|

市場調查報告書

商品編碼

1636280

英國電動車電池材料:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)United Kingdom Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

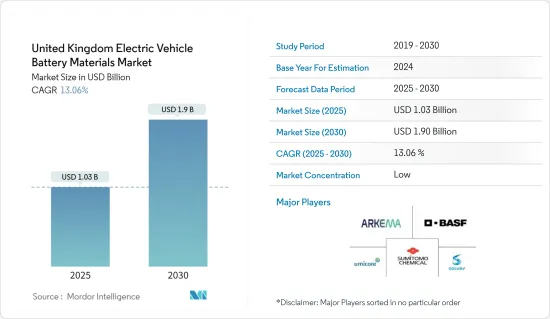

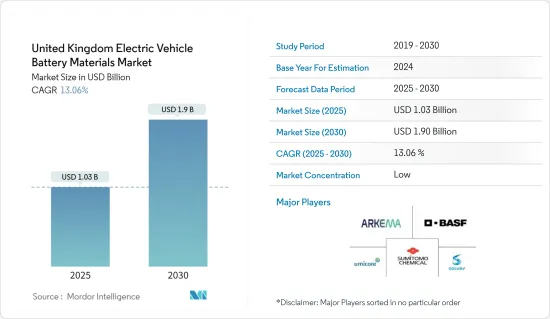

英國電動車電池材料市場規模預計到2025年為10.3億美元,預計2030年將達到19億美元,預測期內(2025-2030年)複合年成長率為13.06%。

主要亮點

- 從中期來看,電動車(EV)銷售的成長以及政府的支持性措施和法規預計將在預測期內推動電動車電池材料的需求。

- 另一方面,蘊藏量短缺可能會明顯抑制電動車電池材料市場的成長。

- 電池技術的進步,如提高能量密度、縮短充電時間、提高安全性和延長使用壽命等,預計將在不久的將來為電動車電池材料市場的參與企業提供重大商機。

英國電動車電池材料市場趨勢

電動車 (EV) 銷量的成長推動市場

- 在英國(英國),電動車(EV)銷量的增加正在推動對電動車電池材料的需求。隨著電動車在國內的普及,對鋰、鈷、鎳、石墨等關鍵電池零件的需求迅速增加。這種需求的增加不僅刺激了當地生產,還吸引了投資並加強了英國電池材料供應鏈。

- 英國正在協調一致地轉向以電動車為中心的清潔能源。近年來,該地區的電動車銷量呈現大幅成長。例如,國際能源總署(IEA)報告稱,2023年英國電動車銷量為45萬輛,較2022年成長21.62%。隨著英國政府推出多項舉措和計劃,電動車銷量預計將激增,導致對電池材料的需求增加。

- 英國政府正透過補貼、稅收優惠和嚴格的排放法規積極培育電動車市場。這些舉措不僅支持了電池材料產業,也增加了國家對電動車的需求。政府制定了雄心勃勃的目標,並預計在不久的將來電動車銷量將成長四倍。

- 為了證明其承諾,英國已於 2023 年推出了零排放汽車 (ZEV) 指令。該指令規定,到2030年,80%的新車和70%的新車將是零排放汽車,到2035年將全面轉型。此外,它將在2030年停止銷售新的汽油和柴油汽車,並要求在2035年所有新車實現零排放。這些措施將在未來幾年加速電動車的生產和對電池材料的需求。

- 此外,英國電動車的競爭格局正在推動電池技術的創新。當地公司和研究機構正在投資先進材料,以提高能量密度、壽命和安全性。該地區主要企業之間的合作旨在開發尖端的電池解決方案,並預示著未來幾年對電動車電池的強勁需求。

- 例如,2024 年 1 月,微軟宣布與美國能源局太平洋西北國家實驗室 (PNNL) 合作推出突破性材料。這項發現結合了人工智慧 (AI) 和超級運算,預計將電池鋰消費量減少 70%。研究人員也強調了顯著提高電池效率的潛力,特別是在電動車(EV)和相關領域。這些進步將推動對複雜電動車電池的需求,進而推動該地區的電池材料需求。

