|

市場調查報告書

商品編碼

1636510

北美電動車 VRLA 電池:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)North America Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

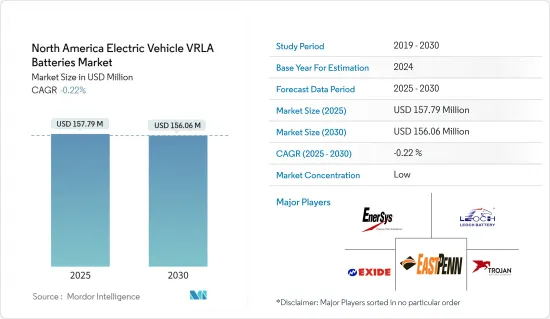

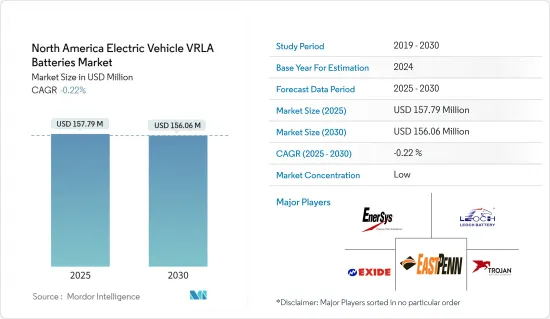

北美電動車VRLA電池市場規模預計2025年為1.5779億美元,預計2030年將下降至1.5606億美元。

主要亮點

- 從中期來看,VRLA電池的成本效益,特別是與鋰離子電池相比,加上電動Scooter和電動二輪車在該地區的迅速普及,可能會提高VRLA電池的成本效益預測期內電動車的需求將會增強。

- 相反,向高性能鋰離子電池的快速過渡降低了VRLA電池與高性能電動車的相關性,對電動車VRLA電池市場的成長構成了重大挑戰。

- 然而,VRLA 電池特別適合效用電動車中的輔助電源或備用系統,其中可靠性勝過能量密度。這個利基市場在不久的將來為電動車 VRLA 電池市場提供了巨大的成長機會。

- 在北美,美國將成為電動車 VRLA 電池市場成長最快的國家。這是由於其成本效率高且維護要求極低,因此擴大在電動二輪車中採用。

北美電動車VRLA電池市場趨勢

低速電動車電池大幅成長

- 在北美,低速電動車(LSEV),如高爾夫球車、電動多功能車、社區電動車(NEV)和電動Scooter主要依賴閥控鉛酸電池(VRLA)。 VRLA 電池通常稱為密閉式鉛酸電池,是低速電動車的首選,因為它們具有成本效益、需要最少的維護,並且擁有強大的供應鏈。

- 此外,VRLA 電池比鋰離子電池更經濟,這對於低速電動車來說是一個很大的優勢。 LSEV(包括高爾夫球車、電動自行車和新能源汽車)專為短距離通勤和低速駕駛而設計,因此 VRLA 電池的經濟性與這些車輛的財務目標完美契合。

- 最近,北美對包括電動卡車在內的低速電動車的需求迅速增加。根據 Cox Automotive 的資料,美國著名中型電動卡車製造商 Rivian 2024 年(截至 2024 年 11 月 10 日)銷量較 2023 年成長約 17.9%。該公司的銷量從2023年的約36,150輛躍升至2024年的42,610輛。由於卡車在運輸業中發揮著至關重要的作用,該地區的貿易預計將大幅成長,銷售額預計將繼續成長。

- 儘管低速電動車中使用 VRLA 電池因其鉛含量而在北美引起環境問題,但值得注意的是,鉛酸電池的回收率很高,這得到了北美各地既定計畫的支持。此外,地方政府也積極推動電池回收舉措。

- 例如,2024年1月,拜登總統在提出加強美國競爭、加強美國在能源儲存領導地位的經濟計畫時強調了利用鉛酸電池潛力的重要性。這些舉措重點在於研發和國內電池製造,旨在提高鉛酸電池的產量並解決與其處置相關的環境問題。

- 北美低速電動車市場持續穩定成長,涵蓋電動Scooter、自行車和小型城市車輛。隨著低速電動車(尤其是電動Scooter)的需求持續成長,主要企業紛紛推出一系列先進車輛來因應。

- 例如,2024年1月,Flash Motors推出了Infinity X Hyper Scooter,代表個人交通的飛躍。英菲尼迪不只是Scooter這些技術創新預計將在未來幾年增加對先進電動Scooter的需求,從而增加對 VRLA 電池的需求。

