|

市場調查報告書

商品編碼

1636537

亞太地區電動車鎳氫電池:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

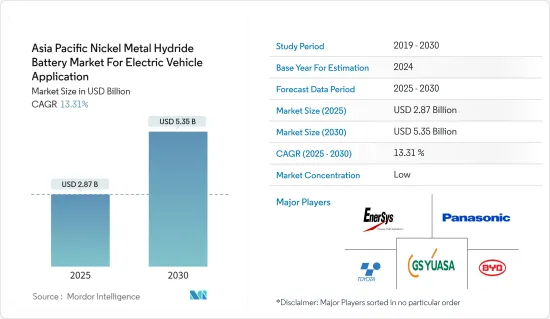

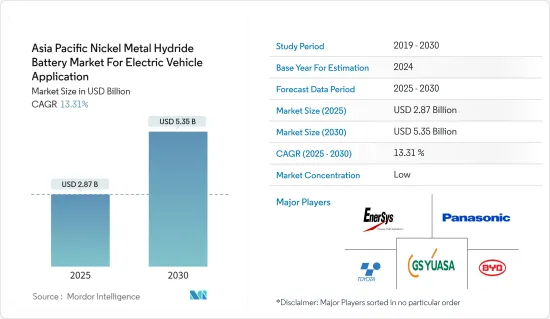

亞太地區電動車鎳氫電池市場預計將從 2025 年的 28.7 億美元成長到 2030 年的 53.5 億美元,預測期內(2025-2030 年)的複合年成長率為 13.31%。

主要亮點

- 從中期來看,混合動力車(HEV) 的日益普及以及中國、印度和日本等國家推出的補貼和稅收優惠等促進電動車發展的政策預計將推動電動車鎳氫電池市場在未來幾年的成長。

- 另一方面,鋰離子技術的快速進步和成本降低預計將阻礙未來幾年的市場成長。

- 然而,隨著亞太地區各國政府加大對電池回收基礎設施的投資,鎳氫電池憑藉其簡單的回收流程,預計將在不久的將來為電動車鎳氫電池市場帶來巨大的機會。

- 由於政府對混合動力汽車的補貼增加,預計預測期內印度將成為亞太地區電動車鎳氫電池市場成長最快的地區。

亞太地區鎳氫電池市場趨勢

鋰離子技術的快速進步和成本降低正在限制市場

- 鋰離子 (Li-ion) 技術的進步和生產成本的穩定下降正在重塑亞太地區 (APAC) 電動車 (EV) 的鎳氫 (NiMH) 電池市場。隨著電動車市場向電池電動車 (BEV) 轉變,鋰離子電池因其卓越的能量密度、效率和價格下降而成為首選。

- 此外,由於續航里程更長、能源效率更高且成本下降,採用鋰離子電池驅動的全電動汽車 (EV) 在亞太地區 (APAC) 越來越受歡迎。根據彭博新能源財經報道,2023年電池價格將暴跌至139美元/kWh時,降幅超過13%。考慮到技術的持續進步和製造流程的改進,預測顯示價格還將進一步下降,2025年的目標是113美元/千瓦時,2030年的目標是80美元/千瓦時。

- 此外,中國、日本、韓國等國家也持續投入鋰離子技術,推動技術創新,使鋰離子電池比鎳氫電池更具成本效益和適應性。

- 例如,2024 年 5 月,中國計劃投資約 60 億元人民幣(8.45 億美元)用於推進下一代電動車(EV)電池技術。 ASSB 是最尖端科技,它利用固體電解質來增強傳統的鋰離子電池 (LIB)。預計此類投資將增強亞太地區鋰離子電池的成長,但可能在預測期內抑制鎳氫電池的擴張。

- 此外,由於鋰離子電池具有更高的能量密度、快速充電能力和適應性,汽車製造商正逐漸將鋰離子電池納入其最新的混合模式和全電動車型中,從而逐步放棄鎳氫電池。

- 然而,鎳氫電池比鋰離子電池更容易回收,全部區域越來越關注永續性。由於回收技術和基礎設施的進步,預測期內鎳氫市場在某些應用領域可能會持續很長時間。

- 因此,在預測期內,鋰離子技術的快速進步和成本降低將從根本上改變亞太地區電動車電池市場的格局。

印度經濟快速成長

- 與佔據主導地位的鋰離子電池市場相比,印度用於電動車 (EV) 的鎳氫 (NiMH) 電池市場也比較小眾。這些鎳氫電池由於其高安全性、長使用壽命和在寬溫度範圍內的高效性能主要應用於混合動力電動車 (HEV) 和其他電動車。

