|

市場調查報告書

商品編碼

1636277

法國電動車電池材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)France Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

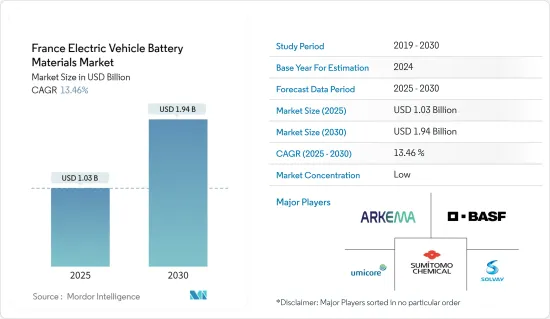

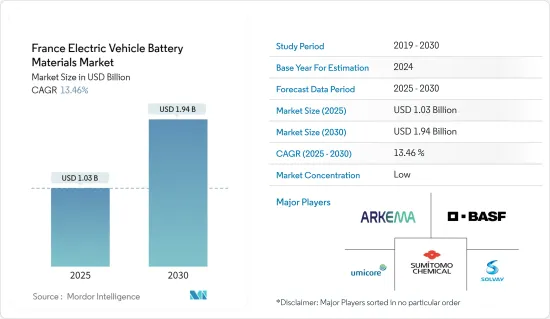

預計2025年法國電動車電池材料市場規模為10.3億美元,2030年將達19.4億美元,預測期間(2025-2030年)複合年成長率為13.46%。

主要亮點

- 從中期來看,電動車(EV)銷售的成長以及政府的支持性措施和法規預計將在預測期內推動電動車電池材料的需求。

- 另一方面,蘊藏量短缺可能會明顯抑制電動車電池材料市場的成長。

- 電池技術的進步,如提高能量密度、縮短充電時間、提高安全性和延長使用壽命等,預計將在不久的將來為電動車電池材料市場的參與企業提供重大商機。

法國電動車電池材料市場趨勢

電動車 (EV) 銷售的擴大推動市場發展

- 在法國,電動車(EV)銷量的增加正在推動對電動車電池材料的需求。隨著電動車銷量的增加,對鋰、鈷、鎳和石墨等關鍵電池組件的需求也在增加。這種不斷成長的需求不僅促進了當地生產,還吸引了投資並重振了法國的電池材料供應鏈。

- 法國在轉向清潔能源方面取得了顯著進展,其中重點是電動車。近年來,該國的電動車銷量大幅成長。例如,根據國際能源總署(IEA)的報告,2023年法國電動車銷量為47萬輛,較2022年成長38.2%。鑑於這一趨勢,預計未來幾年對電池材料的需求將大幅增加。

- 法國政府正積極支持電動車市場的成長,推出補貼和稅收優惠,並收緊排放氣體法規。這些支持措施不僅增強了電動車市場,也對電池材料產業產生正面影響。展望未來,政府制定了將電動車銷量翻兩番的雄心勃勃的目標。

- 具體措施是,政府於 2024 年 5 月與頂級汽車製造商達成協議,設定到 2027 年電動車銷售目標為 80 萬輛,比 2022 年的 20 萬輛大幅成長。此外,政府也承諾投入 15 億歐元(約 16 億美元)支持各種刺激電動車生產和購買的計畫。如此強而有力的舉措不僅將促進電動車產量,還將擴大對電池材料的需求。

- 此外,法國充滿活力的電動車市場也是電池創新的溫床。該國的公司和研究機構正在投資開創性材料,這些材料有望提高能量密度、更長的使用壽命和更高的安全性。該地區主要企業之間的合作進一步加速了電池技術的進步,為電動車電池需求的激增奠定了基礎。

- 2024 年 5 月,阿科瑪和輝能宣布開展合作,重點開發 Kynar PVDF 牌號和輝能用於下一代鋰陶瓷電池的尖端材料。輝能也透露了在法國建立鋰陶瓷電池超級工廠的野心。這些策略性舉措不僅會擴大對先進電動車電池的需求,還會增加該地區對電池材料的需求。