- 總而言之,這些進步和計劃將在預測期內增加電動車對 VRLA 電池的需求,同時也提高該地區的低速電動車產量。

加拿大預計將出現顯著成長

- 在加拿大各地,閥控式鉛酸電池 (VRLA) 對於電動車 (EV)、特別是低速電動車 (LSEV) 和某些工業應用等利基市場至關重要。 VRLA 電池因其堅固性和成本效益而成為加拿大農業、倉儲業和商業領域電動車的選擇。

- 此外,VRLA 電池比鋰離子電池便宜得多,這使其對低成本電動車和工業車輛具有吸引力。該地區電動車(包括配備 VRLA 電池的電動車)的銷量正在激增。例如,國際能源總署(IEA)公佈,2023年加拿大電動車銷量為1,710輛,較2022年成長48.69%,較2019年成長2.4倍。鑑於這一勢頭和加拿大政府最近的舉措,電動車銷量預計在未來幾年將上升,從而增加對電動車電池生產的需求。

- 加拿大擁有強大的回收鉛酸電池(包括 VRLA 類型)的基礎設施。此功能對於加拿大電動車應用中繼續採用 VRLA 電池至關重要。這些回收計劃強調了解決環境問題和負責任地管理鉛含量的重要性。 Call2Recycle 等措施以及區域性努力正在提高加拿大有效管理廢棄 VRLA 電池的能力。

- VRLA 電池還可以為短程城市交通的 LSEV動力來源,在度假區的休閒車中很受歡迎,也可用於堆高機等工業應用。特別是最近,物料輸送對電動堆高機的需求迅速增加。

- 例如,2024 年 6 月,豐田物料搬運 (TMH) 與州和地方當局合作,開始建造一座耗資約 1 億美元的電動堆高機生產設施。該工廠預計將於 2026年終竣工,並將進入電動堆高機已佔北美(包括加拿大)銷量 65% 的市場。預計此類措施將在預測期內增加電動車領域對 VRLA 電池的需求。

- 因此,這些發展預計將提升該地區的電動車產量,並推動未來幾年對 VRLA 電池的需求。

北美電動車VRLA電池產業概況

北美電動車 VRLA 電池市場較分散。主要企業(排名不分先後)包括 East Penn Manufacturing、EnerSys、Exide Technologies、Trojan Battery Company 和 Leoch International Technology。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- VRLA 電池的成本效益

- 電動Scooter和電動摩托車的成長

- 抑制因素

- 替代電池技術的可用性

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按類型

- 吸收玻璃墊電池

- 膠體電池

- 按車型

- 摩托車

- 低速電動車

- 工業電動車

- 按地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- East Penn Manufacturing

- EnerSys

- Exide Technologies

- Trojan Battery Company

- Leoch International Technology

- Johnson Controls

- Crown Battery Manufacturing

- NorthStar Battery

- US Battery Manufacturing

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 備份和輔助應用程式

簡介目錄

Product Code: 50003840

The North America Electric Vehicle VRLA Batteries Market size is estimated at USD 157.79 million in 2025, and is expected to decline to USD 156.06 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition to advanced lithium-ion batteries is diminishing the relevance of VRLA batteries for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backup systems in electric vehicles, particularly where reliability trumps energy density. This niche presents substantial growth opportunities for the electric vehicle VRLA batteries market in the near future.

- In North America, the United States is set to emerge as the fastest-growing nation in the electric vehicle VRLA batteries market, driven by the increasing adoption in electric two-wheelers, thanks to their cost-efficiency and minimal maintenance needs.

North America Electric Vehicle VRLA Batteries Market Trends

Low Speed EV battery Type to Witness Significant Growth

- In North America, low-speed electric vehicles (LSEVs) such as golf carts, electric utility vehicles, neighborhood electric vehicles (NEVs), and electric scooters predominantly rely on Valve-Regulated Lead-Acid (VRLA) batteries. Commonly known as sealed lead-acid batteries, VRLA batteries are favored for LSEVs due to their cost-effectiveness, minimal maintenance needs, and robust supply chains.

- Moreover, VRLA batteries offer a more economical alternative to lithium-ion batteries, a significant advantage for LSEVs. Since LSEVs, encompassing golf carts, e-bikes, and NEVs, are designed for short commutes and lower speeds, the affordability of VRLA batteries aligns perfectly with the financial goals of these vehicles.

