|

市場調查報告書

商品編碼

1636270

北美電動車電池材料:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

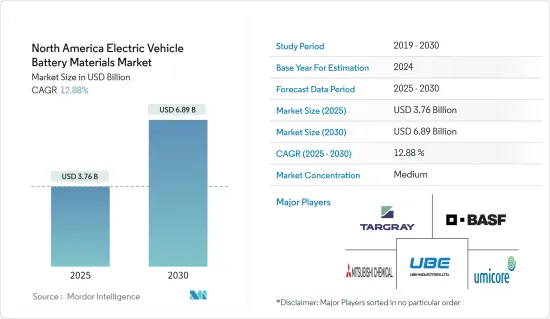

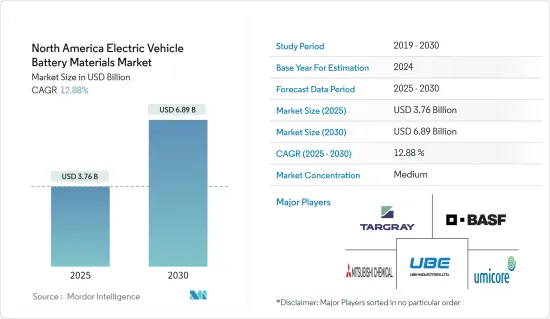

北美電動車電池材料市場規模預計到2025年為37.6億美元,預計2030年將達到68.9億美元,預測期內(2025-2030年)複合年成長率為12.88%。

主要亮點

- 未來幾年,北美電動車電池材料市場預計將受到電動車銷量激增和政府政策法規收緊的顯著推動。

- 相反,北美電動車電池材料市場因國內原料生產不足而高度依賴進口,面臨挑戰。

- 儘管如此,我們仍在繼續努力開發先進的電池技術。預計這一因素將在未來幾年在市場上創造一些機會。

- 美國憑藉其強勁的汽車製造和銷售業,將主導成長前景,並可能在預測期內實現最高的擴張。

北美電動車電池材料市場趨勢

鋰離子電池佔市場主導地位

- 鋰離子電池產業是北美電動車(EV)電池材料市場的基石,其特點是在電動車技術的成長和進步中發揮關鍵作用。作為電動車最廣泛採用的電池類型,鋰離子電池兼具能量密度、效率和壽命的優勢,使其成為現代電動車應用的關鍵。

- 過去十年電池技術和製造流程的顯著進步推動了電動車市場中鋰離子電池的採用。這些進步不僅降低了成本,還提高了性能和可靠性,使鋰離子電池對製造商和消費者越來越有吸引力。

- 近年來,鋰離子電池和電池組的價格一直呈下降趨勢,這使得它們對終端用戶產業更具吸引力。經歷2022年價格小幅上漲後,2023年電池價格將再次呈現下降趨勢。鋰離子電池組成本下降14%,達到139美元/kWh的歷史低點。

- 該領域包括各種各樣的材料,每種材料都有助於電池的整體性能和功能。選擇這些材料是因為它們能夠提高電池能量密度、循環壽命和熱穩定性,滿足汽車產業所需的關鍵性能參數。例如,富鎳陰極材料由於其高能量容量而特別優選,這直接轉化為電動車更長的行駛里程。

- 該地區對電動車的需求不斷成長,導致對鋰離子電池的需求大幅增加。因此,電池製造商和組裝商現在正在投資電池材料的生產設施。這項策略性舉措旨在滿足國內外對鋰電池日益成長的需求。此外,電池技術的進步也進一步推動了需求。隨著電動車變得越來越流行,預計該市場將繼續成長。

- 例如,2023 年 10 月,電動車電池材料領域的主要參與者 Umicore 透過建立 CAM 和 pCAM 工廠,鞏固了在加拿大安大略省的業務。該公司正在安大略省Loyalist積極建造35GWh電池材料生產設施,以服務快速成長的北美電動車(EV)市場。

- 優美科獲得了加拿大政府和安大略省政府的支持,認知到該工廠將在加強該地區的電動車供應鏈和加強整體電動車電池格局方面發揮關鍵作用,我們已獲得了重要的財政支持。

- 因此,如上所述,鋰離子電池領域預計將在預測期內主導市場。

美國正在經歷顯著成長

- 在美國,由於消費者偏好、環保意識以及減少溫室氣體排放的監管壓力,電動車的需求正在穩步成長。聯邦和州級的獎勵,例如電動車購買的稅額扣抵和退稅,在加速電動車的普及方面發揮重要作用。

