|

市場調查報告書

商品編碼

1636239

義大利SLI電池:市場佔有率分析、產業趨勢與成長預測(2025-2030年)Italy SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

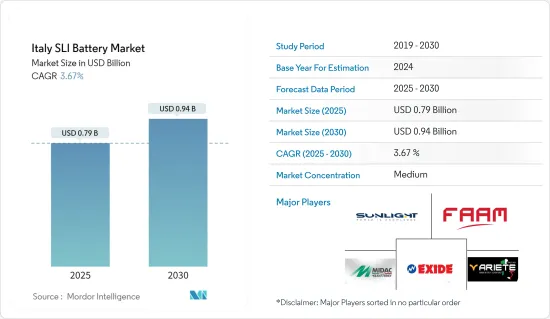

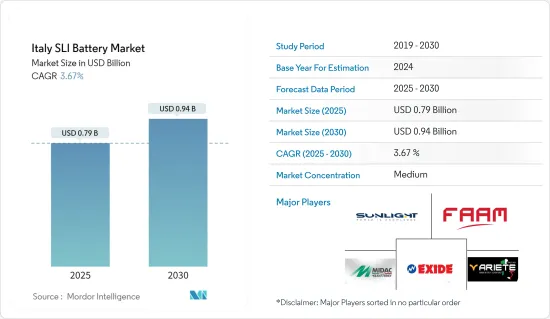

義大利SLI電池市場規模預估至2025年為7.9億美元,預估至2030年將達9.4億美元,預測期間(2025-2030年)複合年成長率為3.67%。

主要亮點

- 從中期來看,該地區汽車工業的成長以及工業應用中 SLI 電池的日益採用等因素預計將成為預測期內義大利 SLI 電池市場的最大推動力之一。

- 同時,來自替代電池化學品的競爭正在加劇,對預測期內的市場成長構成威脅。

- 也就是說,SLI 電池的持續研發工作預計將在未來創造多個市場機會。

義大利SLI電池市場趨勢

汽車板塊有望大幅成長

- 汽車是義大利 SLI 電池市場的重要終端用戶領域。該細分市場包括乘用車、商用車和二輪車等多種車輛,所有這些車輛都嚴重依賴 SLI 電池來實現其所有基本功能。在以其汽車傳統和生產而聞名的義大利,對高品質 SLI 電池的需求始終強勁。

- 例如,國際汽車工業協會的資料突顯了義大利汽車製造業的顯著成長。這種激增可歸因於汽車需求的增加和公民可支配收入的增加。具體而言,2022年至2023年產量成長超過10.5%,複合年成長率為3.3%。這種成長對 SLI 電池市場產生了積極影響,汽車產量的增加導致對此類關鍵汽車零件的需求增加。

- 乘用車類別在塑造市場方面發揮主導作用。隨著人們對車輛電氣化的重視以及逐漸轉向混合動力汽車和電動車,傳統內燃機 (ICE) 車輛對 SLI 電池的要求不斷發展。

- 儘管向電動車的轉型不斷發展,但內燃機汽車仍佔據義大利汽車市場的很大一部分,確保了對 SLI 電池的穩定需求。此外,現代車輛中先進技術和功能的日益整合增加了電力要求,需要開發更強大、更有效率的 SLI 電池來滿足這些需求。

- 例如,2023年12月,法雷奧宣布其Pianezza和Santenna工廠將專注於特色產品的開發和生產。 Pianezza 專注於照明,Santena 專注於人機介面。具體來說,法雷奧將為眾多汽車品牌開發和生產一系列人機介面技術,包括面板控制、觸控螢幕、開關和換檔撥片。此外,這些工廠還參與 SLI 電池的開發和生產,這對車輛的性能和可靠性至關重要。

- 電子商務和最後一哩交付服務的成長進一步推動了對輕型商用車的需求,間接推動了對可靠 SLI 電池的需求。此外,義大利公共交通基礎設施現代化和擴建的持續努力也促進了公共汽車和遠距行業對 SLI 電池的需求增加。

- 因此,鑑於上述情況,汽車最終用戶領域預計將在預測期內顯著成長。

替代電池技術的競爭限制了市場成長

- 市場面臨來自替代電池技術的日益激烈的競爭,預計這將嚴重限制未來幾年的成長。這種競爭主要歸因於鋰離子電池技術的進步和汽車電氣化的逐步轉變。隨著汽車產業經歷從傳統內燃機轉向混合動力和全電動動力傳動系統的變革時期,對傳統鉛酸SLI電池的需求面臨壓力。

- 鋰離子電池以其高能量密度、長壽命和快速充電能力而聞名,正成為車輛啟動和輔助電源功能日益可行的選擇。儘管最初價格昂貴,但鋰離子技術成本的下降,加上其性能優勢,使其成為對汽車製造商和消費者都有吸引力的選擇。這種趨勢在高階和豪華汽車領域尤其明顯,這些領域更有可能吸收先進電池系統的額外成本。