- 鑑於這些發展,很明顯,英國的舉措和計劃不僅將增強對電動車的需求,而且還將在可預見的未來顯著增加對電動車電池材料的需求。

鋰離子電池佔市場主導地位

- 擴大電動車(EV)鋰離子電池的生產對電池材料市場有重大影響。鋰離子電池製造的激增正在推動對鋰的需求,而各個地區發現的鋰對原料成本有直接影響。

- 認知到這一趨勢,主要市場參與企業正在增加對鋰蘊藏量和研發的投資。目的是提高鋰離子電池的產量並滿足對電池原料不斷成長的需求。隨著新蘊藏量的發現,鋰離子電池的價格正在大幅下降。

- 例如,2023年電池價格大幅下降至139美元/kWh,下降13%。專家預測,隨著技術進步和製造效率提高,到2025年將降至113美元/千瓦時,2030年進一步降至80美元/度。

- 為了應對日益嚴重的環境問題,英國政府正積極推動電動車鋰離子電池的生產。為了實現零淨碳排放目標,並滿足該地區對電動車不斷成長的需求,政府正在推出一系列計劃來提高鋰離子電池的生產。

- 2023年5月,捷豹和路虎的母公司塔塔汽車宣布計劃在英格蘭西南部薩默塞特建造一座最先進的電動車電池工廠,投資額達數萬美元。這些戰略舉措預計將加速鋰離子電池作為能源來源的採用,並在可預見的未來增加對電池材料的需求。

- 在最近的發展中,英國在開發先進的鋰離子電池回收技術方面處於主導。公司和研究機構正在創新有效的方法,從廢棄電池中回收鋰、鈷和鎳等有價值的材料。

- 2024 年 3 月,永續電池廢棄物回收專家、總部位於英國的 Altilium 宣布與日產建立合作關係。該合作夥伴關係將引入先進的回收技術,以減少英國製造的新型電池的碳足跡,並減少對進口原料的依賴。該舉措是先進推進中心 (APC) 3000 萬英鎊(3800 萬美元)計劃的一部分,Altilium 獲得了 1500 萬英鎊(1900 萬美元)的巨額津貼。這些舉措不僅將加速鋰離子原料的生產,也將增強未來電動車電池材料的生產。

- 鑑於這些進步和舉措,預計在預測期內對電動車電池材料的需求將大幅增加。

英國電動汽車電池材料產業概況

英國電動車電池材料市場已減半。主要參與企業(排名不分先後)包括住友化學、BASF、阿科瑪、索爾維和優美科。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車銷量成長

- 政府扶持措施及措施

- 抑制因素

- 對原料供應的依賴

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料

- 正極

- 負極

- 電解

- 分隔符

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Mitsubishi Chemical Group Corporation

- Fiamm Energy Technology

- ENTEK International LLC

- Johnson Matthey

- Epsilon Adavnced Material

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 電池技術的進步

簡介目錄

Product Code: 50003567

The United Kingdom Electric Vehicle Battery Materials Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.90 billion by 2030, at a CAGR of 13.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the electric vehicle battery materials market.

- Nevertheless, technological advancements in batteries like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for electric vehicle battery materials market players in the near future.

United Kingdom Electric Vehicle Battery Materials Market Trends

Growing Electric Vehicle (EVs) Sales Drives the Market

- In the United Kingdom (UK), rising electric vehicle (EV) sales are driving up the demand for EV battery materials. As the country embraces electric vehicles, the need for key battery components like lithium, cobalt, nickel, and graphite is surging. This heightened demand is not only stimulating local production but also attracting investments, thereby strengthening the UK's battery material supply chain.

- The UK is making a concerted shift towards clean energy, with electric vehicles taking center stage. Over recent years, EV sales in the region have seen exponential growth. For instance, the International Energy Agency (IEA) reported that in 2023, the UK sold 450,000 electric vehicles, marking a 21.62% increase from 2022. With the UK government launching several initiatives and projects, EV sales are projected to soar, consequently driving up the demand for battery materials.

- The UK government is actively nurturing the EV market through subsidies, tax incentives, and stringent emission regulations. These initiatives not only support the battery material sector but also elevate the nationwide demand for EVs. With ambitious targets set, the government envisions a fourfold surge in EV sales in the near future.

