|

市場調查報告書

商品編碼

1636542

義大利電動車用鎳氫電池:市場佔有率分析、產業趨勢、成長預測(2025-2030)Italy Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

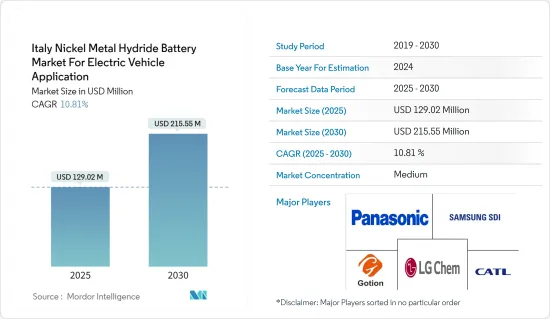

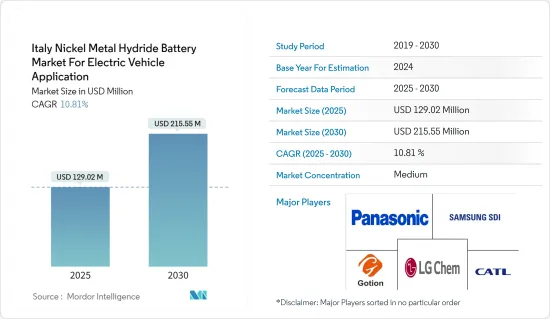

義大利電動車鎳氫電池市場預計將從2025年的1.2902億美元成長到2030年的2.1555億美元,預測期間(2025-2030年)複合年成長率為10.81%。

主要亮點

- 從中期來看,政府對電動車的激勵措施、電動車的普及、技術進步以及減少碳排放的環境法規預計將在預測期內推動市場發展。

- 相反,來自鋰離子電池等替代技術的競爭預計將在預測期內阻礙市場。

- 義大利電動和混合動力汽車市場的擴張為鎳氫電池帶來了重大成長機會。

義大利鎳氫電池市場趨勢

混合動力汽車預計將顯著成長

- 義大利汽車市場對混合動力電動車 (HEV) 的採用顯著增加,豐田Corolla等車型越來越受歡迎。這一趨勢反映了向綠色汽車的轉變,並得到了義大利改善電動車基礎設施和為電動車提供獎勵的承諾的支持。

- 混合動力汽車結合了內燃機和電力推進,有望提高燃油效率並減少排放氣體。這些車輛對於義大利減少碳排放和轉向更永續的交通選擇的策略至關重要。

- 例如,在義大利,混合動力車新註冊數量從 2022 年的 454,989 輛大幅增加到 2023 年的 575,480 輛。這相當於約 26.5% 的成長率,凸顯了混合動力車採用率的穩健上升趨勢。這一激增的背後是政府的獎勵和日益增強的環保意識,使混合動力汽車成為義大利消費者越來越受歡迎的選擇。

- 由於混合動力汽車註冊數量大幅增加,對鎳氫(NiMH)電池的需求預計將增加,因為它們通常用於混合動力汽車。這一趨勢凸顯了鎳氫電池在支持義大利向更永續的交通選擇過渡的重要性。

- 2024年5月,Stellantis宣布計畫在義大利生產飛雅特500e和吉普指南針混合動力汽車。 500e混合動力汽車將於 2026 年第一季在都靈的 Mirafiori 工廠開始生產,而 Jeep 指南針混合動力汽車將在 Melfi 工廠生產。此外,飛雅特熊貓在義大利的生產將持續到2029年。此舉的重點是促進電動車的本地生產。

- 綜上所述,義大利的混合動力電動車(HEV)預計將大幅成長,並推動鎳氫電池市場。

政府的獎勵措施和法規可望推動市場

- 義大利在引進電動車方面取得了巨大進展,基礎設施已到位,人們的興趣也在增加。 Enel X 等公司在擴展充電網路方面處於領先地位。這一勢頭正在幫助義大利擁抱更永續的未來。

- 在歐洲,電動車銷量大幅成長,從2022年的270萬輛增加到2023年的320萬輛。這相當於約 18.5% 的成長率,凸顯了電動車在整個非洲大陸的日益普及和滲透。

- 2024 年 1 月,義大利經濟發展部長阿道夫·烏爾索 (Adolfo Urso) 宣布了新的生態獎勵措施,以鼓勵電動和混合動力汽車的普及。這些經濟獎勵旨在緩解消費者轉型,並鼓勵更多義大利人選擇電動車而不是傳統汽油車。

- 例如,2024年6月,義大利電動車註冊數量大幅增加,證明了EcoBonus激勵措施的有效性。新註冊電動車數量為13,285輛,較2023年6月成長115.8%,凸顯了支持電動車推廣的獎勵的有效性。

- 義大利將在未來四到八年內從 83% 的內燃機汽車 (ICE) 轉向各種電池電動車 (BEV)、混合動力電動車 (HEV) 和插電式混合動力電動車 (PHEV)。轉向新的組合了。這項轉變旨在遏制二氧化碳排放,並利用義大利的電動車環境和適度的電力排放係數。這一演變的核心是鎳氫電池,它是混合動力汽車的主要產品。

- 鑑於這些發展,政府對電動車的激勵措施預計將提振義大利鎳氫電池市場。

義大利鎳氫電池產業概況

義大利電動車用鎳氫電池市場溫和。該市場的主要企業包括(排名不分先後)Panasonic控股、三星SDI、LG化學、國軒高科和寧德時代新能源科技。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府獎勵和法規

- 電動車 (EV) 需求增加

- 抑制因素

- 與替代技術的競爭

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 推進類型

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

- 燃料電池電動車

- 車型

- 客車

- 商用車

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- Contemporary Amperex Technology Co Ltd.

