|

市場調查報告書

商品編碼

1636269

東南亞國協插電式混合動力汽車電池:市場佔有率分析、產業趨勢與成長預測(2025-2030)ASEAN Countries Plug-in Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

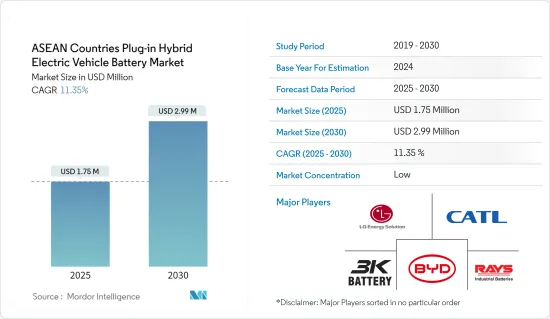

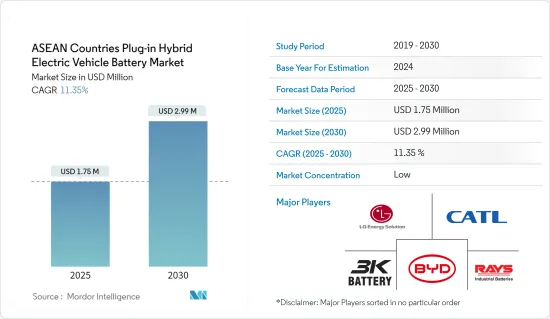

東南亞國協插電式混合動力汽車電池市場規模預計到2025年為175萬美元,預計到2030年將達到299萬美元,預測期內(2025-2030年)複合年成長率為11.35%。

主要亮點

- 未來幾年,東南亞國協插電式混合動力車電池市場預計將受到電動車銷售快速成長和鋰離子電池成本下降的顯著影響。

- 然而,市場面臨更換成本上升的阻力,尤其是插電式混合動力汽車電池。

- 然而,旨在提高能量容量和續航里程的電池化學技術的不斷進步預計將為市場帶來許多機會。

- 預計印尼將在未來幾年在所有國家的市場中佔據主導地位。

東南亞國協插電式混合動力汽車電池市場趨勢

乘用車帶動成長

- 在政府措施、環境問題和技術進步的共同推動下,東協(東南亞國家聯盟)國家的插混合動力汽車(PHEV)電池市場的乘用車領域正在經歷顯著成長。

- 隨著都市化的加速和中階的迅速壯大,東南亞國協對汽車的需求迅速增加。隨著城市擁擠和污染加劇,世界各國政府正在採取更嚴格的排放法規和獎勵來應對,以鼓勵採用電動和混合動力汽車。

- 根據東協汽車聯合會的資料,印尼將在 2023 年以 779,326 輛的銷量領先,其次是馬來西亞,銷量為 719,160 輛。泰國表現出色,銷量為 406,501 輛,其次是越南,銷量為 230,706 輛,菲律賓則銷量為 111,980 輛。新加坡有 32,511 套,緬甸有 2,832 套。這些銷售數據證實了該地區對乘用車的需求不斷成長。

- 補貼、退稅和改善充電基礎設施等政府措施正在支持整個東協插電式混合動力汽車的普及。此外,區域合作和研發投資正在鞏固插電式混合動力汽車電池市場在東協汽車領域的重要性。

- 為了促進國內PHEV電池生產,泰國政府於2023年11月推出了「EV3.5」補貼計畫。該政策的有效期為 2024 年至 2027 年,為生產的每個電池提供最高 2,760 美元的補貼。

- 兩個主要目標是吸引外國投資並將泰國打造成東南亞插電式混合動力汽車汽車電池的領先生產國。隨著中國插電式混合動力汽車品牌目前佔據主導地位以及歐洲興趣的增加,這項策略舉措可能有助於泰國在快速發展的插電式混合動力汽車電池領域的發展軌跡。

- 電池技術的進步正在決定性地塑造東協插電式混合動力汽車市場。尤其是鋰離子電池的技術創新,透過提高能量密度、延長生命週期和實現快速充電,增加了插電式混合動力汽車的吸引力。

- 鑑於這些發展,乘用車市場在未來幾年可能會成長。

印尼主導市場的前景

- 在政府政策、經濟成長、消費行為和技術進步等因素的推動下,東協插電式混合動力汽車(PHEV)電池市場的印尼部分正在經歷顯著的轉變。作為東南亞最大的經濟體,印尼快速成長的汽車市場為插電式混合動力汽車產業帶來了巨大的潛力。

- 印尼政府正積極致力於透過措施和措施減少碳排放並促進永續交通。這些舉措包括稅收優惠、補貼,以及更重要的是充電基礎設施的發展,旨在減輕通常與插電式混合動力電動車相關的高初始成本。