- 2024 年,您可以獲得高達 7,500 美元的稅額扣抵,二手電動車的購買者可以獲得高達 4,000 美元的稅額扣抵。今年的一個顯著變化是,消費者現在可以將此稅額扣抵轉移給合格的經銷商,並在購買車輛時立即獲得折扣。

- 這些激勵措施不僅使電動車更容易為消費者所接受,而且刺激了對先進電池技術和材料的需求。此外,美國政府承諾在2050年實現淨零排放,以及一項包括對電動車充電網路和清潔能源舉措進行大量投資的基礎設施法案,將進一步推動電動車市場的發展,因此預計對電池材料的需求也將增加。

- 這些激勵措施正在刺激電動車在該國的快速普及。特別是,國際能源總署(IEA)報告稱,電動車普及率在過去十年中穩步成長。具體來說,2022年至2023年,電池式電動車銷量激增37.5%以上。考慮到過去五年 71.6% 的複合年成長率,這一成長更加令人印象深刻。這些數字證實了人們對電動車日益成長的興趣,從而提振了國內電池需求。

- 對國內電池製造能力的大量投資也是美國市場的特徵。有鑑於減少對外國供應鏈依賴的戰略重要性,私人公司和政府機構都在大力投資發展國內電池製造設施。特斯拉、通用汽車、現代汽車和福特等公司正帶頭建立超級工廠,大規模生產鋰離子電池。

- 例如,2023年4月,兩家知名汽車製造商宣布計劃在美國建造電動車(EV)電池工廠,展示了美國電動車製造業的持續快速成長。通用汽車宣布將與三星SDI合作投資30億美元在美國建造電動車電池工廠。同時,現代汽車透露與韓國電池製造商SK On建立合作關係,承諾出資50億美元在喬治亞設立電池工廠。

- 這些設施旨在利用先進的製造技術和自動化來提高生產效率、降低成本並確保為國內市場穩定供應高品質的電池。

- 因此,如前所述,美國預計在預測期內將出現強勁成長。

北美電動汽車電池材料產業概況

北美電動車電池材料市場適度分散。該市場的主要企業(排名不分先後)包括Targray Technology International Inc.、 BASF SE、Mitsubishi Chemical Group Corporation、UBE Corporation 和Umicore。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車銷量成長

- 政府扶持政策及政策

- 抑制因素

- 原物料供應依賴進口

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 按材質

- 陰極

- 陽極

- 電解

- 分隔符

- 其他

- 按地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Targray Technology International Inc.

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore

- Sumitomo Chemical Co., Ltd.

- Nichia Corporation

- ENTEK International LLC

- Arkema SA

- Kureha Corporation

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第7章市場機會與未來趨勢

- 電池技術的進步

簡介目錄

Product Code: 50003557

The North America Electric Vehicle Battery Materials Market size is estimated at USD 3.76 billion in 2025, and is expected to reach USD 6.89 billion by 2030, at a CAGR of 12.88% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the North America Electric Vehicle Battery Materials Market is poised to be significantly driven by surging electric vehicle sales and bolstering government policies and regulations.

- Conversely, the North America Electric Vehicle Battery Materials Market faces challenges due to a heavy dependence on imports, stemming from insufficient domestic raw material production.

- Nevertheless, continued efforts are being made to develop advanced battery technology. This factor is expected to create several opportunities for the market in the future.

- With a robust vehicle manufacturing and sales industry, the United States is set to dominate the growth landscape, likely registering the highest expansion during the forecast period.

North America Electric Vehicle Battery Materials Market Trends

Lithium-ion Batteries to Dominate the Market

- The lithium-ion battery segment is a cornerstone of the North American electric vehicle (EV) battery materials market, characterized by its pivotal role in the growth and advancement of electric vehicle technology. As the most widely adopted battery type for electric vehicles, lithium-ion batteries offer a favorable combination of energy density, efficiency, and longevity, making them indispensable for modern EV applications.

- Significant advancements in battery technology and manufacturing processes over the last decade have propelled the adoption of lithium-ion batteries in the electric vehicle market. These strides have not only slashed costs but also bolstered performance and reliability, rendering lithium-ion batteries increasingly attractive to manufacturers and consumers alike.

- In recent years, the price of lithium-ion batteries and cell packs has been on the decline, making them more attractive to end-user industries. After experiencing slight price hikes in 2022, battery prices were once again declining in 2023. The cost of lithium-ion battery packs has decreased by 14% to reach a historic low of USD 139/kWh.