- Gotion High Tech Co Ltd

- LG Chem Ltd.

- BYD Company

- Toyota Motor Corp

- FDK Corporation

- 其他知名公司名單

- 市場排名分析

第7章市場機會與未來趨勢

- 擴大義大利電動和混合動力汽車市場

簡介目錄

Product Code: 50004012

The Italy Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 129.02 million in 2025 to USD 215.55 million by 2030, at a CAGR of 10.81% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, supporting government incentives for electric vehicles, the surge in electric vehicles, technological advancements, and environmental regulations on reducing carbon emissions will likely drive the market during the forecast period.

- Conversely, competition from alternative technologies like lithium-ion batteries is expected to hinder the market during the forecast period.

- Nevertheless, Italy's expanding market for electric and hybrid vehicles presents a significant growth opportunity for nickel metal hydride battery batteries.

Italy Nickel Metal Hydride Battery Market Trends

Hybrid Electric Vehicles are Expected to Witness Significant Growth

- Italy's vehicle market is seeing a notable increase in the adoption of hybrid electric vehicles (HEVs), with models like the Toyota Corolla gaining popularity. This trend reflects a shift towards more environmentally friendly cars, supported by Italy's commitment to improving EV infrastructure and providing incentives for electric mobility.

- HEVs, which meld internal combustion engines with electric propulsion, promise better fuel efficiency and reduced emissions. These vehicles are pivotal in Italy's strategy to reduce carbon emissions and transition to more sustainable transportation.

- For instance, in Italy, the number of new registrations for HEVs increased significantly from 454,989 in 2022 to 575,480 in 2023. This represents a growth rate of approximately 26.5 percent, highlighting a solid upward trend in adopting HEVs. This surge is driven by government incentives and growing environmental awareness, making HEVs an increasingly popular choice among Italian consumers.

- Due to this significant increase in HEV registrations, the demand for nickel metal hydride (NiMH) batteries is expected to rise, as they are commonly used in hybrid vehicles. This trend underscores the importance of NiMH batteries in supporting Italy's transition to more sustainable transportation options.

- In May 2024, Stellantis announced plans to produce hybrid versions of the Fiat 500e and Jeep Compass in Italy. Production of the hybrid 500e will start in Q1 2026 at the Mirafiori plant in Turin, while the hybrid Jeep Compass will be made at the Melfi plant. Additionally, the production of Fiat Panda in Italy will continue until 2029. This move focuses on enhancing the local production of electric vehicles.

- Given the above points, Italy's hybrid electric vehicles (HEVs) are expected to grow significantly and drive the nickel hydride battery market.

Government Incentives and Regulations are expected to Drive the Market

- Italy is making significant progress in adopting electric vehicles, with growing infrastructure and increasing interest. Companies like Enel X are leading the way in expanding charging networks. This momentum is helping Italy embrace a more sustainable future.

- In Europe, electric car sales have grown significantly, increasing from 2.7 million units in 2022 to 3.2 million in 2023. This represents a growth rate of approximately 18.5 percent, highlighting the rising popularity and adoption of electric vehicles across the continent.

- In January 2024, Italy's Minister of Economic Development, Adolfo Urso, unveiled new Ecobonus incentives to accelerate the adoption of electric and hybrid vehicles. These financial incentives are designed to ease the transition for consumers, encouraging more Italians to choose electric cars over traditional gas-powered ones.

- For instance, the impact of the Ecobonus incentives was evident in June 2024, when Italy saw a remarkable surge in electric vehicle registrations. With 13,285 new total electric vehicles registered, this marked a 115.8 percent increase from June 2023, highlighting the effectiveness of the incentives in boosting EV adoption.

- Italy is poised to transition from a landscape dominated by 83% internal combustion engine (ICE) vehicles to a diverse mix of battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs) over the next 4-8 years. This shift aims to curtail CO2 emissions and capitalize on Italy's conducive EV environment and its moderate electricity emission factor. Central to this evolution are nickel-metal hydride batteries, a staple in HEVs.

- Given the dynamics, government incentives for electric vehicles are expected to boost Italy's nickel-metal hydride battery market.

Italy Nickel Metal Hydride Battery Industry Overview

Italy's nickel metal hydride battery market for electric vehicles is moderate. Some of the key players in the market (in no particular order) include Panasonic Holdings Corporation, Samsung SDI Co. Ltd., LG Chem Ltd., Gotion High Tech Co Ltd, and Contemporary Amperex Technology Co Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Incentives and Regulations

- 4.5.1.2 Rising in demand for Electric Vehicles (EVs)

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-in Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 Samsung SDI Co. Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd.

- 6.3.4 Gotion High Tech Co Ltd,

- 6.3.5 LG Chem Ltd.

- 6.3.6 BYD Company

- 6.3.7 Toyota Motor Corp

- 6.3.8 FDK Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Italy's Expanding Market for Electric and Hybrid Vehicles

02-2729-4219

+886-2-2729-4219