|

市場調查報告書

商品編碼

1636536

歐洲電動車鎳氫電池:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Europe Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

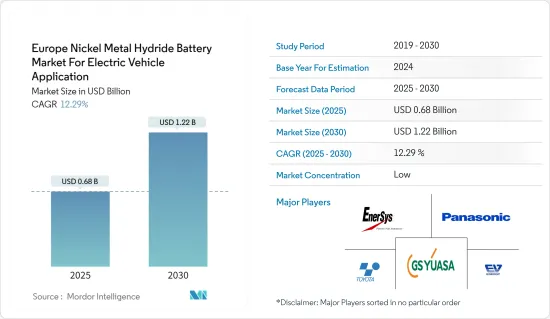

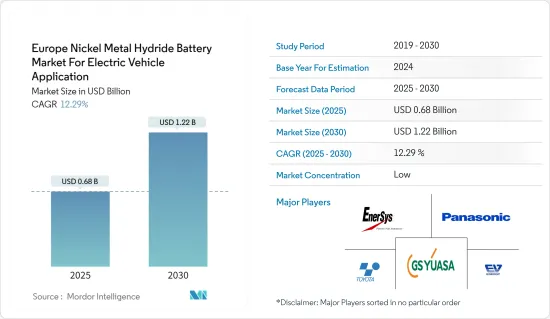

歐洲電動車鎳氫電池市場預計將從 2025 年的 6.8 億美元成長到 2030 年的 12.2 億美元,預測期內(2025-2030 年)的複合年成長率為 12.29%。

主要亮點

- 從中期來看,混合動力電動車 (HEV) 的日益普及以及雄心勃勃的歐洲碳中和與排放目標預計將在預測期內推動電動車應用對鎳氫 (NiMH) 電池的需求。

- 相反,鋰離子技術的快速進步和成本下降可能會對未來幾年的市場成長構成挑戰。

- 然而,歐洲的電池回收基礎設施正在加強,這可能會使鎳氫電池重新成為人們關注的焦點。其成熟的回收流程加上與永續性目標的一致性,為電動車應用的鎳氫電池市場提供了重大的近期機會。

- 由於政府對混合動力汽車的補貼增加,預計預測期內德國將成為歐洲電動車鎳氫電池市場成長最快的地區。

歐洲鎳氫電池市場趨勢

混合動力電動車 (HEV) 成長強勁

- 混合動力電動車(HEV)整合了內燃機和電池供電的馬達,在電動車市場中發揮關鍵作用。在歐洲,混合動力車作為減少溫室氣體排放的過渡解決方案頗受歡迎,其中相當一部分汽車使用鎳氫(NiMH)電池。

- 鎳氫電池比鋰離子電池具有成本優勢,特別是在能量密度不是最重要的 HEV 應用中。這種成本效益使得 HEV 在歐洲具有競爭力,近年來,HEV 在歐洲的採用率大幅增加。根據歐洲汽車製造商協會(ACEA)的數據,到2024年6月,混合動力汽車(HEV)在歐盟(EU)新車註冊中的比例將從2023年的24.4%上升至29.5%。

- 該領域的四大市場法國、義大利、西班牙和德國都實現了令人印象深刻的兩位數成長:法國+34.9%、義大利+27.2%、西班牙+23%、德國+16.5%。這一激增使混合動力電動車的市場佔有率升至 29.5%,較 2023 年 6 月的 24.4% 有顯著成長。隨著政府針對混合動力車的激勵措施和稅收優惠在全部區域推行,這一佔有率還將繼續成長,這表明未來幾年對鎳氫電池的需求將會增加。

- 此外,豐田是一家大型汽車製造商,其普銳斯和Corolla等車型廣泛使用鎳氫電池,在歐洲市場佔有重要地位。這一存在推動了整個全部區域對鎳氫技術的持續需求,並凸顯了鎳氫電池在汽車領域的重要性。

- 此外,雖然充電基礎設施和高成本等挑戰阻礙了電動車 (EV) 的廣泛普及,但混合動力電動車 (HEV) 已成為尋求更清潔交通方式的消費者的可行選擇。為了滿足該地區對電動車日益成長的需求,主要電動車製造商計劃明年推出混合動力電動車。

- 例如,2024 年 7 月,Stellantis 擴大了其基準混合動力傳動系統的供應,以滿足歐洲客戶日益成長的需求。該公司計劃在 2026 年再推出 6 款車型,使其在歐洲每年的混合模式系列達到 30 款。這些措施將為預測期內鎳氫電池需求的增加鋪平道路。

- 這些計劃和舉措可能會增加全部區域的混合動力汽車產量,從而在預測期內增加對鎳氫電池的需求。

德國經濟快速成長

- 德國在汽車電氣化、對混合動力技術的支持以及對電池安全性和可回收性的重視方面的努力預計將支持電動車鎳氫電池市場的強勁成長。預計市場也將受益於政府的激勵措施以及消費者對永續交通途徑的認知不斷增強。

