|

市場調查報告書

商品編碼

1636233

電動車鎳氫電池應用:市場佔有率分析、產業趨勢、成長預測(2025-2030)Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

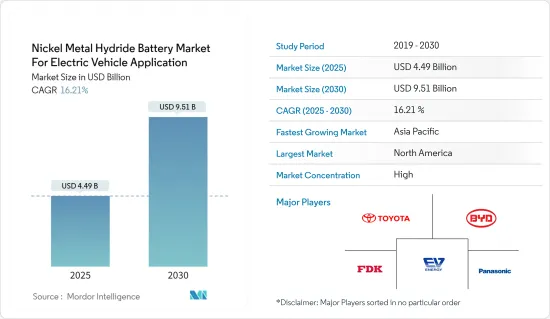

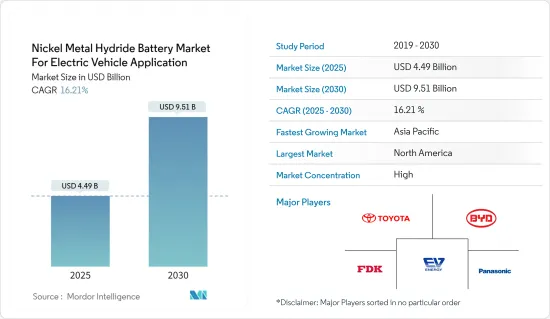

電動車鎳氫電池應用市場預計將從2025年的44.9億美元成長到2030年的95.1億美元,預測期內(2025-2030年)複合年成長率為16.21%。

主要亮點

- 從中期來看,電動車需求增加和成本效益等因素預計將在預測期內推動市場發展。

- 另一方面,來自替代技術的競爭預計將阻礙預測期內的市場成長。

- 然而,技術進步預計將在未來幾年為市場帶來重大機會。

- 由於電動車在該地區各國的滲透率不斷提高,預計亞太地區將主導市場。

鎳氫電池市場趨勢

預計電池驅動的電動車將佔據主導地位

- 純電動車(BEV)是一種沒有內燃機、僅由可充電電池提供動力的電動車。推進依靠馬達,該電動機儲存在大容量電池組中。

- 鎳氫電池由於其相對較高的能量密度、較長的使用壽命以及在各種溫度範圍內有效運行的能力,長期以來一直在各種電動車應用中廣受歡迎。儘管鋰離子電池近年來在市場上佔據主導地位,但鎳氫電池仍然發揮著重要作用,特別是在混合動力汽車和一些純電動車中。

- 全球對純電動車的需求正在迅速成長,銷量預計將從 2019 年的 150 萬輛增至 2023 年的 950 萬輛。這一成長的推動因素包括日益成長的環境問題、旨在減少排放氣體的政府法規以及電池技術的進步。

- 2023年,純電動車成為最受買家歡迎的第三大選擇。 12 月市場佔有率上升至 18.5%,全年整體佔有率達 14.6%,領先柴油引擎的 13.6%。汽油車以35.3%位居第一,混合動力車以25.8%位居第二。

- 然而,2023年12月新純電動車銷量自2020年4月以來首次下降,下降16.9%至16.07萬輛。這一下降是由於2022年12月的強勁表現以及純電動車最大市場德國的顯著下降,下降了47.6%。儘管出現下滑,全年總銷量仍超過150萬輛,較2022年大幅成長37%,純電動車市場佔有率達14.6%。

- 相反,12 月歐盟混合動力電動車新註冊量激增 26%,其中四個最大市場中的三個成長強勁:德國(+38%)、法國(+32.6%)、西班牙(+24.3%)。這一趨勢促成2023年整體成長29.5%,導致混合動力電動車銷量超過270萬輛,佔歐盟市場佔有率的四分之一。

- 隨著產業的發展,對鎳氫技術的持續投資可能會導致鎳氫技術在純電動車市場的復興,特別是在鎳氫獨特優勢最有利的某些細分領域。總體而言,隨著電動車需求的增加和電池技術的不斷進步,鎳氫電池市場的純電動車領域有望成長。