- As a testament to its commitment, the UK rolled out a Zero-Emission Vehicle (ZEV) mandate in 2023. This mandate stipulates that by 2030, 80% of new cars and 70% of new vans should be zero-emission, achieving a complete transition by 2035. Additionally, the sale of new petrol and diesel vehicles will halt by 2030, with all new vehicles required to be zero-emission by 2035. Such measures are set to accelerate both EV production and the demand for battery materials in the coming years.

- Furthermore, the UK's competitive EV landscape is driving innovations in battery technology. Local firms and research entities are investing in advanced materials, targeting improved energy density, longevity, and safety. Collaborations among major regional players aim to develop cutting-edge battery solutions, signaling a robust demand for EV batteries in the coming years.

- For instance, in January 2024, Microsoft, in partnership with the Pacific Northwest National Laboratory (PNNL) under the US Department of Energy, introduced a revolutionary material. This discovery, made using a combination of artificial intelligence (AI) and supercomputing, could reduce lithium consumption in batteries by an impressive 70%. Researchers also emphasize its potential to significantly enhance battery efficiency, particularly for electric vehicles (EVs) and related domains. Such advancements are poised to boost the demand for sophisticated EV batteries and, in turn, elevate the need for battery materials in the region.

- Given these developments, it's clear that the UK's initiatives and projects are set to not only bolster EV demand but also substantially increase the need for EV battery materials in the foreseeable future.

Lithium-Ion Battery Type Dominate the Market

- The growing production of lithium-ion batteries for electric vehicles (EVs) has significantly influenced the battery materials market. This surge in lithium-ion battery manufacturing has driven up the demand for lithium, with its discovery in various regions directly impacting raw material costs.

- Key market players, recognizing this trend, are ramping up investments in lithium reserves and R&D endeavors. Their goal is to bolster lithium-ion battery production and meet the escalating demand for battery raw materials. As new reserves are discovered, prices for lithium-ion batteries are notably declining.

- For instance, in 2023, battery prices dropped significantly to USD 139/kWh, marking a 13% decrease. With ongoing technological advancements and manufacturing efficiencies, experts predict prices could dip to USD 113/kWh by 2025 and plummet further to USD 80/kWh by 2030.

- Governments in the United Kingdom are actively promoting lithium-ion battery production for electric vehicles, driven by rising environmental concerns. With a strong focus on net-zero carbon emission targets, the government has launched numerous projects to boost lithium-ion battery production, aiming to meet the region's growing EV demand.

- In May 2023, Tata Motors, the owner of Jaguar Land Rover, announced plans for a state-of-the-art electric car battery plant in Somerset, southwest England, with investments reaching billions. Such strategic moves are set to accelerate the adoption of lithium-ion batteries as a pivotal clean energy source, amplifying the demand for battery materials in the foreseeable future.

- In recent years, the UK has been leading the charge in developing advanced battery recycling technologies for lithium-ion batteries. Companies and research institutions are innovating efficient methods to recover valuable materials like lithium, cobalt, and nickel from used batteries.

- In March 2024, Altilium, a UK company specializing in sustainable battery waste recycling, announced a collaboration with Nissan. This partnership aims to implement advanced recycling technologies, targeting a reduction in the carbon footprint of new UK-made batteries and a decrease in reliance on imported raw materials. This initiative, part of the Advanced Propulsion Centre's (APC) GBP 30 million (USD 38 million) project, saw Altilium securing a notable grant of GBP 15 million (USD 19 million). Such initiatives not only accelerate the production of lithium-ion raw materials but also bolster the future production of EV battery materials.

- Given these advancements and initiatives, a significant increase in the demand for EV battery materials is anticipated during the forecast period.

United Kingdom Electric Vehicle Battery Materials Industry Overview

United Kingdom's electric vehicle battery materials market is semi-fragmented. Some key players (not in particular order) are Sumitomo Chemical Co., Ltd., BASF SE, Arkema SA, Solvay SA, Umicore SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 BASF SE

- 6.3.3 Arkema SA

- 6.3.4 Solvay SA

- 6.3.5 Umicore SA

- 6.3.6 Mitsubishi Chemical Group Corporation

- 6.3.7 Fiamm Energy Technology

- 6.3.8 ENTEK International LLC

- 6.3.9 Johnson Matthey

- 6.3.10 Epsilon Adavnced Material

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219