- 在德國,電動車(EV),包括混合動力車(HEV),都依賴鎳氫(NiMH)電池,因為其穩定性、安全性和耐用性。近年來,該地區對電動車的需求激增,寶馬、梅賽德斯-奔馳、豐田和大眾等公司滿足了這一日益成長的需求。

- 根據國際能源總署(IEA)的資料,包括混合動力車和插電式混合動力汽車(PHEV)在內的電動車銷量將在2023年達到70萬輛。這一數字較2019年大幅增加了5.48倍。隨著鎳氫 (NiMH) 技術的不斷改進,提供更高的能量密度和混合動力汽車的效率,電動車銷量預計將在未來幾年大幅成長。

- 此外,政府也為低排放氣體汽車(包括混合動力汽車)提供補貼和稅收優惠。由於混合動力汽車充當了消費者向電動車過渡的橋樑,這種政策支持間接加強了鎳氫市場。這些補貼和稅收優惠使得混合動力汽車更加便宜,並鼓勵消費者採用混合動力汽車。

- 例如,德國聯合政府於2024年9月核准了一項減稅提案,以促進電動車的普及。該計劃允許企業扣除新購買的電動或合格的零排放汽車價格的高達 40%。政府預計 2024 年至 2028 年期間每年將平均花費約 4.65 億歐元(5.14 億美元)用於這項措施。這些舉措將推動全部區域電動車的普及,從而在預測期內推動對鎳氫電池的需求。

- 此外,鎳氫技術的不斷進步,如能量密度的提高和效率的提升,可能會導致其在混合動力汽車中的應用範圍擴大。在整個預測期內,這些增強功能將創造新的市場機會,尤其是對於輕度混合動力汽車和插電式混合動力汽車。

- 因此,這些措施和計劃可能會在預測期內促進全部區域的電動車銷售並增加對鎳氫電池的需求。

歐洲鎳氫電池產業概況

歐洲電動車鎳氫電池市場處於半分散狀態。主要參與者(不分先後順序)包括Panasonic Corporation、豐田工業公司、Primearth EV Energy、GS Yuasa Ltd. 和 EnerSys。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 油電混合車越來越受歡迎

- 碳中和及排放舉措不斷增多

- 限制因素

- 鋰離子技術的快速進步和成本的降低

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 依推進類型

- 純電動車

- 油電混合車

- 插電式混合動力汽車

- 燃料電池電動車

- 按車型

- 搭乘用車

- 商用車

- 按地區

- 德國

- 法國

- 英國

- 土耳其

- 西班牙

- 俄羅斯

- 北歐的

- 義大利

- 其他歐洲國家

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- Toyota Industries Corporation

- Primearth EV Energy Co., Ltd.

- GS Yuasa Corporation

- Samsung SDI Co., Ltd.

- Hitachi, Ltd.

- Johnson Controls(Clarios)

- EnerSys

- Fujitsu Ltd.

- SAFT Groupe SA

- 其他著名公司名單

- 市場排名分析

第7章 市場機會與未來趨勢

- 現有電池回收流程的創新

簡介目錄

Product Code: 50003953

The Europe Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 0.68 billion in 2025 to USD 1.22 billion by 2030, at a CAGR of 12.29% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the growing adoption of hybrid electric vehicles (HEVs) and Europe's ambitious targets for carbon neutrality and emissions reduction are poised to boost the demand for nickel metal hydride (NiMH) batteries in electric vehicle applications during the forecast period.

- Conversely, swift advancements and decreasing costs in lithium-ion technology are likely to pose challenges to market growth in the coming years.

- However, with the enhancement of battery recycling infrastructure in Europe, NiMH batteries might garner renewed interest. Their established recycling processes, coupled with alignment to sustainability goals, present substantial opportunities for the nickel metal hydride battery market in electric vehicle applications in the foreseeable future.

- Germany is projected to be the fastest-growing region in Europe's nickel metal hydride battery market for electric vehicle applications, driven by increasing government subsidies for hybrid vehicles during the forecast period.

Europe Nickel Metal Hydride Battery Market Trends

Hybrid Electric Vehicles in Propulsion Type Segment Witness Significant Growth

- Hybrid electric vehicles (HEVs) play a pivotal role in the electric vehicle market, integrating an internal combustion engine with a battery-powered electric motor. In Europe, HEVs are a prevalent transitional solution to curb greenhouse gas emissions, with a significant number utilizing nickel-metal hydride (NiMH) batteries.

- NiMH batteries offer a cost advantage over lithium-ion batteries, especially in HEV applications where energy density isn't paramount. This cost-effectiveness allows HEVs to be competitively priced in Europe, which has seen a notable uptick in HEV adoption over recent years. As per the Association des Constructeurs Europeens d'Automobiles (ACEA), by June 2024, hybrid-electric vehicles (HEVs) boosted their share of new car registrations in the European Union (EU) from 24.4% to 29.5% since 2023.