預計北美將佔據主導地位

- 在混合動力電動車 (HEV) 的普及和綠色交通解決方案的推動下,北美電動車 (EV) 應用的鎳氫 (NiMH) 電池市場正在經歷變革時期。鎳氫電池以其耐用性、熱穩定性和成本效益而聞名,由於其能夠儲存能量並有效支援再生煞車系統,因此廣泛應用於混合動力汽車。

- 近年來,北美對電動車的需求大幅增加。光是美國的電動車銷量就從 2019 年的 32.5 萬輛成長到 2023 年的約 139 萬輛,反映出消費者強烈轉向更永續的交通途徑。這一趨勢得到了鼓勵電動車採用和減少溫室氣體排放的政府獎勵和政策的補充。

- 例如,2024 年 1 月,財政部和能源部宣布,《通貨膨脹削減法案》的電動車充電稅額扣抵30C 將適用於約三分之二的美國人,並將允許低收入地區和非都市區電動車充電基礎設施成本最高可享 30% 的折扣,從而降低安裝電動車充電基礎設施的成本,並增加服務欠缺地區的電動車充電服務。

- 主要汽車製造商,尤其是豐田,透過將鎳氫電池融入混合動力車型,引領了鎳氫電池市場。豐田完善的混合動力汽車產品線嚴重依賴鎳氫技術,對整體市場需求做出了巨大貢獻。此外,汽車產業對提高燃油效率和減少對石化燃料的依賴的關注進一步鞏固了鎳氫電池在混合動力應用中的作用。

- 儘管面臨來自鋰離子電池的競爭,鋰離子電池具有更高的能量密度和更快的充電時間,但鎳氫電池由於其低成本和成熟的製造程序,仍然是許多混合動力汽車的可行選擇。此外,電池技術的進步正在提高鎳氫電池的性能,使其在不斷發展的市場中更具競爭力。

- 總之,在混合動力汽車的普及、技術進步和政府支持政策的推動下,北美電動車鎳氫電池市場預計將成長。隨著該地區繼續優先考慮永續交通,鎳氫電池將在向更清潔、更有效率的行動解決方案過渡中發揮關鍵作用。

鎳氫電池產業概況

用於電動車應用的鎳氫電池市場正在整合。主要參與者包括Panasonic控股公司、比亞迪公司、EV Energy、FDK和豐田汽車公司(排名不分先後)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車需求增加

- 成本效益

- 抑制因素

- 來自替代技術的競爭

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 依推進類型

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

- 燃料電池電動車

- 按車型分類

- 客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 北歐的

- 俄羅斯

- 土耳其

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 印尼

- 泰國

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 埃及

- 奈及利亞

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Holdings Corporation

- BYD Company

- Toyota Motor Corp

- FDK Corporation

- EV Energy Co. Ltd

- Saft Group

- 市場排名/佔有率分析

- 其他知名企業名單

第7章 市場機會及未來趨勢

- 技術進步

簡介目錄

Product Code: 50003501

The Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 4.49 billion in 2025 to USD 9.51 billion by 2030, at a CAGR of 16.21% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and cost-effectiveness are expected to drive the market during the forecast period.

- On the other hand, competition from alternative technologies is expected to hinder market growth during the forecast period.

- However, technological advancements are expected to provide significant opportunities for the market in the coming years.

- Asia-Pacific is estimated to dominate the market due to the increasing adoption rate of electric vehicles across the various countries in the region.

Nickel Metal Hydride Battery Market Trends

Battery Electric Vehicles are Expected to Dominate

- Battery electric vehicles (BEVs) are electric vehicles powered entirely by rechargeable batteries with no internal combustion engine. They rely on electric motors for propulsion and store electricity in high-capacity battery packs.

- NiMH batteries have long been a popular choice for various electric vehicle applications due to their relatively high energy density, longevity, and ability to operate effectively in a range of temperatures. While lithium-ion batteries have dominated the market in recent years, NiMH batteries continue to play a significant role, especially in hybrid vehicles and some BEVs.

- The demand for BEVs has surged globally, with sales growing from 1.5 million units in 2019 to 9.5 million units in 2023. This growth is driven by increasing environmental concerns, government regulations aimed at reducing emissions, and advancements in battery technologies.

