|

市場調查報告書

商品編碼

1636541

英國電動車用鎳氫電池:市場佔有率分析、產業趨勢、成長預測(2025-2030)United Kingdom Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

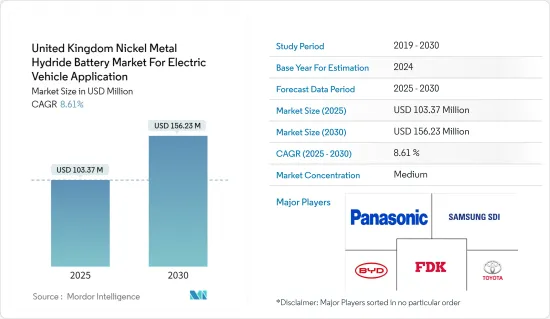

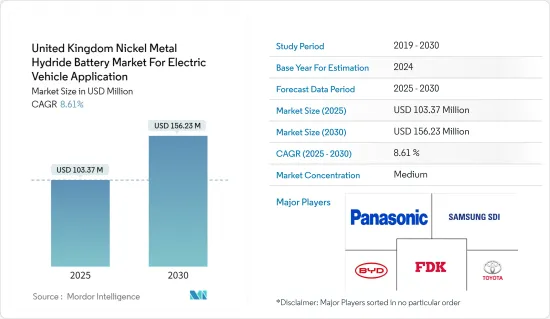

英國電動車鎳氫電池市場預計將從2025年的1.0337億美元成長到2030年的1.5623億美元,預測期間(2025-2030年)複合年成長率為8.61%。

主要亮點

- 從中期來看,電動車的快速成長以及政府的支持措施和獎勵預計將在預測期內推動市場發展。

- 另一方面,來自鋰離子電池等替代技術的競爭預計將在預測期內阻礙市場。

- 由於鎳氫電池的耐用性和成本效益,混合動力電動車(HEV)的復興推動了對鎳氫電池的需求。鎳氫電池是混合動力車的首選,可提供可靠且經濟的解決方案。預計這一趨勢將繼續推動市場成長。

英國鎳氫電池市場趨勢

混合動力汽車預計將顯著成長

- 混合動力電動車 (HEV) 由內燃機和馬達動力來源。馬達由電池中儲存的能量提供動力,並透過再生煞車和內燃機進行充電。

- 鎳氫電池由於其卓越的能量密度、耐用性和在一定溫度範圍內的多功能性,已被用於許多電動車應用。鎳氫電池也出現在混合動力汽車和一些純電動車 (BEV) 中。

- 例如,歐洲電動車銷量從2022年的270萬輛大幅成長到2023年的320萬輛,滲透率增加了18.5%。電動車的日益普及與電池技術的進步密切相關,包括主要用於混合動力電動車(HEV)的鎳氫(NiMH)電池。

- 在英國,2024年10月混合動力電動車(HEV)註冊數量略有下降,與前一年同期比較去年同期下降1.6%。儘管有所下降,但隨著消費者尋求傳統汽油和柴油汽車的更環保替代品,混合動力汽車仍然代表著市場的重要組成部分。

- 此外,混合動力汽車註冊量將從 2023 年的 201,879 輛增加到 2024 年的 224,339 輛,成長 11.1%,顯示消費者對混合動力技術的興趣日益濃厚。市場佔有率從 12.6% 增加到 13.5%,這些成長趨勢顯示混合動力車在預測期內前景樂觀。

- 由於這些發展,混合動力汽車(HEV)領域預計將在英國市場顯著成長。

鋰離子電池的進步對市場的影響

- 在英國,電動車 (EV) 的鎳氫 (NiMH) 電池市場正面臨來自鋰離子電池日益激烈的競爭,鋰離子電池以其卓越的性能和效率而聞名。

- 傳統上,鎳氫電池因其耐用性和成本效益而在混合動力電動車(HEV)中受到青睞。然而,隨著鋰離子技術的進步,鎳氫的市場佔有率正在下降。

- 例如,英國政府資料顯示,該國電動車持有大幅增加,從2022年的628,984輛增加到2023年的930,649輛。約 48% 的成長凸顯了電動車的快速普及,與鎳氫電池相比,鋰離子電池明顯受到青睞。

- 英國政府2035年禁止新銷售混合動力汽車的禁令可能會給鎳氫電池市場蒙上長長的陰影。該計劃的重點將是加快向主要依賴鋰離子技術的全電動和插電式汽車的轉變。

- 英國鎳氫電池市場前景黯淡。由於其優越的性能,鋰離子電池有望成為主流。透過政府措施和產業投資持續支持鋰離子技術可能會進一步阻礙鎳氫電池的成長。

- 有鑑於上述情況,放棄鋰離子電池預計將嚴重阻礙英國鎳氫電池(NiMH)市場。

英國電動車用鎳氫電池產業概況

英國電動車用鎳氫電池市場規模不大。該市場的主要企業包括(排名不分先後)松下控股公司、三星 SDI、比亞迪 Ord Shs A、FDK 公司和豐田汽車公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車 (EV) 需求增加

- 政府獎勵和法規

- 抑制因素

- 來自替代技術的競爭

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 推進類型

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

- 燃料電池電動車

- 車型

- 客車

- 商用車

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- BYD Company

- Toyota Motor Corp

- FDK Corporation

- Gotion High Tech Co Ltd

- Contemporary Amperex Technology Co Ltd.