- 近年來,鋰離子電池和電池組的價格一直呈下降趨勢,這使得它們對終端用戶產業更具吸引力。經歷2022年價格小幅上漲後,2023年電池價格再次下跌。鋰離子電池組的成本下降了14%,達到139美元/kWh的歷史低點。這種下降是由於原料和零件價格下降以及整個電池價值鏈產能增加所致。

- 傳統汽車擴大採用啟停技術,這給義大利傳統的 SLI 電池市場帶來了新的挑戰。啟動/停止系統會在汽車靜止時自動關閉引擎,並在必要時重新啟動引擎,因此需要更強大的電池性能來應對頻繁的騎行。

- 為了滿足這些需求,開發了增強型電解型鉛酸電池(EFB)和吸收玻璃氈(AGM)鉛酸電池,但具有出色循環壽命和充電接受能力的鋰離子電池正在考慮用於此目的。這樣做。為了應對更嚴格的排放和燃油經濟性標準,啟動停止系統在各類車輛中變得越來越普遍,傳統 SLI 電池的市場佔有率可能會下降,取而代之的是更先進的技術。

- 車輛先進能源儲存系統的發展比鋰離子技術更為全面。對替代電池化學材料(包括固態電池、鋰硫電池和鈉離子電池)的研究正在迅速進展。儘管這些技術仍需要在汽車中廣泛使用具有商業性可行性,但與目前的鋰離子電池相比,它們有望在能量密度、安全性和性能方面得到進一步改進。

- 例如,2024年2月,總部位於特維羅拉的義大利電池製造商FAAM宣布與軍用潛艦計畫合作,提供其LFP電池和尖端BMS技術。這些進步對於義大利最新的潛水艇計畫 U212 NFS 至關重要。據 OCCAR 稱,鋰電池系統的測試強調了運行效率的提高、推進力的增強、耐用性的提高、維護要求的降低以及船上安全通訊協定的最高水平。

- 因此,如上所述,替代電池技術的滲透預計將在預測期內抑制市場成長。

義大利SLI電池產業概況

義大利SLI電池市場呈現半瓜分狀態。該市場的主要企業(排名不分先後)包括 Sunlight Group、FAAM、Midac SpA、Accumulatori Ariete SRL 和 Exide Technologies。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 不斷成長的汽車工業

- 擴大電池在工業應用的採用

- 抑制因素

- 來自替代電池化學物質的競爭

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 按類型

- 電池被淹

- VRLA 電池

- EBF電池

- 按最終用戶

- 用於汽車

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- Strategies Adopted & SWOT Analysis for Leading Players

- 公司簡介

- Sunlight Group

- FAAM

- Midac SpA

- Accumulatori Ariete SRL

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc.

- C&D Technologies Inc.

- Trojan Battery Company

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第7章市場機會與未來趨勢

- 電池技術創新

簡介目錄

Product Code: 50003509

The Italy SLI Battery Market size is estimated at USD 0.79 billion in 2025, and is expected to reach USD 0.94 billion by 2030, at a CAGR of 3.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing automotive industry in the region and the increasing adoption of SLI batteries in industrial applications are expected to be among the most significant drivers for the Italian SLI battery market during the forecast period.

- On the other hand, there is increasing competition from alternate battery chemistries that pose a threat to the market's growth during the forecast period.

- Nevertheless, continued efforts to conduct research and development regarding SLI batteries are expected to create several future market opportunities.

Italy SLI Battery Market Trends

The Automotive Segment is Expected to Witness Significant Growth

- Automotive represents a crucial end-user segment for the Italy SLI battery market. This segment encompasses a wide range of vehicles, including passenger cars, commercial vehicles, and motorcycles, all of which rely heavily on SLI batteries for their essential functions. In Italy, a country renowned for its automotive heritage and production, the demand for high-quality SLI batteries remains consistently strong.

- For example, data from the International Organization of Motor Vehicle Manufacturers highlighted a notable upswing in vehicle manufacturing in Italy. This surge could be attributed to the increase in demand for vehicles and increased citizens' disposable incomes. Specifically, between 2022 and 2023, production saw a remarkable uptick of over 10.5%, with an average annual growth rate of 3.3%. This growth positively impacted the market for SLI batteries, as the increased vehicle production led to higher demand for these essential automotive components.

- The passenger car category plays a dominant role in shaping the market. With a growing emphasis on vehicle electrification and the gradual shift toward hybrid and electric vehicles, the requirements for SLI batteries in conventional internal combustion engine (ICE) vehicles continue to evolve.

- While the transition to electric mobility is underway, ICE vehicles still constitute a significant portion of the Italian automotive market, ensuring a steady demand for SLI batteries. Moreover, the increasing integration of advanced technologies and features in modern vehicles has led to heightened power requirements, prompting the development of more robust and efficient SLI batteries to meet these demands.