- Recently, the demand for LSEVs, including electric trucks, has surged in North America. Data from Cox Automotive highlights that Rivian, a prominent medium-duty electric truck manufacturer in the United States, experienced a sales uptick of approximately 17.9% in 2024 (up to November 10, 2024) compared to 2023. The company's sales jumped from about 36,150 units in 2023 to 42,610 in 2024. With trade in the region expected to grow significantly and trucks playing a pivotal role in the transportation industry, sales are projected to continue their upward trajectory.

- While the use of VRLA batteries in LSEVs raises environmental concerns in North America due to their lead content, it's worth noting that lead-acid batteries boast a high recycling rate, supported by established programs across the continent. Furthermore, regional governments have been actively promoting battery recycling initiatives.

- For example, in January 2024, as President Biden introduced economic packages to bolster American competitiveness and reinforce United States leadership in energy storage, he emphasized the importance of harnessing the potential of lead batteries. By focusing on R&D and domestic battery manufacturing, these initiatives aim to boost lead battery production and address environmental concerns linked to their disposal.

- The North American market for LSEVs, spanning electric scooters, bikes, and compact urban vehicles, has been on a steady upward trajectory. As the demand for LSEVs, particularly electric scooters, continues to rise, leading companies are responding by launching a series of advanced vehicles.

- For instance, in January 2024, Flash Motors introduced the Infinity X Hyper Scooter, marking a significant leap in personal transportation. The Infinity X stands out not just as a scooter; it boasts proprietary AI technology that customizes the riding experience by adjusting the engine, battery, brakes, and other components. Such innovations are poised to bolster the demand for advanced electric scooters in the coming years, subsequently driving up the demand for VRLA batteries.

- In summary, these advancements and projects are set to boost the production of LSEVs in the region, alongside a heightened demand for EV VRLA batteries in the forecast period.

Canada is Expected to Witness Significant Growth

- Across Canada, Valve-Regulated Lead-Acid (VRLA) batteries are integral to the electric vehicle (EV) landscape, especially in niche markets such as low-speed electric vehicles (LSEVs) and certain industrial applications. Their robustness and cost-effectiveness make VRLA batteries a preferred choice for electric utility vehicles in agricultural, warehousing, and commercial sectors throughout Canada.

- Moreover, VRLA batteries are significantly more affordable than their lithium-ion counterparts, making them appealing for budget-friendly EVs and industrial vehicles. Sales of EVs, including those powered by VRLA batteries, have surged in the region. For example, the International Energy Agency (IEA) reported in 2023 that Canada sold 0.171 million electric vehicles, marking a 48.69% increase from 2022 and a 2.4-fold rise since 2019. Given this momentum and recent Canadian government initiatives, EV sales are poised to climb in the coming years, driving a heightened demand for EV battery production.

- Canada has a robust infrastructure for recycling lead-acid batteries, including VRLA types. This capability is crucial for the continued adoption of VRLA batteries in Canadian EV applications. By addressing environmental concerns and managing lead content responsibly, these recycling programs highlight their importance. Initiatives like Call2Recycle, along with regional efforts, enhance Canada's capacity to manage end-of-life VRLA batteries effectively.

- VRLA batteries also power LSEVs for short-range urban transport, are popular in recreational vehicles at resorts, and are utilized in industrial applications like forklifts. Notably, the demand for electric forklifts in material handling has surged recently.

- For instance, in June 2024, Toyota Material Handling (TMH) began constructing a nearly USD 100 million facility for electric forklift production, in collaboration with state and local officials. Set to be completed by the end of 2026, this factory enters a market where electric forklifts already represent 65% of North American sales, including Canada. Such initiatives are expected to boost the demand for VRLA batteries in the EV sector during the forecast period.

- Consequently, these developments are anticipated to elevate electric vehicle production in the region and drive the demand for VRLA batteries in the coming years.

North America Electric Vehicle VRLA Batteries Industry Overview

The North America Electric Vehicle VRLA Batteries market is semi-fragmented. Some of the key players (not in particular order) are East Penn Manufacturing, EnerSys, Exide Technologies, Trojan Battery Company, Leoch International Technology, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 East Penn Manufacturing

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 Trojan Battery Company

- 6.3.5 Leoch International Technology

- 6.3.6 Johnson Controls

- 6.3.7 Crown Battery Manufacturing

- 6.3.8 NorthStar Battery

- 6.3.9 U.S. Battery Manufacturing

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219