|

市場調查報告書

商品編碼

1636272

印度電動汽車電池材料:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)India Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

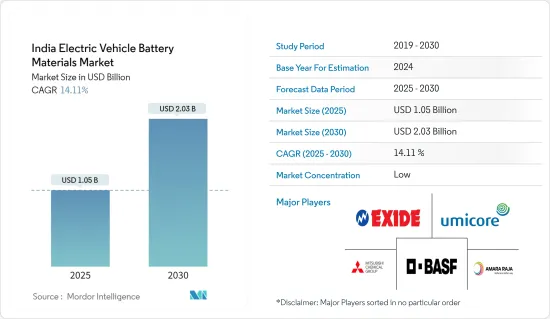

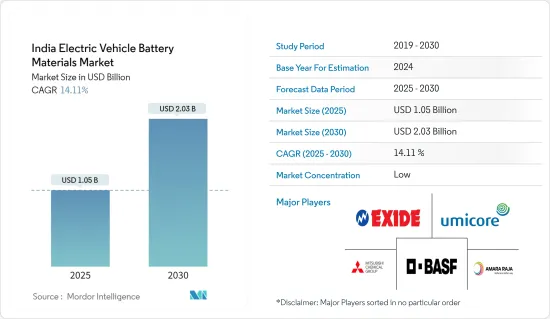

印度電動車電池材料市場規模預計到2025年為10.5億美元,預計2030年將達到20.3億美元,預測期內(2025-2030年)複合年成長率為14.11%。

主要亮點

- 從長遠來看,電動車銷量擴大以及政府政策法規等因素預計將成為預測期內印度電動車電池材料市場最重要的促進因素之一。

- 另一方面,傳統汽車市場的激烈競爭預計將對印度電動車電池銷售產生負面影響。

- 也就是說,對電池技術進步的需求持續成長。預計這一因素將在未來為市場創造一些機會。

印度電動車電池材料市場趨勢

鋰離子電池類型主導市場

- 全球鋰離子電動車電池市場是一個充滿活力、機會與挑戰並存的市場。由於其優越的容量重量比,鋰離子二次電池比其他技術更受歡迎。延長使用壽命、減少維護、延長保存期限和降低價格等優點進一步推動了鋰離子二次電池的採用。

- 近年來,鋰離子電池和電池組對終端用戶產業的吸引力有所增強,這主要是由於價格下降。電池價格在2022年暫時上漲,2023年再次開始下降。一大亮點是鋰離子電池組價格下降 14%,降至 139 美元/kWh 的歷史低點。

- 此外,鑑於日益成長的環境問題,印度政府正在積極支持電動車。我們對淨零碳排放的目標充滿熱情,而且我們的重點很明確。為了滿足快速成長的鋰離子電池需求,主要企業正積極開採電動車電池的關鍵元素鋰。

- 一項引人注目的舉措是,環保電池材料和鋰離子電池回收領域的領導者Lohum於2024年2月宣布,計劃在2024年至2030年間回收20GWh廢棄舊鋰離子電池。這項舉措不僅凸顯了羅姆對永續性的承諾,也使印度能夠透過回收加強其鋰提取工作。

- 此外,印度政府也推出了一系列支持電動車的政策和獎勵。補貼、金融支持、退稅等措施顯著增強了全國對鋰離子電池的需求。

- 總部位於美國的鋰離子電池技術領導者 C4V 於 2023 年 12 月與 Hindalco Industries 簽署了戰略聯盟合作備忘錄。這項合作關係專注於鋰離子電池的電池鋁箔、塗層箔和結構件的生產和供應,特別是針對印度快速成長的電動車電池材料市場。這種合作夥伴關係不僅滿足了不斷成長的需求,還強調了本地製造和專業知識在印度不斷發展的電動車領域的重要性。

- 鑑於這些發展,鋰離子電池材料產業預計將在預測期內獲得成長動力。

電動車銷量不斷成長

- 印度電動車(EV)銷售快速成長,推動了電動車電池材料市場的成長。這一成長是由政府激勵措施、技術突破、環保意識增強以及行業相關人員的策略投資共同推動的。

- 根據國際能源總署的資料,印度的電動車保有量正急劇成長,從 2020 年的 3,100 輛躍升至 2023 年的 82,000 輛左右。在政策和措施的支持下,這種上升趨勢可能會在未來幾年持續下去。