- Energiner Holding, Inc.

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 混合動力汽車(HEV)的復興增加了對鎳氫電池的需求

簡介目錄

Product Code: 50004011

The United Kingdom Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 103.37 million in 2025 to USD 156.23 million by 2030, at a CAGR of 8.61% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the surge in electric vehicles and supportive government policies and incentives are expected to drive the market during the forecast period.

- On the other hand, competition from alternative technologies like lithium-ion batteries is expected to hinder the market during the forecast period.

- Nevertheless, the resurgence of Hybrid Electric Vehicles (HEVs) is boosting the demand for NiMH batteries due to their durability and cost-effectiveness. NiMH batteries are a preferred choice in HEVs, providing a reliable and economical solution. This trend is expected to continue driving market growth.

United Kingdom Nickel Metal Hydride Battery Market Trends

Hybrid Electric Vehicles are Expected to Witness Significant Growth

- Hybrid electric vehicles (HEVs) are powered by an internal combustion engine and an electric motor. The electric motor is operated by energy stored in a battery, which is charged through regenerative braking and the internal combustion engine.

- NiMH batteries have been favored for numerous electric vehicle applications due to their commendable energy density, durability, and versatility across temperature ranges. Their prominence endures in hybrid vehicles and selected battery electric vehicles (BEVs).

- For instance, the significant growth in electric car sales in Europe, from 2.7 million units in 2022 to 3.2 million in 2023, reflects an 18.5 percent increase in adoption. This rising popularity of electric vehicles is closely tied to advancements in battery technology, including nickel-metal hydride (NiMH) batteries, which are predominantly used in hybrid electric vehicles (HEVs).

- In the United Kingdom, the uptake of hybrid electric vehicles (HEVs) saw a slight decline in October 2024, with registrations falling by 1.6 percent compared to the previous year. Despite this drop, HEVs remain a significant part of the market as consumers seek more environmentally friendly alternatives to traditional petrol and diesel vehicles.

- Furthermore, HEV registrations grew by 11.1 percent from 201,879 in 2023 to 224,339 in 2024, indicating rising consumer interest in hybrid technology. With a market share increase from 12.6 percent to 13.5 percent, these growth trends suggest a positive outlook for HEVs in the forecast period.

- Given the dynamics, the hybrid electric vehicle (HEV) segment is expected to show significant growth in the United Kingdom market.

Impact of Lithium-Ion Battery Advancements on the Market

- In the United Kingdom (UK), the market for nickel metal hydride (NiMH) batteries in electric vehicles (EVs) grapples with mounting challenges, primarily from the surging competition posed by lithium-ion batteries, renowned for their superior performance and efficiency.

- Traditionally, NiMH batteries found favor in hybrid electric vehicles (HEVs) owing to their durability and cost-effectiveness. Yet, NiMH's market share has seen a downward trajectory as lithium-ion technology has progressed.

- For instance, data from the UK government reveals a notable surge in the nation's electric vehicle fleet, escalating from 628,984 units in 2022 to 930,649 units in 2023. This roughly 48 percent uptick underscores the burgeoning adoption of EVs, with a clear preference for lithium-ion batteries over their NiMH counterparts.

- The UK government's 2035 ban on new hybrid vehicle sales is poised to cast a long shadow over the NiMH battery market. This policy pivot is set to hasten the shift towards fully electric and plug-in vehicles, which predominantly lean on lithium-ion technology.

- The future of the NiMH battery market in the UK looks challenging. Due to their superior performance, lithium-ion batteries are expected to dominate. Continued support for lithium-ion technology through government policies and industry investments will likely further hinder the growth of NiMH batteries.

- Due to the above points, the transition from lithium-ion batteries is expected to significantly hinder the nickel metal hydride battery (NiMH) market in the United Kingdom.

United Kingdom Nickel Metal Hydride Battery Industry Overview

The United Kingdom nickel metal hydride battery market for electric vehicles is moderate. Some of the key players in the market (in no particular order) include Panasonic Holdings Corporation, Samsung SDI Co. Ltd., BYD Ord Shs A, FDK Corp, and Toyota Motor Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising in demand for Electric Vehicles (EVs)

- 4.5.1.2 Government Incentives and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-in Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 Samsung SDI Co. Ltd.

- 6.3.3 BYD Company

- 6.3.4 Toyota Motor Corp

- 6.3.5 FDK Corporation

- 6.3.6 Gotion High Tech Co Ltd,

- 6.3.7 Contemporary Amperex Technology Co Ltd.

- 6.3.8 Energiner Holding, Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Resurgence of Hybrid Electric Vehicles (HEVs) Boosts Demand for NiMH Batteries

02-2729-4219

+886-2-2729-4219