- 鑑於這些趨勢,預計未來幾年對電動車的需求以及對電動車電池材料的相應需求將保持穩定。

鋰離子電池類型主導市場

- 電動車(EV)用鋰離子電池的產量快速成長,對電池材料市場產生重大影響。電池產量的增加顯著增加了對鋰的需求。不同地區鋰的發現對於決定原料成本起著至關重要的作用。

- 主要市場相關人員正在投資鋰蘊藏量和研發,以提高鋰離子電池產量並滿足對電池原料日益成長的需求。隨著新蘊藏量的發現,鋰離子電池價格長期呈現下降趨勢。

- 例如,2023年,電動車(EV)和電池能源儲存系統(BESS)的電池價格降至139美元/kWh,降幅超過13%。隨著技術創新和製造流程的不斷改進,預計到2025年電池組價格將進一步降至113美元/kWh,到2030年可能達到80美元/kWh。

- 為了因應人們日益關注的環境問題,歐洲各國政府正積極支持電動車鋰離子電池的生產。出於對實現淨零碳排放的強烈興趣,這些政府推出了多項舉措來提高鋰離子電池的產量,以滿足電動車需求的激增。

- 例如,2024年5月,法國Blue Solutions宣布計劃在法國東部建造一座超級工廠。該工廠耗資約 20 億歐元(21.7 億美元),計劃於 2030 年開始生產,旨在生產快速充電時間為 20 分鐘的電動車尖端固態電池。這些努力將使鋰離子電池作為清潔能源解決方案普及,並增加對電池材料的需求。

- 此外,近年來,法國已成為先進鋰離子電池回收技術的領導者。公司和研究機構都在創新有效的技術,從廢棄電池中提取鋰、鈷和鎳等有價值的材料。

- 例如,2024 年 7 月,領先公司 Hydrovolt 宣布向法國擴張,在奧爾當建造一座新的回收設施。該設施佔地約 3,000平方公尺,計劃於 2025 年開始營運,重點是回收電動車和工業電池。這些戰略舉措不僅加速了鋰離子原料的生產,也預示著未來電動車電池材料的產量將會激增。

- 鑑於這些進步和舉措,預計在預測期內對電動車電池材料的需求將大幅增加。

法國電動汽車電池材料產業概況

法國電動車電池材料市場已減半。主要參與企業(排名不分先後)包括住友化學、BASF、阿科瑪、索爾維和優美科。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車銷量成長

- 政府扶持措施及措施

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料

- 正極

- 負極

- 電解

- 分隔符

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Eramet SA

- Imerys SA

- SAFT Groupe

- Toray Carbon Fibers Europe

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 電池技術的進步

簡介目錄

Product Code: 50003564

The France Electric Vehicle Battery Materials Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.94 billion by 2030, at a CAGR of 13.46% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the electric vehicle battery materials market.

- Nevertheless, technological advancements in batteries like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for electric vehicle battery materials market players in the near future.

France Electric Vehicle Battery Materials Market Trends

Growing Electric Vehicle (EV) Sales Drives the Market

- In France, the rising sales of electric vehicles (EVs) are driving up the demand for EV battery materials. As sales of EVs climb, so does the need for key battery components like lithium, cobalt, nickel, and graphite. This heightened demand is not only boosting local production but also attracting investments, thereby invigorating the French battery material supply chain.

- France is making a pronounced shift towards clean energy, with electric vehicles taking center stage. Over recent years, EV sales in the country have seen a remarkable surge. For instance, the International Energy Agency (IEA) reported that in 2023, France sold 0.47 million electric vehicles, marking a 38.2% increase from 2022. Given this trajectory, the demand for battery materials is poised to rise significantly in the coming years.

- The French government actively champions the EV market's growth, rolling out subsidies, tax incentives, and enforcing stricter emission regulations. These supportive measures not only bolster the EV market but also extend their positive influence to the battery material industry. With an eye on the future, the government has set ambitious targets, aiming for a fourfold increase in EV sales.