- 印尼工業部正在為電動和混合動力汽車汽車(包括電動摩托車)提供購買補貼。政府還計劃為傳統內燃機摩托車改裝為電動摩托車提供補貼。購買新型電池驅動的電動車將獲得5,130美元的補貼,而傳統混合動力汽車將獲得一半的補貼。

- 過去十年,電池技術和製造的突破加速了鋰離子電池在印尼混合動力汽車中的採用。這些進步不僅降低了成本,還提高了性能和可靠性,使鋰離子電池成為製造商和消費者的首選。

- 最近,鋰離子電池和電池組的價格呈下降趨勢,對終端用戶產業有吸引力。繼2022年小幅上漲後,2023年價格又恢復下跌,鋰離子電池組價格創下139美元/kWh的歷史低點,跌幅達14%。

- 此外,插電式混合動力汽車電池本地製造設施的興起預計將降低製造成本。因此,插電式混合動力電動車將變得更容易被消費者接受。加上政府的激勵措施和技術進步,經濟轉向負擔得起的永續交通將推動印尼插電式混合動力汽車市場的顯著成長。

- 例如,2023年6月,印尼與四家著名的中國汽車製造商:哈普科內塔、五菱、奇瑞和小康簽署了重要協議,將印尼定位為潛在的電動車出口中心。在與奇瑞汽車的討論中,有明確的意圖探索插電式混合動力汽車(PHEV)的國內製造途徑。插電式混合動力車在中國已經很流行,因為它們比傳統混合動力汽車更省油。奇瑞制定了雄心勃勃的計劃,目標是到 2030 年部署 10 萬輛電動車。

- 鑑於新興市場的發展,印尼有望在未來幾年引領市場。

東南亞國協插電式混合動力汽車電池產業概況

東南亞國協插電式混合動力汽車電池市場呈現半脫節結構。市場的主要企業(排名不分先後)包括 LG Energy Solution、Contemporary Amperex Technology、比亞迪公司、HDS Global Pte Ltd 和 3K Battery。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車銷量成長

- 鋰離子電池價格下降

- 抑制因素

- 電池更換成本高

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 鈉離子電池

- 其他

- 車型

- 客車

- 商用車

- 地區

- 新加坡

- 菲律賓

- 越南

- 泰國

- 馬來西亞

- 印尼

- 其他東南亞國協

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- LG Energy Solution

- Contemporary Amperex Technology Co Ltd.

- BYD Company

- Panasonic Holdings Corporation

- Toshiba Corporation

- Enersys Sarl

- Exide Industries Ltd

- HDS Global Pte Ltd

- 3K Battery

- Clarios, LLC

- 其他知名公司名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 持續研究開發新的電池化學物質

簡介目錄

Product Code: 50003556

The ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Market size is estimated at USD 1.75 million in 2025, and is expected to reach USD 2.99 million by 2030, at a CAGR of 11.35% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Market is poised to be significantly influenced by surging electric vehicle sales and the plummeting costs of lithium-ion batteries.

- However, the market faces headwinds, notably from the steep replacement costs associated with plug-in hybrid electric vehicle batteries.

- Yet, ongoing advancements in battery chemistries, aimed at enhancing energy capacity and extending driving range, promise to unlock numerous opportunities for the market.

- Among all the countries, Indonesia is expected to dominate the market during the upcoming years.

ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Market Trends

Passenger Vehicles to Witness Growth

- Driven by a mix of government policies, environmental concerns, and technological advancements, the passenger vehicle segment of the plug-in hybrid electric vehicle (PHEV) battery market is experiencing notable growth in ASEAN (Association of Southeast Asian Nations) countries.

- With rapid urbanization and a burgeoning middle class, ASEAN nations are witnessing a surge in vehicle demand. As urban congestion and pollution escalate, governments are responding with stringent emission regulations and incentives to promote electric and hybrid vehicle adoption.

- Data from the ASEAN Automotive Federation highlights Indonesia's lead in 2023 with 779,326 units sold, trailed by Malaysia at 719,160 units. Thailand's market stands robust at 406,501 units, while Vietnam and the Philippines report 230,706 and 111,980 units, respectively. Singapore and Myanmar round out the figures with 32,511 and 2,832 units. Such sales figures underscore the growing appetite for passenger vehicles in the region.

- Government initiatives, including subsidies, tax rebates, and charging infrastructure development, are propelling the adoption of plug-in hybrid vehicles across ASEAN. Furthermore, regional collaborations and R&D investments are solidifying the plug-in hybrid vehicle battery market's significance in the ASEAN automotive arena.

