of lithium-ion batteries in the region.

- Several countries, including the United Kingdom, Germany, and France, are rolling out initiatives such as tax credits and subsidies to drive the adoption of battery electric vehicles (BEVs). In tandem, numerous states are setting aggressive goals to phase out internal combustion engine (ICE) vehicles in favor of electric cars. Consequently, this surge in BEV adoption is poised to significantly elevate the demand for lithium-ion batteries over the coming years.

- Several governments across European countries plan to boost the adoption of EVs in the coming years. In May 2024, the French government set a goal for the nation's carmakers to produce two million electric or hybrid vehicles by the end of the decade. Under a new medium-term planning agreement with the government, the industry is set to agree to an interim goal of 800,000 electric vehicle sales by 2027, according to a Finance Ministry briefing.

- Also, several carmakers aim to increase sales of electric light utility vehicles to 100,000 annually over the same period. Such developments are expected to create a vast demand for rechargeable EV batteries, such as lithium-ion batteries, to support the growing number of battery electric vehicles on European roads.

- Due to the abovementioned factors, the BEV segment is expected to witness significant growth over the forecast period.

United Kingdom Expected to Dominate the Market

- The UK electric vehicle industry has experienced rapid growth, significantly propelled by government regulations and incentives aimed at reducing carbon emissions and promoting sustainable transport. The UK government has set ambitious targets, such as the ban on new petrol and diesel cars by 2030, under its broader strategy to achieve net-zero emissions by 2050.

- To support this transition, the government has implemented various incentives, including grants for electric cars and subsidies for home and public charging infrastructure. These policies have not only eased the financial burden on consumers but have also encouraged manufacturers to increase their offerings of electric models.

- Furthermore, according to the International Energy Agency (IEA), the sales of battery electric vehicles in the United Kingdom stood at 0.3 million units in 2023. Also, the UK government has focused on expanding the necessary infrastructure to support electric vehicles and battery infrastructure, which is crucial for widespread adoption. This includes substantial investments in charging networks across the nation, with the aim to significantly increase the number of fast-charging stations. Policies such as reduced parking fees for EVs and exemptions from congestion charges in urban areas like London have further boosted the attractiveness of electric vehicles. The government's commitment is evident in its backing of projects like the Electric Vehicle Homecharge Scheme (EVHS), which provides funding for home charger installations, enhancing the practicality of owning an EV.

- Moreover, in November 2023, the UK government announced the EUR 2 billion (USD 2.5 billion) Advanced Manufacturing Plan, which includes a new Battery Strategy that will see EUR 50 million of government funding allocated to deliver a globally competitive battery supply chain by 2030. The move aims to build supply chain resilience as vehicle makers localize battery production in support of the increasing transition to the production of battery electric vehicles (BEVs).

- Moreover, manufacturers are responding to the supportive regulatory framework by committing to electric-only production lines and investing in local manufacturing of EVs and batteries, indicating a robust future trajectory for the UK electric vehicle batteries industry.

- Therefore, as per the abovementioned points, the United Kindom is expected to be the dominant country in the European lithium-ion battery for electric vehicles market during the forecast period.

Europe Lithium-ion Battery for Electric Vehicle Industry Overview

The European lithium-ion battery for electric vehicles market is semi-fragmented. Some key players in the market include Panasonic Holdings Corporation, Faradion Limited (UK), Contemporary Amperex Technology Co. Ltd (CATL), LG Energy Solution Ltd, and Northvolt AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Prices

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Emerging Alternative Battery Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicles (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicles (BEVs)

- 5.2.2 Plug-in Hybrid Electric Vehicles (PHEVs)

- 5.2.3 Hybrid Electric Vehicles (HEVs)

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 Faradion Limited (UK)

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 LG Energy Solution Ltd

- 6.3.5 Northvolt AB

- 6.3.6 BMZ GmbH

- 6.3.7 Saft Groupe SA

- 6.3.8 FIAMM Energy Technology

- 6.3.9 VARTA AG

- 6.3.10 Samsung SDI Co. Ltd

- 6.3.11 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-state Lithium-ion Batteries for Electric Vehicles

02-2729-4219

+886-2-2729-4219