|

市場調查報告書

商品編碼

1636274

歐洲電動車電池材料:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

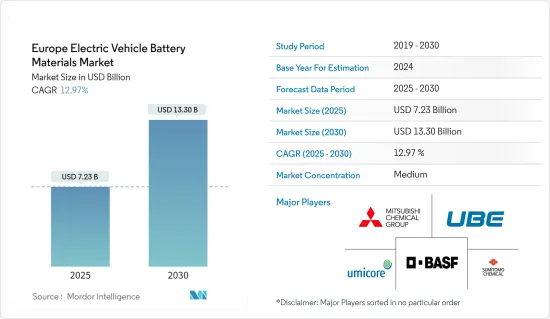

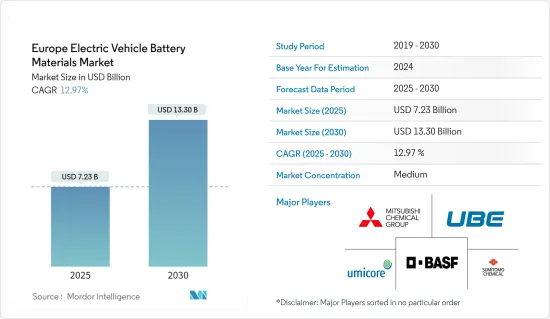

歐洲電動車電池材料市場規模預計到2025年為72.3億美元,預計2030年將達到133億美元,預測期內(2025-2030年)複合年成長率為12.97%。

主要亮點

- 從中期來看,電動車(EV)銷售的成長以及政府的支持性措施和法規預計將在預測期內推動電動車電池材料的需求。

- 另一方面,電池材料對進口的依賴度較高,供應鏈受到的影響很可能對市場產生負面影響。

- 然而,隨著電池隨著能量密度的提高、充電速度的加快、安全性的提高和使用壽命的延長等進步而不斷發展,電動車電池材料市場的參與企業將會出現巨大的機會。

- 在電動車普及率快速成長的推動下,德國將成為歐洲電動車電池材料市場成長最快的地區。

歐洲電動車電池材料市場趨勢

鋰離子電池類型主導市場

- 用於電動車(EV)的鋰離子電池的產量正在成長,並對電池材料市場產生重大影響。產量激增正在推高鋰需求,該地區的鋰發現對原料成本產生了顯著影響。

- 主要市場相關人員正在投資鋰蘊藏量和研發,以提高鋰離子電池產量並滿足對電池原料日益成長的需求。隨著新蘊藏量的發現,鋰離子電池價格長期呈現下降趨勢。

- 例如,2023年,電動車(EV)和電池能源儲存系統(BESS)的電池價格降至139美元/kWh,降幅超過13%。隨著技術創新和製造流程的不斷改進,預計到2025年價格將進一步下降至113美元/千瓦時,並在2030年達到80美元/度。

- 此外,由於對環境問題的日益關注,歐洲各國政府正積極推動電動車鋰離子電池的生產。為了實現淨零碳排放,這些政府推出了多項措施來提高鋰離子電池的產量,以滿足對電動車不斷成長的需求。

- 例如,2023年11月,英國政府宣布投資5,000萬英鎊(6,300萬美元),以加強電池供應鏈,包括鋰離子電池。電池策略重點支援零排放汽車及其供應鏈,並承諾將新資本和研發資金延長至 2030 年。此類措施將加速鋰離子電池作為能源來源的採用,並增加對電池材料的需求。

- 此外,隨著鋰離子電池價格下降和需求激增,新生產工廠的建立進一步增加了對電池原料的需求。近年來,旨在增加鋰離子電池產量的投資大幅增加。

- 例如,法國在 2024 年 2 月宣布,將在未來幾年內從公共和私營部門投資 100 億歐元(108.4 億美元),在全國範圍內建立四個電動汽車電池(包括鋰離子電池)超級工廠。 。這些戰略投資預計將擴大法國的電池產量,導致對鋰離子電池材料的需求相應增加。