- In a move to boost domestic PHEV battery production, the Thai government, in November 2023, introduced the "EV3.5" subsidy program. This initiative offers a subsidy of up to USD 2,760 per battery produced, valid from 2024 to 2027.

- The primary objective is two fold: to entice foreign investments and cement Thailand's stature as a pivotal player in the Southeast Asian plug-in hybrid vehicle battery manufacturing landscape. Given the current dominance of Chinese plug-in hybrid vehicle brands and the growing interest from European counterparts, this strategic move is poised to redefine Thailand's trajectory in the swiftly evolving plug-in hybrid vehicle battery sector.

- Battery technology advancements are crucially shaping the plug-in hybrid vehicle market in ASEAN. Innovations, especially in lithium-ion batteries, are boosting energy density, extending life cycles, and enabling faster charging, thereby enhancing the allure of plug-in hybrids.

- Given these dynamics, the passenger vehicle segment is poised for growth in the coming years.

Indonesia is Expected to Dominate the Market

- Driven by factors such as government policies, economic growth, consumer behavior, and technological advancements, the Indonesian segment of the ASEAN plug-in hybrid electric vehicle (PHEV) battery market is undergoing a notable transformation. As Southeast Asia's largest economy, Indonesia's burgeoning automotive market holds immense promise for the plug-in hybrid electric vehicle sector.

- Through policies and initiatives, the Indonesian government is actively working to reduce carbon emissions and champion sustainable transportation. These efforts, including tax incentives, subsidies, and crucially, the development of charging infrastructure, aim to alleviate the higher upfront costs typically associated with plug-in hybrid electric vehicles.

- The Indonesian Ministry of Industry has rolled out purchase subsidies for electric and hybrid vehicles, including electric motorbikes. Furthermore, there's a push to subsidize converting traditional combustion-engine motorbikes to electric. New battery-electric vehicle purchases can benefit from a generous subsidy of USD 5,130, while conventional hybrids enjoy a subsidy that's half that amount.

- Over the past decade, breakthroughs in battery technology and manufacturing have accelerated the adoption of lithium-ion batteries in Indonesia's hybrid electric vehicle landscape. These advancements have not only reduced costs but also enhanced performance and reliability, making lithium-ion batteries a favored choice for both manufacturers and consumers.

- Recently, lithium-ion battery and cell pack prices have been on a downward trajectory, appealing to end-user industries. After a minor uptick in 2022, prices resumed their decline in 2023, with lithium-ion battery packs hitting a historic low at USD 139/kWh, marking a 14% decrease.

- Moreover, the rise of local manufacturing facilities for plug-in hybrid electric vehicle batteries is poised to drive down production costs. This, in turn, is set to make plug-in hybrid electric vehicles more accessible to consumers. Coupled with government incentives and technological strides, this economic pivot towards affordable and sustainable transportation is primed to spur substantial growth in Indonesia's plug-in hybrid electric vehicle market.

- For example, in June 2023, Indonesia sealed a significant agreement with four prominent Chinese automakers - Hapco Neta, Wuling, Chery, and Xiaokang - positioning Indonesia as a potential electric vehicle export hub. In talks with Chery Automobile, there's a clear intent to explore research avenues for manufacturing plug-in hybrid electric vehicles (PHEVs) domestically. Given their enhanced fuel efficiency over traditional hybrids, plug-in hybrid electric vehicles are already popular in China. Chery has ambitious plans, targeting a rollout of 100,000 electric vehicles by 2030.

- Given these developments, Indonesia is poised to lead the market in the coming years.

ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Industry Overview

The ASEAN Countries Plug-in Plug-in Hybrid Electric Vehicle Battery Market is semi-fragmented. Some of the key players in this market (in no particular order) are LG Energy Solution, Contemporary Amperex Technology Co Ltd., BYD Company, HDS Global Pte Ltd, and 3K Battery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Decreasing Lithium-ion Battery Price

- 4.5.2 Restraints

- 4.5.2.1 High Battery Replacment Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Singapore

- 5.3.2 Philippines

- 5.3.3 Vietnam

- 5.3.4 Thailand

- 5.3.5 Malaysia

- 5.3.6 Indonesia

- 5.3.7 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution

- 6.3.2 Contemporary Amperex Technology Co Ltd.

- 6.3.3 BYD Company

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Toshiba Corporation

- 6.3.6 Enersys Sarl

- 6.3.7 Exide Industries Ltd

- 6.3.8 HDS Global Pte Ltd

- 6.3.9 3K Battery

- 6.3.10 Clarios, LLC

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Continued Research and Development In New Battery Chemistries

02-2729-4219

+886-2-2729-4219