- 在印度惡劣的氣候條件下,鎳氫電池因其優異的熱穩定性和耐高溫性而受到青睞,其表現優於鋰離子電池。近年來,搭載鎳氫電池的電動車的需求大幅增加。根據美國汽車工業協會(SMEV)的數據,到 2024 年 10 月,全國電動車銷量將達到 49,306 輛。 2020會計年度至2024會計年度期間,銷售額飆升了37倍,預計在政府政策和措施的推動下,未來幾年將進一步成長。

- 此外,電動車快速採用和製造(FAME)計劃、混合動力汽車商品及服務稅降低等政策也間接促進了鎳氫電池技術在混合動力汽車中的應用。各州政府已在全國各地宣布了多項推廣混合動力汽車汽車和電池電動車的計畫。

- 例如,2024年7月,印度北方邦政府宣布免除混合動力汽車的道路稅。該政策旨在鼓勵使用清潔汽車並減少傳統汽油和柴油汽車對環境的影響。這些舉措可能會鼓勵全部區域混合動力乘用車的普及,從而推動未來幾年對鎳氫電池的需求。

- 在印度,混合動力汽車越來越被視為內燃機汽車 (ICE) 和全電動汽車之間的橋樑。豐田、瑪魯蒂鈴木等主要汽車製造商正在推出混合模式,推動了鎳氫電池的需求。

- 例如,2024 年 10 月,現代馬達印度有限公司 (HMIL) 宣布了未來幾年在印度推出混合動力汽車的策略。該公司的擴張計畫將分兩個階段實施,到 2025 年將初步增加 17 萬輛,到 2028 年將再增加 8 萬輛。這些舉措將推動混合動力電動車市場的發展,為預測期內鎳氫電池創造重大機會。

- 因此,這些措施和計劃可能會促進全部區域的電動車銷售,從而在預測期內推動對鎳氫電池的需求。

亞太地區鎳氫電池產業概況

亞太地區電動車鎳氫電池市場規模減少了一半。主要參與者(不分先後順序)有Panasonic Corporation、豐田自動織布機公司、比亞迪股份有限公司、GS湯淺株式會社、EnerSys等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 油電混合車越來越受歡迎

- 電動車補貼和稅收優惠大幅增加

- 限制因素

- 鋰離子技術的快速進步和成本的降低

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 依推進類型

- 純電動車

- 油電混合車

- 插電式混合動力汽車

- 燃料電池電動車

- 按車型

- 搭乘用車

- 商用車

- 按地區

- 中國

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- Toyota Industries Corporation

- Primearth EV Energy Co., Ltd.

- GS Yuasa Corporation

- Samsung SDI Co., Ltd.

- Hitachi, Ltd.

- BYD Company Limited

- EnerSys

- Toshiba Corporation

- LG Energy Solution

- 其他著名公司名單

- 市場排名分析

第7章 市場機會與未來趨勢

- 現有電池回收流程的創新

簡介目錄

Product Code: 50003954

The Asia Pacific Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 2.87 billion in 2025 to USD 5.35 billion by 2030, at a CAGR of 13.31% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the rising adoption of hybrid electric vehicles (HEV) and policies promoting EV adoption, such as subsidies and tax incentives in countries like China, India, and Japan, are expected to drive the demand for nickel metal hydride battery market for electric vehicle application during the forecast period.

- On the other hand, rapid advancement and cost reduction in lithium-ion technology are expected to hinder market growth in the upcoming years.

- Nevertheless, governments in APAC are investing in battery recycling infrastructure, and NiMH batteries, with their easier recycling process, are expected to create significant opportunities for the nickel metal hydride battery market for electric vehicle applications in the near future.

- India is expected to be the fastest-growing region in Asia Pacific's nickel metal hydride battery market for electric vehicle applications due to rising government subsidies for hybrid vehicles during the forecast period.

Asia Pacific Nickel Metal Hydride Battery Market Trends

Rapid Advancement and Cost Reduction in Lithium-ion Technology are Restrain the Market

- The advancements in lithium-ion (Li-ion) technology and a steady decline in production costs have reshaped the nickel-metal hydride (NiMH) battery market for electric vehicles (EVs) in the Asia-Pacific (APAC) region. With the EV market pivoting towards battery electric vehicles (BEVs), lithium-ion batteries are preferred due to their superior energy density, efficiency, and falling prices.

- Moreover, in the Asia-Pacific (APAC) region, fully electric vehicles (EVs) powered by lithium-ion batteries are popular owing to their extended ranges, superior energy efficiency, and decreasing costs. Bloomberg NEF reported that 2023 battery prices took a significant plunge, landing at USD 139/kWh and marking a drop of over 13%. Given the continuous technological advancements and enhancements in manufacturing processes, forecasts indicate a further dip, aiming for USD 113/kWh by 2025 and an ambitious target of USD 80/kWh by 2030.