- 印度政府處於推廣電動車的最前沿,並推出了各種政策和獎勵。目前處於第二階段的混合動力汽車和電動車快速採用和製造(FAME)計劃將為電動車購買提供慷慨的補貼,並支持充電基礎設施的發展。此外,政府雄心勃勃的目標是到 2030 年使道路上所有車輛的 30% 為電動車,這也成為市場成長的催化劑。

- 科技進步,尤其是鋰離子電池的進步,使電動車對消費者越來越有吸引力。提高能量密度、縮短充電時間和延長電池壽命等關鍵增強功能對於推動電動車的採用至關重要。這些進步取決於鋰、鎳、鈷和錳等基本材料的穩定供應和成長,從而影響電池材料市場。

- 對環境問題的日益關注以及消費者對電動車好處的認知不斷提高是關鍵的促進因素。空氣污染的有害影響,加上世界向永續能源解決方案的轉變,使電動車成為傳統內燃機汽車的可行替代品。隨著消費者偏好轉向電動車,對電池材料的需求將會飆升。

- 各大汽車製造商和高科技公司都在電動車領域進行了大量投資。塔塔汽車公司是印度汽車產業的領導者,正在為電動車生產和基礎設施投入大量資源。同時,Exide Industries 和 Amara Raja Batteries 不僅提高產能,還致力於創新電池技術,以滿足不斷成長的需求。

- 2023 年 8 月,Ola Electric 推出了最新的電動Scooter,現代馬達印度公司收購了通用汽車的塔里岡工廠,並強調了對電動車生產的承諾。

- 因此,對電動車電池基本材料的需求大幅增加,這對於加強電動車基礎設施至關重要。印度熱衷於培育一個生態系統來發展電動車產業,設立製造單位、建立研究中心和推出廣泛的充電網路等措施就證明了這一點。

- 鑑於這些發展,預計電動車銷量在預測期內將大幅成長。

印度電動汽車電池材料產業概況

印度電動車電池材料市場較為分散。該市場的主要企業(排名不分先後)包括BASF股份公司、三菱化學集團、優美科、住友化學和埃克塞德工業公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車銷量成長

- 政府扶持政策及政策

- 抑制因素

- 與傳統汽車市場競爭激烈

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 按材質

- 陰極

- 陽極

- 電解

- 分隔符

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co., Ltd.

- Exide Industries

- Arkema SA

- Amara Raja

- 其他主要企業名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 電池技術的進步

簡介目錄

Product Code: 50003559

The India Electric Vehicle Battery Materials Market size is estimated at USD 1.05 billion in 2025, and is expected to reach USD 2.03 billion by 2030, at a CAGR of 14.11% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as growing electric vehicle sales and supportive government policies and regulations are expected to be among the most significant drivers for the India Electric Vehicle Battery Materials Market during the forecast period.

- On the other hand, high competition from the conventional vehicle market is expected to have a negative impact on EV battery sales in India.

- Nevertheless, there is continued growing demand for Advancements in Battery Technology. This factor is expected to create several opportunities for the market in the future.

India Electric Vehicle Battery Materials Market Trends

Lithium-ion Battery Type to Dominate the Market

- The global lithium-ion electric vehicle battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other technologies in popularity, due to their superior capacity-to-weight ratio. Their adoption is further fueled by advantages like extended lifespan, minimal maintenance, enhanced shelf life, and declining prices.

- In recent years, the allure of lithium-ion batteries and cell packs has intensified for end-user industries, primarily due to falling prices. After a brief uptick in 2022, battery prices resumed their downward trajectory in 2023. A significant highlight was the 14% drop in lithium-ion battery pack prices, reaching a record low of USD 139/kWh.

- Moreover, in response to escalating environmental concerns, Indian governments are fervently championing electric vehicles. With a keen eye on net-zero carbon emission goals, the focus is clear. Lithium, a cornerstone element for EV storage capacity, is being actively extracted by leading companies in India to meet the surging demand for lithium-ion batteries.