- 這些先進措施預計將在預測期內顯著增加鋰離子電池產量,導致電動車電池材料的需求激增。

德國正在經歷顯著的成長

- 由於其汽車工業和對永續交通的承諾,德國在電動車 (EV) 電池材料領域發揮重要作用。過去幾年,德國已成全部區域領先的電動車生產國。

- 根據國際能源總署 (IEA) 預測,2023 年德國電動車 (EV) 銷量將達到 70 萬輛,與 2022 年持平,但比 2019 年成長 5.5 倍。隨著歐洲各國政府最近推出的一系列計劃和舉措,電動車銷量預計在未來幾年將大幅成長。

- 德國在歐洲電池聯盟中發揮關鍵作用,該聯盟旨在在歐洲建立具有競爭力的永續電池製造價值鏈。德國政府與主要電動車公司密切合作,正在對國內電池生產設施進行大量投資。

- 2024 年 1 月,瑞典鋰離子電池製造商 Nordvault 獲得歐盟核准,提供 9.02 億歐元(9.8643 億美元)的重大國家援助計畫。這筆資金將用於在德國海德建立電動車和混合動力汽車電池生產廠。此舉將促進該地區的電池生產並增加對電動車電池材料的需求。

- 德國在先進電池和回收技術方面處於領先地位。公司和研究機構都在創新有效的方法,從廢棄電池中提取鋰、鈷和鎳等有價值的材料。

- 2024 年 5 月,波蘭 Elemental Strategy Metals (ESM) 宣布計畫與美國新興企業公司合作夥伴 Ascend Elements 合作建造鋰離子電池回收工廠。年產能2.5萬噸,計劃於2024年秋季建設,計劃於2026年運作。此類企業將提高原料生產並進一步增加電動車電池材料的產量。

- 鑑於這些發展,我們預計在預測期內電動車電池產量將呈現成長趨勢,並且對電動車電池材料的需求將大幅增加。

歐洲電動汽車電池材料產業概況

歐洲電動車電池材料市場適度細分。主要參與企業(排名不分先後)包括BASF公司、三菱化學集團公司、宇部株式會社、優美科公司和住友化學公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車銷量成長

- 政府扶持措施及措施

- 抑制因素

- 原物料供應依賴進口

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料

- 正極

- 負極

- 電解

- 分隔符

- 其他

- 地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐的

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Contemporary Amperex Technology Co. Limited

- Johnson Matthey

- ENTEK International LLC

- Northvolt

- SGL Carbon

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 電池技術的進步

簡介目錄

Product Code: 50003561

The Europe Electric Vehicle Battery Materials Market size is estimated at USD 7.23 billion in 2025, and is expected to reach USD 13.30 billion by 2030, at a CAGR of 12.97% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- On the other hand, the high import dependency on battery materials and the impact on the supply chain are likely to negatively impact the market.

- However, as batteries evolve with advancements like enhanced energy density, quicker charging, heightened safety, and extended lifespans, significant opportunities emerge for players in the electric vehicle battery materials market.

- Driven by a surge in electric vehicle adoption, Germany is poised to lead as the fastest-growing region in Europe's electric vehicle battery materials market.

Europe Electric Vehicle Battery Materials Market Trends

Lithium-Ion Battery Type Dominate the Market

- The production of lithium-ion batteries for electric vehicles (EVs) is on the rise, significantly influencing the battery materials market. This surge in production has driven up the demand for lithium, and discoveries of lithium in the region are notably affecting raw material costs.

- Key market players are channeling investments into lithium reserves and R&D, aiming to boost lithium-ion battery production and meet the growing demand for battery raw materials. As new reserves are discovered, the prices of lithium-ion batteries have seen a downward trend over time.