- The segment's four largest markets - France, Italy, Spain, and Germany - all reported impressive double-digit growths: France at +34.9%, Italy at +27.2%, Spain at +23%, and Germany at +16.5%. This surge elevated the hybrid-electric market share to 29.5%, a notable increase from 24.4% in June 2023. With government incentives and tax benefits for HEVs being rolled out across the region, this share is poised for further growth, signaling a rising demand for NiMH batteries in the coming years.

- Moreover, Toyota, a leading automaker that extensively employs NiMH batteries in models like the Prius and Corolla, boasts a significant market presence in Europe. This presence fuels the ongoing demand for NiMH technology throughout the region, highlighting the importance of these batteries in the automotive sector.

- Additionally, while challenges such as charging infrastructure and high costs hinder the full adoption of electric vehicles (EVs), hybrid electric vehicles (HEVs) emerge as a practical alternative for consumers moving towards cleaner transportation. In response to the growing demand for EVs in the region, a leading EV manufacturer is set to introduce hybrid EVs in the upcoming year.

- As an illustration, in July 2024, Stellantis expanded its benchmark hybrid powertrain offerings to additional nameplates, responding to heightened demand from European customers. The company boasts a lineup of 30 hybrid models in Europe for the year, with plans for six more launches by 2026. These initiatives pave the way for increased demand for nickel metal hydride batteries during the forecast period.

- Such projects and initiatives are likely to increase HEV production across the region, and there is expected to be a rising demand for NiMH batteries during the forecast period.

Germany to Witness Significant Growth

- Germany's commitment to vehicle electrification, endorsement of hybrid technologies, and emphasis on battery safety and recyclability are set to keep the NiMH battery market for electric vehicles steady. The market is also expected to benefit from government incentives and increasing consumer awareness about sustainable transportation options.

- In Germany, electric vehicles (EVs), including hybrid electric vehicles (HEVs), rely on nickel-metal hydride (NiMH) batteries for their stability, safety, and durability. Over the past few years, the demand for EVs has surged in the region, with companies like BMW, Mercedes-Benz, Toyota, and Volkswagen stepping up to meet this growing demand.

- Data from the International Energy Agency (IEA) reveals that in 2023, electric vehicle sales, encompassing HEVs and plug-in hybrid electric vehicles (PHEVs), reached 700,000 units. This figure marks a remarkable 5.48-fold increase since 2019. As NiMH technology continues to advance, boasting features like higher energy densities and improved efficiency in HEVs, electric vehicle sales are poised for significant growth in the coming years.

- Further, the government provides subsidies and tax incentives for low-emission vehicles, including hybrids. Such policy backing indirectly strengthens the NiMH market, given that hybrids serve as a bridge for consumers transitioning to electric mobility. These subsidies and tax benefits make hybrids more affordable, encouraging consumers to adopt them.

- For instance, in September 2024, Germany's coalition government approved a tax reduction proposal to boost electric car adoption. The initiative allows companies to deduct up to 40% of the value of newly acquired electric and qualifying zero-emission vehicles. The government projects an average annual expenditure of approximately 465 million euros (USD 514 million) for this measure from 2024 to 2028. Such initiatives are set to bolster EV adoption across the region, subsequently driving up the demand for NiMH batteries during the forecast period.

- Additionally, ongoing advancements in NiMH technology, including increased energy densities and improved efficiency, are likely to broaden their use in hybrid vehicles. These enhancements also pave the way for new market opportunities throughout the forecast period, particularly in mild hybrids and plug-in hybrids.

- Hence, these initiatives and plans are likely to enhance EV sales across the region and raise the demand for NiMH batteries during the forecast period.

Europe Nickel Metal Hydride Battery Industry Overview

Europe's nickel metal hydride battery market for electric vehicle applications is semi-fragmented. Some key players (not in particular order) are Panasonic Corporation, Toyota Industries Corporation, Primearth EV Energy Co., Ltd., GS Yuasa Corporation, and EnerSys, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Hybrid Electric Vehicles

- 4.5.1.2 Rising carbon neutrality and emissions reduction initiatives

- 4.5.2 Restraints

- 4.5.2.1 Rapid Advancement and Cost Reduction in Lithium-ion Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-In Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Turkey

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 NORDIC

- 5.3.8 Italy

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Toyota Industries Corporation

- 6.3.3 Primearth EV Energy Co., Ltd.

- 6.3.4 GS Yuasa Corporation

- 6.3.5 Samsung SDI Co., Ltd.

- 6.3.6 Hitachi, Ltd.

- 6.3.7 Johnson Controls (Clarios)

- 6.3.8 EnerSys

- 6.3.9 Fujitsu Ltd.

- 6.3.10 SAFT Groupe S.A.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Established Battery Recycling Processes

02-2729-4219

+886-2-2729-4219