- In a notable move, Lohum, a frontrunner in eco-friendly battery materials and lithium-ion battery recycling, announced plans in February 2024 to recycle 20GWh of scrap lithium-ion batteries between 2024 and 2030. This initiative not only underscores Lohum's commitment to sustainability but also positions the country to bolster its lithium extraction efforts through recycling.

- Furthermore, the Indian government is rolling out a suite of policies and incentives to champion electric vehicles. Measures like subsidies, financial backing, and tax rebates are significantly bolstering the demand for lithium-ion batteries across the nation.

- In a strategic collaboration, C4V, a United States based leader in Li-Ion battery technology, inked a Memorandum of Understanding (MOU) in December 2023 with Hindalco Industries. This partnership focuses on producing and supplying battery-grade aluminum foils, coated foils, and structural components for Li-ion cells, specifically targeting the burgeoning EV battery materials market in India. This alignment not only addresses the escalating demand but also underscores the significance of local manufacturing and expertise in the evolving Indian EV landscape.

- Given these developments, the lithium-ion battery material industry is poised for positive momentum during the forecast period.

Growing Electric Vehicle Sales

- India's burgeoning electric vehicle (EV) sales are propelling the growth of the EV battery materials market. This upswing is driven by a confluence of factors: government incentives, technological breakthroughs, heightened environmental consciousness, and strategic investments from industry players.

- Data from the International Energy Agency reveals a dramatic rise in India's EV population, soaring from 3,100 units in 2020 to approximately 82,000 units in 2023. With supportive policies and initiatives, this upward trajectory is set to continue in the coming years.

- The Indian government is at the forefront of championing EV adoption, rolling out a slew of policies and incentives. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, now in its second phase, has been instrumental, offering generous subsidies for EV purchases and bolstering the development of charging infrastructure. Furthermore, the government's ambitious target of having 30% of all vehicles on the road be electric by 2030 acts as a catalyst, propelling market growth.

- Technological strides, especially in lithium-ion batteries, have rendered EVs increasingly appealing to consumers. Key enhancements, such as improved energy density, reduced charging times, and extended battery lifespan, are pivotal in driving EV adoption. These advancements hinge on a consistent and growing supply of essential materials like lithium, nickel, cobalt, and manganese, thereby influencing the battery materials market.

- Heightened environmental concerns and a surge in consumer awareness about EV benefits are pivotal drivers. The detrimental impacts of air pollution, coupled with a global shift towards sustainable energy solutions, position EVs as a compelling alternative to conventional internal combustion engine vehicles. As consumer preference tilts towards EVs, the demand for battery materials surges correspondingly.

- Leading automotive and tech giants are pouring substantial investments into the EV arena. Tata Motors, a frontrunner in India's automotive landscape, is channeling significant resources into EV production and infrastructure. Concurrently, Exide Industries and Amara Raja Batteries are not only ramping up their production capabilities but also delving into innovative battery technologies to cater to the escalating demand.

- Highlighting the industry's aggressive expansion, August 2023 saw Ola Electric unveil its latest electric scooters, while Hyundai Motor India secured General Motors' Talegaon plant, underscoring its commitment to EV production.

- Consequently, there's been a marked uptick in the demand for materials pivotal to electric vehicle batteries, crucial for fortifying the electric mobility infrastructure. India is diligently nurturing an ecosystem to elevate its electric vehicle sector, evident from its initiatives in setting up manufacturing units, establishing research hubs, and rolling out an extensive charging network.

- Given these dynamics, the forecast period promises a robust surge in electric vehicle sales.

India Electric Vehicle Battery Materials Industry Overview

The India Electric Vehicle Battery Materials Market is semi-fragmented. Some of the key players in this market (in no particular order) are BASF SE, Mitsubishi Chemical Group Corporation, Umicore, Sumitomo Chemical Co. Ltd., and Exide Industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 High Competition from Conventional Vehicle Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Mitsubishi Chemical Group Corporation

- 6.3.3 UBE Corporation

- 6.3.4 Umicore SA

- 6.3.5 Sumitomo Chemical Co., Ltd.

- 6.3.6 Exide Industries

- 6.3.7 Arkema SA

- 6.3.8 Amara Raja

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219