- In addition, countries such as China, Japan, and South Korea have consistently invested in lithium-ion technology, driving innovation and rendering lithium-ion batteries more cost-effective and adaptable than NiMH batteries.

- For instance, in May 2024, China is set to invest approximately 6 billion yuan (USD 845 million) into advancing next-generation battery technology for electric vehicles (EVs). ASSBs, a cutting-edge technology, enhance traditional lithium-ion batteries (LIBs) by utilizing a solid electrolyte. Such investments are anticipated to bolster the growth of lithium-ion batteries across the Asia-Pacific region, while potentially curbing the expansion of nickel-metal hydride (NiMH) batteries during the forecast period.

- Further, due to their superior energy density, quicker charging capabilities, and adaptability, automakers are progressively integrating lithium-ion batteries into their latest hybrid and fully electric models, often sidelining NiMH batteries in the region.

- However, NiMH batteries boast easier recyclability than their lithium-ion counterparts, resonating with the increasing emphasis on sustainability across the APAC region. With advancements in recycling technologies and infrastructure, the NiMH market could find longevity in select applications during the forecast period.

- Hence, the rapid advancements and cost reductions in lithium-ion technology have fundamentally reshaped the landscape of the Asia-Pacific battery market for EV applications during the forecast period.

India to Witness Significant Growth

- India's market for nickel-metal hydride (NiMH) batteries in electric vehicle (EV) applications remains niche when juxtaposed with the dominance of lithium-ion batteries. These NiMH batteries are primarily applied in hybrid electric vehicles (HEVs) and other EVs owing to their strong safety profile, extended lifecycle, and efficient performance across a broad temperature spectrum.

- NiMH batteries are favored in India's challenging climatic conditions for their superior thermal stability and resilience to high temperatures, outpacing lithium-ion batteries. Demand for NiMH battery-powered EVs has surged significantly in recent years. According to the Society of Manufacturers of Electric Vehicles (SMEV), by October 2024, EV sales nationwide reached 49,306 units. Sales have skyrocketed 37 times from FY20 to FY24, with further growth anticipated in the coming years, bolstered by government policies and initiatives.

- Furthermore, policies such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme and a reduced GST on hybrid vehicles indirectly bolstered the adoption of NiMH battery technology in hybrids. The various state governments announced several schemes to promote hybrid and battery electric vehicles across the country.

- For instance, in July 2024, the Uttar Pradesh government of India announced a waiver of road tax on hybrid cars. This policy aims to encourage the adoption of clean vehicles and reduce the environmental impact of traditional gasoline and diesel-powered cars. Such initiatives are likely to promote hybrid passenger cars across the region and raise the demand for NiMH batteries in the coming years.

- In India, hybrid vehicles are increasingly seen as a bridge between internal combustion engine (ICE) and fully electric vehicles. Major automotive players, including Toyota and Maruti Suzuki, are rolling out hybrid models, boosting the demand for NiMH batteries.

- As a case in point, in October 2024, Hyundai Motor India Limited (HMIL) unveiled its strategy to launch hybrid vehicles in India over the next few years. The company's expansion plan unfolds in two phases: an initial boost of 170,000 units by 2025 and another 80,000 units by 2028. These initiatives are poised to elevate the hybrid EV sector, presenting a significant opportunity for NiMH batteries during the forecast period.

- Hence, these initiatives and plans are likely to enhance EV sales across the region and raise the demand for NiMH batteries during the forecast period.

Asia Pacific Nickel Metal Hydride Battery Industry Overview

Asia Pacific's nickel metal hydride battery market for electric vehicle applications is semi-fragmented. Some key players (not in particular order) are Panasonic Corporation, Toyota Industries Corporation, BYD Company Limited, GS Yuasa Corporation, and EnerSys, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Hybrid Electric Vehicles

- 4.5.1.2 Surge in Subsidies and Tax Incentives for EVs

- 4.5.2 Restraints

- 4.5.2.1 Rapid Advancement and Cost Reduction in Lithium-ion Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-In Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 South Korea

- 5.3.4 ASEAN Countries

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Toyota Industries Corporation

- 6.3.3 Primearth EV Energy Co., Ltd.

- 6.3.4 GS Yuasa Corporation

- 6.3.5 Samsung SDI Co., Ltd.

- 6.3.6 Hitachi, Ltd.

- 6.3.7 BYD Company Limited

- 6.3.8 EnerSys

- 6.3.9 Toshiba Corporation

- 6.3.10 LG Energy Solution

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Established Battery Recycling Processes

02-2729-4219

+886-2-2729-4219