- For instance, in December 2023, Valeo's Pianezza and Santena sites announced their focus on developing and producing distinctive products. Pianezza specializes in lighting, while Santena is dedicated to human-machine interfaces. Specifically, Valeo will be developing and producing a range of human-machine interface technologies, including panel controls, touch screens, switches, and paddle gear shifts, catering to a wide array of car brands. Additionally, these sites are involved in the development and production of SLI batteries, which are essential for vehicle performance and reliability.

- The growth of e-commerce and last-mile delivery services has further bolstered the demand for light commercial vehicles, indirectly driving the need for reliable SLI batteries. Additionally, the ongoing efforts to modernize and expand Italy's public transportation infrastructure have contributed to increased demand for SLI batteries in the bus and coach industry, where battery reliability is paramount for ensuring uninterrupted service and passenger safety.

- Therefore, as per the points mentioned above, the automotive end-user segment is expected to witness significant growth during the forecast period.

Competition From Alternative Battery Technology to Restrain Market Growth

- The market faces increasing competition from alternative battery technologies, which is expected to significantly restrain its growth in the coming years. This competition primarily stems from advancements in lithium-ion battery technology and the gradual shift toward vehicle electrification. As the automotive industry undergoes a transformative phase, moving away from traditional internal combustion engines toward hybrid and fully electric powertrains, the demand for conventional lead-acid SLI batteries is under pressure.

- Lithium-ion batteries, known for their higher energy density, longer lifespan, and faster charging capabilities, are becoming increasingly viable alternatives for vehicle starting and auxiliary power functions. While initially more expensive, the declining costs of lithium-ion technology, coupled with its performance advantages, are making it an attractive option for automakers and consumers alike. This trend is particularly pronounced in the premium and luxury vehicle segments, where the additional cost of advanced battery systems can be more easily absorbed.

- In recent years, the price of lithium-ion batteries and cell packs has been on the decline, which has made them more attractive to end-user industries. After experiencing slight price hikes in 2022, battery prices again declined in 2023. The cost of lithium-ion battery packs decreased by 14% to reach a historic low of USD 139/kWh. This reduction can be attributed to decreases in raw material and component prices and an expansion in production capacity throughout the battery value chain.

- The rising adoption of start-stop technology in conventional vehicles presents another challenge to the traditional SLI battery market in Italy. Start-stop systems, which automatically shut off the engine when the vehicle is stationary and restart it when needed, require more robust battery performance to handle frequent cycling.

- While enhanced flooded batteries (EFB) and absorbent glass mat (AGM) lead-acid batteries have been developed to meet these demands, lithium-ion batteries are increasingly being considered for this application due to their superior cycle life and charge acceptance. As start-stop systems become more prevalent across vehicle classes in response to stringent emissions regulations and fuel efficiency standards, the market share of conventional SLI batteries may decrease in favor of more advanced technologies.

- The development of advanced energy storage systems for vehicles is more comprehensive than lithium-ion technology. Research into alternative battery chemistries, such as solid-state batteries, lithium-sulfur batteries, and sodium-ion batteries, is progressing rapidly. While these technologies still need to be commercially viable for widespread automotive use, they hold the promise of even greater energy density, safety, and performance compared to current lithium-ion batteries.

- For instance, in February 2024, FAAM, an Italian battery manufacturer headquartered in Teverola, disclosed its collaboration with a military submarine program, offering its LFP batteries and cutting-edge BMS technology. These advancements are pivotal in Italy's latest submarine venture, the U212 NFS. As per OCCAR, the lithium battery system's trials underscored heightened operational efficiency, enhanced propulsion, extended endurance, lowered maintenance needs, and top-tier onboard safety protocols.

- Therefore, as mentioned above, the penetration of alternative battery technology is expected to restrain the market's growth during the forecast period.

Italy SLI Battery Industry Overview

The Italian SLI battery market is semi-fragmented. Some of the key players in this market (in no particular order) include Sunlight Group, FAAM, Midac SpA, Accumulatori Ariete S.R.L., and Exide Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Automotive Industry

- 4.5.1.2 Growing Adoption of Batteries in the Industrial Applications

- 4.5.2 Restraints

- 4.5.2.1 Competition From Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Sunlight Group

- 6.3.2 FAAM

- 6.3.3 Midac SpA

- 6.3.4 Accumulatori Ariete S.R.L.

- 6.3.5 Exide Technologies

- 6.3.6 Johnson Controls

- 6.3.7 EnerSys

- 6.3.8 Leoch International Technology Limited Inc.

- 6.3.9 C&D Technologies Inc.

- 6.3.10 Trojan Battery Company

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Battery Technology

02-2729-4219

+886-2-2729-4219