- For instance, in 2023, battery prices for electric vehicles (EVs) and battery energy storage systems (BESS) dropped to USD 139/kWh, marking a decline of over 13%. With ongoing technological innovations and manufacturing improvements, projections suggest prices will further dip to USD 113/kWh by 2025 and reach USD 80/kWh by 2030.

- Moreover, European governments are actively promoting lithium-ion battery production for EVs, driven by mounting environmental concerns. With a keen focus on achieving net-zero carbon emissions, these governments have launched multiple initiatives to boost lithium-ion battery production, aiming to meet the surging EV demand.

- For instance, in November 2023, the United Kingdom government unveiled a GBP 50 million (USD 63 million) investment to fortify its battery supply chain, including lithium-ion batteries, aligning with the nation's future EV production goals. The Battery Strategy promises focused support for zero-emission vehicles and their supply chains, with new capital and R&D funding extending to 2030. Such initiatives are poised to bolster the adoption of lithium-ion batteries as a clean energy source, subsequently driving up the demand for battery materials.

- Additionally, as lithium-ion battery prices decline and demand surges, the establishment of new production plants further fuels the need for battery raw materials. Recent years have witnessed a significant uptick in investments aimed at boosting lithium-ion battery production.

- For instance, in February 2024, France unveiled a EUR 10 billion (USD 10.84 billion) investment, sourced from both public and private entities, to establish four gigafactories for electric vehicle batteries, including lithium-ion variants, across the nation in the upcoming years. Such strategic investments are set to amplify battery production in France, subsequently heightening the demand for lithium-ion battery materials.

- Given these advancements and initiatives, a marked increase in lithium-ion battery production and a surge in demand for EV battery materials are anticipated during the forecast period.

Germany to Witness Significant Growth

- Germany plays a significant role in the electric vehicle (EV) battery materials sector, driven by its automotive industry and commitment to sustainable mobility. In the past few years, the country has become one of the leading EV producers across the region.

- According to the International Energy Agency (IEA), Electric vehicle (EV) sales in Germany reached 0.7 million units in 2023, consistent with 2022 figures but marking a 5.5-fold increase since 2019. With numerous projects and initiatives recently launched by the European government, EV sales are poised for significant growth in the coming years.

- Germany plays a pivotal role in the European Battery Alliance, which aims to establish a competitive and sustainable battery cell manufacturing value chain in Europe. Collaborating closely with leading EV companies, the German government is making substantial investments in domestic battery cell production facilities.

- In January 2024, Northvolt, a Swedish lithium-ion battery manufacturer, secured European Union approval for a significant EUR 902 million (USD 986.43 million) state aid package. This funding is earmarked for establishing an EV and hybrid vehicle battery production plant in Heide, Germany. Such moves are set to boost battery production in the region, driving up demand for EV battery materials.

- Germany is leading the charge in advanced battery recycling technologies. Both companies and research institutions are innovating efficient methods to extract valuable materials, such as lithium, cobalt, and nickel, from used batteries.

- In May 2024, Elemental Strategic Metals (ESM), a Polish firm, in collaboration with its US start-up partner Ascend Elements, unveiled plans for a lithium-ion battery recycling plant. With a capacity of 25,000 tonnes per year, construction is slated for autumn 2024, aiming for operational status by 2026. Such ventures are set to boost raw material production, further elevating the output of EV battery materials.

- Given these developments, the trajectory points towards heightened battery production for EVs and a marked surge in demand for EV battery materials in the forecast period.

Europe Electric Vehicle Battery Materials Industry Overview

Europe's electric vehicle battery materials market is moderately fragmented. Some key players (not in particular order) are BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore, Sumitomo Chemical Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependency on Imported Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 Turkey

- 5.3.8 NORDIC

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 BASF SE

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Umicore SA

- 6.3.6 Contemporary Amperex Technology Co. Limited

- 6.3.7 Johnson Matthey

- 6.3.8 ENTEK International LLC

- 6.3.9 Northvolt

- 6.3.10 SGL Carbon

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219