- Battery-electric cars were the third most popular choice among buyers in 2023. In December, their market share rose to 18.5%, contributing to an overall annual share of 14.6%, which surpassed diesel's steady 13.6%. Petrol vehicles maintained the top spot at 35.3%, while hybrid-electric cars held the second position with a 25.8% market share.

- However, in December 2023, new battery-electric car sales fell for the first time since April 2020, decreasing by 16.9% to 160,700 units. This decline was attributed to a strong performance in December 2022 and a notable drop in Germany, which saw a 47.6% decrease, as it is the largest market for battery-electric cars. Despite this dip, the total sales volume for the year exceeded 1.5 million units, marking a significant 37% increase compared to 2022, with the battery-electric car market share reaching 14.6%.

- Conversely, new EU registrations of hybrid-electric cars saw a 26% surge in December, driven by strong gains in three of the four largest markets: Germany (+38%), France (+32.6%), and Spain (+24.3%). This trend contributed to an overall increase of 29.5% in 2023, resulting in more than 2.7 million hybrid-electric vehicles sold, which accounted for a quarter of the EU market share.

- As the industry evolves, the continued investment in NiMH technology could lead to its resurgence in the BEV market, particularly in specific segments where its unique advantages are most beneficial. Overall, the BEV segment of the NiMH battery market is poised for growth as demand for electric vehicles rises and battery technology continues to advance.

North America is Expected to Dominate

- The North American nickel-metal hydride (NiMH) battery market for electric vehicle (EV) applications is witnessing a transformative phase driven by the increasing adoption of hybrid electric vehicles (HEVs) and the push for greener transportation solutions. NiMH batteries, known for their durability, thermal stability, and cost-effectiveness, are widely utilized in HEVs due to their ability to store energy and efficiently support regenerative braking systems.

- In recent years, the demand for electric vehicles in North America has surged significantly. The growth of electric vehicle sales, which increased from 325,000 units in 2019 to approximately 1.39 million units in 2023 in the United States alone, reflects a strong consumer shift toward more sustainable transportation options. This trend is complemented by government incentives and policies promoting EV adoption and reducing greenhouse gas emissions.

- For instance, in January 2024, the Department of Treasury and the Department of Energy confirmed that the Inflation Reduction Act's 30C for EV charging tax credit will be available to approximately two-thirds of American citizens and will provide up to 30% off the cost of the charger to individuals and businesses in low-income communities and non-urban areas, making it more affordable to install EV charging infrastructure and increasing access to EV charging in underserved communities.

- Major automotive manufacturers, particularly Toyota, have driven the NiMH battery market by integrating them into their hybrid models. Toyota's well-established HEV lineup, which relies heavily on NiMH technology, has contributed significantly to the overall market demand. Additionally, the automotive industry's focus on improving fuel efficiency and reducing dependence on fossil fuels has further solidified the role of NiMH batteries in hybrid applications.

- Despite competition from lithium-ion batteries, which offer higher energy densities and faster charging times, NiMH batteries remain a viable option for many HEVs due to their lower costs and established manufacturing processes. Moreover, ongoing advancements in battery technology are enhancing the performance of NiMH batteries, making them more competitive in the evolving market.

- In conclusion, the North American nickel-metal hydride battery market for electric vehicle applications is positioned for growth, driven by the increasing adoption of hybrid vehicles, technological advancements, and supportive government policies. As the region continues to prioritize sustainable transportation, NiMH batteries will play a crucial role in the transition to cleaner and more efficient mobility solutions.

Nickel Metal Hydride Battery Industry Overview

The nickel metal hydride battery market for electric vehicle applications is consolidated. Some of the major players include (not in particular order) Panasonic Holdings Corporation, BYD Company, EV Energy Co. Ltd, FDK Corporation, and Toyota Motor Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Cost-effectiveness

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-in Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Indonesia

- 5.3.3.7 Thailand

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 BYD Company

- 6.3.3 Toyota Motor Corp

- 6.3.4 FDK Corporation

- 6.3.5 EV Energy Co. Ltd

- 6.3.6 Saft Group

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

02-2729-4219

+886-2-2729-4219