- In a concrete move, the government inked a deal in May 2024 with top car manufacturers, setting a target of 800,000 electric vehicle sales by 2027, a significant jump from 200,000 in 2022. Additionally, with a commitment of 1.5 billion euros (approximately USD 1.6 billion), the government is backing various programs to stimulate both the production and purchase of electric vehicles. Such robust initiatives are set to not only boost EV production but also amplify the demand for battery materials.

- Moreover, France's vibrant EV market is a hotbed for battery technology innovation. Companies and research institutions in the country are channeling investments into pioneering materials that promise enhanced energy density, extended lifespan, and heightened safety. Collaborations among leading regional companies are further propelling advancements in battery technology, setting the stage for a surge in EV battery demand.

- Highlighting this trend, Arkema and ProLogium, in May 2024, unveiled their partnership focusing on Kynar PVDF grades and cutting-edge materials for ProLogium's next-gen Lithium Ceramic Batteries. ProLogium also revealed ambitions to establish a gigafactory for lithium ceramic batteries in France. Such strategic moves are poised to not only amplify the demand for advanced EV batteries but also escalate the need for battery materials in the region.

- Given these dynamics, the trajectory for EV demand and the corresponding appetite for EV battery materials looks robust in the coming years.

Lithium-Ion Battery Type Dominate the Market

- The production of lithium-ion batteries for electric vehicles (EVs) has surged, profoundly influencing the battery materials market. This uptick in battery production has driven a marked rise in lithium demand. Discoveries of lithium in various regions play a pivotal role in determining raw material costs.

- Key market players are channeling investments into lithium reserves and R&D, aiming to boost lithium-ion battery production and meet the escalating demand for battery raw materials. As new reserves are discovered, the prices of lithium-ion batteries have seen a downward trend over time.

- For example, in 2023, battery prices for electric vehicles (EVs) and battery energy storage systems (BESS) dropped to USD 139/kWh, marking a decline of over 13%. With ongoing technological innovations and manufacturing improvements, projections suggest battery pack prices could further dip to USD 113/kWh by 2025 and reach USD 80/kWh by 2030.

- In response to growing environmental concerns, European governments are actively championing lithium-ion battery production for EVs. With a keen focus on achieving net-zero carbon emissions, these governments have launched multiple initiatives to boost lithium-ion battery production, catering to the surging EV demand.

- For instance, in May 2024, Blue Solutions, a French firm, unveiled plans for a gigafactory in eastern France. With an investment of around 2 billion euros (USD 2.17 billion), the facility aims to produce a cutting-edge solid-state battery for EVs, boasting a rapid 20-minute charging time, with production slated to commence by 2030. Such endeavors are poised to bolster the adoption of lithium-ion batteries as a clean energy solution, subsequently amplifying the demand for battery materials.

- Additionally, in recent years, France has emerged as a leader in pioneering advanced recycling technologies for lithium-ion batteries. Both companies and research institutions are innovating efficient techniques to extract valuable materials, including lithium, cobalt, and nickel, from spent batteries.

- For instance, in July 2024, Hydrovolt, a prominent player, revealed its expansion into France with a new recycling facility in Hordain. Spanning approximately 3,000 square meters, this facility is set to commence operations in 2025 and will focus on recycling both EV and industrial batteries. Such strategic moves are not only accelerating the production of lithium-ion raw materials but also hint at a future surge in EV battery material production.

- Given these advancements and initiatives, a significant uptick in the demand for EV battery materials is anticipated during the forecast period.

France Electric Vehicle Battery Materials Industry Overview

France's electric vehicle battery materials market is semi-fragmented. Some key players (not in particular order) are Sumitomo Chemical Co., Ltd., BASF SE, Arkema SA, Solvay SA, Umicore SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 BASF SE

- 6.3.3 Arkema SA

- 6.3.4 Solvay SA

- 6.3.5 Umicore SA

- 6.3.6 Eramet SA

- 6.3.7 Imerys SA

- 6.3.8 SAFT Groupe

- 6.3.9 Toray Carbon Fibers Europe

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219