- This segment encompasses a diverse array of materials, each contributing to the overall performance and functionality of the batteries. These materials are chosen for their ability to enhance the battery's energy density, cycle life, and thermal stability, thereby addressing critical performance parameters required by the automotive industry. Nickel-rich cathode materials, for instance, are particularly favored for their high energy capacity, which directly translates to extended driving ranges for electric vehicles-an essential factor for consumer adoption and market competitiveness.

- The region's increasing appetite for electric vehicles has propelled a notable surge in demand for lithium-ion batteries. Consequently, battery manufacturers and assemblers are now channeling investments into battery material production facilities. This strategic move aims to cater to the escalating need for lithium batteries, both on a domestic and international scale. Additionally, advancements in battery technology are further driving this demand. The market is expected to witness continued growth as electric vehicle adoption rises.

- For instance, in October 2023, Umicore, a significant player in electric vehicle battery materials, is solidifying its presence in Ontario, Canada, with the establishment of the CAM and pCAM plants. The company is actively building a 35 GWh battery materials production facility in Loyalist, ON, specifically tailored to cater to the burgeoning North American electric vehicle (EV) market.

- Recognizing the pivotal role this plant will play in bolstering the regional electric vehicle supply chain and enhancing the overall electric vehicle battery landscape, Umicore has secured significant financial backing from both the Canadian and Ontario governments.

- Therefore, as per the points mentioned above, the lithium-ion battery segment is expected to dominate the market during the forecasted period.

United States to Witness Significant Growth

- The United States segment has a robust and growing demand for electric vehicles, driven by a combination of consumer preferences, environmental awareness, and regulatory pressures to reduce greenhouse gas emissions. Federal and state-level incentives, such as tax credits and rebates for Electric Vehicle purchases, play a crucial role in accelerating the adoption of electric vehicles.

- In 2024, the available financial incentives include a tax credit of up to USD 7,500, while buyers of used electric cars might be eligible for up to USD 4,000. A notable change this year is that consumers can now choose to transfer this credit to a qualifying dealer, securing an instant discount on their vehicle purchase.

- These incentives not only make Electric Vehicles more affordable for consumers but also stimulate demand for advanced battery technologies and materials. Furthermore, the United States administration's commitment to achieving net-zero emissions by 2050 and the proposed infrastructure bill, which includes substantial investments in Electric Vehicle charging networks and clean energy initiatives, are expected to bolster the Electric Vehicle market further and, consequently, the demand for battery materials.

- These incentives have spurred a swift adoption of electric vehicles in the country. Notably, the International Energy Agency reports a steady rise in electric vehicle adoption over the past decade. Specifically, from 2022 to 2023, battery electric vehicle sales surged by over 37.5%. This growth is even more pronounced when considering the annual average rate over the past five years, which stood at an impressive 71.6%. Such figures underscore the escalating interest in electric vehicles, consequently boosting the demand for batteries in the nation.

- Significant investments in domestic battery manufacturing capabilities also characterize the United States segment. Recognizing the strategic importance of reducing dependence on foreign supply chains, both private sector players and government entities are investing heavily in the development of local battery manufacturing facilities. Companies like Tesla, General Motors, Hyundai, and Ford are spearheading efforts to establish gigafactories that produce lithium-ion batteries at scale.

- For instance, in April 2023, Two prominent automakers unveiled plans to construct electric vehicle (EV) battery plants in the United States, underscoring the continued rapid growth of electric vehicle manufacturing in the nation. General Motors, in collaboration with Samsung SDI, disclosed a joint investment of USD 3 billion for an electric vehicle battery plant in the United States. Concurrently, Hyundai revealed its partnership with South Korean battery manufacturer SK On, committing a substantial USD 5 billion to establish a battery factory in Georgia.

- These facilities aim to leverage advanced manufacturing technologies and automation to enhance production efficiency, reduce costs, and ensure a stable supply of high-quality batteries for the domestic market.

- Therefore, as mentioned above, the United States is expected to witness significant growth during the forecast period.

North America Electric Vehicle Battery Materials Industry Overview

The North America Electric Vehicle Battery Materials Market is moderately fragmented. Some of the key players in this market (in no particular order) are Targray Technology International Inc., BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, and Umicore

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Imported Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Targray Technology International Inc.

- 6.3.2 BASF SE

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Umicore

- 6.3.6 Sumitomo Chemical Co., Ltd.

- 6.3.7 Nichia Corporation

- 6.3.8 ENTEK International LLC

- 6.3.9 Arkema SA

- 6.3.10 Kureha Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219